Read This if Most of Your Wealth is in Housing!

Since rent caps have come in place in California and New York–that is, the amount that landlords can charge their tenants for rent is limited–a storm has been brewing in the housing market.

Many people who found it challenging to make ends meet on their income alone took action during the craze in markets a couple of years ago. Listening to their favourite TikTok investor and Jim Cramer, they had three obvious choices: they could go big into Tesla or Gamestop & hunt for short squeezes; they could go big into Bitcoin & Dogecoin; or they could create a side hustle by renting out a nightly apartment, condo, back room on AirBNB. Those who chose the third option may have gotten themselves in too deep and it will spill over into the entire market as a whole.

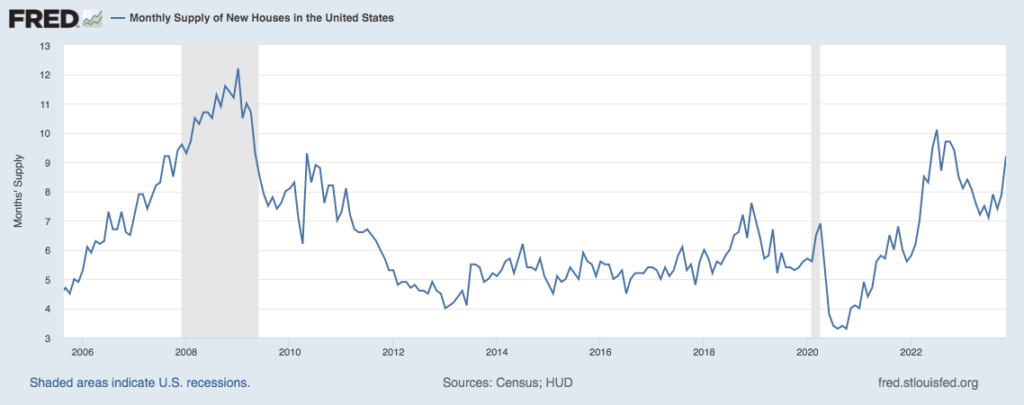

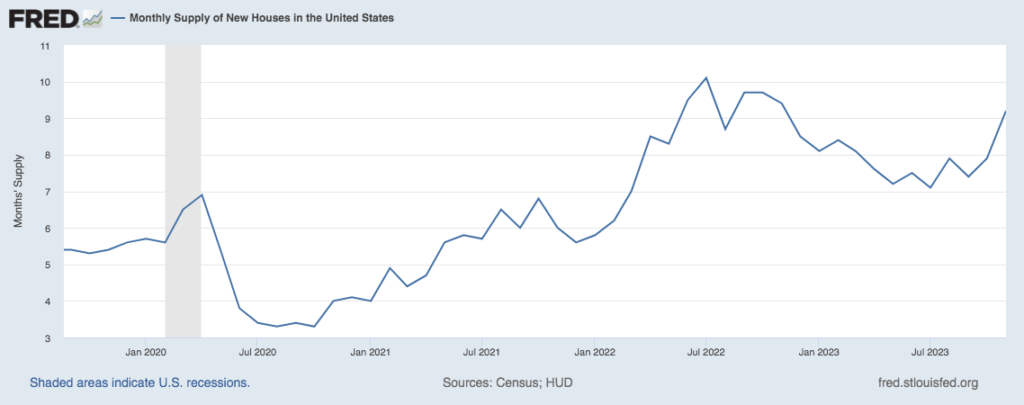

Currently, if we look at the current housing supply on the market it is rather small relative to the total number of housing. This is particularly relevant since the homes ‘not’ for sale are not utilized in price discovery of the housing market. Many have landed huge mortgages (death loans) with a 2 or 3% fixed interest rate–can you afford to sell and lose this? At the same time, housing demand may be said to be low due to high personal debts, higher interest rates or low household incomes, a housing supply about in line with demand means prices won’t move all that much.

Nobody buys (cant afford to), nobody sells (cant afford to).

Enter Government

Let’s say you and your spouse have three rental apartments (though not owned entirely) that account for 70% of your household income. Now, something has changed–each of these rentals have been hit with the price cap, making it hardly worth it to continue to rent. However, a separate problem has occurred from this–> you now own assets that are subject to the price rental cap which is to say, hold capped value to anyone looking inward. Banks are currently incredibly reluctant to lend to you but especially now as they view your asset as hardly worth anything to lend against. Therefore, your hardly collecting rental apartment does nothing as a form of collateral for a loan and you’re already out money on the properties themselves. Since this accounts for a considerable amount of your income–you can either continue to muddle on or you can decide to sell albeit at a loss.

Let’s say you decide to sell. This adds another home on the market (check one on the side of supply). You tell your neighbours, who are in the same predicament, who agree its the best to sell as well. They post it on Facebook & X where they stimulate 30 others to sell their home and so on.

Suddenly, it becomes whoever sells first is able to capture the most equity left in their property and the rest is a race to the bottom; more home supply entering on the market is going to have a negative impact on home prices. The home prices is not impacting just the ones who are selling now, it’s impacting the people who are not selling and waiting it out.

There’s also reason to believe that they will sell as well. Despite many being comfortable locking in lets say a 3% mortgage for 20 years, approximately a third of Americans’ equity is tied up in their house according to year old data. It is a core asset. If they become unprofitable, a majority can no longer keep the expenses up.

