A Spicy Situation

Limited Availability for Non-Subscribers!

Company:

Hot Chili Limited is an Australia-based copper company. The principal activity of the Company is engaged in mineral exploration. The Company is focused on copper exploration and development in Chiles Atacama Region. The Companys Costa Fuego Project is a copper mining hub in Region III on the Chilean coastal range. Its Chilean coastal range Costa Fuego Copper-Gold Project comprises the Cortadera, Productora/Alice and San Antonio deposits. The Cortadera deposit is focused on copper-gold discoveries in Chile. Productora is an advanced-stage copper-gold project. Its El Fuego copper Project encompasses two historic underground mines, which include San Antonio and Valentina. The Companys wholly owned subsidiaries include Sociedad Minera El Corazon Limitada, Sociedad Minera Los Mantos SpA, Sociedad Minera Frontera SpA, and Sociedad Minera Bandera SpA.

They are looking to become one of the largest copper developers in the world with their deposit.

Copper

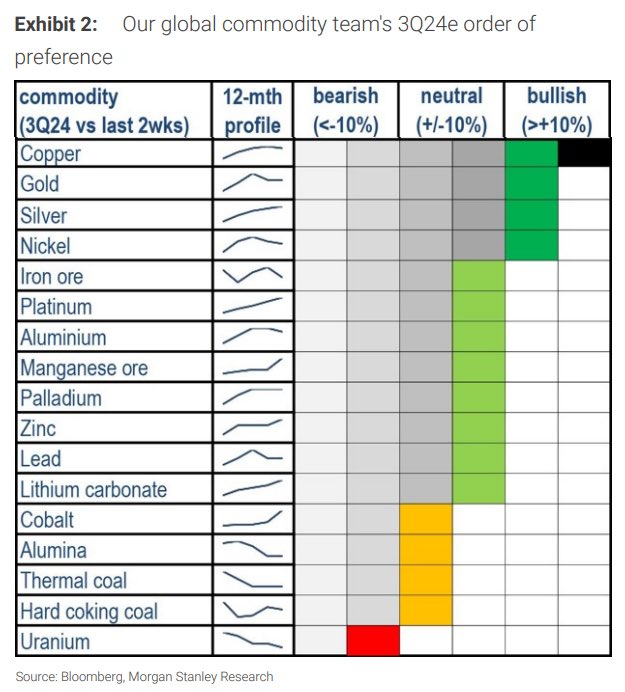

Firstly, it makes sense to explore the commodity that many are speculating is ready to rip given it’s continual neglect throughout the years.

Copper Deficit:

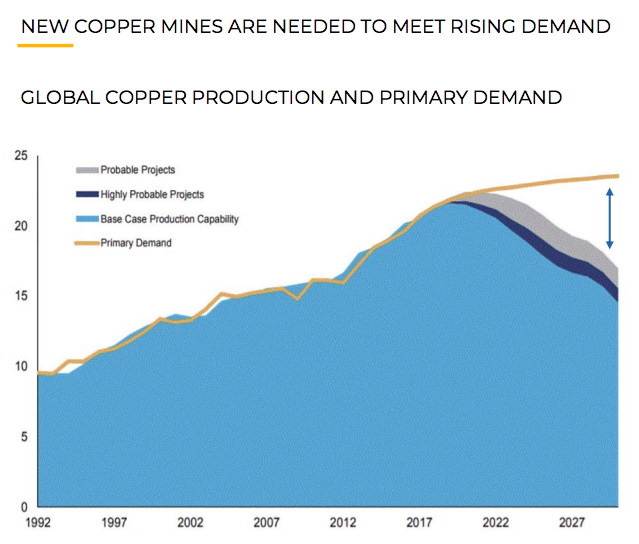

Interestingly, Hot Chili predicts that there will be a production of just less than 2M tonnes per annum with a market (according to current trajectories) to reach 22M tonnes of demand.

I have been (sorely) holding a lot of gold miners in my portfolio for the last few years and I’ve been checking up on their status monthly. One thing that is apparent– even if they’re gold or silver focused, they all want more exposure to copper. Hot Chili has had many meetings at predominately gold conferences as well with great interest.

Nearly 24% of all the copper supply to come on air over the next 10 years is expected to come from Chile. As you begin to read the post you’re going to like to see this:

Did you know we have a section dedicated towards Traveling the World? Check it out!

