The Production Problem: A Silver Set up

Silver production has a unique trait that many may not be familiar. It’s that it’s majority production are not done by silver miners. Instead, the silver that comes about is a byproduct of lead or zinc mining, which accounts for 65-70% of the amount of silver produced yearly. Investors therefore cannot expect supply to increase in unison with demand because this would mean that zinc and lead miners would have to ramp up (and there’s added demand for silver, not lead or zinc). You cannot expect them to incur expenses without reason.

However, this can work against investors of course. When Demand is not very high, an unwanted demand for silver is still being produced, flooding the market with supply & inventory.

But upon a further look at this mismatch, this doesn’t appear to be an issue. Supply just can’t keep up with the added demand as of late. Lets dive in!

Before we do, remember to Follow us on Twitter, Instagram and sign up for our newsletter

While supply has rebounded a bit, it’s well below where it needs to be. Approximately 700 million ounces (Moz) are withdrawn from mines every year and a high figure of recycled silver may come out to 200 million ounces. So where does this 900 million go?

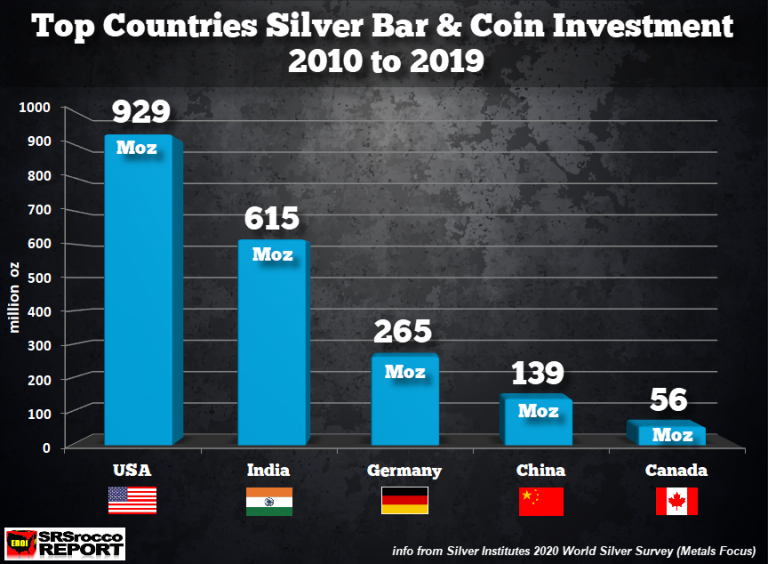

Rather dated data from billionaire investor Eric Sprott had shown me that the trend was there’s only so much to go around. He noted that nearly 400Moz have been bought (investment) within this 900Moz market in the last 5 years (recording as of 2020). After hearing this and hearing that about 100 Million ounces go to Silver ETFs, I began to be curious about just how much is available to buy relative to demand.

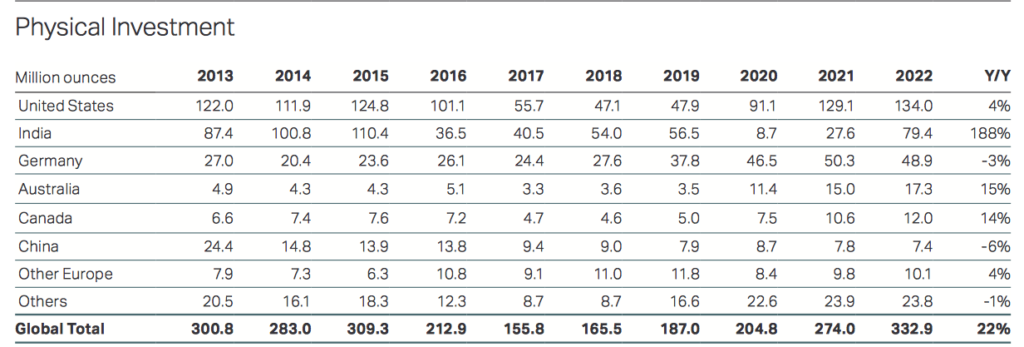

If we start in 2019–>2019 alone, 186M oz of physical silver had been bought by investors.

