Using Fire Protectors as Wealth Protectors

What in gods name is this article about…

Fire protec–using a fire blanket to protect my cash?

Not quite. There’s a country out there that very few people hear about, can point to on a map, or know anything about. While they’re not the richest (& likely won’t be given their history) they are very stable from an economic point of view. Moreover, there’s an interesting trend occurring where bit-by-bit the country is privatizing itself.

In their Persian tongue, Azer translates to Fire and Baigan translates to Protector–you guessed it–I am talking about Azerbaijan! I should have written this earlier actually because during my Europe travels there (that you can hear about here) we encountered an Azerbaijan element in each one–A government meeting with lots of security in Budapest; A flag monument in Serbia and a Caucuses celebration in Georgia–weird.

Everyone is so quick to disregard these countries as being shitholes that are too stupid to get out of their own way…but a quick review you begin to see that they are managing things just fine.

The Country

Azerbaijan is located between Russia, Iran, Armenia, Georgia and the Caspian Sea. It’s home to a remarkable blend of ancient and modern history with sites like millennia-old fire temples and Baku’s modern, sleek architecture. In addition to its impressive history, the culture, food and art scene, its a major gas producer and exporter. Most of what you’ve seen the country is probably about their war with Armenia, meetings with Russia/Turkey, The Baku Grand Prix races (since 2017) and their President telling off that BBC reporter.

Stability

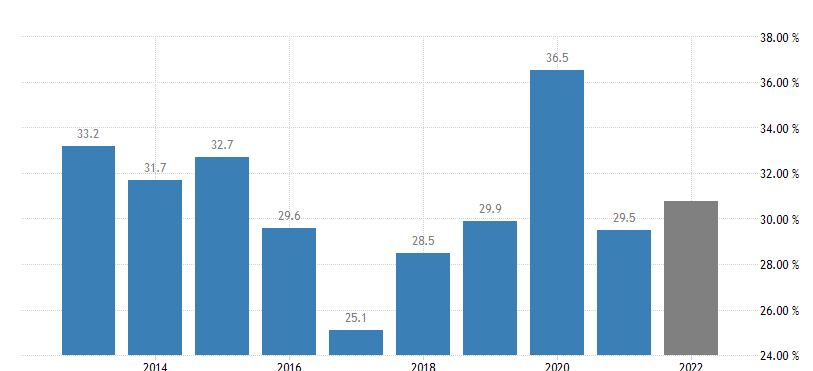

As shown in 2021 and 2022, higher oil and gas prices revitalized the country’s balance of payments (current account surplus of 15.2% in 2021 and 18% in 2022). The IMF 2022 Article IV Mission report goes on to say “Azerbaijan’s economy benefits from the higher energy prices resulting from the war in Ukraine… this is related to the increased gas import reliance from Europe… Risks to the outlook have increased due to the war but remain broadly balanced”.

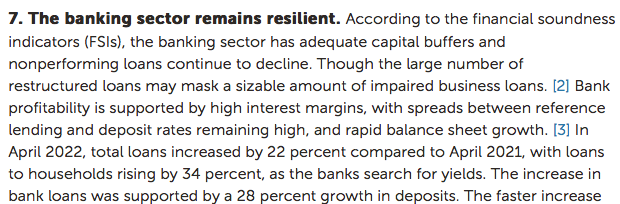

Azerbaijan’s Debt to GDP is one of the lowest in the entire world–sitting at 11.70% (this is rare… if you exclude territories and microstates this is the 5th smallest in the world). This has allowed it’s banking sector to remain quite resilient.

Country Facts

-93% of their exports are oil, natural gas, distillation products. While it’s not good to put all your eggs in one basket, if I had to do so with one industry, I’d choose the energy sector.

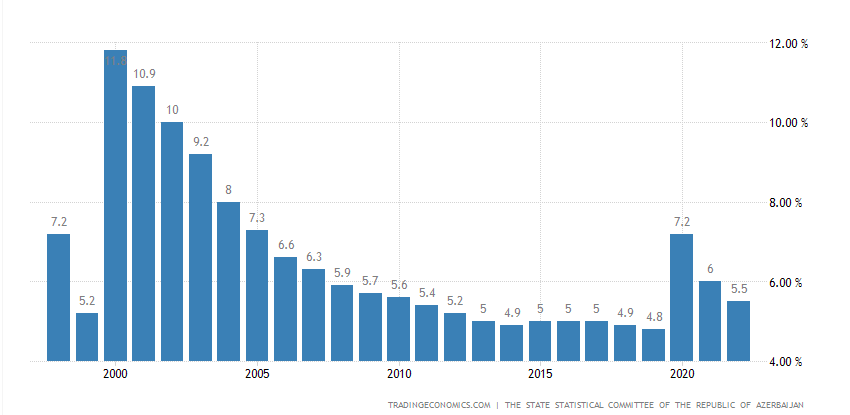

-They have quite high inflation at 11.70% but their interest rates sit at 9%–about the same delta you’d expect in the West on bank deposits.

-3.7% of their GDP is spent on their military (3.8% in Russia and 3.4% in USA). Azerbaijan’s political enemy seems to exclusive to Armenia. Otherwise they’re either trading with a country or are agnostic to them.

The last time the country had a negative trade balance was in late 2004. In 2020, they came close, but quickly bounced back again. Since, they have developed lots of trade deals/agreements and infrastructure to support their exports, particularly with Europe.

