Gold is money, everything else is credit

JP Morgan, 1912

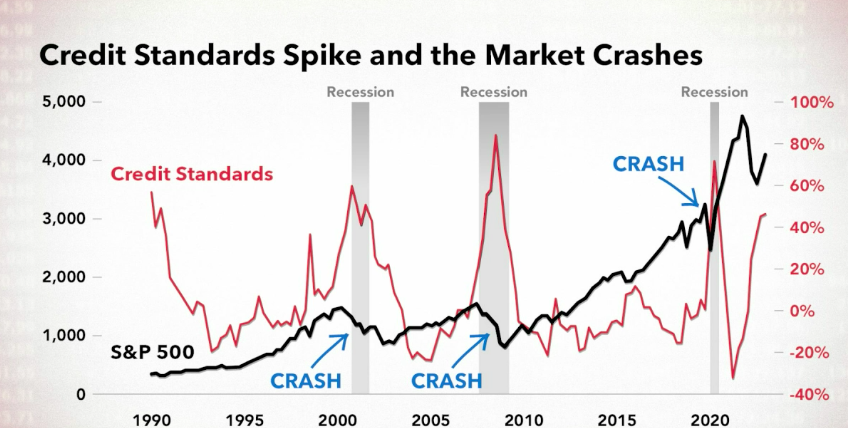

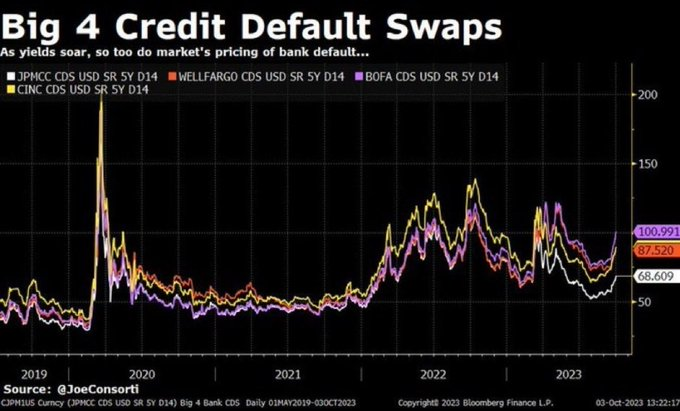

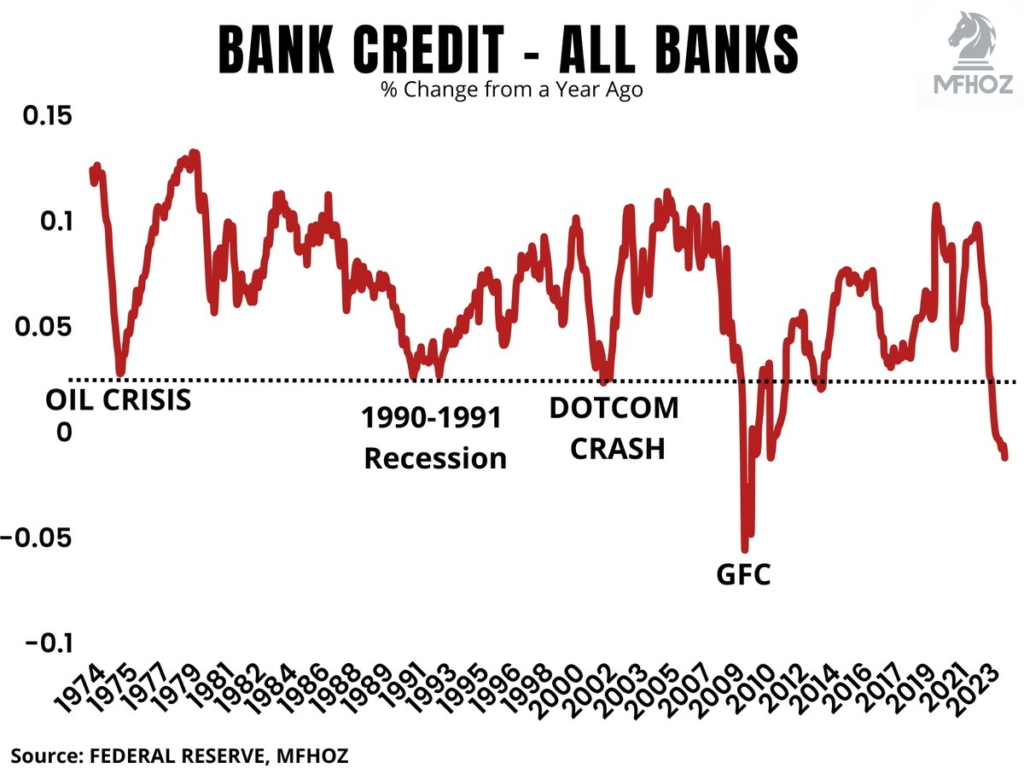

Credit Markets are broken… there needs to be some event to “reset” confidence or the system itself. Get the Free Newsletter to hear our thoughts on what’s next!

