The Old, New Guy on the Block

Mineros S.A. is a gold mining company headquartered in Medellín, Colombia with producing and development stage properties in Colombia and Nicaragua, including the Nechí Alluvial Property in Colombia and the Hemco Property in Nicaragua, which together, comprise the Company’s main properties’.

The Company also has a number of growth projects including the Porvenir Project and the Luna Roja deposit at the Hemco Property. Mineros also has an agreement with artisanal miners, the Caribe exploration target at the Hemco Property in Nicaragua and holds a 20% interest in the La Pepa project in Chile, each of which are exploration projects

The company is more than 50 years old and has been private for most of that time. It has now been trading on the Toronto Stock Exchange for the last three years (hence the title) and remains on the Colombian stock exchange.

They are a consistent, slow and steady gold producer with the interests to diversify their portfolio by shopping in Tier-1 jurisdictions. Eastern Canada is on their priority list.

Operations

Gold production has slightly increased QoQ and significantly YoY. Total company mines (Colombia/Nicaragua) produced actual ounces of gold of 27,394 and hold a guidance (2024) of 118,500 – 131,000 ounces.

Nicaragua (Artisanal) produced 24,347 gold ounces with the expectation of 90,000 -98,000 by years end.

AISC per ounce of gold totalled 1,389 USD vs. 1,203USD in March 2024/2023. Interestingly, their grades of gold are very low (73 mg/m3) and they hold a recovery rate of between 70-79%. Cost rises offset the revenue rises due to the Colombian Pesos rebounding strength & general mining OpEx.

In Colombia, Mineros is exploring for alluvial gold predominantly east of the Nechí River, where the company is currently mining within quaternary alluvial sediments.

A total of 3,658 metres in 132 holes were drilled in the first quarter of 2024, with 91 metres focused on Mineral Resource expansion and 3,567 metres of infill drilling in the current production area, achieving approximately 37% of the 2024 drilling plan.

Colombia currently has a mine life of 10 years. However, it’s worth noticing that nearly 50 years ago, it also had a mine life of 10 years which had continued since then. They simply keep moving onward. Due to the low grade, they do save costs in processing as they only require water to management the ore.

In Nicaragua, their main mine is the Hemco property which has seen increased in gold ounce production. Their near mine exploration is focused on the current mining operations; the Panama Mine and the Pioneer Mine. Mineralization is related to an epithermal gold system associated with multiple quartz veins. A total of 9,983 metres of diamond drilling in 34 holes was completed in the first quarter of 2024.

Their true exploration project (Porvenir; volcanic hosted gold-zinc-silver system) is currently in pre-development-stage project located 10.5 km southwest of the existing Hemco property facilities.The analysis of the 2023 metallurgical campaign is currently underway, and the Company expects to receive analytical results, metallurgical test outcomes and complete the update of the metallurgical model in the second half of 2024 (soon).

Also at Hemco is their Bambanita target which Mineros expects to develop drill targets by the third quarter of 2024 and their Luna Roja target where they are focusing on expanding the current Mineral Resources and identifying new targets surrounding the main deposit–everything is on track with expectation.

Additionally, diamond drilling campaigns at the Caribe Target has been ongoing since the first quarter of 2024 with the aim of determining a conceptual geological model for the target.

In Chile, the Company holds a 20% interest in the La Pepa Project and there are no further updates.

Unique Play

Nicaragua is not only a mining operation in itself, but it also receives 50% of its revenue from artisanal miners who are very experienced, know the lands and operate efficiently. The end result is with very little overhead for Mineros & less hassle hunting the gold themselves. Interestingly, the artisanal miners can sell their product elsewhere but with all the complexities that communism brings, they will have to sell their gold nuggets for about 30% of the gold value– whereas selling to Mineros they can retrieve 90% of the value. A sort of hybrid-agreement but it’s a win-win.

Why bother at all?

Because in a country with no property rights per sé, Nicaragua forces businesses to allow local farmers on their land to mine their gold. Rather than pull out (which would be my instinct), Mineros sought to utilize these miners for their work and provide them with Co-ops, insurance coverage and other benefits for doing so.

Our gold production from Company owned mines was largely as expected and we processed more artisanal material in Nicaragua showing the tremendous flexibility of our operations to compensate for unanticipated downtime in our processing plant at our Hemco operations.

President & CEO Andres Restrepo on Q1 2024

There is a downside however, given that higher gold prices kills a little bit of their margin (since they are buying from artisanal miners at a higher cost). Nicaragua in itself has growth potential given that there is a lot of unmapped, unexplored territory believed to have gold deposits.

There are no permit, lawsuit, licensing problems–they have a great relationship with the locals in both operations.

What Enables Them To Keep Moving?

