No this is not a fishing company, it is commonly found at deep sea however! I’ve said this before and I’ll say it again–despite having outrageously stupid (tax) policies, Norway is a country that holds a lot of great value stocks paying juicy dividends. The exciting part is that not many consider this market so there’s a lot less competition for dividend investors (at the expense of lower liquidity of course). Hope you enjoy this overview and I’d really appreciate it if you could share this post & follow us on Twitter!

Company

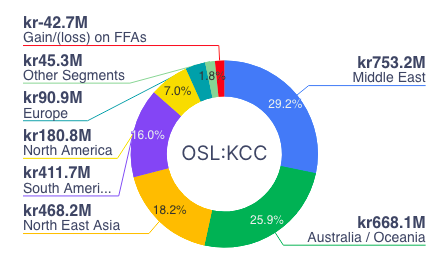

Klaveness Combination Carriers ($KCC) ASA is a Norway-based fleet operator. The company owns and operates combination carriers that can switch between dry and wet cargo shipments. Its fleet consists of of 16 vessels, eight CABU vessels and eight CLEANBU vessels. The CABU (Caustic Soda-bulk) and CLEANBU (Clean Petroleum Product-bulk) vessels mainly transport Clean Petroleum Products or Caustic Soda Solution from refineries and production plants located in Middle East/India, Far East or United State Gulf to end users or distributors in Australia and South America, the world’s main export hubs of dry bulk commodities. On the return voyage the combination carriers transport dry bulk commodities including alumina, bauxite, grains, salt, iron ore and coal. Klaveness Combination Carriers ASA was established in March 2018 and has offices in Oslo and Singapore.

Updates

The company is proud to have three CABU newbuilds arriving 2026. Four ships are registered in Norway whereas the remaining twelve are registered in the Marshall Islands. Their main activity is to generally take “wet” materials one way and take “dry” materials the other, effectively crossing themselves but getting the best of both worlds, literally.

Klaveness Combination Carriers is embarking on an initiative to enhance vessel connectivity through a pilot program with Starlink, a satellite internet service provided by Marlink to ensure high-speed, low-latency, and high-capacity internet access even in the most remote maritime locations.

They have also agreed to a deal to retrofit four additional vessels with air lubrication systems from Silverstream Technologies, used to improve fuel consumption and subsequent CO2 emissions by reducing friction between the ship’s hull and the water.

This addition means that now six of their ships will be fitted with the system. Silverstream’s technology utilizes air release units along the hull. Oil-free compressors generate pressurized air that is sent through the units to create a layer of micro-bubbles that lubricate the hull, thereby reducing friction to save more on CapEx.

Energy efficiency is a main mandate where they look to buy a “net-zero” ship by 2030. To do so, they are eyeing some key investments to include silicone antifouling, air lubrication systems, as well as hull-cleaning drones, shaft generators, propeller boss cap fin retrofits, solar panels, shore power, and battery hybrid systems.

Performance

Since it has gone public, investors have been happy (notwithstanding the recent 11% pullback)