In our Panama post, we explain the troubles with an amazing 1.5% of the world’s copper supply.

Interesting Details

Hot Chili is a pure copper play, interestingly their capital raises have been non-dilutive to shareholders as well. Even if they have to issue warrants or shares, it will not be a long-lasting event given their balance sheet stability at this given moment. They hold an Indicated Resource of 798 Mt grading 0.45% CuEq & Inferred Resource of 203 Mt grading 0.31%CuEq (Feb 2024)

There’s about 5 or 6 developer to producer that are working at the same sort of scale that Hot Chili currently has as an asset. They are hoping to shape up predicted growth from approximately 100K tonnes per annum to 150K tonnes per annum and are aggressively pursuing their 30,000m drill program with keen eyes for acquisitions nearby.

Hot Chili has also released a detailed report with some interesting details. Using a conservative 3.85 USD/pound copper price at an 8% discount and what came out was 16 year mine life producing 95,000 tonnes of copper per annum with 50,000 ounces of gold as well

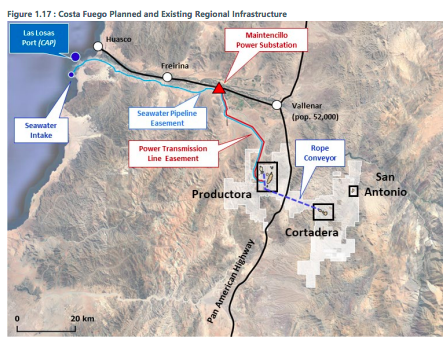

Their ore bodies can be processed with salt water which saves a tremendous amount of money on costs. Their main operations are at a low elevation as well (a common hindrance to mining anywhere in Chile). This number is so significant that they reckon their project to build will amount to around 1 billion USD but this would amount to 2 billion USD if it were in the United States.

They are now the largest copper producer on the Australian Stock Exchange and all the other copper producers are not capable of holding a project that yields 100,000 tonnes of copper per annum production (even if they are a larger deposit).

Situation

~13.1M AUD in the bank

US$1.33/lb Cu cost of operating (equals about 10,000 USD per Cu tonne equivalent)–huge upside to the copper pricing. If we assume that the Copper holds at 4.20 per pound (please see chart above):

Post-Tax–> NPV8% US Millions: 1,463 with an IRR 25%

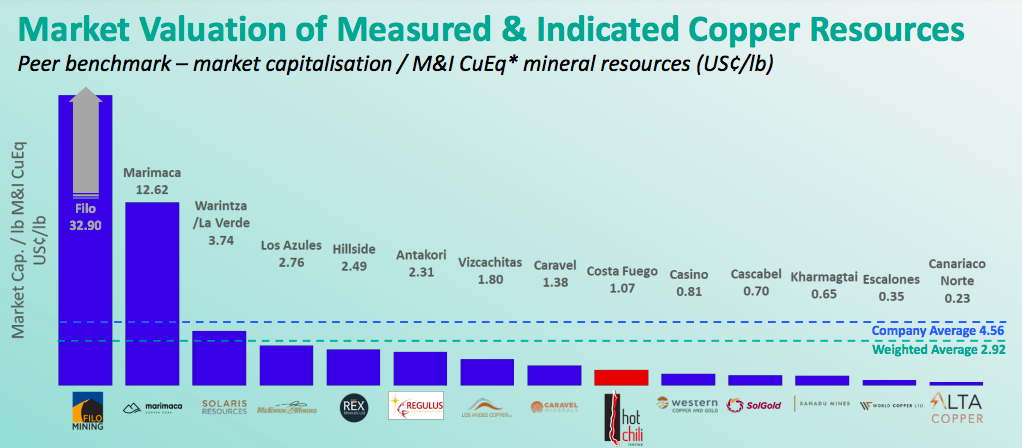

Comparing their Market Cap to their Deposit you can see there is a lot of company upside–even if they don’t have the highest grade copper nor the largest deposit.

Interestingly, the Net Present Value (NPV) of the company moves about 100M (AUD) for every 10 cents the copper price moves above $3.85 per pound. You can also calculate this a different way by considering a 50% increase in the copper price above $3.85/lbs. triples their NPV. Converting this value at a .25 multiple provides you with 11 dollar (USD) share price for Hot Chili. [At the time of writing this is 14.5X return]. This is purely based upon their copper deposits.

