Betting it all on this:

Botswana. Here it is… a landlocked country in Southern Africa.

According to the numbers, Botswana is as close to a developed country as Africa has ever had. Here are some figures that make them stand out

- Ranks 4th on the continent for GDP per capita

- Positive current account

- With 2,249,104 for a population and such a huge land mass it is one the least dense populated countries in the world

- The only country in 2020 that did not compromise it’s democratic principles during Covid

- 3rd highest ranking in the continent for low corruption (behind Cabo Verde and Seychelles as number 1).

- Debt to GDP has increased and still only sits at 26.1%

- Botswana has the highest literacy rates in mainland Africa at 86% (Seychelles is number 1).

- Inflation sits at only 1.5% (as of September 2023).

- Botswana have introduced some interesting tax incentives for investing & companies locally; already a territorial tax country

- No exchange controls

- It’s last war was in 1852 and lasted 1 year; the other three wars were affairs in external countries where they sent soldiers.

- 25-35% of their GDP come from diamonds, they are rich with other resources as well.

- Known for its stable government & prudent management of its economy. Has been independent since 1966, the longest democracy in Africa.

- The IMF’s latest summary report state: The financial sector is sound, stable, and resilient. Financial stability could be further strengthened by operationalizing the frameworks for emergency liquidity assistance, deposit insurance, and bank resolution, as well as continuing to enhance financial sector supervision

There’s a lot of interesting features that have enabled it to be an exception on the continent.

Although every country has bad aspects…

- Balance of Trade has nearly hit it’s lowest point in 50 Years.

- Have no improvement in agriculture or manufacturing

- 70% of their foreign exchange reserves comes from diamond mining [I am not yet convinced that this will go away overnight, but lab-produced diamonds may be a real long-term threat]. The IMF summary goes on to warn: Supply-side structural reforms are necessary to support the diversification of the economy and increase the relative size of the private sector. This will help boost the economy’s growth potential, reduce unemployment, and enhance resilience to external shocks.

- 30% of their revenues & 85% of their exports come from diamonds (again, not diversified)…long term trends have shown a decline of mineral revenues, largely due to increased costs especially in the diamond industry.

- Anecdotally, I spoke to a lawyer who suggested that the stable days may be becoming a thing of the past as desperation seeps in… (For example, at the beginning of this year, Botswana again placed a total import restriction on a number of vegetables from Namibia, extended it for two years straight.

- “Severe” Food insecurity continues to rise, from 18% of the population in 2018-2019 to over 27% in 2023 now.

- Botswana are 1 of 5 African countries who export a majority of their production to neighbouring countries. As Southern African falls behind with some severe economic concerns, these exports will also so contract.

- Even with a 2.5M population, with such a small industry, unemployment sits over 25%

- HIV is a massive problem.

HIV

Over 1/5th of the population of Botswana has HIV–they consistently rank the highest. Young women aged 15-24 have a prevalence of 66%. The rate from age 15-49 is 25%. The high socioeconomic costs of managing HIV/AIDS at a national level are challenging to the nation’s economy.

There are great results to turn the prevalence rates and mother-to-child rates around–it looks like they’re rounding the corner in some respects. However, as with everything, you need someone to facilitate these new widespread treatments. Botswana has a tremendous health worker shortage.

They are aiming to recruit at least 1,000 pharmacists, some from abroad, after nurses said they would no longer dispense medications stating it “was outside of their scope of work”. The situation has led to congestion at the country’s pharmacies and left some patients unable to get their medications at all. From their Nurses Union, “our local tertiary institutions do not produce enough pharmacists and pharmacy technicians who can be engaged to serve our people”. There are even shortages on being able to get condoms to retail.

The Minister of Health acknowledges this issue due to severe social inequality with pay, idleness and poor morale of the workers. While some of this is laziness & bad attitude, it’s difficult to blame everyone as almost 20% of healthcare workers died due to AIDs from 1999 to 2005.

Botswana even lacks enough books or furniture for schools to train a new generation of healthcare professionals to mitigate this problem in the future.

No more shine?

It’s always cause for concern when an unsophisticated country is reliant on one commodity or industry without the obvious capability to maneuver to hedge risks– Botswana may very well be such a case. Botswana’s economy is 70% reliant on diamond exports.

Diamonds are an interesting investment during high inflation periods and a speculation that their value will hold in the buyers’ eyes, however unfortunately the emergence of lab-created diamonds are slowly finding their place in the market. This is not due to the fact that lab-created diamonds are superior, in fact they are virtually indistinguishable.

Unlikely a bar of gold or palladium, diamonds are no longer ‘rare’ and are in risk of losing their twinkle. So much so that the massive diamond company of De Beers are considering cutting their prices a shocking 40%.

Diamonds are difficult to price as their value is determined by conglomerating a spectrum of characteristics, which include its cut, it’s clarity, it’s certifications, it’s colour as well as it’s carat (weight). These ultimately give a rarity and therefore, a value. A poor-quality 2-carat diamond may be worth more than a pristine diamond (in terms of cut, clarity and colour) that only weighs 0.5grams.

