Platinum Play

Platinum is a rare, stable metal that, owing to its diverse and distinctive chemical and physical characteristics, is often used in jewellery as well as medical, electrical, and chemical applications as we’ll discuss below. Most people who are into the metals space pay considerable attention when it comes to gold and silver while the platinum group metals (platinum, palladium, osmium, rhodium, ruthenium and iridium) are less interesting. Platinum is often used to describe subscriptions, cards and memberships but less for ones’ portfolio.

But platinum is set to experience one of the largest supply cuts in it’s history. This is due to record deficits and record recycling lows of existing supplies.

Forecasts

The World Platinum Investment Council (WPIC) raised its 2023 forecast deficit for platinum to a record high as investors bet on the metal’s supply declining. Platinum consumption is bound to outpace supply by nearly 1 million ounces in 2023. The trend has gotten off to a bad start with the supply deficit in the first quarter of 2023 alone amounting to around a half of million ounces. Furthermore, the WPIC foresees that demand will increase 24% while supply will lag behind only increasing 13%. Looking ahead across the decade, mining supply is expected to increase at a rate of 1-2% annually, at current rates.

Investment bank UBS has raised their price forecast for the metal by the end of this year to 1,200 USD per troy ounce.

TD Securities forecast trouble for most of 2023 and then the metal rising to $1,100 by the end of the year & remain bullish looking ahead.

Mitsubishi Corporation articulates that platinum is essential for the green energy transition, highlighting its importance in electrolysis and investment interest on the back of the hydrogen sector.

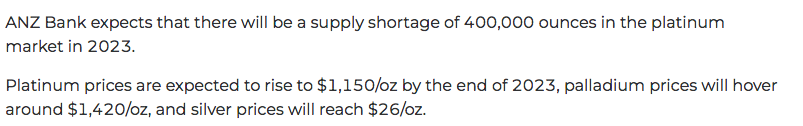

ANZ bank also have a bullish view

S&P Global commented early in the year:

“Platinum was the best-performing precious metal price over the course of 2022, rising 12.0%, compared with a 1.7% fall for palladium and 4.8% and 1.3% rises for silver and gold, respectively. With Russia normally a major supplier of platinum group metals, or PGMs, supply risks remain…”

Please see my article on Silver here!

Uses

Platinum is primarily used as a catalytic converter for cars, jewelry and electronics, medical devices, chemicals, glass and aircraft equipment (cars being the predominant use).

The secondary highest use-case for platinum is jewelry with half of this demand coming from China (something to watch).

The glass manufacturing, chemicals in plastics, hydrogen economies (making hydrogen) & fuel-cell vehicles are all emerging technologies that utilize more platinum, but far insignificant compared to the former.

The last demand pillar is investment or retail demand; platinum bar and coin holdings as a safe haven. In 2020, 500,000 ounces fell into the category of bars and coins and 300,000 the year later.

Platinum’s price is highly volatile because its supply and demand are susceptible to change based on what’s happening in world politics and economic outlook rather than a pure safe haven or monetary place like gold. Steep peaks and valleys could be an opportunity for significant gains but also substantial losses depending on ones’ staying power.

Overall, I expect demand to fall in line with the contraction of credit, collateral, lending and overall economic activity–but what happens if supply falls at a faster rate? Price goes up.

Where’s it come from?

Russia, the second-largest producer of platinum have been quite occupied with their border war with Ukraine, managing shipments to Europe and it’s activity in Africa. Around 10% of platinum comes from Russia, but most of the mining is a by-product from nickel, nickel-coppers.

If we consider the third-largest platinum producer in Zimbabwe (8% of the global production), they are only expected to have modest increases in their production across this decade. From 2016 to 2021 their cyclically adjusted growth returns (CAGR) only increased 0.05% and from 2023 to 2026 there is only an expected growth of 3%, as per a Global Platinum Mining report. Zimbabwe do have large resources in the ground, but lack infrastructure and mining capacity (with no immediate signs of changing).