I’m sure the old school investors are happy that their 10-year mine life ends up being 50 years! The mining process in both properties is a slow moving dredging exercise. Part of this is made possible from an artificial pond they have created followed by dredges to remove the organic parts and set them aside to be refilled later. Essentially, the process filters out the gold and replaces the land as it was. The exact process is not 100% clear to me (as I cannot easily teach it back to you) but Mineros effectively extracts and processes the mineral with minimal disturbance to the lands. Interestingly, with respect to Colombia, they do offer individuals incentives to relocate to the lands that were mined prior; I suppose the socialists in Colombia cannot argue with that! The mine has been around for 100 years shuffling hands from Brits, to Americans, now to Colombians.

I believe their relationship with the authorities and the locals to be very good exemplified through their formalization of small-scale mining. Mineros has been working on a collaborative model which allows for the co-existence between small and large-scale mining. Nine operating units work under this model, which employs 256 people directly and 771 people indirectly. They operate in compliance with the company’s environmental, labour and operational standards (reducing the illegal mining threat).

On September 21, 2023, Mineros sold all of the outstanding share capital of Mineros’ subsidiary, Minas Argentinas S.A., which holds a 100% interest in the Gualcamayo Property in Argentina, to Eris LLC. This move was likely to buff up their cash reserves to seek more stable jurisdictional opportunities.

They have remained profitable 10 out of the last 10 years.

The Company’s exploration and growth is focused on the replacement and expansion of Mineral Resources and Mineral Reserves by completing further work at or near our operating mines, at our growth projects and at early-stage exploration targets on our under-explored property interests.

March 2024 Company Financial Report

Stock

-0.08 (-6.78%) past month

+0.50 (83.33%) past 6 months

+0.45 (69.23%) past year

-0.04 (-3.51%) past 5 years

Share price of 1.09 CAD at the time of writing.

Last quarter they have posted 16.77M of net income, showing an 8% increase QoQ. Their revenue increase was 15% but offset by an increase in cost of sales. Of this, there has been a 305% increase in net income from operating activities, explained by a major expense cutback from their sale of Argentina operations.

| Operating Margin % | 21.02 (Q) |

| Net Margin % | 4.15 (Q) |

| FCF Margin % | 9.58 (Q) |

| ROE % | 5.32 (Q) |

| ROA % | 3.38 (Q) |

| ROIC % | 16.72 (Q) |

They are not only into gold, but silver. Their silver production/sales has increased a great deal comparing Q1 of 2024 vs. Q1 of 2023–>

Total Silver Produced 242,649 ounces produced in 2024 and 2023 in 134,669 representing a 80% increase.

Ratios

| P/E | 11.04 |

| PEG Ratio | 0.23 |

| PS Ratio | 0.48 |

| PB Ratio | 0.73 |

| Price-to-Tangible-Book | 0.76 |

| Price-to-Free-Cash-Flow | 4.88 |

| Price-to-Operating-Cash-Flow | 2.37 |

| EPS | 0.21 |

By most accounts, the stock is undervalued between 35-60%

| Current Ratio | 1.41 |

| Cash Ratio | 0.44 |

| Quick Ratio | 1.17 |

If you want to be rich, be boring

Jim Rogers, Billionaire

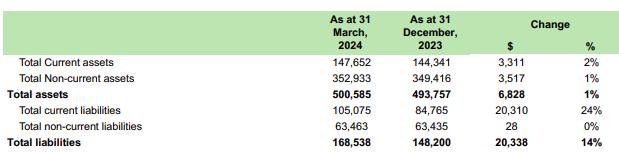

Balance Sheet

Total Liabilities/Total Assets = 33.6%

Total Liabilities/Total Current Assets= 114%

The current liabilities you are looking at is the dividend increases you’ll see below.

- Main costs for the Colombian operations are environmental with compensations being necessary; the main costs of Nicaragua are operating expenses.

- The noteworthy moves in changes related to the higher prices in mining costs (slight inflation rise), the currency exchanges and the sale of their Argentine assets.

- Dividends are well accounted for to be paid. Gold price increases exponentially increase their net margins.

Working capital wise:

As of March 31, 2024, the Company had cash and cash equivalents of $45,876,000 and working capital, defined as current assets less current liabilities, equal to $42,577,000 (December 31, 2023: $59,576,000). The Company has sufficient

cash on hand, available credit, and liquidity to fully manage its business.

Highlights

- Dividend payer (not paying a dividend for sake of saying they’re a dividend payer–> 9-12% annually!). Enough resources to continue operations undisturbed.

- Healthy gross margins around 30-40% with an expectation of costs and returns for the future. FCF Yield is over 20% now (yearly). Cash flow expenditures have contracted considerably Quarter over Quarter (cutting costs wherever possible).

- Leveraged to the price of precious metals

- AISC sits comfortably for them–> meaning every ounce they pull out equals about 1200 USD profit. Costs have increased year over year but their free cash still remains strong [Cash Cost per ounce of gold sold for continuing operations in the first quarter of 2024 was $1,202 and AISC per ounce of gold sold from continuing operations was $1,429, compared with Cash Cost per ounce of gold sold from continuing operations of $1,055 and AISC per ounce of gold sold from continuing operations of $1,252 for the first quarter of 2023]

- Your Grandfathers stock pick; slow and steady. Nothing too sexy but it has consistent pay-days.