US Debt Rises $1 Trillion in 100 Days on average, according to Bank of America. They estimate it will take just 95 days for the debt to climb to $35 trillion from $34 trillion, compared to the 92 days it took to grow to $33 trillion from $32 trillion.

The Frenzy of “Free”

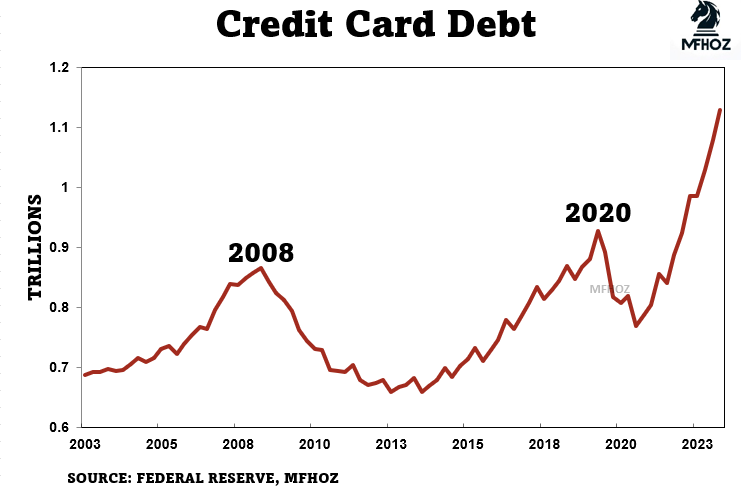

Debt, Debt and more Debt

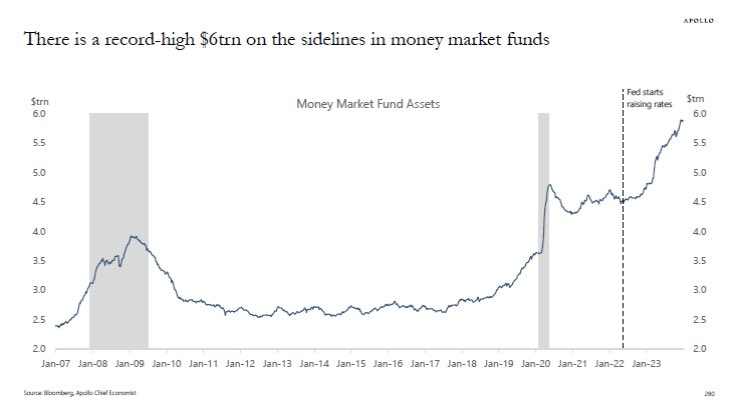

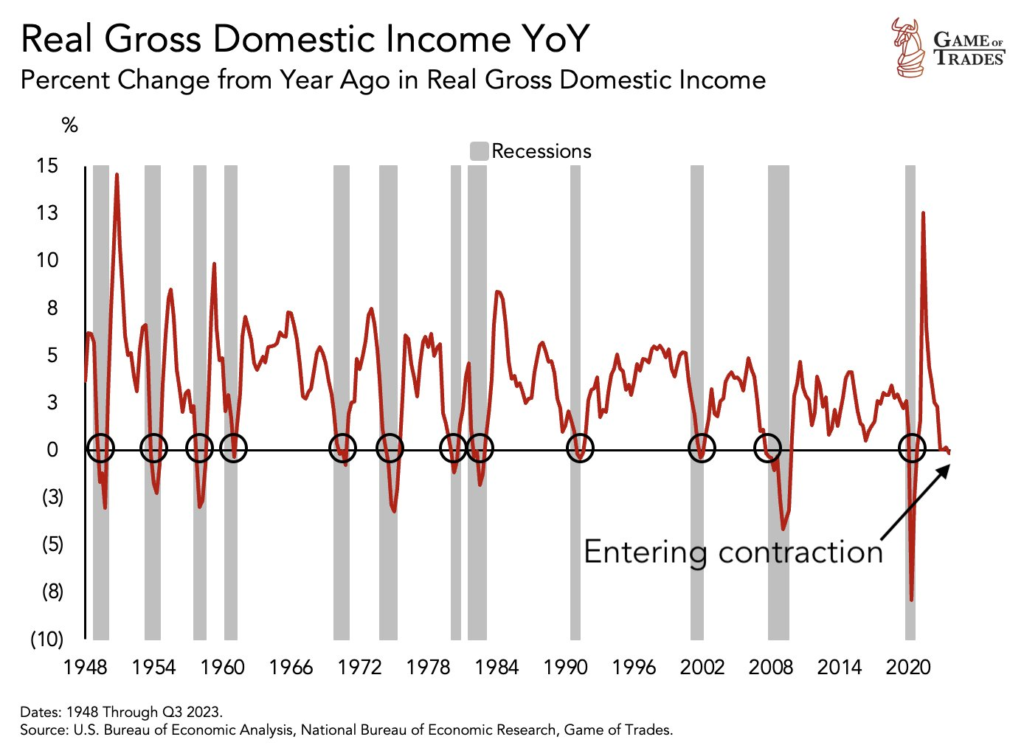

Many suspect that revaluing the price of gold would be a simple, fast solution to the excessive currency units that circulate in this financialized Fugazi economy. Others believe a tremendous crash of epic proportions is needed to send so much of this extra money to “money heaven” to re-stabilize markets. Either way, credit issuance is at preposterous levels that is touching a threshold.

