Company

Aftermath Silver Ltd. is a Canadian junior exploration company. The Company is focused on silver and is engaged in the discovery, acquisition, and development of silver projects in stable jurisdictions. It has developed a pipeline of projects at various stages of advancement. The Company’s projects include Cachinal, Challacollo, and Berenguela. The Cachinal low-sulphidation silver-gold epithermal deposit project is located in Chile’s Antofagasta Region, 40 kilometers (km) east of the Pan American Highway. Challacollo is an intermediate-sulphidation silver-gold epithermal deposit located in Region I in Northern Chile, approximately 130 km southeast of the major port city of Iquique and 50 km south of the town of Pica. Berenguela is a silver-copper project located in the Altiplano of south-eastern Peru in the Department of Puno at an elevation of 4,200 meters, approximately 50 km southwest of the city of Juliaca and six km northeast of the town of Santa Lucia.

The stock ticker is TSXV: AAG

Four Metals

Silver, Manganese, Copper and Zinc are their main exposures.

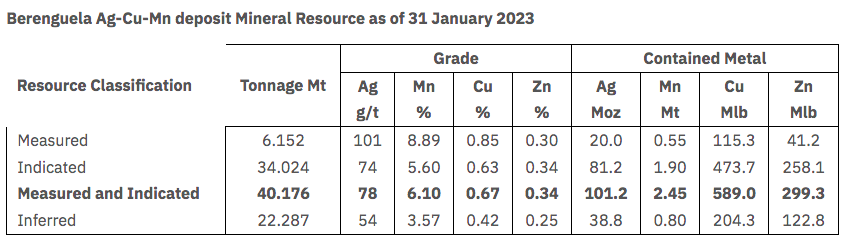

Berenguela

It’s their most promising holding and focus; some of the grades of silver have been very noteworthy with 100s of grams per tonne in numerous cores. Berenguela hosts a potentially open-pittable silver-copper-manganese resource close to Santa Lucia in Puno province, southern Peru. The relative value in the resource by metal is approximately, Ag=26%, Mn=44%, Cu=26%, Zn=4%. The property is a total tenement package of 16,294 acres and has almost 7,000m drilled from 2022 with 63 diamond drill cores taken.

It benefits from excellent infrastructure with water resources, grid power, potable water supply, and skilled labour in the local communities. A railway loading station is located at Santa Lucia, connecting to the port of Matarani on the Pacific coast. Santa Lucia is connected to the national grid at 220 Volts. Hence, it being their main focus.

Manganese News

Aftermath Silver achieved a 99.9% pure battery-grade manganese sulphate crystals from Berenguela project in Peru, with high-purity sample assaying 32.4% Mn and 95% recovery rate, potentially providing a new source outside China.

Challacollo

This is an low-sulfide epithermal deposit which as of 2020 holds 6.64 million tonnes at 165 g/t silver in the Indicated category (35.2 million ounces silver and 58 thousand ounces of gold) and 2.8 million tonnes at 124 g/t silver in Inferred, with associated gold credits (11.1-million ounces silver and 15,000 ounces of gold). Aftermath owns 99.9% subject to payments for the 46,950 acre property. The grade is quite attractive which could conceivably offer profitability to begin mining development as the underlying metal appreciates. Approximately 80-90% of the resource is Open-Pit–I believe Berenguela is their main focus because they are waiting for higher silver prices at Challacollo:

Their mining calculations were completed using the following assumptions:

Edge dilution of 7.5% and 100% mining recovery.

Ore mining costs of US$3.5/t and waste mining cost of $2.5/t.

Processing costs of US$17/t and General and Administration costs of $2.5/t.

Totalling 25.5/t costs. 30 dollar silver is a 17% margin. Underground mining is even worse, of course.

Cachinal

Cachinal is a low-sulphidation epithermal deposit located in one of Chile’s top regions for silver and gold. The property is 12,026 acres with a 99.9% ownership. It is along a precious metal belt that runs parallel to the prolific northern Chilean porphyry copper belt.

This deposit was mined from underground workings during the 20th century. Since, sporadic drilling by previous owners of the project in 2005 has delineated near-surface silver-gold mineralization. It is estimated to contain 16Moz of indicated silver and an additional 2.5Moz inferred. Grades of silver between the open pit and underground range from 73-180 g/t, still very high. Currently, there is no work underway at this property.

Macro Benefit

Battery grade manganese sulphate monohydrate is a pale pink inorganic chemical, with the formula MnSO4.H2O, in demand as a source of manganese for the battery manufacturing industry. I have mixed feelings about the battery industry given how it’s fuelled by an agenda and huge subsidies, but batteries as far as I can tell, are the direction the world is headed. Pure crystals of MnSO4.H2O contain approximately 32% manganese and one tonne of manganese metal should theoretically yield approximately 3 tonnes of MnSO4.H2O. MnSO4.H2O is commonly produced by reducing the mineralization to metal, then dissolving the metal in acid. However, the process developed for Berenguela is simpler and less energy intensive – the mineralization is directly processed with acid to dissolve the manganese and other metals. This is required so that the solution can be purified, then the manganese sulfate is directly crystallized.

As we stand now, China currently accounts for roughly 90% of global high purity MnSO4.H2O production so potential new sources of sulphate outside of China are becoming geo-strategically and commercially important.

