Please first consider to pick up our Free Newsletter and our Subscription Silver and Gold Plans:

Lets go:

Silver Dollar Resources Inc. is a publicly-traded company engaged in

mineral exploration. Their objective is to acquire mineral properties of merit in mining-friendly jurisdictions and create shareholder value by finding and developing economic precious and base metal deposits.

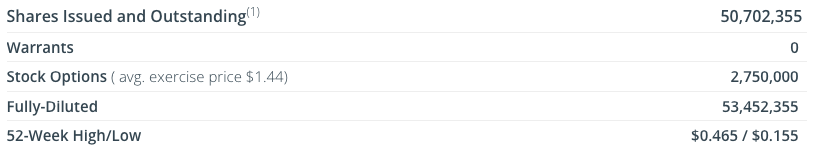

Stock Details

0.39 CAD

16.98M CAD Market Cap

| Main Listing: | Canadian Securities Exchange (CSE) |

| Listing date: | May 27, 2020 |

| Canadian Securities Exchange symbol: | SLV |

| United States OTCQX symbol: | SLVDF |

| Frankfurt Stock Exchange symbol: | 4YW |

Operations

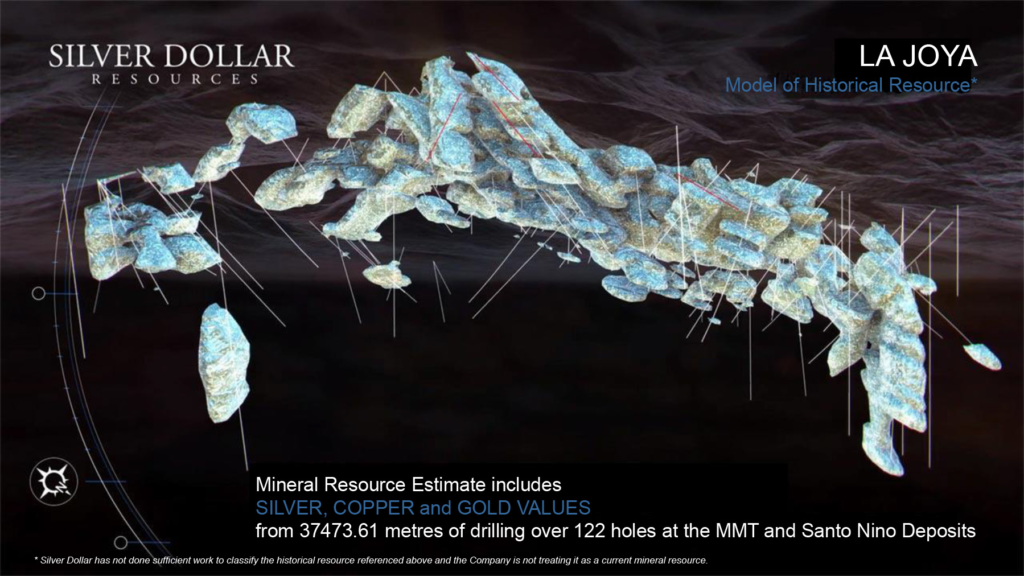

La Joya (the flagship property) is owned at 100% interest in the silver-copper-gold property. This property was optioned from First Majestic Silver in August 2020 & Silver Dollar completed the acquisition in 2023. First Majestic acquired the Property in 2015 as part of its acquisition of SilverCrest Mines; however, no work was carried out on the Property between 2015 and 2020; it was merely an asset sitting on their balance sheet. It was 75 km from SE from the capital of Durango.

One drill result returned 815 g/t or 28.75 oz/ton AgEq over 5 metres within a broader interval of 363 g/t or 12.8 oz/ton AgEq over 19.35 metres.

Modern exploration activity began on the Property in 1977, which included extensive drilling by previous operators to support them with their geological model. The property is over 4,400 hectares in size.

2) Nora Silver-Gold Project; Located in the Eastern Sierra Madre sub-province in the transition to the high plateau of Mexico, the Property lies centrally within the “Silver Trend” (many big players in the region already) that runs from the northwest to the southeast through Durango State.

Silver Dollar acquired a 100% interest in the Nora Ag-Au property from Canasil Resources, subject to a 2% net smelter returns royalty

The project sits on two veins: The Candy vein, which shows evidence of small-scale historical mining activity, is 0.50 m to 2.00 m wide & the Nora vein which is located 600 m northeast of the Candy vein with a parallel north-south strike and can be traced for 230 m along strike with widths of over 9.0 m.

3) Canada; Red Lake Properties–> Pakwash Lake Property; Silver Dollar owns a 100% interest in the Pakwash Lake property, subject to a 1.5% net smelter returns royalty. Located approximately 30 kilometres km south-southeast of the town of Red Lake. The 4,252-hectare property is situated in a structurally active area of the Red Lake Mining Division where exploration activity was re-energized in the last few years.

Longlegged Lake Property; Silver Dollar owns a 100% interest in the Longlegged Lake property, subject to a 1.5% NSR royalty. Located approximately 30 kilometres (km) south of the town of Red Lake, the 2,597-hectare property is situated in a structurally active area of the Red Lake Mining Division ~15 km south of the Dixie Gold property. Other active neighbours in the area include BTU Metals and Golden Goliath Resources.

There is a lot of activity happening with Red Lake in Canada, a new round of exploration is undergoing.

4) JULY 15th, 2024 NEWS! RIGHT TO Acquisition: RANGER-PAGE (Ag-Pb-Zn) PROJECT in Idaho’s prolific Silver Valley. It holds drill-ready targets outside area of six past-producing mines and adds to their portfolio of Tier-1 jurisdictions. The interesting part of this acquisition is their proximity to a mining culture nearby with half a dozen towns and processing mills proximal to the mine properties themselves; the infrastructure is in place.

