Temporarily Available to Non-Subscribers

First of all, thank you once again for being a subscriber–it enables us to continue to find various companies and do these short reports. Please check out my previous posts’ as well.

If you like Travel, Business Proposals or Wish to share your own article without compromising your identity see below:

FEMEX Resources on the ASX

Production commenced in December 2020 following a rapid three-month development period, and first sales were generated in February 2021, shipped from the Company’s port facility at Geraldton. Over 3 million tonnes of premium ore have been exported to date, generating solid cash flow already. This has generated a net operating cashflow of more than A$150 million

Bullet Points

- Fast moving–mining only began in September 2020

- High-grade iron ore: 64% Fe lump and 63% Fe fines; low cost operator

- Positive cash flow (150M net operating cash flow since Dec 2020)–after tax

- Healthy valuations

- Infrastructure in place to reduce costs, guarantee product to market & generate new revenue streams

- Earnings go back to shareholders. Dividends: 16% in 2022 and 7.77% in 2023

- Upside with higher iron ore prices; managed well in high inflation

(60% Iron ore containing hematite or magnetite is regarded as high-quality iron ore, otherwise known as direct shipping ore)

Ratios

Price: 0.25 AUD per share

Shares Outstanding: 694.2M

Market Cap: 173.6M AUD

P/E: 5.3

P/B: 1.47

P/S: 0.83

P/Equity: 1.45

EPS: 0.050

Net profit margin= 14.86%

SGA expense/sales= 4.07%

Current Ratio= 3.27

Quick Ratio= 3.00

Balance Sheet

Cash $63.2 (December 2023); 73M AUD (June 2023) –> about 33% of market-cap

Total Assets: 169.11M

Total Current Assets: 101.5M

Total Current Liabilities: 31M

Net Debt: 21.37M

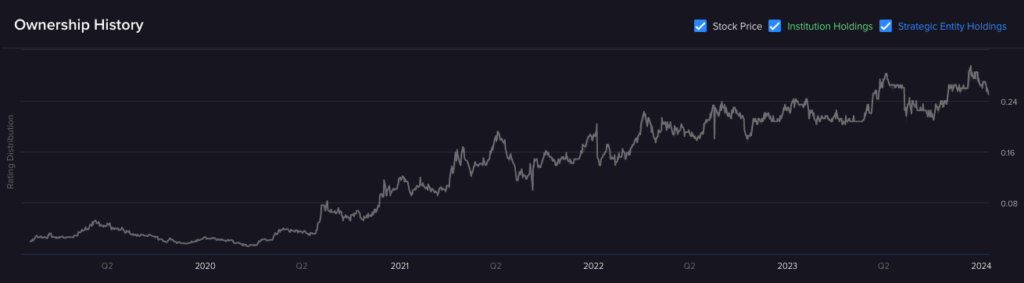

Ownership

36% owned by Stategic entities, 62% owned by “other” and about 2% owned by institutional investors. However, the largest increase in shares are owned by institutional shareholders.

Company

The company exports 1.3Million Iron Ore tonnes annually from their 100% owned property.

Fiscal Year 2022:

generated A$50.7M Profit After Tax

A$52/t Net Operating Margin (assuming 110 USD/t Iron Ore this is a 31.5% margin).

As of Fiscal Year 2022: Fenix produced 1.3 million metric tonnes of ore with this production to remain steady.

Half Year Quarter 2023:

Six shipments totalling 351,828 wet metric tonnes (wmt) of high-grade iron ore shipped

- Average grade of 64.4% Fe for lump product and 63.3% Fe for fines

- Interestingly, the margins increased to$60 AUD/t after decreasing cash expense by 5% to less than 80 AUD

- Average Price received for the Iron Ore: ~A$174/t or US $116/t

“The period ended 30 September 2023 showed a promising trajectory for Fenix with a 5% cost reduction, lowering C1 cash costs to under A$76 per tonne (yet again). This financial performance reflects an overall reduction of over $15 a tonne, resulting in an operating cash margin of A$70 a tonne”

2023 Year End Quarter

Iron Ridge produced and sold six shipments totalling 353,376 wmt of iron ore during the quarter, consisting of 207,056 wmt of lump and 146,320 wmt of fines, another increase.

Cash Costs for Iron Ridge production for the quarter are stable at A$78.2/wmt shipped to Geraldton Port, equivalent to US$51/wmt (SepQ:US$50/wmt).

Large increase in net operating margin of A$102/dmt (Sep Q: ~A$70/dmt)

Shipping costs for June 2023: ~A$28/t (~US$19/t). Shipping costs fell slightly, but largely remain steady.

Hedged during production

Successful hedging program – 50ktpm extended to now be locked in until

June 30 2024 @ A$170/t.

