Unfortunate Timing with Everything; But Brighter Times Ahead?

I am bullish on energy sectors for this whole decade. While the whole world bitches about windmills, solar, electric, carbon and fossil fuels, the bitter truth is that energy security for a country = political security. If you have to grow it, manufacture it, or move it–it requires energy. Some politicians get it, others don’t.

The ones who don’t get it primarily live in Europe. The ones who do get it live in USA (not all), Latin America and Asia. Energy consumption IS economic activity but half of the world is willing to sacrifice this for the moral virtue of saving the planet (which, to their Malthusian ideology just translates to removing you but thats a different article).

Energy sectors with the exception of so-called green energies have been cursed with higher taxations, permits, fees, fines, regulations and a whole political agenda narrative built around “carbon is the bad guy”. This is on top of the already extremely capital intensiveness of the sector, limiting its success.

I do not think these policies will wipe out every existing company in this sector (as I hope to show with this stock below), rather it will deter or destroy any upcoming one which ultimately means less producers.

Get to the Stock, Damn it

Upstream oil & natural gas company in the United States called Amplify Energy ($AMPY). It is headquartered in Houston, Texas and engages in the acquisition, development, exploration and production of oil and nat gas properties. It was founded in 2016 and became the successor to Memorial Production Partners 2017 Chapter 11 bankruptcy. It seems that they’re in the midst of bouncing back after their oil spill mishap in California, but are falling back in revenue & the energy market is pulling back right now. Perhaps more to fall in the short/mid-term but long-term I believe they are positioned well, pardon the pun.

It has 5 operations. These are:

- Oklahoma; 35 Million barrels of oil equivalent. 47% liquid reserves. 385 gross wells and 286 net wells.

- Rockies (Wyoming); 28.4 Million Barrels proven. 100% liquid reserves. 137 wells. The company has reached out to an investment bank to gauge market interest in the sale of this asset in Q1 2024. It has a 22-year life & approximately 7,000 acres.

- Offshore California; 13.7 Million Barrels proven. 100% liquid reserves. 63 gross/net wells, however are not producing following a 2021 oil spill. Ready to resume this year (2023). They plan to recommence an offshore development project to improve the reserve and recuperation rate in mid-2024. All permits in place for 7 additional wells. Estimated Original Oil in Place to be 600M-1B barrels.

- East Texas/North Louisiana; 263.4 Billions Cubic feet of proven reserves. 24% liquid reserves. 1580 gross wells and 865 net wells

- South Texas; 2.9 Million barrels of oil equivalent. 90% liquid reserves. 384 gross wells and 25 net wells.

All reserves are proven as of December 2022. The company has 230 employees.

Their assets are mature which require little working capital/maintenance and average life of 14 years at current drilling rates. The depreciation of their volume is expected to average 6% per year.

Simply Wall St only has 2 analysts covering it; Refinitiv only has on analyst covering it (11.00 price target and buy); Tipranks also only has 1 analyst giving a buy and price target of 12.00; three others do not have enough data to demonstrate. It’s not on a lot of radars.

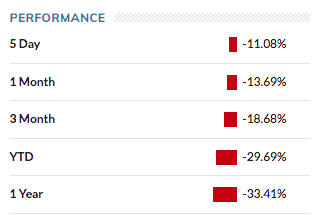

Performance

Share Price: $6.18 on NYSE

But the Assets remain… more on the charts at the end

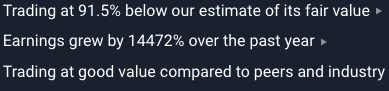

You’d be pleased to read that it may very well be making a turn around after being battered and bruised. According to Morningstar–> The stock has been trading between a 48.26% and 6.53% discount to its quantitative fair value over the past year.

YoY (2022)

Net margin = 12%

Gross Margin = 58%

ROIC= 30%

ROTC= 111%

ROCE=48.33%

Debt-to-Equity: 0.39

Shares outstanding: 39.09M

Short interest: 899K

2.35% of float shorted

Ratios:

P/E= 0.56

P/B=0.78

P/S=0.73

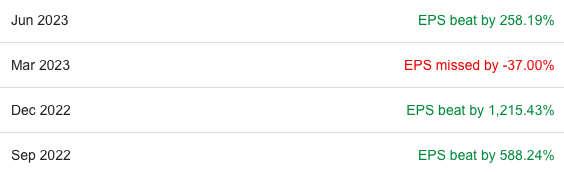

EPS Q2 2023= 0.24; 0.17 surprise, (8.69 Q1 2023; 8.53 surprise)

Quick Ratio: 0.87

Price to FCF: 2.73

Beta= 1.72

Dividend Yield= None. Last dividend was March 2020 (totalled to 6.3% annually)