North America ranks 4th in this line of platinum-group metals.

The last main source of platinum is from recycling of platinum from automobiles and jewelry which almost equates to 2M troy ounces a year (75% from cars from around the world). About 25% of the supply comes from recycling, however, this is expected to increase in the future modestly as well.

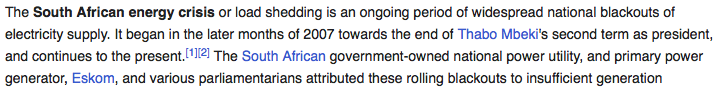

But platinum gets very interesting if you start looking at the number one producer (~70-80% of the world’s platinum) in South Africa. This equates to 4.2 of 6.2 million platinum ounces that hit the market every year. South Africa is undergoing a real economic collapse, with frequent power outages, no economic activity, pure lawlessness, genocidal acts and complete failure to produce agriculture due to endless government intervention. Anyone with any sort of capital and a sense for danger is trying to get the hell out and the least able to produce, remain. It’s difficult to blame them, an estimated 26,000 people have been murdered in 2021/2022 alone. This is an aerial shot of all the farmers that have been murdered in South Africa as of recent. Communists don’t believe in private property and they’re not joking.

Current estimates have the blackouts lasting for another 2 years so large mining companies like Sibanye Stillwater, Anglo American Platinum & Impala are finding it increasing difficult and practically infeasible to produce at the same level at all. These miners predict a 15% contraction in their supply (similar to the WPIC report) with Anglo American cutting 25% output. With poorly maintained infrastructure and plants there’s only so much power to go around from the state-run electricity company.

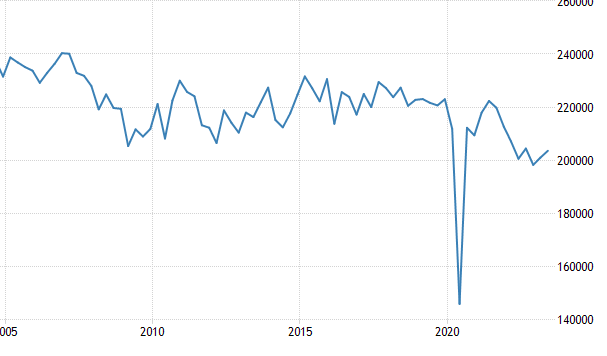

Above is the GDP from mining. You can see that 2020 has been absolutely unprecedented but the interesting take away for me is current mining revenues are below all the times that supply exceeded demand (see Aberdeen Table) and during one of the largest mining strikes in country history still produced more revenues than current levels.

Even if mining remains unchanged in South Africa, there are other factors such as the current Transnet SOC railroad strike (about benefits, worker pay) effectively blocking metal exports from the mines to market. A mere 11-days of strike amounts of 800,000 tonnes of ore unshipped. There’s simply nobody capable or willing to ensure the transport remains steady. Turns out meritocracy works after all.

South Africa had an excellent system of refining the platinum ore as well (smelting, base metals refinery, then precious metals refinery) in-country–however if there’s a lack of power supply or if an economic collapse were imminent than this would once again limit the amount of deliverable platinum to market.

The current account deficit in South Africa widened to ZAR 160.7 billion in the second quarter of 2023 from a downwardly revised ZAR 63.7 billion in the prior quarter but below market expectations of a ZAR 178.4 billion shortfall. This was the largest current account gap since Q3 2019, as the trade surplus fell significantly to ZAR 31.1 billion from ZAR 110.6 billion in Q1, due to a rise in merchandise imports and a decline in goods exports. At the same time, the shortfall on the services, income and current transfer account rose to ZAR 191.8 billion in the second quarter from ZAR 174.3 billion in the first quarter. As a ratio of GDP, the current account balance deficit widened to 2.3% in the second quarter of 2023 from 0.9% in the first quarter.