Perhaps part of this increase in employment has been the increase in the numbers of businesses from Moscow relocating to find a more stable, investment friendly jurisdiction; the world’s problems are their benefit. For instance, IT and communications have experienced a large year over year 15.5% growth increase.

Public –Private

The UK is the largest foreign investor in Azerbaijan, with 450 UK companies currently operating inside. At the moment, billions are traded yearly between Azerbaijan and the rest of Europe. Although, what has caught my eye are not the behemoths like BP or Shell, but the recent move to privatize; privatization may be something you take for granted but this country was ex-Soviet, the epitome of nationalized state control.

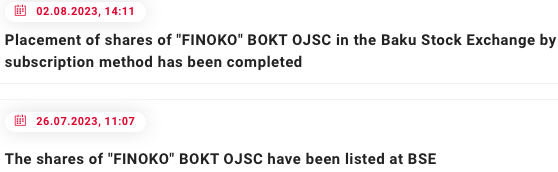

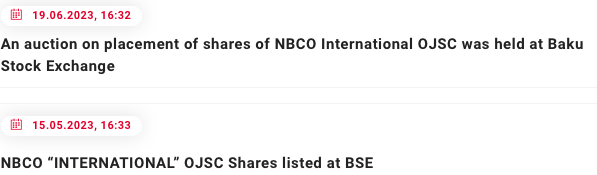

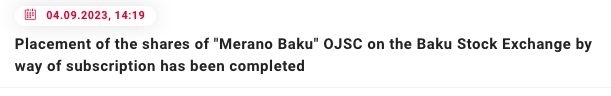

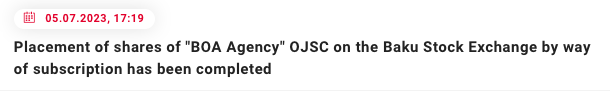

Admittedly, I have no idea about these companies–but I wanted to post them to show that they are taking advantage of their stock exchange in Baku (Capital). This is a bigger deal because including these companies there are only 24 equity listings in total. The offerings aren’t too plentiful or attractive because of tiny volume, but I think big picture is that there’s a change of heart with respect to doing business in the country–countries hardly change overnight. Note the dates here (in red)

While most of these equities are in capital markets & industrials, there are 54 corporate bonds in an array of sectors such as mining, gas, airlines and manufacturing. There are dozens and dozens of government bonds and mortgage bonds listed as well (in AZN & USD).

One of these corporate bonds is from Southern Gas Corridor (SGC) 4 whereby on 31 December 2020, the entire SGC was safely completed and gas began flowing into Europe (Italy) from the Caspian for the first time–this has created further interest in future agreements between the EU.

Additionally, a very large oil company (SOCAR) had received Fitch and Moody’s credit upgrades in the last year. Another small detail I’ve noticed but noteworthy nevertheless… everything on the Baku Stock Exchange and many of their banks are marketed in English.

Thinking about Investing?

Even though they are positioned well for an inflationary decade and are obviously adding to their stock market, the volume to date is immensely low and unattractive still compared to other areas.

There are things that one should be aware of yet. According to Corruptions Perception Index produced by Transparency International (2022) Azerbaijan ranks 157 least corrupt of 180. In other words, the place is still pretty-darn corrupt.

Azerbaijan has been in a conflict in the Nagorno-Karabakh region as well with various levels of intensity. There are ethnic, historical, political reasons behind this conflict (most of the world have idiotic borders drawn up). These conflicts carry significant and long-lasting disgust between Azers and Armenians, both perhaps accurately and falsely accusing each other of wrong-doing. It appears to my eye that Azerbaijan are ‘winning’ with Armenians leaving the area that they are trying to (re)claim. It’s awful, but big picture I’m not sure it’s a deal-breaker like other conflicts in the Middle East [Click here to learn about an unlikely Gas deal!].

Azerbaijan’s major issues are domestic with consumer price inflation and food inflation. A new, and significant concern is food security with 17% of their imports coming from Russia most of which is wheat and other food staples. Additionally, access to fertilizers for own agricultural production is a concern. Although, on the macro level, it is clear that higher oil and gas prices benefit Azerbaijan.

Closing

There’s a reason why people are not rushing out to invest in Azerbaijan (beyond the reason that 50% of people think this is the name of health disease). The place only became independent since 1991, has many backward former Soviet laws still, it’s still undergoing development, has a relatively unidimensional economy & war conflicts are ongoing.

However, I believe that they are a rather stable country that people overlook, partly because they associate it with the war headlines. Given it’s utilization as being a ‘gas pump’ for the new frontier of West/Central Asia & most prominently, Europe, I think they will continue to grow economically. Their growth is supported by expanding trade agreements, responsible spending and a very low debt load. At the same time, they are aiming to diversify and develop other areas of their economy which could make them a more prominent player on an international scale. They do face some domestic issues, but the major takeaway is higher energy prices= more revenues for Azerbaijan. The world’s problems, are their benefit.

I’m reaching out to brokers now to gauge the difficulty of opening an account to purchase equities and corporate bonds. I will update the post when I learn more if you guys and girls are interested. I hope to get there to create another OnTheBall Travels article too.

Thank you for taking the time to read. I’d really appreciate it if you could share this article on social media!

#StayOnTheBall