From what I’ve gathered, it seems that a lot of their funding will come from their own assets. They have a gold streaming option on their precious metal deposits. They also have the electricity infrastructure as well as their water assets. The need to dilute shareholders and raise a half a billion dollars will therefore be greatly mitigated. I encourage you to read their Costa Fuego Copper Project here–> https://www.hotchili.net.au/wp-content/uploads/2024/04/NI43-101_Mineral_Resource_Estimate_20240408.pdf big document.

Costa Fuego PEA Highlights:

NPV = $1.1B, 21% IRR, 3.5 yr payback, 112k tonne per annum copper production. This PEA predicts a 18-year life of mine production with 14 years considered primary production. Interestingly too, 97% of PEA inventory is completed using their Indicated Resource– the upside for a larger NPV is certainly worth considering.

Moving forward all of their calculations assume a price of $3.30 per pound of copper and a price of $3.80 for the future consensus forecast

Unlocking the value of water assets

If you’re going to go out in the next 10-15 years with such a company, it is also valuable to know that water is becoming a resource that many mines are struggling to find. Water may even become a liability given their need to locate desalination plants which is a struggle in the middle of nowhere. Luckily for Hot Chili, they are able to process copper ore by using salt water directly. It’s important to note the problem of water scarcity in the Atacama region ofSouth America is one of the largest challenges facing new global copper supply

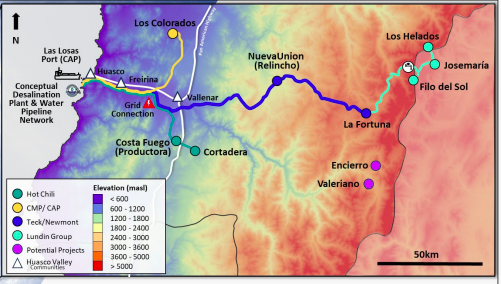

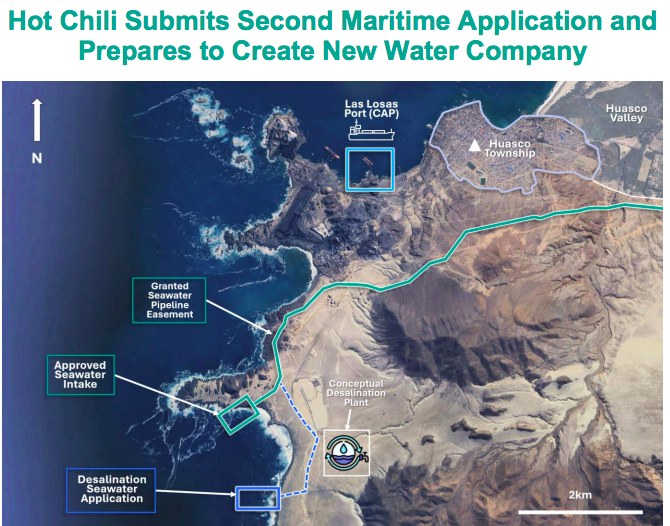

However, the feature that I believe caught my interest & “sold” me relates to the capacity to expand beyond copper. As part of the endless permitting involved, Hot Chili has secured a Maritime Concession as well as land access on the coast of the country. They also just so happen to be in an area of Chile where there’s a 15K Liter/per second deficit of clean water. For the locals of this region, this is quite frankly their only hope at receiving a reliable water supply. Additionally, there are numerous metal deposits in around this area that are without water for processing of their ore discoveries; until now.

All things considered, they have off-spin this water asset to become a whole other company with a lifespan far exceeding the lifespan of the copper mine. In terms of new competitors looking to gain their own water license to do the same? They’re looking at about a 10-year licensing process if they start tomorrow.

At a time when cost of capital is high and lending is difficult for mining operations, it’s far more sensible to seek contractual agreements with Hot Chili’s water utilities.

Whether they sell the asset, work with local governments to provide water access to the locals, work with a pipeline provider or build a desalination plant themselves remains to be seen. However again, if we extrapolate out further we can see a situation where it could allow them to fund mining operations through long-dated government contracts to enhance their margin at the end of the day & explore other mineral assets.