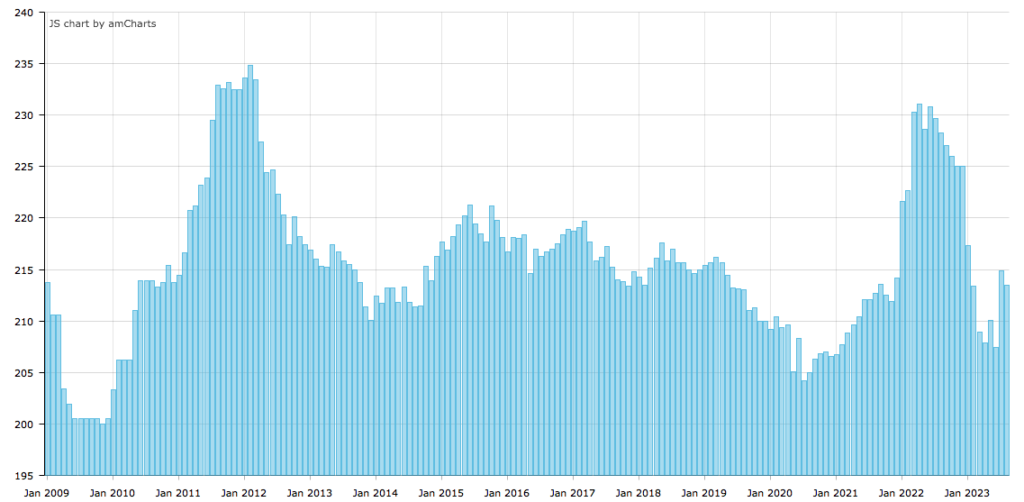

This is the Diamond Price Index (aims to average out these C’s to evaluate it’s trading price)

Lab-grown diamonds only account for 2-3% of the produced diamonds. Whereas, anywhere from 110 to 140M carats of diamonds are mined each year (28.4 grams per carat). Although, a study lately surveyed 12,000 newlyweds on their engagement ring of choice; natural or lab-created diamonds. Over 1/3rd had elected for lab-created diamonds–and engagement rings compose 1/4th of the diamond market annually.

A Burning Match

Debswana is Botswana’s largest diamond mine producing a majority of all of Botswana’s diamonds (87%) with the only other operating mine being Karowe mine. Debswana is so large it nearly accounts for quarter of the world’s diamonds, yearly. This mine hit record sales in 2022, increasing 48.5% YoY.

De Beers mining (unit of Anglo American) and the Botswana government share ownership of the mine at a rate of 50:50. Sound good? Well, the Botswana government made sure that they profit at a rate of 81.2% and De Beers get 18.8%. So De Beers are chucking up the costs to the tune of 50% just to receive a profit cut of 18.8%. They are doing this due to the fact that the operations are so enormous they can still turn a profit. They have signed a new deal for mining licenses till 2054 and a sales agreement extention with the Botswana government. However, as with all mining, as the mines get deeper and costs become higher it begs the question if De Beers will be willing to continue to engage eating the costs for only a fragment of a return. This is all dependent on the input costs and sale costs remaining at healthy margins as well, which has been a problem. As of Aug 2023, the De Beers Group has reported a sixth consecutive decrease in sales. The Botswana government have been trying to extend deals with Lucara diamonds (Karowe mine) to diversify contractual options since.

Additionally, new contracts signed with the Botswana government appear great but ultimately mean less carats sold by De Beers to their own customers. To compensate, they can cut to smaller diamonds but this requires employment expense, more infrastructure, more machines to polish on a fixed margin. The fact of the matter is that they don’t have enough skilled personnel in Botswana to employ either. At the end, this is less dollars available to go back into mining & the Botswana government aren’t helping.

Manufacturers believe the change is putting additional pressure on the sector as the cost of production in Botswana is high relative to other centres. Among the additional costs manufacturers are required to pay is a training levy, which was recently reapplied specifically to diamonds. The levy is currently set at 0.2% of turnover. In the petroleum industry in Botswana, the charge is 0.05% of turnover, given the low margins in that sector.

“We’re lobbying government for the same,” says Botswana Diamond Manufacturing Association chairman Siddarth Gothi. “We’re an industry with high turnover, thin margins, and low profits, so it puts us at a disadvantage to pay this training levy based on turnover… especially relative to other centers such as India and neighboring South Africa and Namibia”

Closing

Botswana has always been the diamond in the rough (pardon the pun) when it comes to all 54 African countries. It has been known for its stability, it’s democracy, it’s consistent exports, responsible governance and relative safety. De Beers (Anglo American) have secured new mining licenses with the option of further exploration of their many properties & increased production promises for the foreseeable future.

However, following word from a lawyer in the region, they may be bucking their own trend and heading into political uncertainty.

Despite improvements in HIV patient data & availability of treatments, there have been difficult having enough employees to manage this healthcare service–no solutions are on the table. Additionally, while diamond mining is still their bread and butter in the economy, they may be in a precarious position as the mining companies may be disincentivized to take a higher mining expense for an increasing reduced return. The government’s eagerness for immediate diamond profits, increases in tariffs, & levies, a high unemployed & unskilled rate and lack of willingness to diversify the economy may leave everything on a knifes edge. This is compounded by the small but growing market of lab-grown diamonds representing a healthy percentage of the retail market.

This should go as a reminder to diversify your investments!

Don’t put all your eggs in one basket; or don’t put all your diamonds on your economy.

#StayOnTheBall