Income Statement/Balance Sheet/Cash Flow

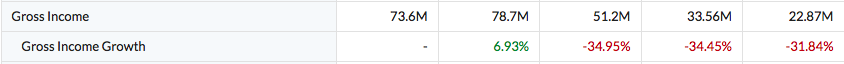

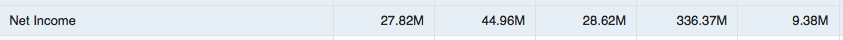

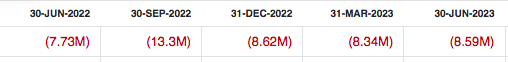

SG&A is consistently between $25M-30M, annually. The net income was so high in Q1 2023 due to negative income tax over 240M

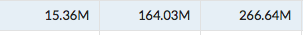

//Gross income

//Net income

They have a recorded Unusual expense of 483.2M in 2020 which definitely explains the stock getting crushed. Further aggravated by a 22.2M unusual expense in 2022.

Net income was 55.15M in 2022 compared to -32.07M in 2021 and -484M in 2020.

2022 (Q2 2023)

Assets

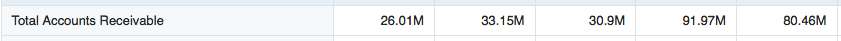

Total current assets= 99.4M // (88.34M)

Total= 459.48M // (715.48M)

Total Equity= -4.57M // (358.14 M)

Cash only (1.87M; Q2 2023)

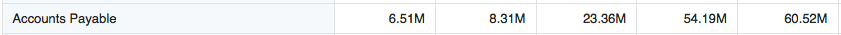

Liabilities

Total Current liabilities = 139.85M (140% of current assets) // (101M)

Total Liabilities = 464.04M (101% of total assets) // (357.34M)

Total Debt= 196.57M // (125.82M)

Net debt/Long-term adjusted EBITDA=1.8X 2022 to 1.2X 2023

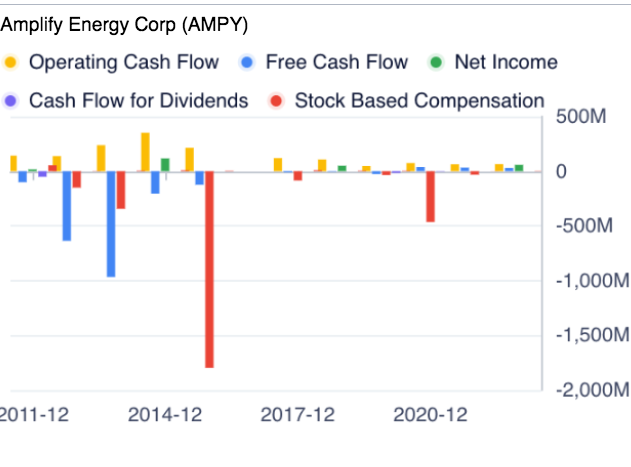

Cash flow

Cashflow from Operating activities (Q2 2023)= 4.91M–> only quarter where CFO was less than CapEx.

Cashflow from Operating activities (2022)= 64.49M

Net Cashflow from Investing activities (Q2 2023)= -10.73M

Net Cashflow from Investing activities (2022)= -41.53M

Net Cashflow used in Financing (Q2 2023)= -5.07M

Net Cashflow used in Financing (2022)= -41.76M

The company has been paying down its debts considerably since 2018

FreeCashFlow (2022) = 29.66M

*Free Cash flow for Q3 2023 was 6.1M* Since 2018, they’ve only had 3 quarters with negative free cash flow.

[Update! 2023 AMPY reported third quarter EPS of $-0.340, $0.50 worse than the analyst estimate of $0.160. Revenue for the quarter came in at $76.8M versus the consensus estimate of $74.5M]

Their latest report forecasts a $200M Free Cash flow from FY23-FY25 while having sub-300M Market Cap and 125M Total Debt

Litigation

Two oil cargo ships have struck their offshore oil pipeline really causing a dogs breakfast for all those involved. From their oil spill, the state and a plethora of three letter agencies have come after them after smelling blood. The update from a March 2023 10-K filing is:

The Company has reached court-approved agreements to resolve all criminal matters stemming from the Incident. Specifically, on August 26, 2022, as part of the resolution with the United States, the Company agreed to plead guilty to one count of misdemeanor negligent discharge of oil in violation of the Clean Water Act. The Company will pay a fine of approximately $7.1 million in installments over a period of three years, serve a term of four years’ probation and reimburse governmental agencies approximately $5.8 million for their response to this event. Further, on September 8, 2022, as part of the resolution with the state of California, the Company agreed to enter a plea of No Contest to six misdemeanor charges. The Company will pay a fine in the amount of $4.9 million to be distributed among the state of California, including the State’s Fish and Game Preservation Fund, and Orange County. The Company will serve a one-year term of probation and has agreed to certain compliance enhancements to its operations.

