Company

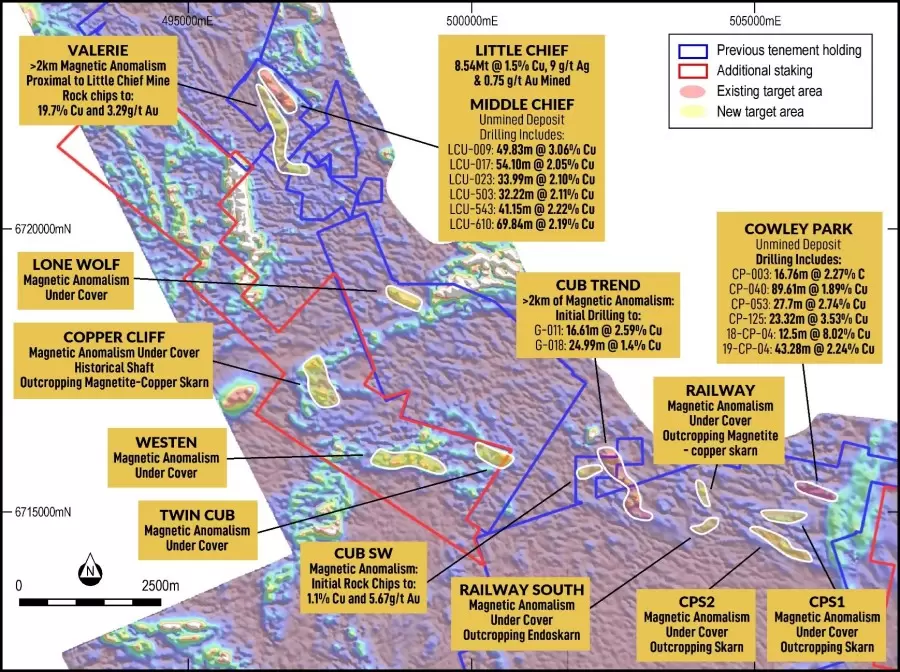

Gladiator Metals Corp. is a mineral exploration company focused on the advancement of multiple high grade copper prospects at its Whitehorse Copper Project, an advanced-stage copper (Cu), molybdenum (Mo), silver (Ag), gold (Au) skarn exploration project in the Yukon Territory, Canada. The Project comprises of 314 contiguous claims covering approximately 5,380 Hectares (13,294 acres) in the Whitehorse Mining District. The Whitehorse Copper Project is located within the traditional territory of the Kwanlin Dun and Ta’an Kwach’an Council First Nations.

It achieved TSX-V Approval on February 13, 2023

Interest

My interest was first piqued because I hadn’t seen copper grades this high in a company before. The reliability of high-grade finds is very, very noteworthy.

A lot of big players in the neighbourhood, too.

Consider the following: Anything over 100 metres and 1% copper equivalent or better is considered to be high-grade.

I won’t go over each and every one of them but every single one of their resources returns high-grade if you can believe that (not just copper either). However, it’s worth noting that every single project is in the stage of it being a “prospect” or simply a “future target”. We are in very early innings in this ball game.

Explosive?

In some prospects, there has been no modern drilling on sites. One hasn’t been drilled properly since 1982, making a lot of these very speculative but perhaps the lack of data and existing high-grades could be a nice little shock for investors/speculators. They believe to be targeting over a 100 million tonnes (Mt) of inferred copper resource. To put this in perspective, this is as large as all of the copper that the country of Australia is said to produce. Could it be?

Math wasn’t my strong point but?

Let’s say they possess 1,000,000 metric tonnes of copper (a hundredth of their wild goal/prediction)… & there is 2204 lbs. per metric tonne. That is 2,204,000,000 lbs. of copper which is now being traded at $4.64 per tonne. As of today, their resource would be valued at $10,229,436,800 USD. Of course, you have to actually find the metal, refine it, process it, ship it, drill continually, build infrastructure and an operating mine (not cheap) it’s not like this is free money. But if we consider a copper price of today with even 1 million Mt of Copper… than that would make the resource value 532.78X more valuable than it’s current market cap

Plan:

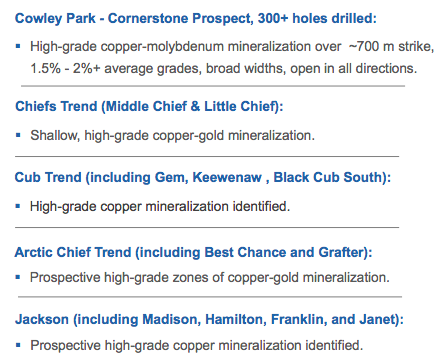

Cowley Park: Establish initial drilling framework for inferred resource drilling at the Cowley Park Prospect. Plus begin targeting upside potential for further Copper-skarn mineralisation.Chiefs trend: Highlight further high-grade, near-term copper resource potential by testing southern target area.