In 2020, this number shot up to 200.8Moz (with 331Moz “bought” in exchange traded products (ETPs) the same year).

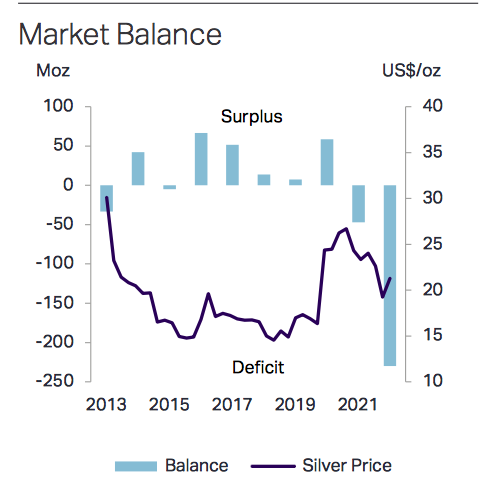

In 2021, physical silver investments continued to 278.7Moz motivated by retail investors seeking an inflation haven which had been the largest buy since 2015. This was also the year where there had been a silver shortage of 51.8Moz (largest since 2015).

Approximately 1.05Boz purchased totalled the year with half of this going towards industrial uses. Photovoltaics, jewelry, investment, photography, electronics, defence and aerospace, battery usage and alloys all experienced a jump in demand.