New Changes

In addition to price caps, New York City, California but also in many cities in Texas have introduced another measure adding so many restrictions to AirBNB that it renders AirBNB illegal. In New York for instance, AirBNB cancelled previous bookings beyond a date last year for thousands. They now require all rentals to be approved by the city (I’m reminded of the Nazi question, ‘Show me your Papers, Please’ now). Some restrictions include that the renter must live with you personally, must rent for a period of a month, the total number of people cannot be more than two and information is required to be known about the renter (Maybe some people love bunking up with strangers for months?). For the average person with an AirBNB though, this is a non-starter & in effect, it’s banned.

Just in NYC, 34,000 AirBNB listings still exist and 11,000 have already been taken off the market since these new announcements. This is really difficult for owners because of the numbers they baked into the cake in their personal financing.

Let’s say if someone owns an apartment rental in Austin, Texas they should be getting 1100 USD a month and remain vacant for 2 months–before expenses this is 11K USD a year. On AirBNB you may be able to charge 150 USD a night. If you’re booked up for 6 months a year–before expenses this is 27,000 USD a year. Using this assumption, many people refinanced their previous debts at low interest rates and continued to borrow and borrow. Add the fact that costs of living have gone up tremendously a long with the cost of new capital & mortgage payments & it’s challenging to see how AirBNBs can yield free cash flow. In other words, they are really counting on their 27,000 USD income a year (on AirBNB) for it to be worth it.

Again, you are faced with the same situation as the rent cap. Your options are settle for the 11,000 USD a year (in this example), run negative cash flow and tighten you belt tremendously for years–or accept your immediate losses (if any) and cash out of your apartment rental, first!

You can begin to see the positive feedback loop that is primed to occur and these government policies while they sound harmless could induce the first chip to fall. Struggling Americans’ like to hear that action is taken against those ‘greedy landlords’ but fail to see the big picture that perhaps the mandate has nothing to do with AirBNBs, landlords or any of it–it’s the involvement of a third-party to intervene (yet again) in people’s lives to get asset prices down.

Between both AirBNBs and price rentals–this side hustle/full-time job directly impacts thousands of people.

But it’s worse than that

Most analysts in the real estate market are only focusing on one, yet crucial, expense of the mortgage payment. In my example above notice I said “before expenses”.

- Homeowners Insurance is increasing everywhere; in Florida they are risking to stop buying Hurricane insurance (6K a year) good luck if a Hurricane comes.

- Maintenance costs

- Property Taxes (good luck with not paying this)

- Miscellaneous Taxes

- The cost of labour; people are demanding more for their work

- Inflation (Disinflation is reduced inflation–not deflation)

- Increases in tenants not being able to afford rent

It’s already begun:

Many of the 25 major U.S. cities with the highest rates of homelessness have seen their homeless populations grow, though seven did have smaller homeless populations in 2023 than they did in 2020. Eight of the top 25 cities are in California, with several in Texas also making the list.

Trench Warfare

While I think a large percentage will be forced to put their property on the market, I wonder who will be forced to do so not because of weak rental income, but due to falling prices. How low will prices have to go for them to say it’s not worth it & be forced to sell at a loss (further expanding the supply on the market)? And then if they do sell, are they able to afford a new mortgage with the higher interest rates further reducing the demand on the market? Where are they going to live? What are they going to do with their income from the home sale?

And guess what the Federal Reserves’ mandate is?

“Powell told reporters that spiked mortgage rates would help to “reset” the U.S. housing market, and that “we need to get back to a place where [housing] supply and [housing] demand are back together and where inflation is down low again, and mortgage rates are low again.”

It’s a big club and you ain’t in it

First they steal your purchasing power through inflation (to compensate for a spending problems they created), then to deal with inflation they seek to destroy the value of your equity (in housing) you’ve earned throughout the years. See how this works?

So, Cheaper housing?

Yes it’s all pointing to this–but it begs the question who will be able to purchase housing again if most of the equity has been lost in a long fall of home prices (think 2008 crash). It’s especially concerning when it’s announced (cause they’re already in one in my mind) that the USA is in an economic recession. Not to mention the added currency units that will be coming to the market for another inflation spark.

Closing

I think this should be a good lesson– that when you print [and spend] countless amounts of money on hastily on bad, non-performing assets then the market will do some wild things. In order to try to keep the systems in place, governments will always intervene and toy with the market like a puppet. These interventions are where big opportunities of wealth-making can occur. For instance, if I’m correct in my article–that this will inevitable lead to lower home prices in the future–rather than go out and buy a home [in USA] now, you may be best off renting for the time being until the storm passes. It’s difficult to see how this doesn’t impact anything in stock markets as well. Look how 5year Credit Default Swaps have performed over 1Y in the USA:

Of course, all this is being sold that it will reduce rental prices for the little guy–but the mainstream press’titues are not mentioning on what these measures will do to home prices. Fewer homes for rentals means fewer rentals available (ask Ireland). For the innocent person who finds all their equity in housing, this could be a bad set up. Even if they do sell, it becomes a question what do you do with all that cash? Well, that’s where we come in, too.

However, all this seems to point to the government desire for home prices to come down by sucking out any productivity and literally forcing people to sell their property to make ends meet. Despite the sweet rates locked in, the debts are too high for your average citizen and the main item they possess which nobody wants to sell, is real estate. It’s already started. Bookmark this post.

Nothing is what it seems or what you’re being told.

#StayOnTheBall