What the hell is going on with Trump’s Tariffs? What are markets going to do next!? Why does everything seem like its grounding to a halt and the good times are finished?

The general narrative is that Trump’s tough guy tactics are a blend of MAGA, toughness against “cartels” & foreign competitors and a concern of trade agreement & tax revenues. Many, even in the MAGA crowd, are not happy with it as it has shot the VIX to enormous heights and consequently damaged their predictable “everything goes up” plan using 401K or other pension accounts.

So, is Trump an idiot narcissist simply creating volatility for his oligarch buddies to make 100s of millions amidst the chaos, or is there something greater at play here?

First, some X Jokes:

I’ve previously shared my contrarian thoughts on the reasoning behind the sanctions against Russia (subscribe to find out more), but in short, these tariffs are more of the same. I should state that I don’t believe this is Trump’s plan and that things could change in 2028– this is a move that spans far beyond any presidential term.

If you thought the President of the United States truly had commanding powers, you likely wouldn’t have had a dementia patient as the last President. We can argue about that later–but the crucial starting point is that economic sanctions and currencies are not as simple as raising or lowering sales tax on fish or newspapers. They are far more consequential and therefore must be approached with caution–especially with the precarious debt situation and off-balance obligations of the United States. I only make this point so you can zoom out beyond the latest flashy news headlines.

Long term plan or not, this doesn’t explain why action would be taken that harms the retirement savings or the number of goods in circulation in the United States–it seems quite counterproductive on the surface. If you’re an importer and exporter and you are tight on the books, a 50% tariff is game over for you–and likely the same for your clients.

Onshoring

When I say Onshoring, I am referring to the number of multinational corporations moving back to the United States in effort to revamp or rejuvenate the United States domestic economy.