- Upside growth potential with their hunt for a Tier 1 asset + their existing Nicaragua properties.

- Currently production of 230,000 ounces of gold per year. They are targeting 400-500,000 ounces per year by adding a third asset to their portfolio. Obviously, a major benefit is already being in production without the need to raise capital

- Undervalued; access to multiple exchanges.

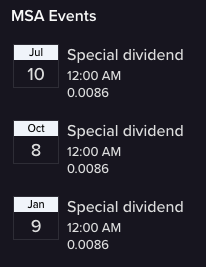

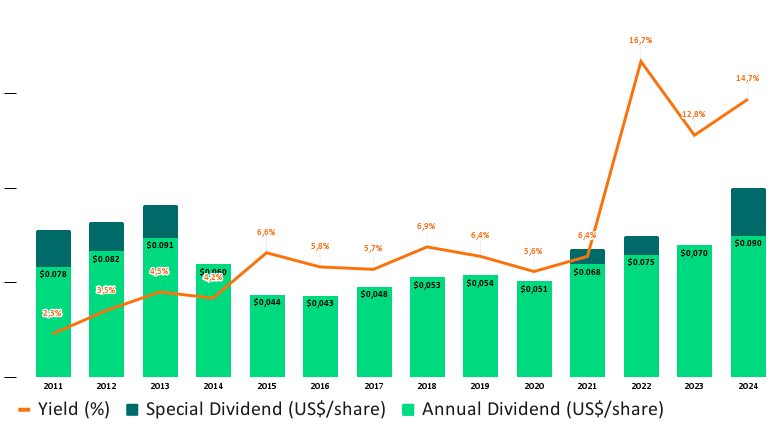

Dividend

Each date will involve 1/4 of the $0.075 / share annual dividend or $0.01875, and 1/4 of the $0.025 / share annual dividend or $0.00625. The dividend has been increased by 8% year over year.

The dividend will be paid quarterly on April 18, 2024, July 18, 2024, October 17, 2024, and January 16, 2025. I like that they have the books to know they’ll pay this far in advance.

I like the fact that they are serious about paying their dividend to shareholders and are seeking to do so with some regularity. Fortitude Gold Corp is another that I may write about who are doing the same with their dividend, but its not as high.

This year will be their highest dividend payments in 13 years.

Downsides

Mining is inherently a risky business notwithstanding the risks that present when you’re operating in Nicaragua and Colombia. Additionally, I believe that the stock has not been recognized by the general market because Canadians generally believe gold investing to be a fad. Most money managers are hooked on growth still and gold equities for the most part have been murdered in prior years. There is also a risk that the cost of acquisition or cost of SG&A shoots up beyond where they currently sit if they expand to more costly jurisdictions which will likely tap into the shareholder dividend.

Also, by going over their report you can see that as miners they also suffer from inflation pressures but also currency risks. They had lost a 17% exchange against the US Dollar by operating in Colombian pesos (peso strength). This plays a factor in their increasing AISC (that is expected to increase about 8% this year); but they do use conservative numbers to calculate their overall cash cost of operations.

The last downside is their slow dredging process that moves in one direction may cause them to come up with areas with low deposits of gold. They are testing continually to develop a complete, thorough model of the ground but nevertheless, some gold production results may be disappointing (since they cannot mine backwards).

Closing

Mineros is a type stock that your grandfather bought when he was 40 and he checks it every month since then with no intention to sell. In fact, there are shareholders with the company who have held shares for at least 50 years (and some of us find it difficult to hold something for 5 days…). This is due to the mining company’s consistency with operations. Mineros seems to understand this which tells me they’re not in a hurry to dilute shareholders.

The CEO & Chairman has expressed interest in acquiring a tier 1 asset in the future but the reality is that they have a lot of exploration potential in Nicaragua that will be known soon in 2024.

Mineros is currently producing a couple hundred thousand ounces of gold a year with a great margin allowing them to sit on some cash, pay a dividend, hold great valuations and demonstrate free cash flow.

The fact that they are old school & operating in a sector (gold mining) that is frowned by many, in an area hated by most (Latin America, namely Nicaragua) tells me that this is an opportunity to jump in while the share price is still down. The risks are mitigated given their engagement with the local miners, the supportive measures in place and environmental considerations that mitigate future political threats.

Finally, Mineros seem to be not only unique with their high dividend policy but in their collaboration models between themselves and the local miners. Their ability to utilize locals who know the lands well, at a great price, in a professional manner is something that I simply don’t see with other companies (some companies are not even welcome on their own lands!).

It likely won’t make you wealthy overnight and it’s not sexy– but it could (literally) pay dividends for years to come. How many years? Well if you ask Mineros, they’d tell you you’re good, at least, for another 10 years.

Thank you for taking the time to read, here are some other stocks I wrote about PLEASE check them out and let me know what you think!

PLEASE SHARE THIS ARTICLE💪