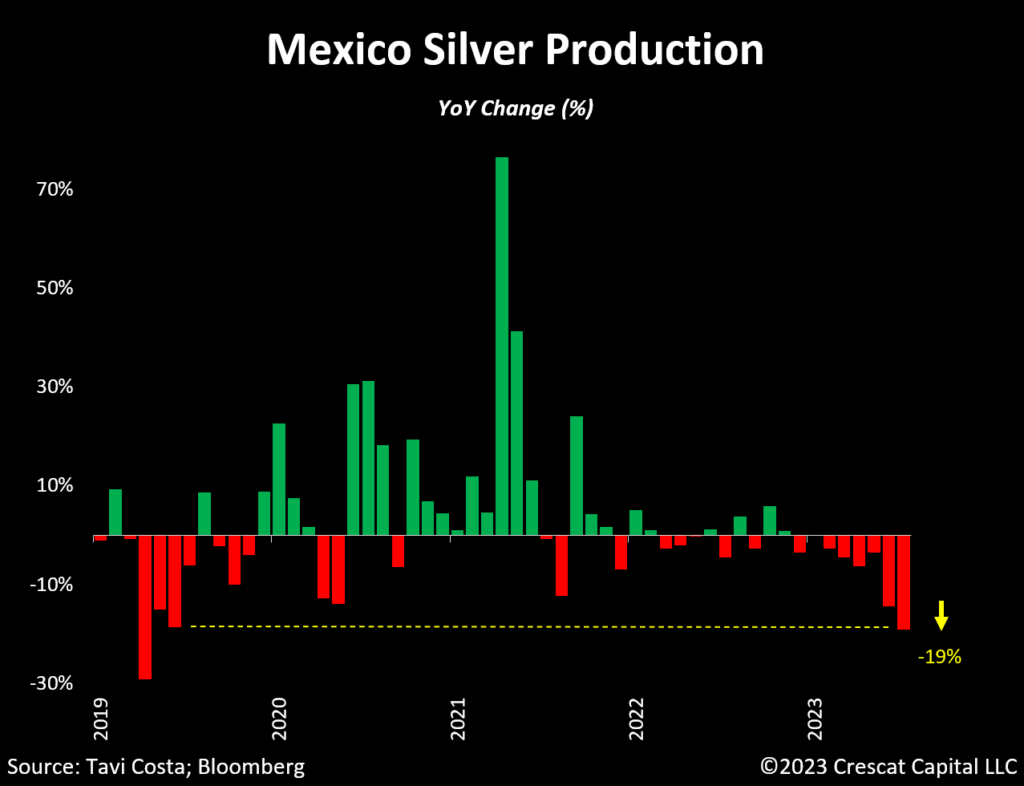

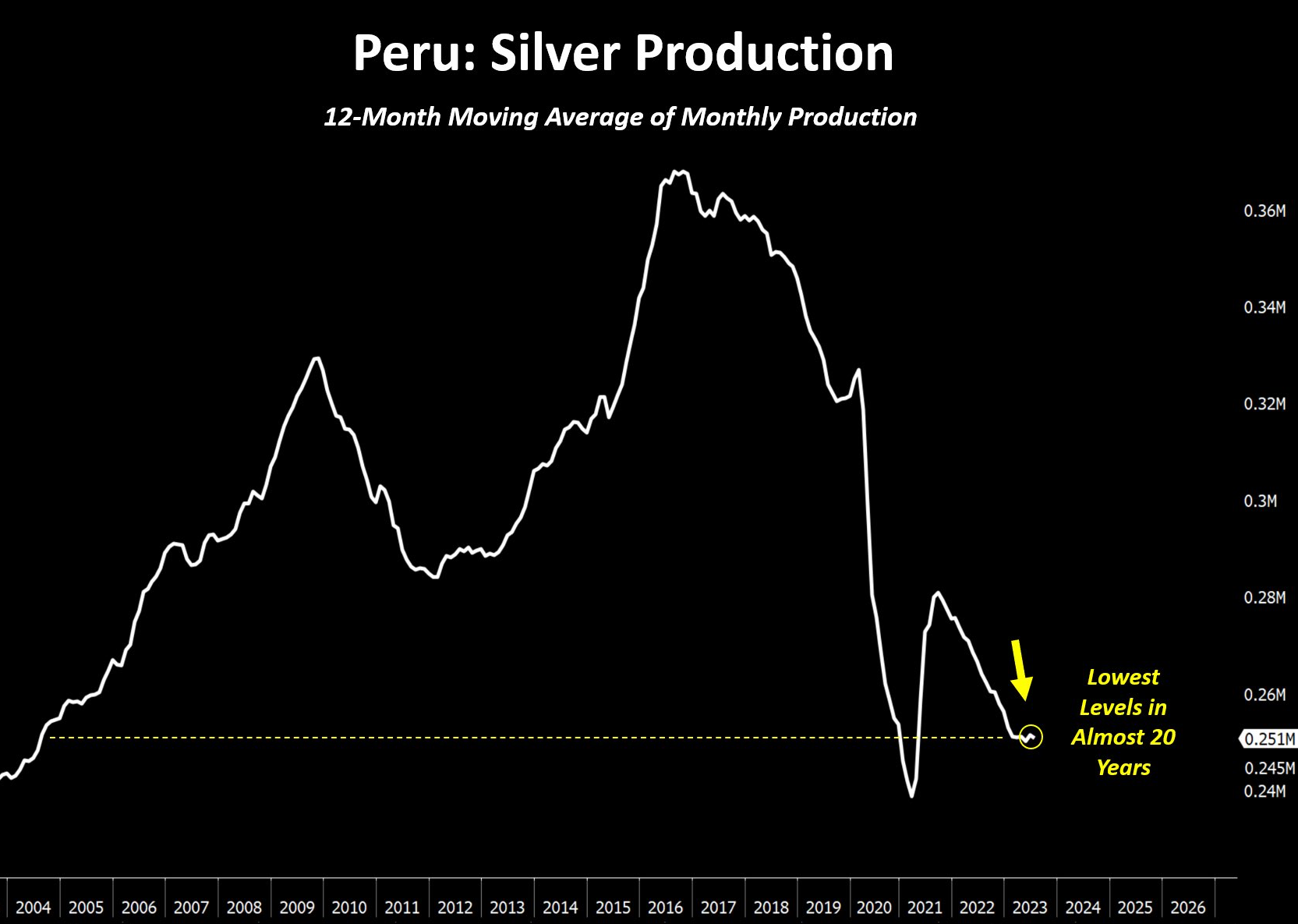

Globally mined silver for 2021 modestly grew to reach 822.6Moz with silver mines increasing output by 10.2% with all-in-sustaining-costs falling. Mexico was the largest producer, followed by China, Peru, Australia and Poland.

