This ties into my six-part series of articles highlighting the real danger of population collapse. We are truly headed full throttle over a cliff of having not enough people. I encourage you to subscribe to figure out more and how I am planning to capitalize on this problem.

Central Asia vs. the Rest

I wanted to write this to venture capitalists or investors with sightedness who may be looking 5-10-15 years outward from now to make their big 10X, 50X or 100X return. I believe one factor that may not be totally appreciated is one of demographics. Let’s have a look at the trend below:

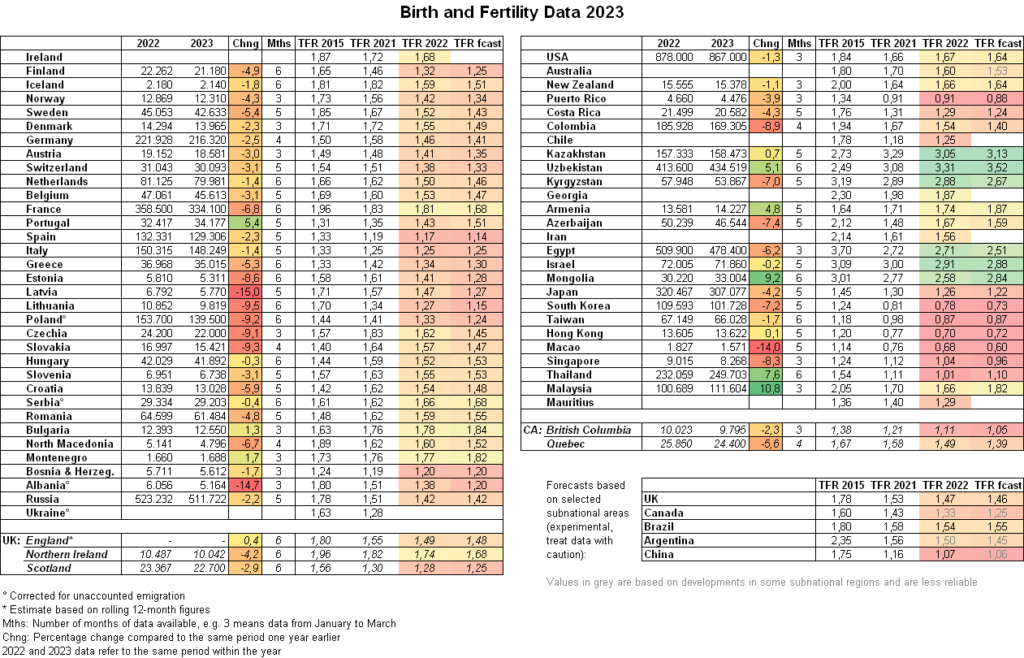

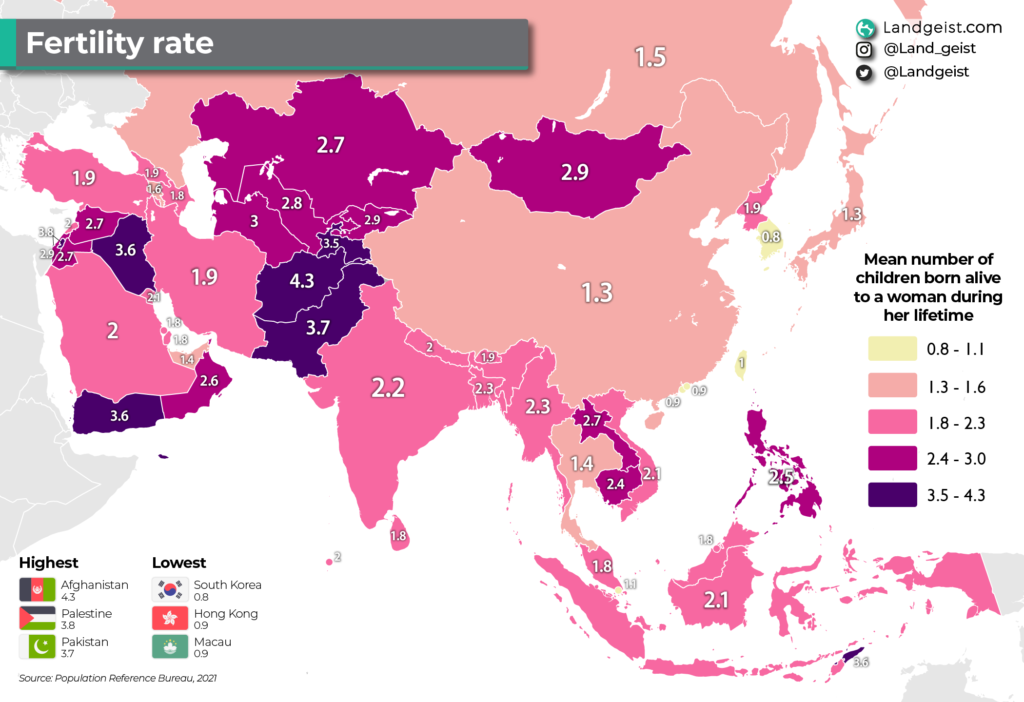

Here are some interesting takeaways (Remember 2.1 is required to sustain the population)