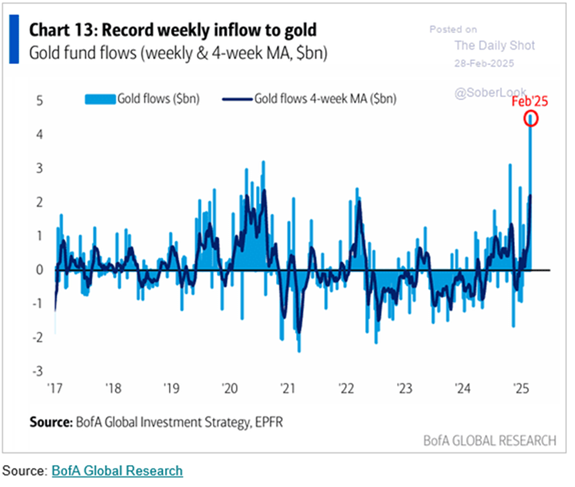

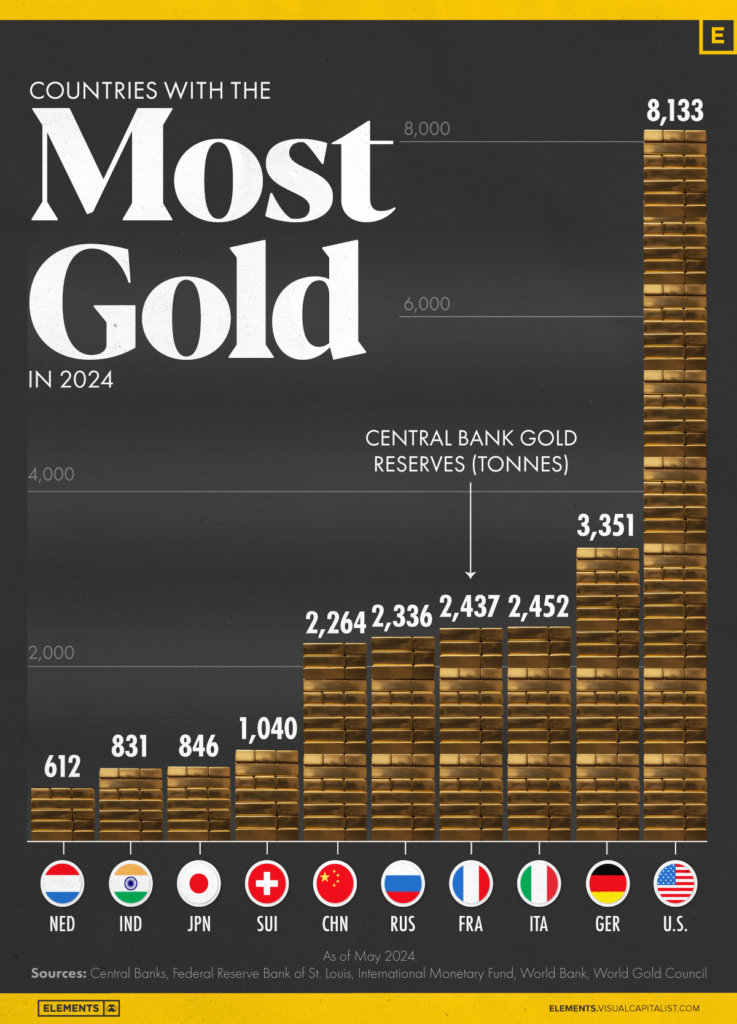

I believe the Trump Administration is carrying out a larger plan to revalue the price of gold

Rewind

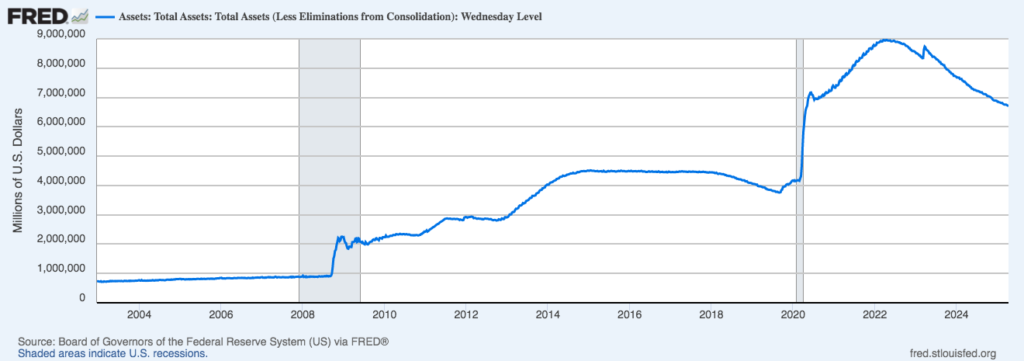

The United States economy is one of financialization; it is not known to export rubber like Indonesia, soybean like Brazil, cocaine like Colombia or automobiles like Germany; it’s main export are dollars. The world is effectively bailed out and/or supported because of their (in)direct line to the money printing capacity from the Federal Reserve since 2008.

What Changed?