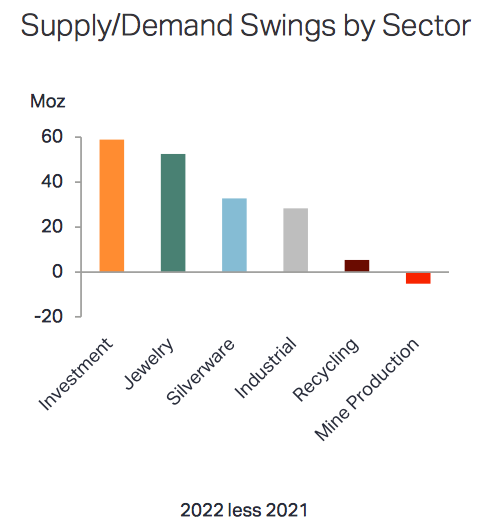

So 2021 set records, could there be a new record for 2022? Yes. Physical silver investment grew now to 329Moz. Industrial demand has increased compared to the previous year to 539MOz. Interestingly, this was when ETPs saw a decline of 110Moz in silver holdings. Jewelry and silverware landed at 235Moz and 73Moz respectively, given a surge from India. Total purchases amounted to 1.24Boz (compared to 1.05B) leading to a deficit almost 4X larger than the previous year!

