What’chu Ghana do about it?

I’ve gotten off a call recently with a Namibian lawyer whereby we were talking about the company structures and tax details. We were talking about how lots of legal proceedings are out-of-date, simply unknown or resort to case law in court.

Unfortunately, my plans were deemed not feasible and the conversation morphed into a chat about the general continent of Africa and various events. One of those areas mentioned was Ghana. So, as always, let’s look at what’s going on.

Consider Subscribing for premium, controversial & researched content + many perks as outlined below!

Thank you for your attention–back to the post!

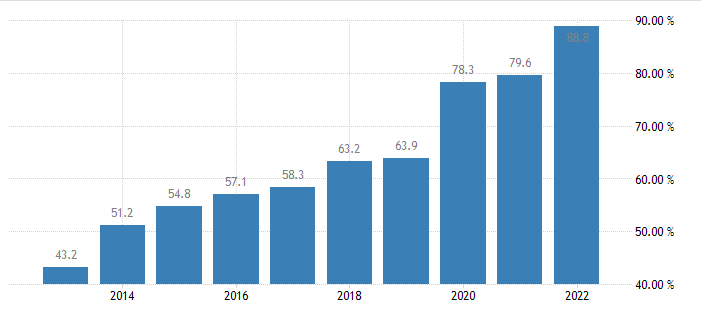

Ghana has always been a country that bucked the trend and remained more aligned with ‘democracy’ since gaining independence in 1957–at least relative to their neighbours. According to Freedom House, in terms of overall global freedom score it is one of the only “free” countries on the continent with a score of 80/100 (the only free country in West Africa). It’s internet freedom score is also one of the more free countries in Africa deemed “partly free”.

I will say from experience, years ago I’ve met some folks from there & they were probably some of the happiest people I’ve ever met.

- It’s population is 32.88 million people.

- It’s GDP is about $73B.

- It’s fertility rate has fallen considerably but still sits at 3.62, well above replacement.

Most of their exports come from three sources. Pearls, metals, coins & stones (37%), mineral fuel oils(32%) and Cocoa/Cocoa mix (16%). These exports are quite diversified between China, India, Switzerland, South Africa, Netherlands, UAE, USA, and others. In terms of food, they only produce nuts, melons, small amounts of meat & fish and cocoa.

I would be here all day writing their import categories–know that they import virtually everything they need. Like their exports, they range between China, India, USA, UAE, United Kingdom, Belgium, Turkey, South Africa, South Korea and others, pretty diversified.

Their trade balance is now trending negative after 6 years of a positive balance.

Good Times From Oil

But…Inflationary Crisis

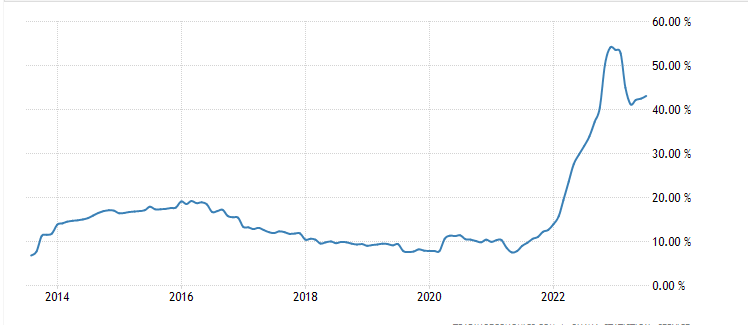

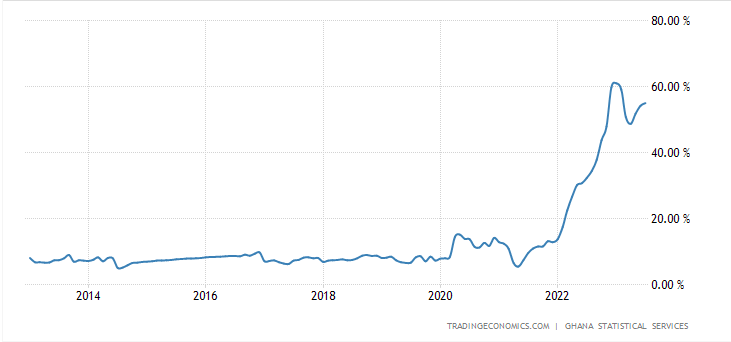

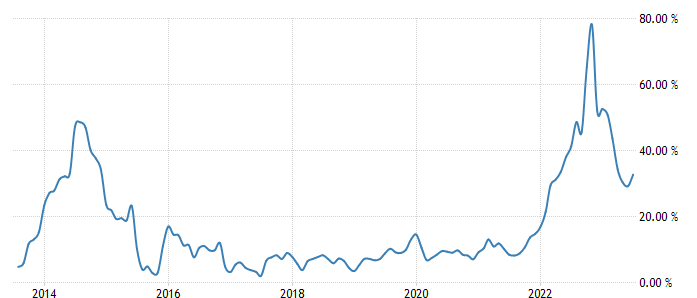

This has shot Ghana into an economic crisis that has undone a lot of their growth.

Of course, with these newfound oil profits they increased spending, issuance of debt, social programmes, raised interest payments and expanded its government size which meant more mismanagement of funds (around 55% of all employees work for the state). Inflation was worsened too because Ghanian traders, miners or drillers demanded imports of Western or Chinese products utilizing dollars (by selling Ghana Cedi). Of all the factors that went crazy, Household Utilities have truly gone parabolic.

Other (troubling) Details

- Despite exporting a lot of Gold (5B dollars worth a year) they only have 8.74 tonnes on their books. That’s a lot for you and I but quite insignificant when you consider Ecuador and Peru have over 4X this and Syria still has 3X this amount. Having said this, they are considering selling some of this reserve by doing a gold-for-oil swap to curb inflation.