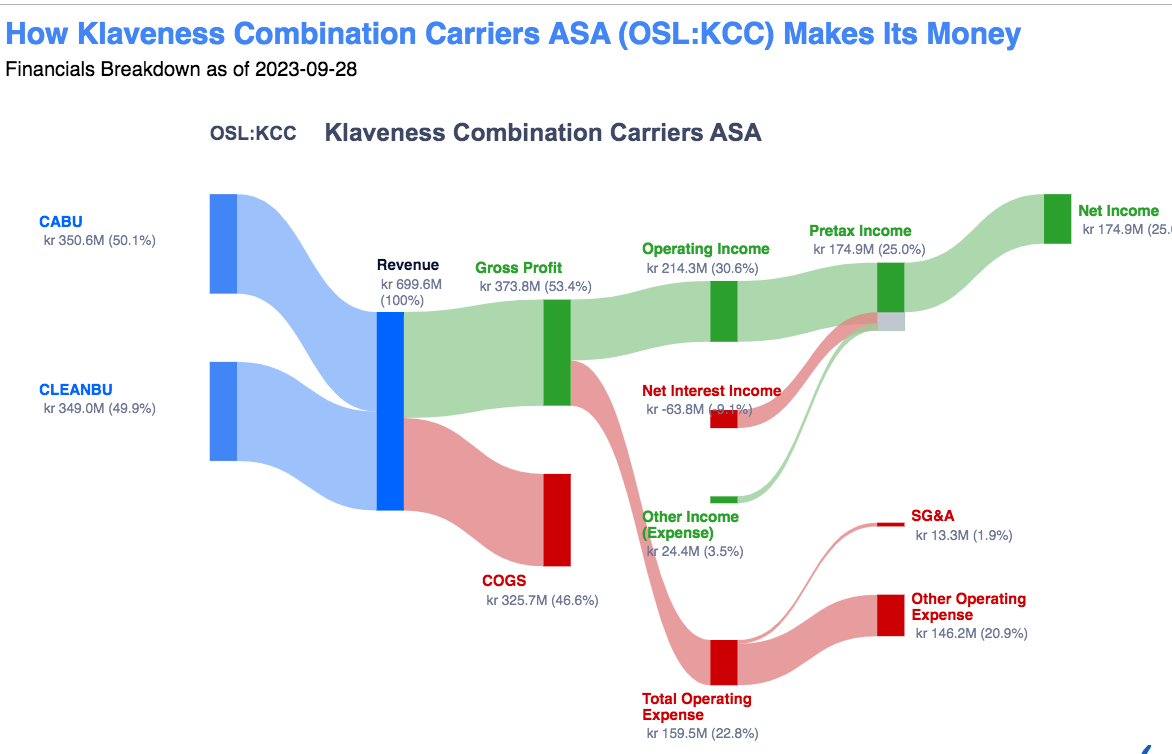

Gross Margin: 68.53% (Industry Avg: 26.34%)

Gross Margin 5Y Avg: 58.4%

Net Margin: 30.26% (Industry Avg: 7.11%)

Net Margin 5Y Avg: 14.6%

Operating Margin: 35.9% (Industry Avg: 9.57%)

Operating Margin 5Y Avg: 22.2%

SG&A Expenses/Net Sales: 4.03%

Profitable 9 out of 10 years.

For the nine months ended 30 September 2023, Klaveness Combination Carriers ASA revenues increased 12% to $210.4M. Net income increased 34% to $61M. Revenues reflect CABU segment increase of 77% to $97.2M, CLEANBU segment increase of 41% to $91.8M. Net income benefited from Other interest income increase from $700K to $6.1M (income), Foreign Exchange Gain/LossNon-Business decrease of 62% to $319K (expense).

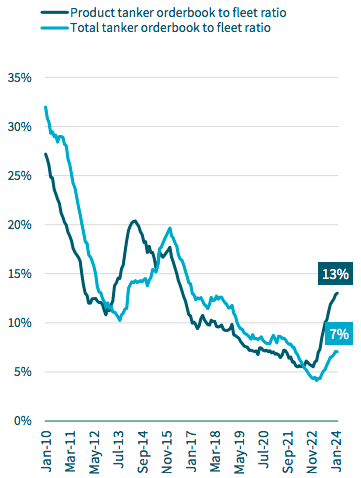

Klaveness Combination Carriers is poised to ride a “perfect storm … with product and dry markets gathering steam”, says Broker, Fearnley Securities.

Enjoy this content!? Get our new updates just like this one!

It’s worth adding that

- Cost of Revenue for the quarter sits at 23.62M which fell 17% while revenues increased

- Alumina/dry bulk and petroleum diversification

- It has completely smashed the Norwegian stock market performance over the last year (see below)

- Revenues are more focussed on Asia & Pacific; They opened a Dubai office in Feb 2023

- All of their ships have been converted to the necessary ship-types to satisfy port clearance (regardless of commodity).

- ESG investors (or investors mandated to buy so-called “clean” investments) will be pleased that the new ship orders will introduce a new standard of efficiency with an estimated 35% reduction in carbon footprint than the first generation CABU vessels built between 2001 and 2007, which the newbuilds will replace.

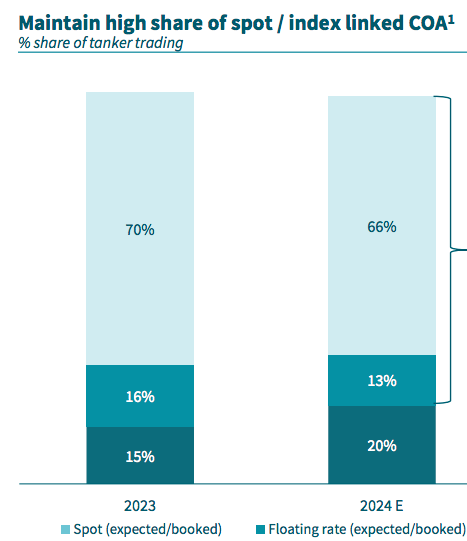

- CLEANBU customer acceptance +35%; CABU caustic soda cargo booking increased by +10% in 2024

- Currently: Their fuel consumption is 30-40% less per ton-mile transported cargo when compared to standard dry bulk and tanker vessels.