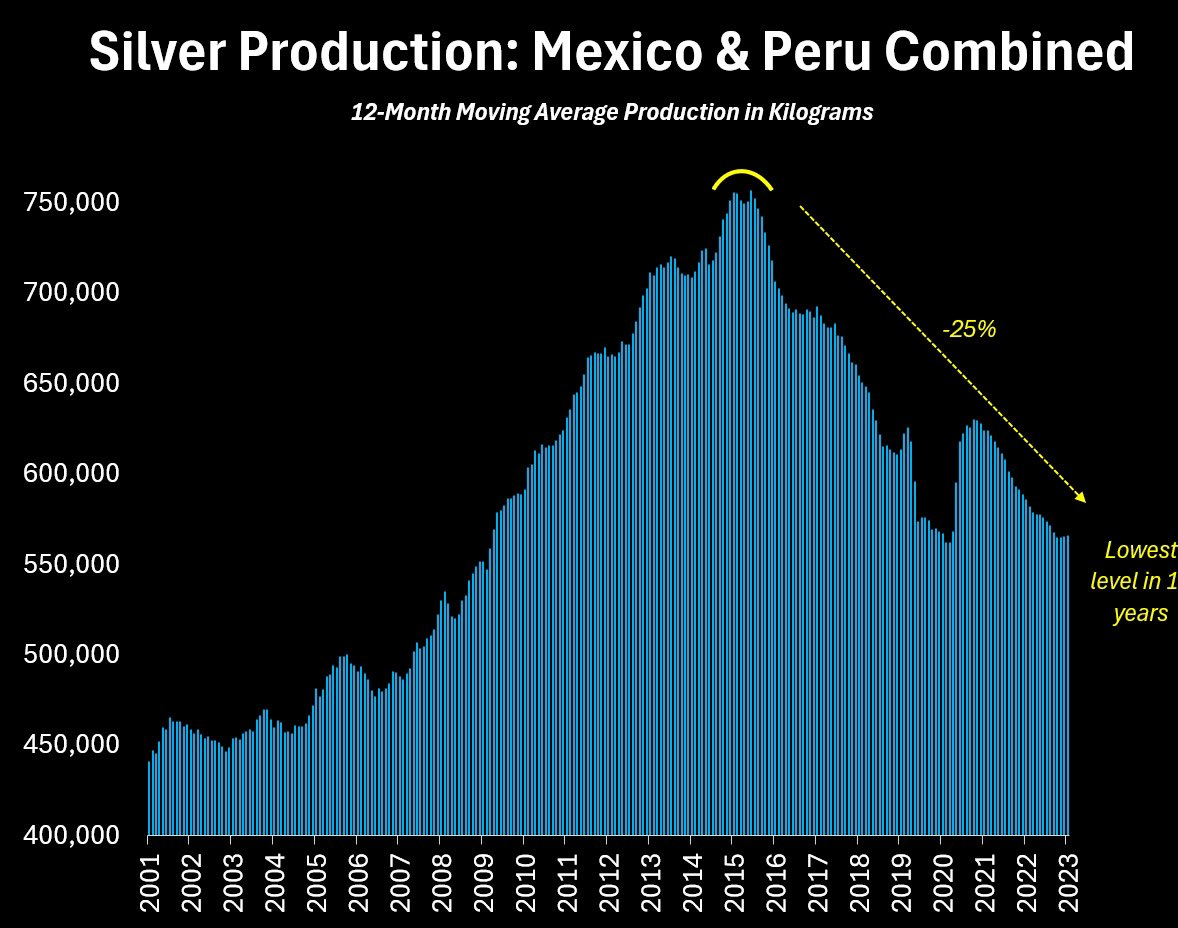

Silver mining production merely increased 1% to 830Moz due to the operating costs of the miners rises year over year. Once again, Mexico leading the charge followed by Peru, China and Russia.

Just physical demand for silver increasing around the world; in some countries it’s doubling from simply years prior.

As per the World Silver Survey 2023:

A lack of supply gains was another factor contributing to last year’s deficit. Limited organic growth, project delays and disruptions resulted in a marginal decline in mine production while recycling barely rose.

Deficits for Days

Whats even more shocking is this is including China’s dystopian zero-covid measures that drastically curbed purchases. While China does consume a considerable amount, they also produce a healthy fraction of the world’s supply as well–that limited its supply hitting the market even further. If you’re also following the collapse of China with any focus at all, you can price in the removal of this supply to world markets. Again, follow on Twitter (or stay tuned into our articles page) for more!

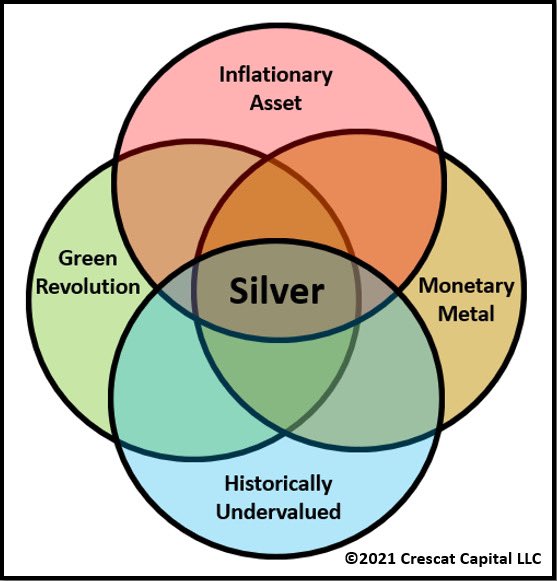

As for 2023, the Silver institute forecasts a 76% reduction in demand from ETPs and a demand fall of 6% YoY mostly from a contraction in jewelry and silverware demand. Bar and coins purchases are estimated to fall also, but still remain high (up 33% compared to the 2010-2019 figures shown above). However, industrial demand is expected to continue it’s all-time-highs as photovoltaic applications continue to show demand. As a result of this industrial demand, supply deficits are still estimated to amount to 142.1Moz. It’s estimated that the supply short falls from 2021-2023 will amount to 430.9Moz, which amounts to over half of ALL mining production, annually.

By-product metal prices such as Zinc and Lead have fallen, leading to less output, too. As previously stated, this is a true issue as the fate of the silver industry is partly out of their hands. Mexico and Chile are pure silver behemoths of production–carrying a lot of responsibility–whereas the other jurisdictions are cutting output.