Operating from 1916 to 1917 and from 1926 to 1969, it was a top-10 producer in the District having produced over 1.1 billion pounds of combined Zn-Pb and 14.6

million ounces of Ag.

2024 Exploration is Fully Funded

Grades

Analytical results for all samples have been received with 134 of the 170 samples collected returning assays greater than 100 grams per tonne (g/t) silver equivalent (AgEq). Notably, sample #161 taken from a historical underground working called Hueco Grande returned the highest grade with an assay of 4,311 g/t (or 152.07 ounces per tonne) AgEq!!

Surface samples assayed up to 1,218 g/t AgEQ at La Joya (as of August 2023), and three of five target areas have never been drill tested for further discoveries.

This property is situated approximately 75 kilometres southeast of the Durango state capital city of Durango in a high-grade silver region with past-producing and operating mines, including Silver Storm’s La Parrilla Mine, Industrias Penoles’ Sabinas Mine, Grupo Mexico’s San Martin Mine, Sabinas Mine, First Majestic’s Del Toro Mine, and Pan American Silver’s La Colorada Mine.

Wipe your eyes for these:

The breakdown of the Central Dyke Zone sample assays greater than (>)100 g/t AgEq includes:

- – 67 samples >100 g/t AgEq,

- – 39 samples >200 g/t AgEq,

- – 20 samples > 400 g/t AqEq, and

- – 8 samples >700 g/t AgEq.

At their Nora projects they have had:

- 83.6 oz/ton (2,369 g/t) AgEq over 1.01 m within a broader interval of 12.76 oz/ton (361.8 g/t) AgEq over 8.37 m.

Recent finds from Nora: Re-evaluation of Nora’s priority targets continues with initial surface sample results having confirmed high grade up to 29.61 g/t gold, 2,215 g/t silver and 3.34% copper in the Candy vein structure

Team

The team is lean with award winning geologists who together have discovered over 1 billion ounces of silver and 10,000,000 ounces of gold in their career. Collectively, the management and advisory team hold decades of experience in capital markets and mining.

Obvious Reminder

This is not an investment advisory post and everybody ought to make their own decisions based upon their own research and investigation. You know the drill!

Funding

They are fully funded for the next phase of exploration and they have the support Canadian mining billionaire Eric Sprott AND NYSE-listed First Majestic Silver, no stranger to Mexico. Both of these collectively own 30% of the shares.

It is nice that they have also gained Frankfurt exposure in addition to Canadian Securities Exchange and over the counter in United States.

Amazingly as well, insider ownership of this company stands at nearly 43%, one of the highest insider participations I have seen in a long time.

Fundamental Resources Corp. has the stock trading at 8 cents per silver ounce (whereas the junior miner average is 50 cents and the producer average of $2.11 per silver equivalent ounce; cheap!) This means that if it were trading true to it’s silver resource equivalence, the stock would have a 529X upside!

Of course, they don’t trade like this, but even compared to their peer producer average at current silver prices its a 26X upside!

They are sitting on 2,500,000 in Cash (CAD) and have 14,000,000 shares outstanding.

Worth Mentioning

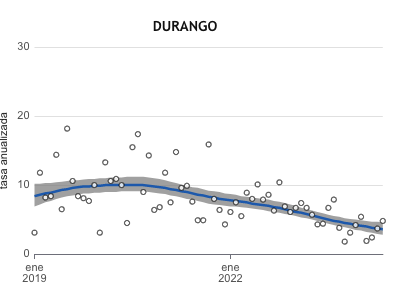

I have written a great deal of Mexico (check below if you’re interested), but I take great care by observing the criminality factor that is prevalent around the country. It’s worth mentioning that Durango is a very safe state in terms of homicide and overall crime not only compared to its neighbouring states, but compared to North America. Durango is an immensely large state with a rich mining history. Someone dear to me has connections there! Zacatecas, which is an extension of this silver belt is also great for silver but it is a very violent state.

Also worth mentioning–> Mexico has seen a reduction in silver mining output for the last couple of years despite growing industrial and investment demand. AMLO, Mexico’s prior president has de facto banned mining and been extremely litigious against Canadian silver miners. The current President of Mexico is a Jewish Communist who has stated a very anti-mining rhetoric as well.

Closing

This is a company with a highly experienced team, supported by some highly knowledgeable capital, in a safe(r) state in Mexico with absurdly high-grades of silver (but also periodically of gold, copper & now base metals). The high grades can afford them to operate at lower costs if they were to enter into development and grant them significant upside to the [I believe] inevitable upside in silver prices.

The growth case for this junior miner is there–> They have drill-ready targets, new high grade results and optionality with how to play their next drill holes, exposure to other metals & remain supported by 2.5M of cash in the bank and funding operations covered.

However, despite all of this, I am skeptical to pull the trigger on this one given the fact that Sheinbaum has yet to make a move/announcement anything pertaining to mining in Mexico. Despite the teams’ experience and high-grade, a bad narrative around operations could set this company behind schedule. Mexican cartel organizations also play a significant role in mining operations that could certainly spook investors.

This, like other companies we’ve wrote about, is a speculation. Once we can see what the reaction is going to be with respect to mining in Mexico, then it should be a good time to make a decision one way or the other. However, in so far there’s no further political risk of Mexico–> you have all the biggest names, most experienced levels working on an amazingly high grade set of assets at a time when silver is experiencing lots of tailwinds.

Are you going to bet your Silver Dollar on this company?

Let us know by Following us on X (Twitter): On The Ball, LLC & Write about whatever you want to be published here

As always, #StayOnTheBall