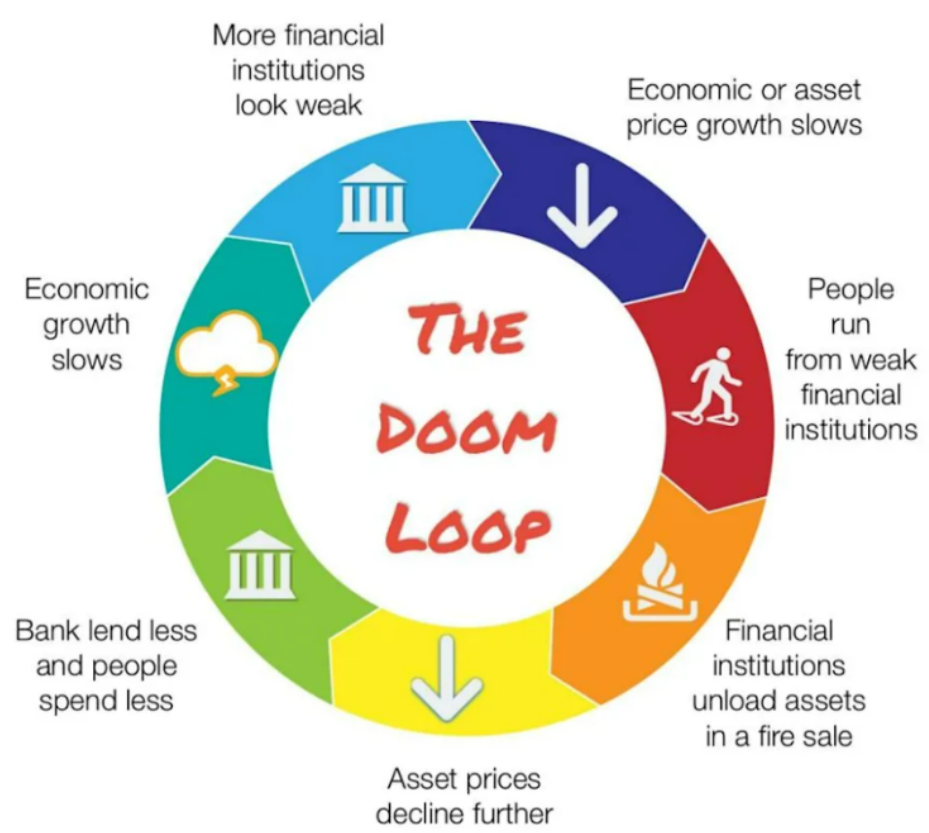

I believe the United States has determined that it can no longer continue to play the cop on the block with respect to the global economy; Europe is far, far too weak & regulated, the United Kingdom is crumbling, Japan’s debt is far too high, the Global South is content with selling their oil and gas for other currency, South America does not innovate and everybody else has negative feelings towards the United States. With global fertility shrinking and the average IQ of the world nosediving, things don’t look good. Plus, the United States has their own problems to manage.

You get the picture…

So, action must be taken. The United States can sink beautifully together with the world, or it can try to cut the rope and let everyone else drown with their own problems–I believe it’s going to try doing the latter.

QUICK! Two options. Our Free Newsletter or International News Coverage Every Month like No Other. Choose Below!

1)

2)

USA Problems?

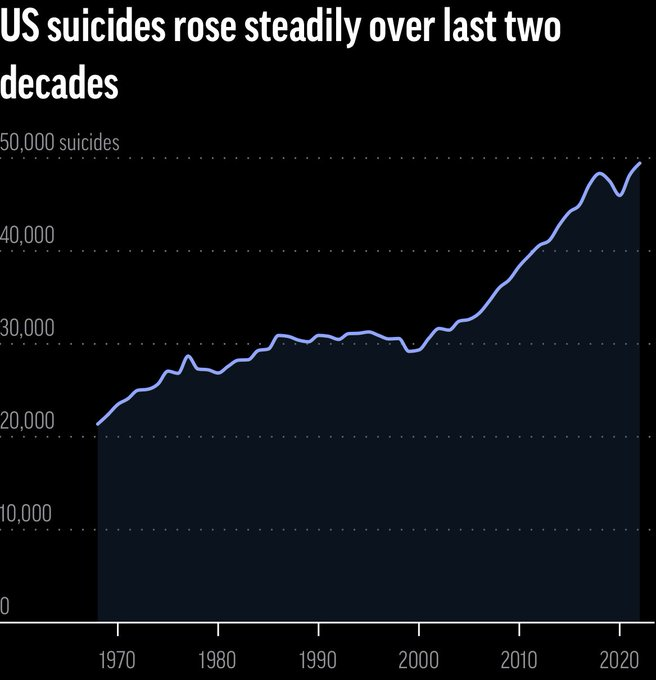

Cutting away from the globalized economy would indeed cause major pain for the United States and its citizens, especially with huge amounts of debt rolling over in a short period of time. They would be forced to realize or “handle” the debt themselves with no foreign buyers with likely higher interest rates (look at rates rising lately). Additionally, the weakened revenues for equities is a great catalyst to bring down markets to more appropriate valuations, damaging 60% of citizens alread allocated to markets. Local workers would also demand steep wages and benefits from their new ‘onshored’ employers.

However, remember, the USA economy is far smaller than the global economy, and the USA still possesses their magic money printer. The demands for high wages of onshoring may also be mitigated by a horrendous stock market crash and rampant unemployment. For a citizens with debt payments, some job, any, for poor wages may be better than nothing at all.

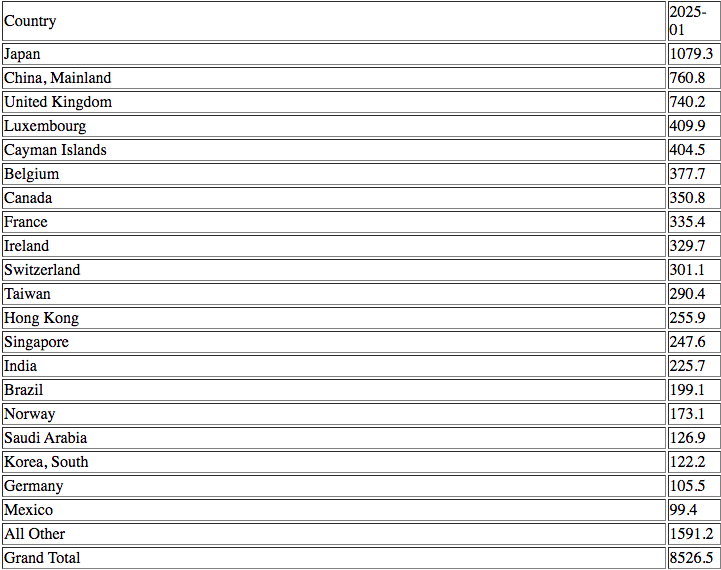

This is where the onshoring would be key and I believe Trump & the Treasury may try to mandate some sort of reserve requirement for large corporations to have treasuries on their balance sheet. A new mystery buyer [of debt] like Belgium in 2011 and Cayman Islands (recently) may emerge, too. This is speculation on my behalf.