- To facilitate a gold for oil swap (which made headlines), the government has mandated that gold miners sell 20% of their gold to the central bank.

- Their success was despite an explosion of their sole oil refinery in 2017 but now, despite being an oil exporter themselves they still need to import refined oil for consumption.

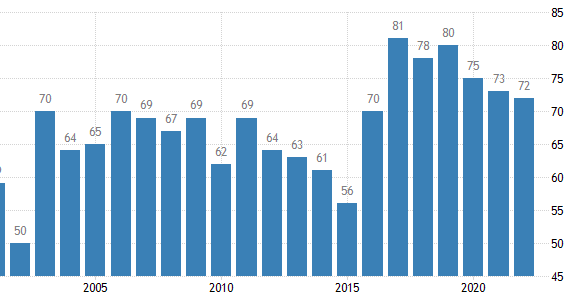

- Gasoline prices have come down but remain at new highs at 1.13 USD/L. The average over the last 30 years is ~70 cents.

- Fitch predicts contraction in the Ghana economy due to inflation, austerity measures, reduced foreign investment and tax heights (of course) to kill domestic production.

- Bank of Ghana showed Ghana’s Gross International Reserves to be at 7.6B (June 2022) to cover 3.4 months worth of imports (even after a 750 Million loan at the same period). It’s trending worse. Their international reserves are expected to hit rock bottom by the end of 2023 according to the International Monetary Fund (IMF)(currently at 0.8 months import cover), the Bank of Ghana contradicts this by stating they have 2.7 months of cover. Even according to their report, they predict it will fall to 1.7 months cover in 2024 (Zimbabwe, South Sudan and Ethiopia have import month covers of 0.2, 0.5 and 0.6, respectively–highlighting that West, South, Central and East Africa all have their troubles).

- IMF to the rescue… when have you heard that and not laughed? May 17th the IMF gave a 3-year, $3B loan with 600M up front. They have strict terms for the remaining loan money but I’m doubtful they will receive it since it’s a hard sell to bring on future investors and a reliance on imports.

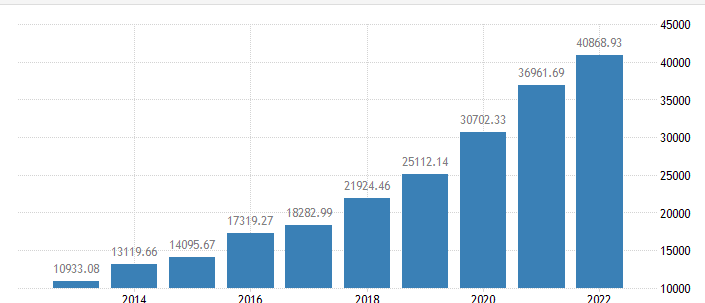

A Ghan’r?

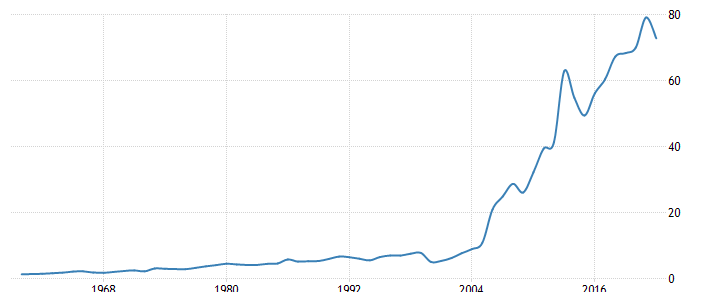

If I had to sum up what Ghana did to their immense economic expansion from oil profits–they blew it. They kept the good times rolling as long as they could and now they’re paying the price. If you look at Foreign Direct Investment it shows next to zero FDI from 1970s to 2005. Then from 2005 (from now 144M) it went to 2.41 BILLION in 2008. A little pull back and good times all the way to 3.49 Billion in 2016. One last pull back and straight to 3.88 Billion before falling all the way to 1.33 Billion in 2020 and staying around here.

These number analogous to investors showing up for the party, having fun, and when the host got a little too carried away, they left.

It’s amazing that there was absolutely no effort to revamp or repair their oil refinery for over 6 years now. As long as this remains out of order, this will worsen their fight against inflation to purchase refined energy; if they don’t purchase energy than their economy slumps and the Debt:GDP ratio grows.

I believe the dwindling international reserve count to be a big factor, too. It’s not so much they ruined their oil revenues and are tapping into their minimal gold reserves but to drain that account in the meantime has left them with no back-up and forced them to ramp up the money-printer again…leading them straight into the jaws of the IMF.

The use of gold is something interesting to see (I wish more governments would use gold for commodities!) but the reality is this is an extremely limited move. At current gold prices, their 8400 kilos amounts to around 517,146,000; according to the Bank of Ghana their first four months of 2023 oil/gas imports costed 303.89M, 308.19M, 297.82M and 294.97M. So even if they liquified all their gold for oil, it buys them 2 months at current consumption?

I think this fact really brings it all together to see how Ghana is just trying to breathe right now. As of June 9th of this year, only $227 USD was traded on the Ghana stock exchange—and we thought gold miners had bad liquidity!

It’s been said “You make far more money when things go from horrible to bad, than when things go from good to great”. Unfortunately it seems that Ghana has fallen off the great cliff a couple years ago and still remain far from the ground.

What do you think? Are they going to turn this around and have another massive growth period? Are they going to be completely wiped out? Will you be waiting to buy the bottom? Regardless what you do, thank you for taking the time to read! Please share this and any other article you enjoy– I’d really appreciate it

#StayOnTheBall