However, 10 agencies belonging to state and federal sources are doing their own investigations. Recently, they have dodged a bullet:

EPA sent a notice asking the Company to provide information as to why it should not be suspended from participating in future federal contracting pursuant to 2 C.F.R. § 180.700(a), (c) and 2 C.F.R. § 180.800(a)(4). On April 22, 2022, the Company responded to the Show Cause Notice. On September 9, 2022, the EPA informed the Company’s counsel that the EPA has administratively closed the case at this time, and as such, the Company is no longer under a Show Cause Notice.

How could this get any worse?

As a lot of their focus was on dealing with these litigious matters their credit facility was set to expiry. They refinanced (to compensate for one of their assets being offline) although, it was at the exact timing that the regional financial crisis also hit–causing further difficulty. However they were able to get their oil and natural gas hedges in for the years 2024 & 2025 moving forward.

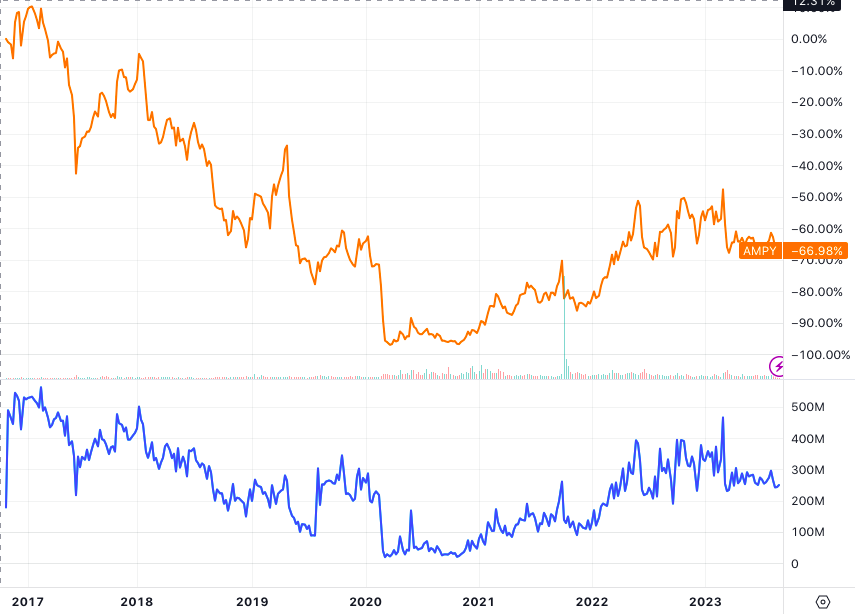

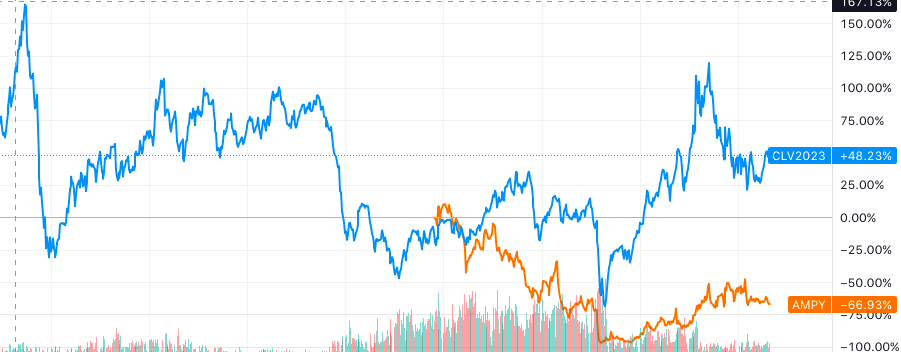

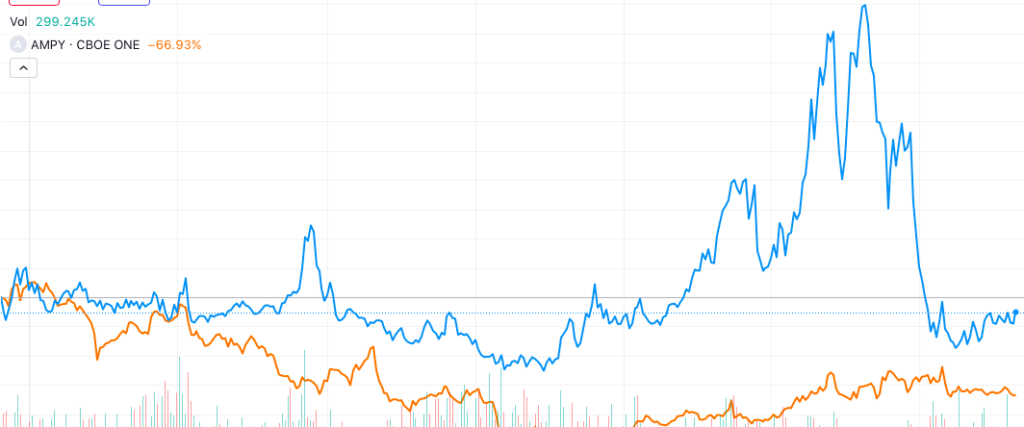

Weathering the Storm

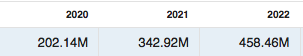

$AMPY has gotten destroyed since it went public back in 2016. But it seems that they’ve nailed their launch at the worst time relative to the oil & nat gas market (Photo 2 & 3 below). They have also had a bad experience with regulators following their oil spill, a challenge to refinance and the market is showing no mercy for their share price.

While natural gas was truly explosive across 2021 and 2022, it’s performance has been terrible since AMPY’s inception. Natural Gas price at the launch was about 2.82MMBtu, now at the time of writing, it’s 2.77MMBtu.

Despite the high commodity prices over this period, this was offset by the unexpected oil leak at their California property. However, they’ve settled a consolidated putative class action with California courts against 4 shipping companies and the Los Angeles-Long Beach Harbour. After amendments to complaints and some back-and-forth, it was settled in federal court this year for $50M USD and an injunctive relief will be funded under the Company’s insurance policies.

They have paid out an estimated 170M of assets and my hunch is that court filings are not over, despite managing well thus far. The good news though is they received their own net payments:

On March 1, 2023, the Company announced that the vessels that struck and damaged the pipeline and their respective owners and operators have agreed to pay the Company $96.5 million in a settlement. The Marine Exchange has agreed to non-monetary terms as well. The overall resolution includes subrogation claims by Amplify’s property damage and loss of production insurers, with Amplify ultimately receiving a net payment of approximately $85 million. The parties are working to finalize the settlement agreement documentation

Closing

Currently, the markets have been pricing in global recession with respect to oil prices. Russia and Saudi Arabia’s oil production cuts have received lots of attention by oil bulls but they often fail to consider that these countries are forward-looking to see demand cuts as well. If OPEC knows emerging markets are short on dollar liquidity [for oil] than it’s in their best interest to stabilize the market by preparing accordingly. Although, this is for now–long term we aren’t going to see oil demand subside and lack of investment is going to continue to rear it’s ugly head.

For Amplify Energy, the previous 4 quarters have been green in terms of sales, revenues and earnings; Q3 earnings are negative, however. Beyond the immediate class actions and recessionary downturns, if you’re bullish energy for the foreseeable future, this may be a stock to consider at it’s current multiples.

Relative to other stock picks it does not appear to hold an economic moat with its moderate balance sheet. Some have expressed their displeasure regarding the obvious weakness in stock price–saying it would be better if it were acquired completely. It’s weak points are it’s little cash, likelihood to sell an asset or issue shares in the near future, weak operating cash flow relative to it’s CapEx, and it’s uncertainty to deliver on its promises.

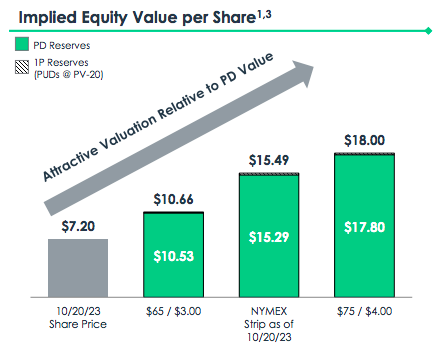

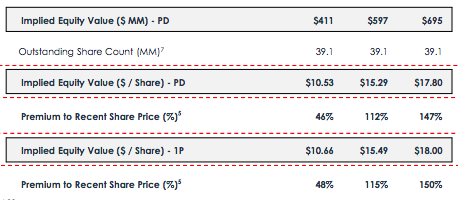

Yet acquisition or not, there’s no denying that this is undervalued and unnoticed due to its bad events. If we go back to the underlying value of their properties (in the Performance section) to where the stock price should be trading relative to their [property reserves that can be produced using existing wells] PD–there’s plenty of upside. The exciting aspect of those numbers (providing up to a 150% return) assume an oil price of $75 AND calculate this number off of a $7.20 base (the stock is now $6.18).

Consistent free cash flow, paying down debt, the resumption (& expansion) of California operations, little need for large CapEx and a depressed share price making acquisition ironically more likely all signal that Amplify Energy carry more upside in the years to come. It’s reduced profitability due to reduced energy prices and sales may have allowed it to go missed by analysts–but not for those of you who

#StayOnTheBall

Thank you for reading!!