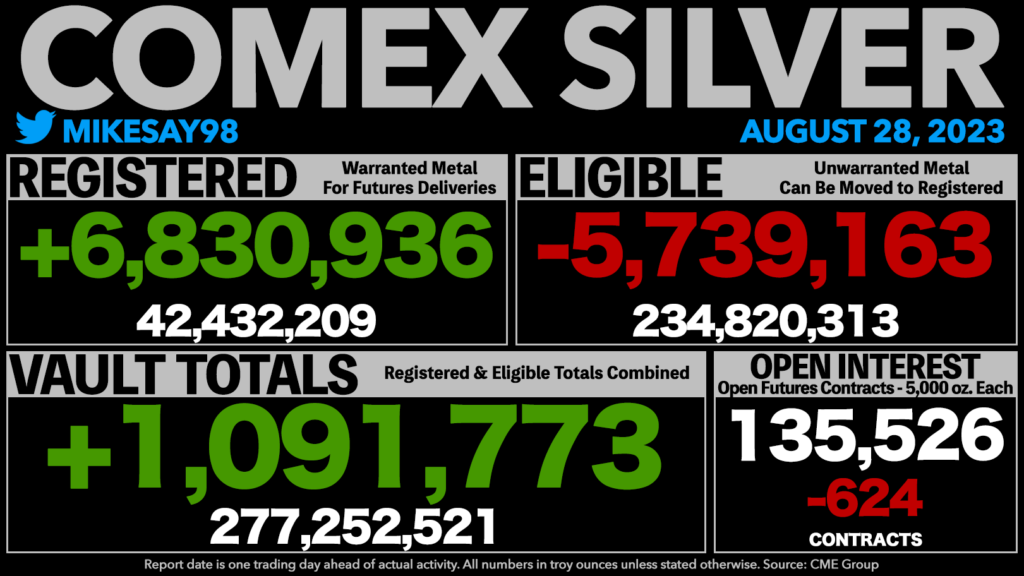

This is the Comex holding at the closest to the time of writing. It’s worth saying that the increase found in the Comex is the largest since last September and from what I can tell it’s generally being drained month-month. Open-interest is now equal to 244% of all vaulted silver and a huge 1,597%.

I’d recommend following @mikesay98 on twitter he tracks this like a hawk.

But, the Price…?

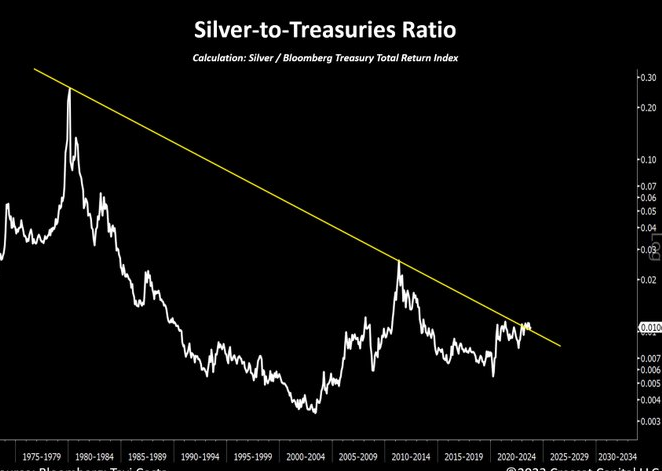

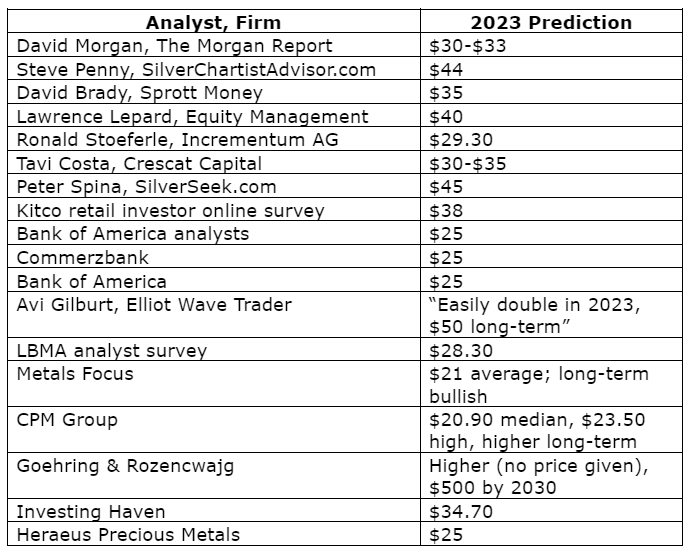

The silver chart has performed (as of September 1st) 15.45%, 28.85% and 64% for 6 months, 1 year and 5 years, respectively. While this proves to be a healthy inflation-hedge, it is also around 3% off from breaking it’s 12-year resistance when it peaked at over 50 USD per ounce in 2011.

