Sector Search: Safest Investments, by History

After doing a little bit of market research I’ve come across some data that I think will prove helpful for you and your portfolio. Before we dive in make sure you follow on Twitter & Instagram & if you enjoy it, at the end they’ll be a link requesting a simply email for a newsletter!

Australia has the world’s top-performing equity market over the past 120 years, thanks to its ability to largely evade the global financial crisis, according to a new study published by Credit Suisse Group AG. Stocks Down Under have achieved an annualized real local-currency return of 6.8 per cent per year since 1900, according to the broker’s Global Investment Returns Yearbook 2020. The report was produced in collaboration with the London Business School and Cambridge University.

The thought behind this was their ample banking sector, abundant resources, foreign investment and its services-based economy. They highlighted the countries’ rule of law, regulatory frameworks and education systems as supporting its success (perhaps Australia had its expire date in 2020 then).

Want to know the best performing asset going back 120 years? Tobacco. It offered a 14.20% annualized return, for over a century. Click here to learn more about Tobacco!

Want to know the top 5 stocks in the USA over the last 20 years?

- Monster Beverage Corp (Beverages)= 87,560%

- Tractor Supply Co. (Farming; Discretionary)= 45,750%

- Old Dominion Freight Lines Inc. (Trucking) = 13,340%

- Holly Frontier Corp (Oil Refining)= 11,810%

- Altria Group (Tobacco) =9,620%

Drinking, smoking, trucking, refining oil and farming–This is why legendary investor Jim Rogers says, “If you want to be rich, be boring”.

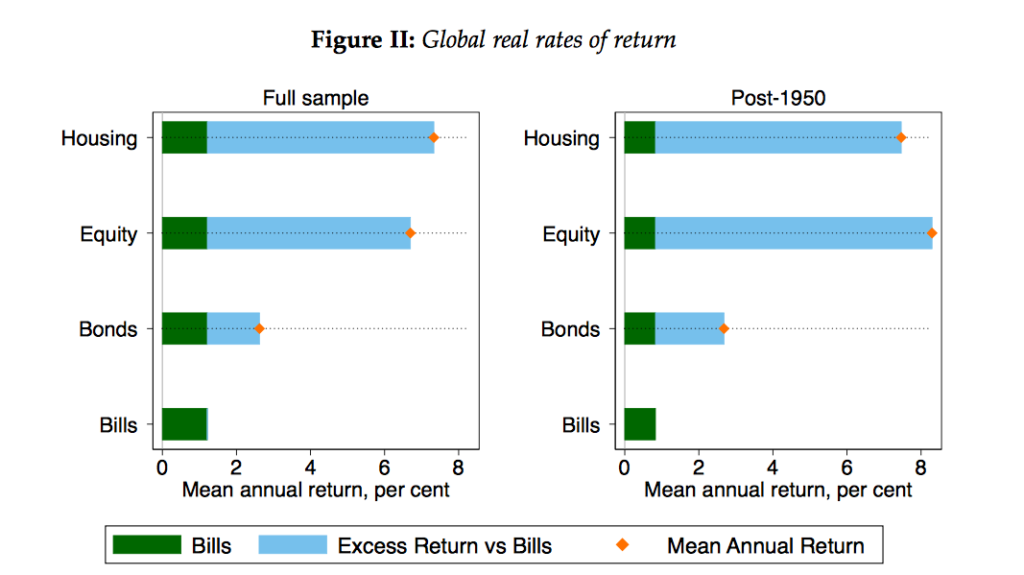

A Harvard study was does evaluating asset performance going back to 1870 all the way to 2015. The countries involved were Australia, Belgium, Denmark, Finland, France, Germany, Italy, Japan, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, UK, USA. Their analytics measured total returns broken down into investment income (yield) and capital gains (price changes) for four major asset classes. Two of them, equities and housing–generally seen as risky and two of them typically seen as relatively safe—government bonds and short-term bills.

Their findings outlined that housing and equities provided the best return, around 7% annualized. Housing was supreme before WW2 and after the war, equities outperformed housing but became much more volatile and correlated to the business cycle. Housing offers higher returns via rental income per annum as opposed to capital gains (on housing price)–acting similar to equity dividends or passive income.

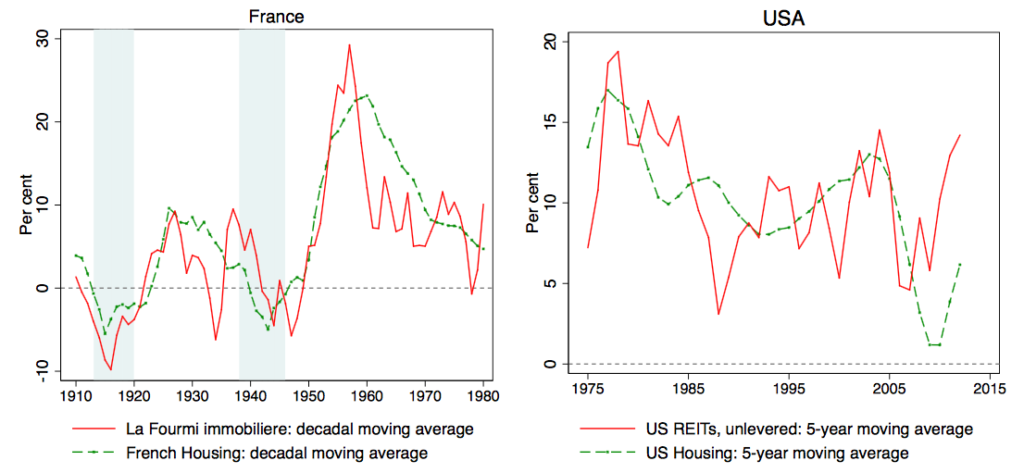

REITs in French and USA stock markets returned about the same as the housing market, albeit more volatile.

Interestingly, the risky return has often been smoother and more stable than the safe return, averaging about 6%–8% across all eras.

When they evaluated the “safe” bond investments they found: the pre-conceived safe asset return (bonds and bills) had been very volatile over the long-run, more so than one might expect and often times even more volatile than real risky returns. It showed a return of between 1-3% nominally (in war or peacetime).

Take Away

Knowing this brief lesson in history I have three take aways

- KISS. Keep it Simple Stupid. Maybe this is what just comes to my mind but if the industry is pretty straight-forward selling items people want or need (beverages, tobacco, oil, gold) than I see it continuing to do well. Consistent performance, adds up.

- Volatility between bonds and equities appear to be inverses related. The Bonds experience more volatility given longer periods whereas equities become less volatile with added duration. Warren Buffet doesn’t recommend buying the S&P 500 and sitting back for no reason

- It’s important to be in markets that have a large resource component (as opposed to purely financialized products or derivatives). Energy security= Political & Market security

- Equities are the way to go for absolute largest return in markets, but for huge gains it’s a slow and steady wins the race, game.

I hope some of these have been helpful! Click here to write about an investment sector people are not appreciating–> Create a writing name and we’ll publish your work anonymously

#StayOnTheBall