South African Reserve Bank

Let’s say you’re still the eternal optimist & you believe the BRICS alliance will turn things around– consider that South Africa doesn’t even need economic hard times to hurt supply. In 2014, the social and political make up of South Africa has caused the mines to shut for a long 6 months over a strike for higher wages. If inflationary pressures act up, than this indirectly leads to a tightening supply not only due to heightened operating costs, but because of potential demands from employees for more pay.

On 23 January 2014, almost 70 000 platinum mine workers went on strike. The majority of workers were from major platinum producers such as Impala Platinum, Anglo American Platinum and Lonmin Platinum Mines based in the Rustenburg are of the North West Province. These mine workers belong to a newly formed trade union, Association of Mines and Construction Union (AMCU) under the leadership of Joseph Mathunjwa. The workers, represented by AMCU, demanded a salary increase from R5 000 to R12 000 per month from their employers. In return the platinum companies called the workers’ demands of R12 000 impractical and refused to go beyond a 10 percent wage increase

South Africa History Online (SAHO)

COMEX

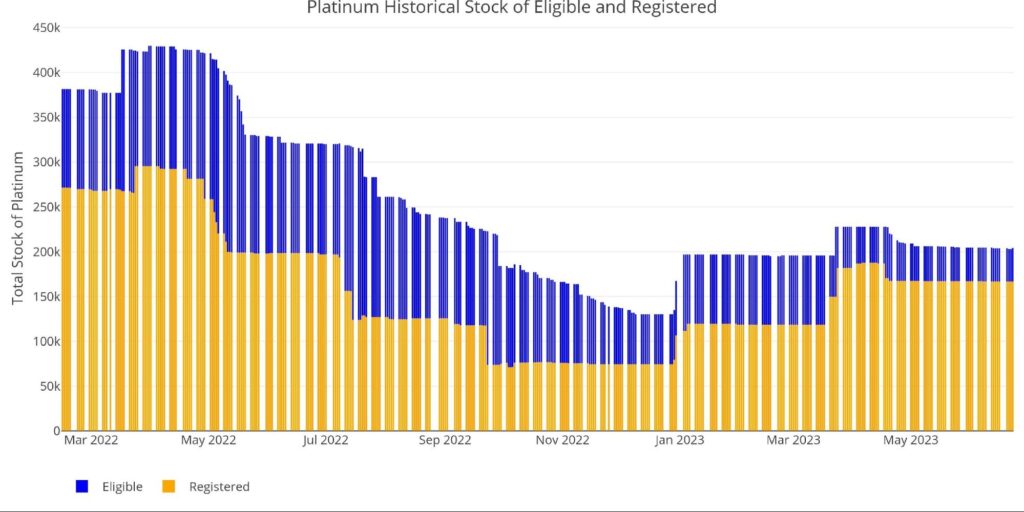

How does existing supplies look? Well, it’s tight.

COMEX volumes have gotten quite low at the beginning of this year with them restocking more months later.

Open interest represents 475% of the registered platinum supplies at the COMEX. If we assume that there’s 200,000 ounces of registered ounces and use the normal 50 ounces per contract, that’s only 4000 contracts out there. At today’s prices 200,000 ounces is 185M (for it all…). An institutional-sized investor could taunt this market if they wanted. I’m of the opinion it’s a matter of time until one does just that. [You’re seeing this with the Uranium market already! <–Click here for another FREE article]

Crucially, adding future supplies to COMEX is difficult given that mining platinum is unlike mining other precious metals in two ways. The first way is that platinum is often mined as a basket of metals, involving palladium and rhodium (platinum being ~20% of the make up). Therefore the price dynamics of these other platinum group metals influence the mining of platinum. If you’ve read my silver article you’re familiar that silver has a similar problem. Secondly, while gold is certainly a rare metal, it is mined 5X more than platinum, further restricting the ability to ‘catch up’ to the adding demand and with the low reserves on the books already.