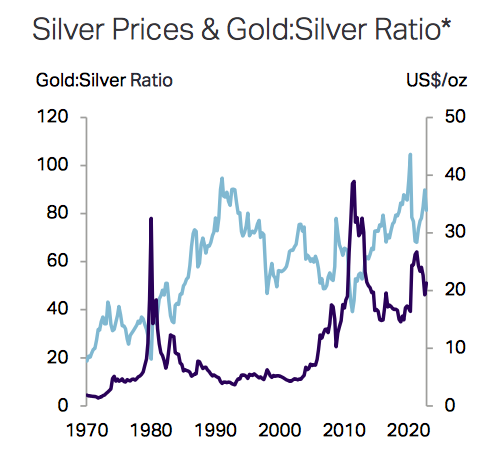

Others have eluded that silver is primed to rip because of its historic discrepancy between it’s price and the ratio of gold:silver in price. The chart above demonstrates that the Gold:Silver ratio sits around 80 (80 ounces of silver per 1 ounce of gold). Some of course have also eluded this is a bogus indicator, but it’s worth noting that mineable silver to gold ratio holds at just 7-10:1 and the average gold:silver ratio is 47:1 (60:1 for last 20 years; although this when industrial demand has exploded, too).

Even if you believe that this gold:silver ratio is a nothingburger, it is true that silver experiences more volatility relative to gold. This is partly due to the reason that during turmoil times people jump into gold, not silver. This causes the gold price to increase, which affirms to a larger number of investors that the precious metals are in fact interesting after all, leading them to purchase the item that has yet gone up in price (& remains nominally cheap). Silver also enables a much larger audience of retail investors than gold does because of its reduced price. This “piling in” on silver is expected during this metals bull market.

The last point worth making is that in dollar demand (from the US mint), the ratio of silver to gold sits close to 1-to-1, which means that they are selling approximately 80X as much volume of silver as they are gold.

If we assume 800Moz of silver produced yearly and 80Moz of gold produced per year, than this ratio is 10:1. If 400Moz is being eaten by industrial demand (for sake of calculation) than this leaves half (excl. silverware and jewelry) available for investment. Hence, available investment for physical buyers, contracts and hedging purposes is 5:1 (silver to gold) but the rate of sales (in dollars) sits at 1:1. This cannot continue at this rate.

[BIG Update!: This hasn’t been included in the original posting. Mexico & Peru, the world’s largest producers are not performing like they once were]

NEWS

The dynamic is getting worse and worse–

https://www.mining.com/web/global-silver-deficit-to-rise-in-2024-due-to-higher-demand-lower-supply

Closing

If supply shortages remain a trend throughout this decade than we should expect a strong price correction to the upside.

This discrepancy between supply and demand for silver lends itself to produce wild volatility in the price—often lagging gold’s performance. Given that demand has quite visibly increased and that supply is becoming increasing crunched by producers, this may be the makings of a perfect storm. Anecdotally, I should also note that some folks I know to be smarter than I (& far wealthier) also believe that larger gains will be found in the silver space relative to the gold space.

So how does one play this? Well, let’s save that for another article…

I’ll leave you with some interesting quotes to ponder further:

Commodities have been in a super-cycle since 2020, with silver looking to play a special role, especially considering how cheap it is relative to other commodities. When you are in a super-cycle, you often find high-beta plays do better. Between 1999-2011, silver did much better than gold.

Wells Fargo

Silver tends to outperform 3:1 in bull markets. Once silver eclipses $30-50, the next move could soar to $70-$100

David Morgan, The Morgan Report

A recession could put a damper on industrial demand but not enough to make silver a recessionary casualty. It is going to do well next year, just like gold

OANDA corporation

In 2022, 60% of silver was delivered by air, which was unprecedented. Silver usually travels by sea freight. [Freight by air is now] possible because of the high premium. Demand is so insatiable that they don’t want to wait two or three months for a sea container to arrive

Philip Newman at Metals Focus

We hit peak silver supply back about five, six years ago. Silver production on a worldwide basis has actually been dropping, and we’re not seeing as much silver produced from the mines.When silver prices go up, it’s not like the silver mines can increase production, because the silver mines only supply about 25% of the silver.

Randy Smallwood, CEO of Wheaton Precious Metals

I appreciate you taking the time to read and please share to help out a friend!

Take the time to check out other articles while you’re at it 👍

#StayOnTheBall

Want to buy your own silver but don’t know where to start? Get it touch here