- The three new ships are currently be built in China–The ongoing China economic collapse may considerably delay delivery.

Ratios

P/E: 6.28

P/B: 1.66

P/S: 2.49

P/Equity: 1.43

P/E/G: 0.19

Current: 2.43

Quick: 2.16

Cash: 1.36

EPS: 14.687

Beta: 0.9

Market Cap: 6B

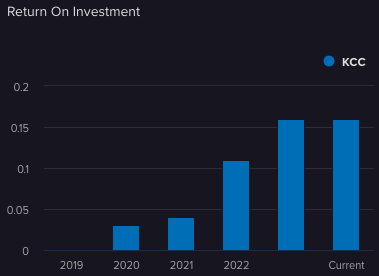

Return on Assets: 6.05%

Return on Equity: 26.36% (5 year average 14.86%)

Asset turnover 0.45FY (5Y Avg: 0.37) increasing (This is par for their immediate competitors but below global averages for transportation sectors using data the last 4 years).

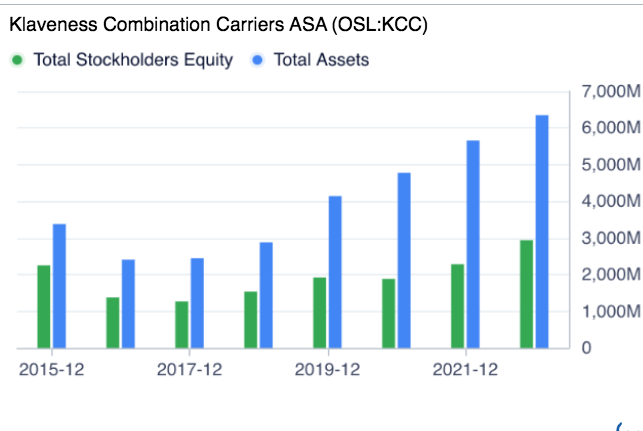

Balance Sheet

497.07M Non-Current Assets (Vessels)

17.59M New Building Contracts

6.43M Other Non-Current Assets

38.87M USD Other current assets

68.1M USD in cash (& cash equivalents)

113.0M USD Undrawn Credit Facilities that they have access to if needs be.

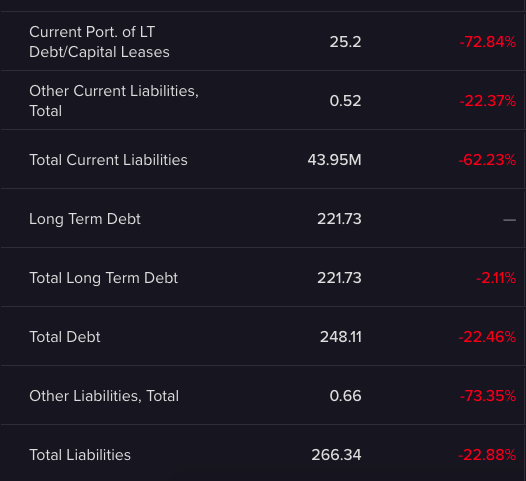

154.83M Non Current Liabilities (Mortgage Loans)

657K Long-term financial liabilities

66.90M Long-term Bond Loan

43.95M Current Liabilities

Total Liabilities/Total Assets–> 266 342/628 041–>42.4%

60.43M shares outstanding exist (a 15% increase from 2022 to 2023)

CapEx has come down a considerable amount from 4 years ago, but their plans to invest in environmentally friendly additions to their ships could see a reversal, which undoubtedly will hurt the dividend. I guess they don’t have to overdo it however since they already possess quote, “KCC scores an A- for “climate change” in annual CDP disclosure”.

So far, you can see like other shipping companies with cash, they’ve decided to either pay large dividends or pay back their debts. $KCC is doing both. As of Feb 20th, 2024:

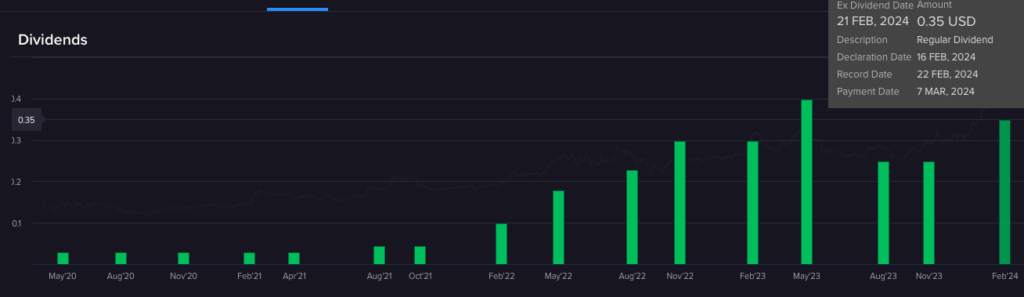

Dividends

We have a payout ratio of almost 60% with consistent dividends (actually rising as economic figures showed up increasingly poor). Currently it sits at 15.3% dividend yields per annum. There are no plans to cut the dividend dramatically so far for 2024

Forecasted

Dividends per Share (kr) | 13.16 | 15.27 | 14.74 | 11.58 |

Ownership

| 32.54M: Shares | 219.53M: Value | 53.82% |

In addition to the holding company, over 13% of the shares are owned by insiders.

Oslo-listed Klaveness Combination Carriers has logged “solid” earnings in a historically strong fourth quarter — and expects to set more records this year. The Norwegian owner of vessels that carry both wet and dry cargoes said 2023 had been its best-ever year.

Engebret Dahm, CEO

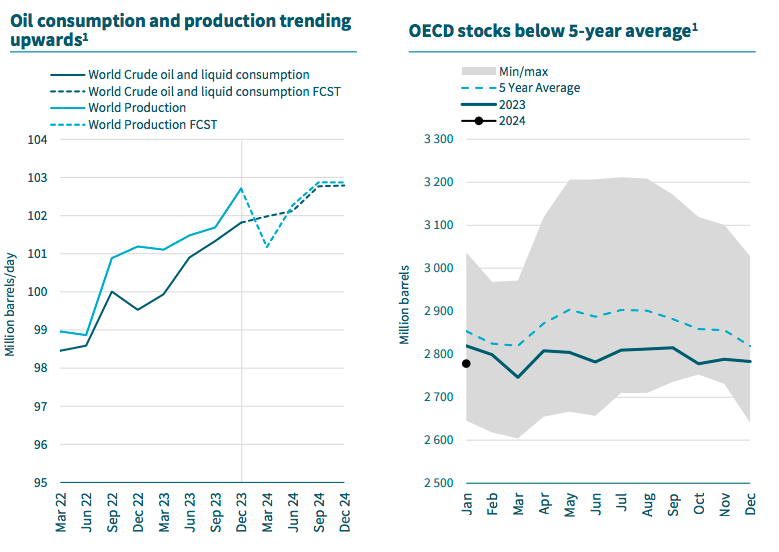

Sector Set Up

Taken from their latest presentation: stocks are falling against the forecasted production/consumption for crude oil. Also, look at the low orders put in for new ships–there’s only so many ships available competing for this increasing demand.

They are perfectly positioned to benefit from the new Australia battery material industry set to expand till 2029.

Closing

Despite many of the interviews being in Norwegian and it only being listed in Norway, Sweden (KCCo) & Germany (36K), the stock has still garnered attention from investors who have buying consistently.

The company does have a decent amount of long-term debt relative to their cash holding, however their positive cash flow, high margins & very low SG&A allow them to continue to pay this back whilst shareholders earn through a dividend in the meantime. This is all on the back of record performance/earnings in 2023 from both shipping segments. They also do not expect any immediate uses of their cash reserve for 2024. What I look for as we enter sovereign debt crises everywhere is the ability to produce cash flow and Klaveness have been able to do this reliably with consistent holding from shareholders.

For ESG-minded investors, they have shown a commitment to being as energy efficient sustainability as much as possible with their new installations & enhanced efficiency ships due in two years. I am mindful on their over-commitment to the “net zero, green energy, carbon-free” lingo where they may run the risk of investing too much in this space for little to no return on their capital because of political pressure at home. However, at least the next 12 months look similar to the last with an expected CapEx of 32.5M in energy efficient updates, technical updates and dry docking for all ships.

In addition to gaining exposure to the Norwegian stock market, the majority of revenues come from the Middle East (given the nature of the business), other Asian countries and Oceania–as a nice diversifier out of North America and Europe (especially if you believe the Global South will continue to grow economically).

The sector of the company may be too boring for some investors, especially during the tech frenzy–but the management are experienced, they have been operating with success for many years, they are playing the long game with diversified asset sectors (slightly more favoured on using tankers vs. dry bulk). Besides, who doesn’t like a 15% dividend? Sail on, investors.

I hope you enjoyed this article–remember to send in your email for notifications like this, follow us on Twitter below and always #StayOnTheBall