Property vs. Big Players

The Productora deposit is 100% owned by a Chilean incorporated company Sociedad Minera El Aguila SpA (SMEA). SMEA is a joint venture company – 80% owned by Sociedad Minera El Corazón Limitada (a 100% subsidiary of Hot Chili), and 20% owned by CMP Productora (a 100% subsidiary of Compañía Minera del Pacífico S.A (CMP)).

The main deposits are the following:

The Productora & Alice deposit is located within the Chilean Iron Belt, which extends for more than 600 km along a 20 to 30 km wide. It has been part of a mine that ceased operations in 2012. Drilling operations thus far highlight contiguous finds with a larger mineral resource. The Cortadera is a copper-gold-molybdenum porphyry deposit, comprising a series of mineralised centres. Previous mining took place upon mining leases where several small workings were developed in the oxide zone as trenches, surface excavations and short tunnels (perhaps their most unexplored of the deposits). The San Antonio deposit has been interpreted as a skarn copper deposit with mineralisation presenting in lodes with strong structural and lithological control. It has been privately owned since 1953 outling high-grade copper finds since this period.

Their property does have infrastructure benefits in place such as the regional township of Vallenar, the Pan-American Highway, a small airport located approximately 3 km south of Vallenar & the Las Losas Port for shipping product outward. To be honest, I feel like I could have made this stock breakdown double as long–this is a huge property with a lot analysis involved.

It’s worth mentioning that they are at a deep discount vs peers: $HCH 0.07x NPV (peers 0.25x) (see below).

Hot Chili is in a situation that despite holding a ginormous copper asset, they are in a stage of having to raise capital whereas their competitors likely do have the balance sheet to fund operations of their own but I believe they have advantages that set them up to play with the big players with big balance sheets.

- The sheer size of the property and deposit they own, enabling them to see 1 billion in revenues per annum (at current inferred resources)

- The fact that they have total exposure to the upside in copper prices due to supply constraints around the world with no immediate junior competitors on their tail (in Chile).

- They have their permitting in order, which can take up to a decade in order to get going for exploration and producing an active mining property (Communists in South America HATE mining).

- Their location, being at 800 feet above sea level; they are well positioned compared to their competitors who have to navigate the Andes Mountains

- The fact that they have an asset that they can turn into a whole other water/utility company–the chances are that the local governments in the region would like to sign long-dated contracts & the other perhaps better capitalized mining properties would become reliant on them

- The only economic commitment to keep the project in good standing are mining patents, which can be summarised as a mining tax paid to the government on a yearly basis (March each year). Total mining patent costs for 2023 were around US$295 000. No mining rights are at the risk of expiring.

- Port optionality: Hot Chili will fund 20% of an estimated two-year, US$4.6 million Feasibility Study for a bulk tonnage copper concentrate facility Following the Feasibility Study, Hot Chili shall have a Right of First Refusal to ship copper concentrates through Puerto Las Losas facilities for three years, totalling a five year deal initially.

- Their support from some larger miners in the copper space. They are trading as a small fish but eating with the sharks. In other words, they are large and active but the market is viewing them as just another junior right now.

New Partnerships

As of July 2023, SMEA and Frontera entered into royalty agreements with Osisko Gold Royalties Ltd (Osisko) for the grant of a 1% NSR royalty on HCH’s share of copper and 3% NSR royalty on HCH’s share of gold produced from the Project. The royalties were granted for a USD 15 million in cash consideration pursuant to an investment agreement between the HCH, SMEA, Frontera and Osisko.

Additionally, the monster Glencore have established a significant shareholder ship in the company. They own approximately 10% of the company now. Glencore can purchase up to 60% of concentrate for first 8 (about 60% of life of mine) years life of mine – at benchmark terms but must maintain >7.5% ownership in Company

News

HCH is one step closer to locking down one of the major infrastructure pieces for its Costa Fuego copper project in Chile now that we have signed an MOU for a port agreement.

- Frontera, executed an option agreement with a private party to earn a 90% interest in the San Antonio copper-gold deposit. The Option Agreement was renegotiated by HCH in December 2023, with the previous total purchase price of US$11 000 000 decreased to US$4 300 000 for the total El Fuego landholdings

Hot Chili is currently in the middle of a 30,000m drill program. They are targeting a potential increase in study scale toward 150k tonnes/ per annum copper project for +20 years

Their measured and indicated resource now sits at 800M tonnes with a further 200M tonnes inferred of copper. They also have over 3,000,000 troy ounces of gold in their deposit as well.