Benefits from the State POV

With the multinational corporations returning home (and other foreign companies locating there), the USA would see:

- A domestic economy that perhaps cannot compete with China but it’s on its way to becoming resilient again (rather than just shipping pallets of dollars abroad)

- A huge level of repatriated dollars leading to significant inflation to handle the debt payments (inflate it away); domestically

- A cheapened dollar (due to lack of buyers on a global scale) against other currencies to make exports more attractive; internationally

- A way to pull out from the world so their economies hit rock bottom; kick them off the dollar cold turkey. In other words, it allows for the USA to be in a position of strength.

- It is far easier to revalue gold with weakened dollars.

From the workers point of view, it may mean significantly higher wages in absolute terms, but not in real terms, with inflation included. The workers may receive 140,000 USD to work at a bakery, but in real terms, it’d still be equivalent to the 30,000 USD it is today. So, the average worker ought to pick up some bars of gold now!

All about Gold

This dynamic of cheapening the dollar (both by having a huge remittance inside their borders AND less demand from foreign banks) is the perfect excuse to revalue one commodity in particular–> Gold.

With a higher price of gold, the “new” monetary system can be established and hence an element of stability once again–with the USA (they hope) on top.

You Might Even Get Tired of Winning

There are three ways that the United States may be able to “re-attach” itself as the dominant force yet again in the world.

- 1) Gold

Why would there be so many headlines about auditing the gold at Fort Knox? Was there ever a chance that the public would hear about the gold not being there in the first place?

I also suspect USA will become more active in South America in the coming years, a gold-utopia.

- 2) Weakened Competitors

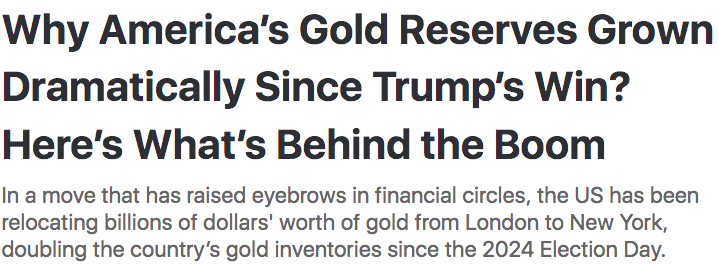

“In 2024, the United Kingdom exported £51.6 billion worth of gold, making it the most exported product. The top destinations for UK gold exports were China, Switzerland, Azerbaijan, the United Arab Emirates, and the United States”

From the United States Treasury’s data:

Treasuries are the grease to lubricate the old system. They are the best form of collateral that enables all of these countries to borrow to pay their debts (and they have tremendous debts). In total, the world has $13T of on balance sheet USD debt, $70T in off balance sheet USD debt and over 1 quadrillion in USD denominated derivatives. The USA has everybody addicted to dollars, a break from this habit is going to hurt.

- 3) Artificial Intelligence

I’m out of my element on this one–but it is apparent that there is an ongoing arms race on whoever can achieve the best super computer AI, first. The country to have the best and most numerous supply of drones, robots, and artificial intelligence protocol will hold world dominance. While it’s quite possible the USA is not superior in this, there are few competitors who can compete in this realm. It’s no accident that Trump announced a private-sector investment of $500 billion in AI infrastructure.

In 2025, a record number of data centers are expected to be under construction in the U.S. Specifically, CBRE forecasts 4,750 data centers will be in the process of construction, a significant increase from the previous record of 4,250.

The game plan is to detach from the failing global monetary system only to re-attach as being its leader once again, this time, under a new standard

Two sides of the Same Clipped Coin

If we remove our hate for China, hate for Trump and objectively view the trends before our eyes–> It looks quite like the United States is adopting the Chinese ways.

- China is a manufacturing economy for powerhouse; this is what these moves would attempt to recreate in the United States.