It has been estimated that 10.5M troy ounces exist in above-ground stock (held my Mr Smith, Mrs. Wu, governments, investors, ETFs) which accounts for ~17 months of demand. So in other words, if mining were to completely stop, there may be additional resources to draw upon (assuming those are willing to sell). However, again if we extrapolate out further 4-5 years, this other (unlikely) supply won’t do a dent on demand.

Investment Managers

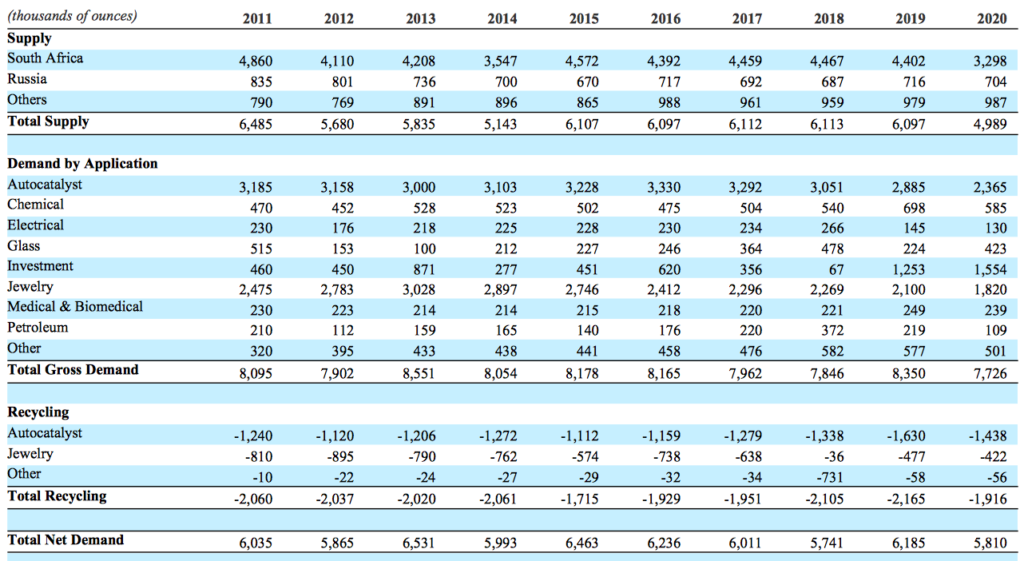

Here is a great chart from Aberdeens 10-K 2022 (ETF ticker PPLT). You can see that Total Net Demand (gross demand-total recycling) has exceeded supply in all years besides 2011, 2017, 2018. Similar to the price action (see below), there hasn’t been much volatility in these either supply or demand to date but the take away is that the market is steadily in a deficit.

I’ve taken some time to search this ETF which purports to own physical platinum supplies because of a meeting I’ve recently had. A few months back, I’ve met with an investment manager in one of the British Crown Dependencies who told me gold investments are between 3-5% for institutional investors and 2-3X higher for family offices. Though he said most of this is being held in Exchange-Traded Funds (ETFs) or ‘paper’ gold. When I asked about Platinum he said “I’m not sure, but its far smaller than gold for sure” Based on these numbers, you may get an idea of how little exposure platinum has to large investors.

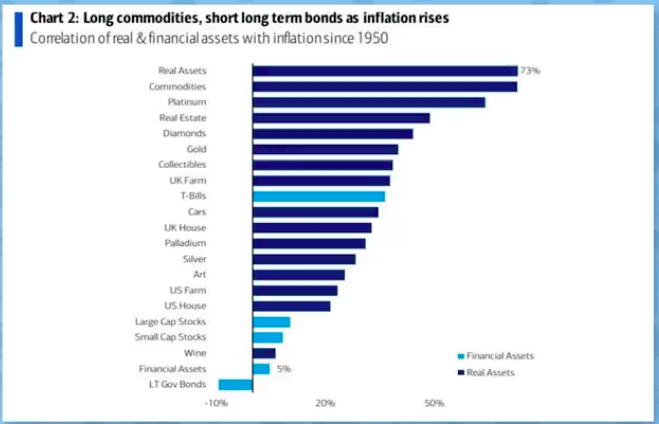

Although, like gold, platinum still serves as an interesting inflation hedge as well.