Their production and type of ore has remained consistent over the last year

Grades increase at depth

Their resource totals 8.3Mt at 64.8% Fe.

The higher grade does not have any problematic impurities to evade costs and ensure a quick turnover to market. It’s estimated that the Shine Iron Ore pit has approximately 15 million tonnes available which equates to a mine life of about 12-15 years at current production rates.

Infrastructure

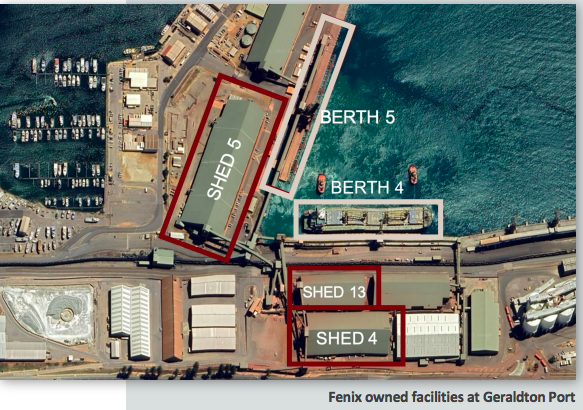

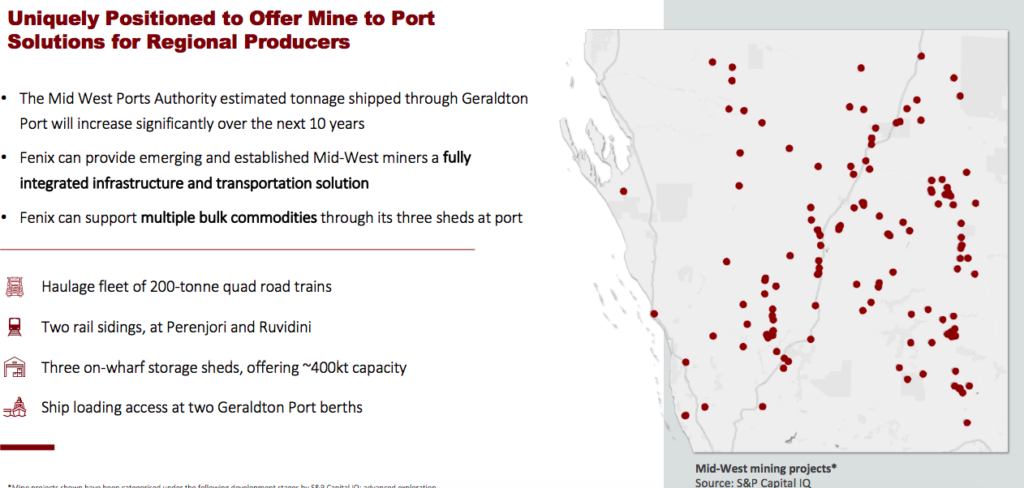

An advantage that Fenix has is their infrastructure in place, this allows them to ship their product directly to market without having extended CapEx. They are supported by a fully integrated haulage fleet, port facilities and rail access. Amongst this fleet are 30, 200-tonne trucks and two rail sidings. For year end, they have had the integration of Fenix-Newhaul as a 100% owned subsidiary completed with the acquisition of Newhaul Pty Ltd.

Additionally, besides their own utilization, their lease agreement and export allocation at Geraldton Port has provided them with a customer to generate additional revenue streams. CuFe Limited (ASX:CUF) secured as foundation third party customer for port services. Total third-party volumes shipped in December quarter was 544,228t (Sep Q: 196,176t).

They have now expanded their warehouse storage capacity to 400,000 tonnes for themselves or other customers. From the storage sheds, they hold on-wharf ship loading infrastructure with in-loading access via truck or rail consistently achieving shortest loading times. Their two rail sidings provide access to the Mid-West rail network connecting to Geraldton Port

They have created over 200 jobs for Western Australia & local indigenous communities.

This allows the company to be more resilient during inflation periods as seen in the last 2 quarters–> Other companies in Western Australia aren’t so lucky.

Market

Fenix benefits directly from higher Iron Ore prices:

“Iron ore prices strengthened with the average CFR price received, pre-hedging and quotation price adjustments, rising to US$138 per dry metric tonne (dmt) equivalent to A$212/dmt.”

“Bank expectations of solid demand and risks to supply drove iron ore prices 36% higher than this year’s low touched in May. The Chinese government stated it would issue CNY 1 trillion in debt to target infrastructure and manufacturing projects”

China remains in a precarious position with their excessive credit, debt bubble and housing scam, but for the time being Yuan are still accepted for Iron ore & long term, Iron ore performs well in inflationary periods.

At the same time, guess where people spend during economic recessions to “get the economy moving again”–> infrastructure & industry.

Also in the short term, BHP approved industrial action to suspend activity for around 400 train drivers in Australia (not impacting Fenix), dampening supply inputs”.