Through its 100% subsidiary company Sociedad Minera Frontera SpA (Frontera), controls an area measuring approximately 20 000 ha at Cortadera through various 100% purchase option agreements with private mining title holders and 100% owned tenure.

All mining tenements are in good standing and all mining requirements have been met for the exploration phase. At this stage, there are no legal requirements for any kind of bonds to be issued.

Their goal is to finance around 2026 and bring in full production by 2029 or so. Given this, I don’t recommend this stock play if you feel like you’d have to remain very liquid as you’ll likely have to commit to your holding (or add to it) for many years to really see the explosive upside.

Share Structure

| Outstanding: 119,445,206 | Free Float: 83,856,961 ( 70.21 %) |

| GLENCORE PLC | 10,885,497 | 9.113 % | 8 M $ |

| Gs Group Australia Pty Ltd. | 8,320,123 | 6.966 % | 6 M $ |

| Murray Edward Black | 6,441,716 | 5.393 % | 5 M $ |

| Blue Spec Mining Pty Ltd. | 4,052,956 | 3.393 % | 3 M $ |

| Blue Spec Drilling Pty Ltd. | 2,479,525 | 2.076 % | 2 M $ |

| Nerida Ruth Scott | 2,010,000 | 1.683 % | 1 M $ |

| CAP S.A. | 1,323,078 | 1.108 % | 949 494 $ |

| Jaerica Pty Ltd. | 1,290,322 | 1.080 % | 925 987 $ |

| Dalton Corporate Pty Ltd. | 1,000,000 | 0.8372 % | 717 640 $ |

| David Stewart Field | 900,000 | 0.7535 % | 645 876 $ |

On The Ball does not provide investment advice or financial services as you know, having said this, A writer of ours has his own small investment company and aims to take advantage of this company. Contact us and we can get try to get in touch, if interested.

Closing

I am of the opinion that we’re going to see commodities produce wild runs one by one. First lithium, then uranium, then cocoa (if you can believe that!), perhaps silver, gold, oranges, soy, the list goes on and eventually we get to copper. Copper demand has been increasing while the supplies are predicted to wildly decrease year over year (perhaps even more given the large disturbance of one of the largest copper mines in Panama). We’re already seeing pricing that adds literally millions of net profit for Hot Chili and I think we can agree that Copper has yet to explode with investment interest.

Since mining is such a terribly difficult business model (the cash goes into the ground…) and it’s so capital intensive, you pretty well always need a story to accompany the project. Either a great find years ago, low cost of capital, infrastructure, high-grades, opportunity to resume discoveries, etc. I believe the story that sold me on Hot Chili was the water resources and all the licenses/permits that are currently in place. They’re not the biggest undiscovered copper deposit, but they have the leverage to enable them to transition into making operations happen.

The major copper deposits in Chile are all stuck within the Andes Mountains at a time when a far-left government have made it next to impossible to extract continental fresh water (since it’s basically a desert). As a result, to explore their undeveloped projects to manage the ore, the requirement for salt water + desalination is a must. To reach this supply, the competitors will have to deal with altitudes of up to 4000M & an exaggerated birds fly of 150km to the coast (with the mountains in the way). Therefore, since Hot Chili has the only active Maritime Concession to extract sea water, they have the leverage of what everybody else requires. They can run a water company for local communities, for themselves, for the other miners in the region & fix a long-dated relationship with governments to fund operations for the copper mine.

The play here, like the other equities who have seen their explosive returns is not necessarily the highest grade but one who has a large amount of per annum production and hence the largest exposure to the underlying copper price. The potential increases (from here) if we consider 5,6,7 dollar copper per pound is outrageously high and it’s important to note that the global supply is becoming worse and worse the longer we go out.

Hot Chili may be able to time this perfect as once their operations touch 100K tonnes per year production, the copper supplies are at a steep deficit relative to their demand. We’re seeing a set up where the downside to this company is likely the long wait for these dynamics to play out whereas the upside is a massive pinch in the copper price and consequently, their share price.

As always, thank you so much for your subscription! It keeps us going to find these companies and do research for you. We appreciate it

#StayOnTheBall