This is the third composite sample we’ve tested as part of our on-going metallurgical program, and once again KCA have achieved a high purity manganese sulphate monohydrate sample with a 95% Mn recovery containing approximately 200ppm impurities

President of Aftermath

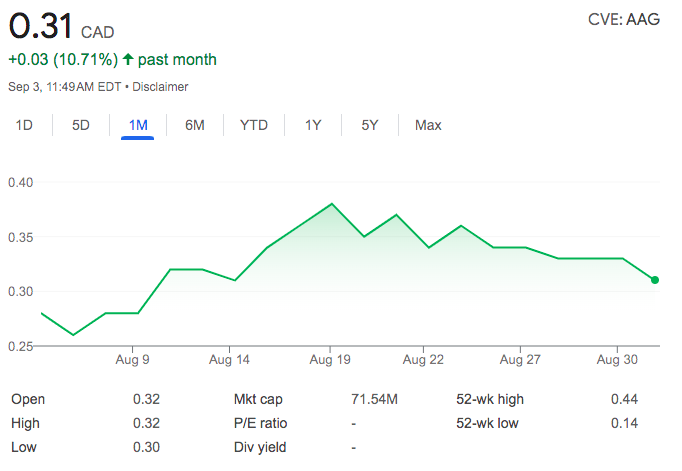

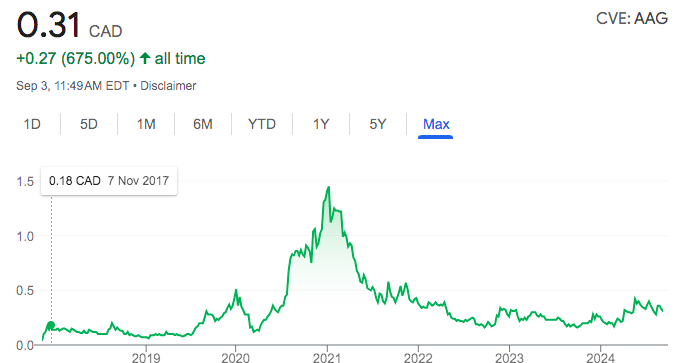

Stock

Price: 0.325

52 week low and high: 0.14-0.44

Market Cap: 73M (CAD)

Cash: $4.5M CAD

Fully diluted: 283.08M shares

Activity

For the nine months ended 29 February 2024, Aftermath Silver Ltd revenues was not reported. Net loss decreased 18% to C$4.8M.

- The Company has an option to acquire a 100% interest in Berenguela through a binding agreement with SSR Mining (6 years)

- Aftermath Silver Peru S.A.C, has obtained drilling approval via the amendment of its Semi-Detailed Environmental Impact Assessment (MEIAsd), for the further development of the Berenguela Project in Puno, Peru. This amendment was granted on 29th April 2024 and grants a 30-month period for drilling activities

Aftermath Silver Ltd. announced that 7,914,398 of the outstanding warrants to purchase common shares of the Company have been exercised recently for cash proceeds to the Company of C$1,989,439.5. Eric Sprott now holds 33,519,694 million shares, or 14.4% of Aftermath’s issued shares.

Things I like

- An Ex-China play with respect to pure Manganese

- Holdings of Copper and [high-grade] Silver properties, both metals in production deficits.

- Micro-cap

- Management team has a history of $1 billion of equity financing and

M&A transactions - All of their properties have current or historical resources. Their goal is to drill to transition their ounces from inferred to indicated and express open-pit potential.

- 12% insider ownership, 85% retail/other holding. Leaving tonnes of room for institutional to enter in the future and very little “rug pulling” threats from big money.

Disclaimer

Of course this is not investment advice, in the traditional sense–but, not in the literal sense either! This doesn’t even seem like as much of an investment as it is a speculation that they will be able to advanced from an exploration to a development to a production company with these underlying minerals. Don’t bet your retirement on Aftermath!

Check Out Our New Prepper Forum, Feel Free to Add to It

Closing

Like the other miner stocks I have written about, Aftermath stands to grow from the leveraged commodity prices–in fact, they may be waiting for higher prices before fully exploring their properties. A major benefit beyond their crystal-pure manganese is their diversification into high-grade silver and along Chile’s prolific copper belt as well; both of which are in structural supply deficits.

Aftermath states two of their goals is to “demonstrate indicative project economics through a Preliminary Economic Assessment within 24-36 months; determine whether we proceed to a Pre-feasibility or Feasibility Study”. If their findings prove promising, than you could foresee a situation where a major could come in to fund development of a mine, certainly the management has experience doing this sort of thing.

Furthermore, I am biased, but I feel more comfortable reading that mining operations are in Peru and Chile as opposed to the frozen and highly competitive/expensive mining districts in British Colombia or Red Lake, Ontario. Canada has shown the world that they are true communists who do not believe in the idea of private property nor have they done anything to make business easier, especially not for ‘dirty’ mining operations. On the other hand, mining is a major employer in these poor South American nations.

The upside may be tremendous with this one; but a lot remains to be seen whether they can raise further capital and turn heads in a tough and I suspect, becoming tougher, market moving forward. There are lots of interesting projects out there with unique stories to them–can their high-recovery, high-grade manganese and high-grade silver top the list?

If you liked this post, you may appreciate these two below too!

#StayOnTheBall