Cub trend: Highlight continuity of high-grade, near surface, copper and gold mineralisation for future resource drilling.

Arctic Chief: Highlight continuity of high-grade near surface copper and gold mineralisation for future resource drilling.

Best Chance: First drill test of outcropping high-grade, magnetite-Copper skarn mineralisation and test continuity of mineralisation between target and Arctic Chief.

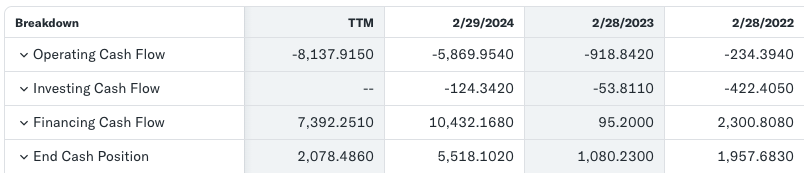

Ratios & Balance Sheet

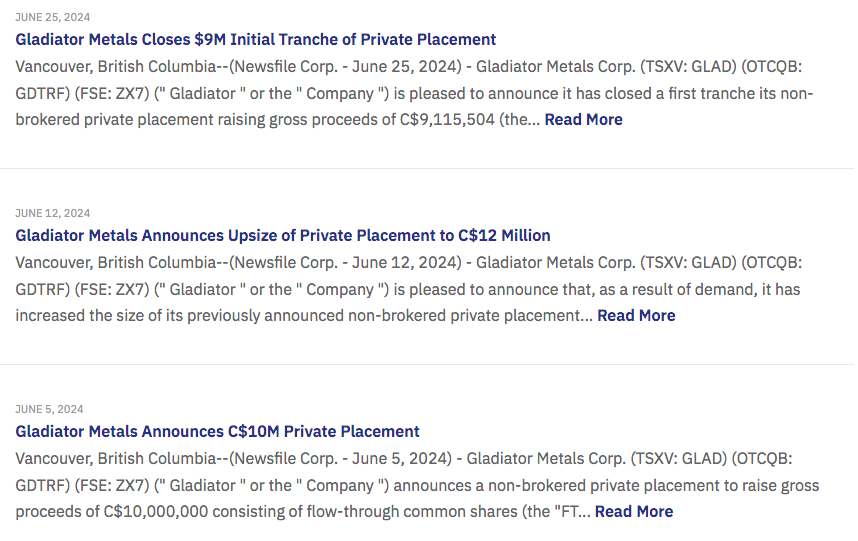

They are well capitalized

Raising a bit of capital lately for fully funded drill program

But this of course has come at the cost of shareholder dilution (sorry if you’re already a shareholder). In fact since 2021, there’s been a lot of it

Share Issued

44,485.2270 –> 2024

20,255.1270 –> 2023

19,142.6270 –> 2022

5,265.4730 –> 2021

And of course, all of the money raised goes straight into the ground–mining really is a crappy business until you strike something fantastic. Like 100Mt of copper!

Its clear that the company will need to seek a partnership, tighten their belt and/or raise more capital to continue future drill programs. In fact please read the Closing segment. But, so far so good!

Management, sophisticated investors and employees own over 1/3rd of all outstanding shares, so they’re clearly not just in it for their overpaid salary and that’s that (I can tell you some people who seem to be…)

Retail investors and institutional investors split around 28% of the holdings and interestingly a local steel fabrication & welding company have a large 11% holding. Do they know something?

Latest Drill from the Summer Drill Plan

“Gladiator Metals Assays 10.8m at 4.31% CuEq Within 45m at 1.76% CuEq and Drills 8m @ 3.72% CuEq Within 109.77m @ 1.05% CuEq at Cowley Park”

They are able to continually strike high-grade copper. At Cowley Park, all 8 drill holes came back with high-grade copper-equivalent. Here are 4 other strikes

- CPG-035: 8m @ 2.57% Cu and 0.15% Mo (3.72% CuEq) from 8m plus 14m @ 1.31% Cu (1.57% CuEq) from 72m within 109.77m @ 0.77% Cu (1.05% CuEq) from 4.23m

- CPG-032: 30m @ 1.48% Cu and 0.13% Mo (1.72% CuEq) from 56m within 48m @ 1.08% Cu (1.72% CuEq) from 38m

- CPG-031: 8m @ 1.48% Cu and 0.13% Mo (2.40% CuEq) from 87m within 52m @ 0.74% Cu (1.08% CuEq) from 77m

- CPG-034: 6m @ 2.42% (3.15% CuEq) from 9m within 14m @ 1.22% Cu (1.60% CuEq) from 7m

300 drill holes have now been made and mineralization remains open along strike and down dip in all directions. A recent drill hole reveals they have have a larger property than they once thought.