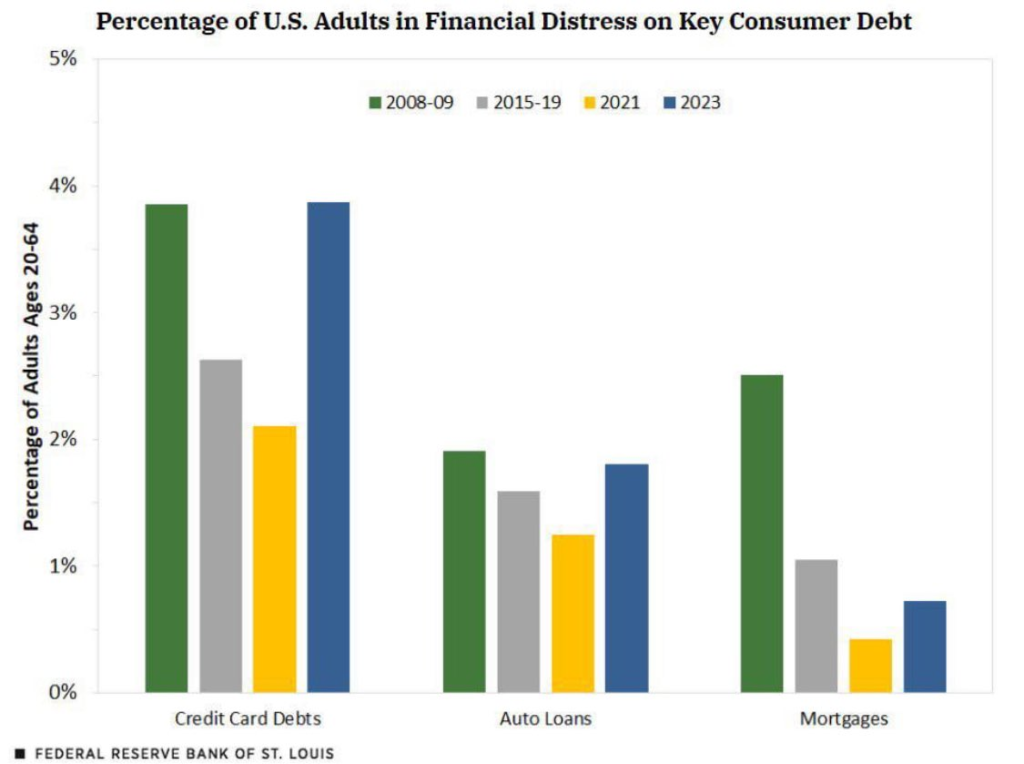

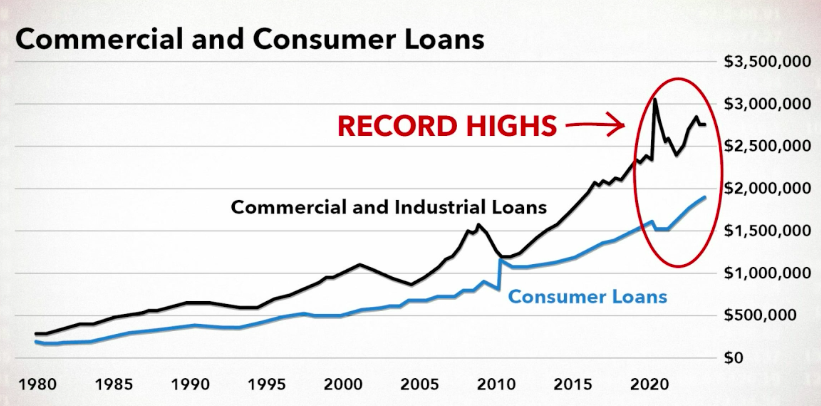

Credit cards, mortgages, companies (corp debt) all of it is hitting a tipping point as people are unable to refinance at higher rates. If you spend an afternoon to go over the balance sheets of many US Equities to find that they are zombies; relying on more and more financing to sustain their books. Here’s one such company I tweeted about:

4 Trillion dollars are coming due between now and 2026. Accompany that with shrinking economic figures (according to the already phoney figures)

This is why I am bullish on Smith and Wesson because of their low debts and steady cash position, for 171 years! Not exciting, but I’d rather be boring and survive. It’s tough to own anything with huge amounts of debt with consistent negative free cash flow, net income and high expenses. Click this company to find out if it’s interesting for you, too!

#StayOnTheBall