Citi Bank predicts that Iron Ore will touch 150 USD per tonne which extends the operating margin for Fenix. “Citi maintained its 0-3 month price target of US$150 a tonne or 20% upside from Tuesday’s close of US$125 a tonne adding to their previous prediction that resuming mill production would support demand as well”.

Australia is the largest Iron Ore producer in the world (Usable ore: 880 million MT; iron content: 540 million MT) Brazil, China, India, Russia (in this order) follow behind. With the other major producers making up most of the BRICS, Australia is bound to see more ore demand from their Western power allies over the years.

Another matter worth mentioning is Chinese steelworks are demanding high grade ore to meet increasingly strict government regulations (take this with a grain of salt however because of China’s precarious situation).

Iron Ore is off to a hot start in 2024, but I should state that I think prices will come down in the short term as China’s collapse (no demand for steel) becomes evident to exporters and investors. It will take some adjusting but Fenix will need to find a new buyer to compensate for a sudden drop (likely India/Indonesia/Philippines). I’m confident Fenix will weather the storm.

Updates

Fenix acquired the Shine Iron Ore Mine, two on-wharf storage sheds at the Geraldton Port (mentioned above), two Mid-West rail sidings and the sale of mining assets at the Extension Hill Iron Ore Mine.

- The Shine Iron Ore Mine has a Mineral Resource Estimate of 15.1Mt

@ 58% Fe

The sale of Extension Hill Iron Ore Mine has been sold to Terra Mining Pty Ltd and Extension Hill Pty Ltd (EHPL).

For Felix, the transaction is a logical move to explore collaboration on haulage and port services. It will provide Fenix with future payments of up to $2 million while also removing a rehabilitation liability of approximately $5 million that Fenix owed as part of their contract from whom they bought Extension Hill from back in July..

For Fenix, the consideration of A$2 million will be received by Fenix as $250,000 on first shipment of ore and a royalty of $0.50 per tonne are sold.

The Company expects to continue to boost export volumes as additional Mid-West mining projects are developed and third-party operations are expanded

Expenses Moving into 2024

- A$5.0m paid to Sinosteel as the first tranche of the Beebyn-W11 right to mine agreement;

- A$5.0m in loan funding provided to 10M Pty Ltd, as part of the ore purchase agreement;

- A$8.0 in taxes and royalty payments;

- A$4.0m in the settlement of hedging swap contracts; and

- Net capital expenditure and transaction costs of A$2.0 million mainly related to M&A fees and the acquisition of new prime mover trucks, net of the disposal of existing fleet, as part of the expansion of haulage fleet.

Mining updates:

Fenix acquired the Right to Mine from Sinosteel Midwest Corporation (SNC) 10 million tonnes from the high grade Beebyn-W11 deposit located 20km from Iron Ridge with mining expected to commence in 2024.

Ore purchase agreement executed for 500,000 tonnes of high-grade iron ore from 10M

Pty Ltd’s Twin Peaks Iron Ore Mine is expected to boost Fenix production volumes in 2024.The deposit has been shown to have a JORC 2012 compliant total Measured and Indicated Mineral Resource Estimate of 20.5 million tonnes at a grade of 61.3% Fe.

Terms of the deal are consideration payable by Fenix to SMC of $10 million (paid as $5 million cash on signing and $5 million cash upon receipt of approval of a Mining Proposal for Beebyn-W11) and a fixed $2 per tonne Base Royalty payment as well as a variable Profit Share Royalty. Fenix maintains exclusive sole control of all mining,

hauling, logistics and port operations relating to the mining and export of 10 million dry metric tonnes of iron ore. The acquisition cost for Fenix equates to $1 per tonne plus royalty payments, which is a fraction of their quarterly income.

Listening to the Chairman speak, it’s clear there is emphasis on growth & to nurture the logistics network to benefit from the numerous miners throughout Western Australia

Closing

Fenix Resources have shown tremendous growth to strategically secure themselves for further growth and to mitigate downturns. At first, I was just interested in the dividend, but now I may be in it for the long run.

Given that they not only have mining assets, but the rail and the port access provides them the opportunity to reduce costs and see that their product makes it to market to reduce complications. Additionally, these assets allow for diversification of revenue base via opportunity to provide third-party logistics. If you’ve read our KUYA article you are aware that companies moving rapidly in a market not fully engaged in commodities can go unseen–Fenix resources may be such company.

Fenix is generating free cash flow (extremely early since launch), they are poised to benefit from higher iron ore prices in the medium-term future, increasing production, they operate at healthy margins with low valuations, offer a high grade find and pay you a dividend to get a taste of their success. What else do you want?

Thank you for subscription & do take advantage of our live chat if you have any comments, inquires or thoughts.

#StayOnTheBall