Enjoy This? SUBSCRIBE For Many More. Affordable Offers!

New Claim

Gladiator recently staked 55 claims for an additional 11.3 km encompassing whats known as the Jackson copper-skarn prospect.

This added 6 kms of strike to the Project shows significant upside potential, with shallow historical drill results intersecting high-grade copper (+/- gold and silver) including finds ranging between 4-6% of copper with up to 247 g/t of silver, too.

Some rock samples even came back with 9% Cu with high grade zinc and gold also being present.

Key Takeaways

- Some of the highest grades copper I have ever come across; major exposure to upside in copper pricing

- Tier 1 jurisdiction (for now) with a major mining culture

- Multi-metal de-risking in their portfolio

- Their management and director team literally has over 100 years combined experience in capital markets, mining assets, public company management and geology

- Sub 20M USD stock; asymmetric potential. They aim to be a 100M market cap and define a resource of 20Mt of copper (this is a ginormous global deposit…)

- Close to infrastructure and roads to reduce costs. Existing road access, hydro power & rail transport to export the product.

Copper

Please see my article here (when it’s still available) to discuss the shortages of copper and how we’re heading into a severe supply squeeze in the metal.

There are some amazing deficits currently in copper and it’s only set up to get worse. The price already is positioned for large net margins in a lot of these development companies.

I think the “green electrification” of the world is 95% bullshit, but the reality is that Copper is entering into a significant deficit and this is worsening with a growing underinvestment into the resource space.

Remain Skeptical

- Revenues were not reported and net income for shareholders hit 4.4M for Q4 2023.

- Not nearing production within the next year; they are still trying to evaluate what type of resource asset they possess.

- Yukon makes it challenging to mine 24/7 or receive ample infrastructure/resources compared to other jurisdictions. They really have a short window to really ramp up the drill, otherwise costs may run higher in later seasons.

- The political risks of mining in Canada are monting which is likely facing a banking AND real estate crisis soon (ongoing). Despite holding an opportunity, it doesn’t mean that they will be able to unlock it.

- Case in point, from the Communist Broadcast Corporation (CBC) after their exploration permit was granted: While the company has claims that span nearly 30 per cent of McIntyre Creek, the permit exclusively pertains to areas with industrial zoning. “The official community plan designation for the proposed McIntyre Creek Park is green space…In order for exploration to occur, we’d have to go through an official community plan amendment process approved by council, and that would involve engagement and a public hearing process…” Canada’s green-rhetoric + indigenous groups complaining will undoubtedly be a road block in advancing stages, let alone potentially a complete dead end.

- Trouble raising capital? Interest continues from investors but what happens when the Nasdaq pulls back 10-15%? How eager will they be to bury their LP’s money in Yukon?

Closing

This company could be quite historic if they could find a resource that resembled country-wide sizes. The fact that grades are consistently so high indicates that there is a higher probability a mine can be developed up North. Notwithstanding future share dilution, there could be a huge way to leverage yourself by playing not only the macroeconomic/geopolitical effects on copper (supply/demand) but also the cheap price per pound that you’re being offered right now.

What comes to mind right now is that the days may be too early to allocate sufficient capital to really gain from the potential upside. We’re not even at the exploration stage of development (permits and regulatory community matters) and with only 2M CAD remaining in the bank I think the share price will be bound to fall before there’s more clarity on the immediate upside for investors. Even if you wish to speculate, I am still thinking it’d be wise to let more drill results come in, see how they manage their cash and how their outlook looks in the coming years. In fact have a look at their plan:

An additional $4,500,000 exploration expenditures prior to year 3 anniversary

At the 3 Year Anniversary: An additional $6,000,000 exploration expenditures prior to year 6 anniversary + $100,000 cash payment AND 5,000,000 new common shares

6 Year Anniversary: $125,000 cash payment due + 6,000,000 common shares

Hence, I feel its like predicting who’s going to win the Super Bowl 1-week into the season

Is Canada (who I like to call Canazuela) going to remain stable enough for this project to come to fruition, or will the communists in Ottawa seize the opportunity to wreck yet again thing? Either way, I’m very bullish on copper!

#StayOnTheBall