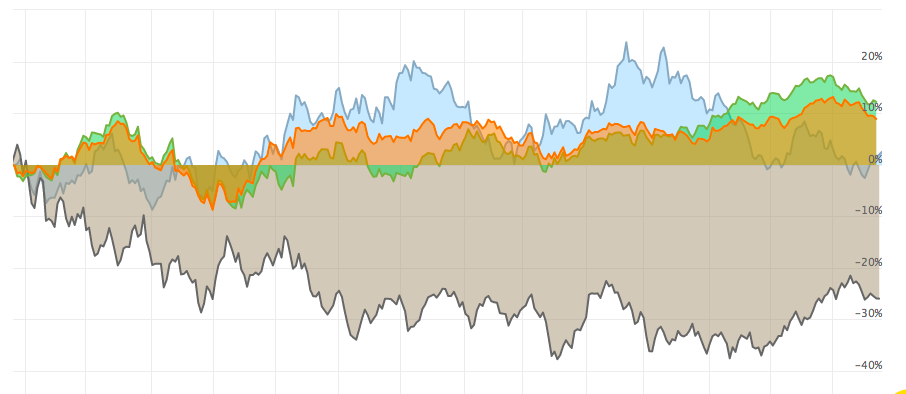

Let’s look at the price action over the last 5 years:

Nothing too glamorous or shocking. Although, this price performance is quite uncorrelated to the general markets—something that may be favourable if we see turmoil in the years ahead. To demonstrate this, here’s an example going back to July 2022

The blue is platinum. The orange is the Dow Jones. The green is the S&P 500 and the brown is oil.

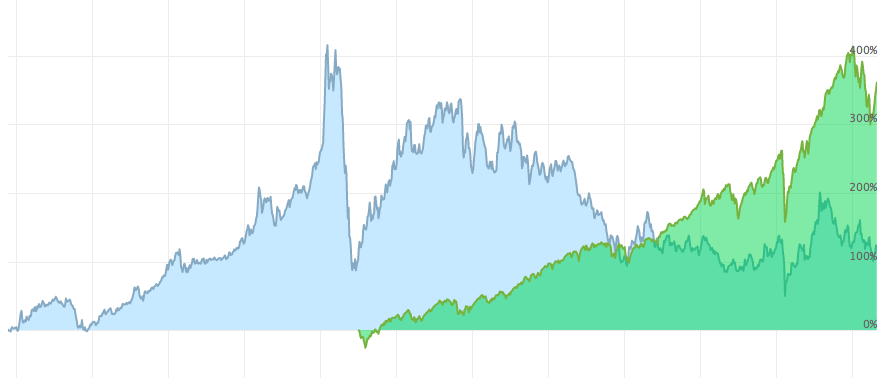

Platinum (blue) vs. the S&P 500 (green). It either shows the potential for platinum, the bubble in stocks or both.

With supply falling faster than demand, the world’s largest producer facing economic issues, little COMEX supplies, inflationary scares over the next decade and uncorrelated returns relative to other asset classes–I think Platinum deserves a place in ones’ portfolio for hedging purposes during these chaotic times. I wouldn’t be surprised if the price continued to fall due to tightening industrial demand globally but there will be a crowd to buy the bottoms in attempt to squeeze supplies and play the long game as a supply slump could last years and years.

Please try to find the time to share and post on social media to help friends and family out & for the 3rd time (??) don’t forget to check out my Silver article!

#StayOnTheBall