- China operates two currencies (domestic and international); The United States could be doing the same

- China operates a very top-down surveillance police state; Take a look at the FBI, the Defence Department & the state censorship apparatus. As I write this a “Real ID” has been announced

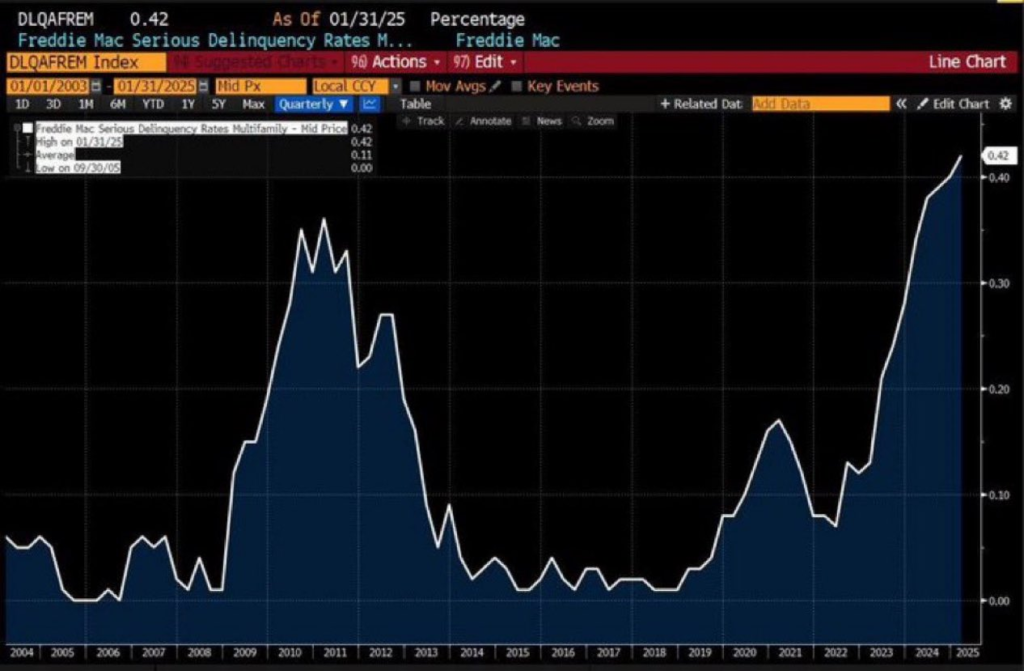

- China has an immensity of debt, a housing bubble, high unemployment and a mounting lack of faith in “the system”; just like the United States.

- China has complete control over its markets; I believe the United States will end up creating control over its bond market similar to something you’d see Erdogan doing in Turkey.

- China is accumulating huge amounts of gold, an unknown amount; The United States is said to have the most amount of gold out of any country, likewise, it remains as an unknown amount

- Both are racing for AI dominance

Together you can see that the similarities; both are trying to dominate in some sort of new economic system.

I still stand by the idea that Russia is the real power that everybody should be watching. As Putin said before “when the two lions are fighting, the wise monkey sits on the sideline and observes”. That’s for another article.

Closing

The United States has no shortage of idiotic politicians and citizenry who cheer them on (sorry to say)–but they also possess some of the most exceptional people on the globe. It’s not by pure luck that they’ve been able to expand their influence this far and wide. For nearly everybody, ones ability to become a professional consumer and hastily burn money in the United States is truly outstanding– there’s no other place like it. By removing my biases of what I think of the place–I still have to admit that the United States is not going to go down without a fight. If you and I can see that the level of debt obligations are unsustainable, surely there are professionals and experts at the Fed, Treasury and CIA who can see it, too.

The USA need an enormous reason (such as turning inward to their domestic economy) to revalue gold 10-50X its current trading price to handle its wave of debt. It’s far too risky to continue to print-and-spend and have the standard of living decline for no reason; a great story or narrative has to be sold to the public to ignore what is really happening. It’s worth reminding readers that when I say the USA I am referring to the state, not it’s residents or citizens.

The introduction of sanctions and tariffs are not some arbitrary “big dick” contest. Instead, I believe they are part of a radical plan to detach from the failing global monetary system only to re-attach as being its leader once again. This time, the world will be under a new standard and I believe that new standard will be based upon gold.

If I’m correct–>What does this mean for you?

It means you don’t have enough gold in your portfolio!

Please Subscribe for tips, investment ideas, discounts, global news and more articles

#StayOnTheBall