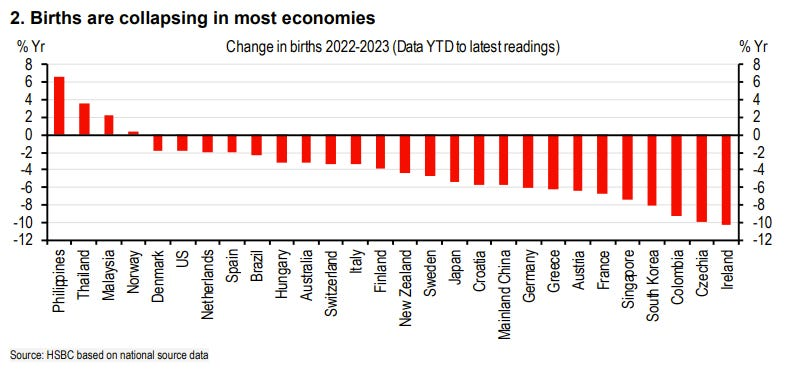

- From 2015 to 2021. Only twelve countries showed an increase in birth rates. Of these, only Kazakhstan and Uzbekistan were already above (or ended up above) replacement. The largest increase was 0.24 by Hungary. DID YOU READ OUR ARTICLE ON THIS?

- From all of these countries only: Portugal, Malaysia, Thailand, Uzbekistan, Kazakhstan, Mongolia, Armenia, Montenegro, Bulgaria & Hong Kong show an increase in rates from 2022 to 2023. Of these that demonstrate an increase, only Mongolia, Kazakhstan, Uzbekistan are above replacement.

- Three countries that have shown declines in their fertility rates from 2022 to 2023 are still above replacement: Israel, Egypt and Kyrgyzstan (hence these 6 are the only ones above replacement sampled).

- [Not listed above] All increases to population in Europe or the five eyes are a result of immigration. These migrants are economic migrants, [generally] bringing few skills, bad habits, reduced education, & will exhaust the economies of Europe by being a net expense (this data is crystal clear). The nations of origin are all from locations with far lower IQs than the pre-existing European standard. Logically, we can only expect a reduction in the quality of work to be expected, thus impeding the rapid growth necessary to carry investment capital.

If we look at further data not sampled, it’s not too pretty either. The top 50 countries with the highest birth rates are all African with the addition of Afghanistan, Soloman Islands, Vanuatu, Yemen, Nauru, Iraq and Palestine. How many of these make you eager to invest or raise your family? The only country/territory above replacement in Europe is the Faroe Islands–and how many of you had to Google where that is located? (Sorry Faroese).

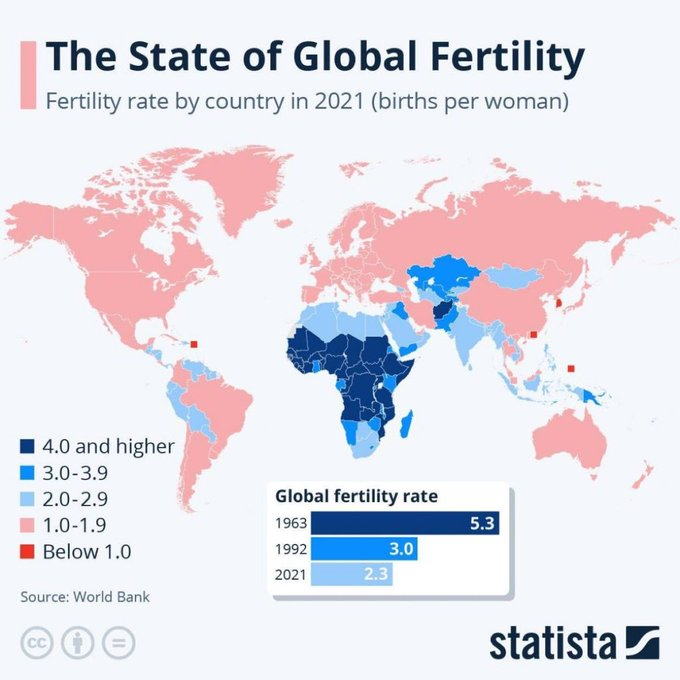

Overall, the geographic region with the highest total fertility rate was Africa with a rate of 4.18 births per woman, strongly supported by Central and Western Asia. Low-income countries have the highest total fertility rate of 4.47 children born per woman. While upper-middle-income countries are with a TFR of only 1.52. It’s just like the opening scene to the movie Idiocracy.

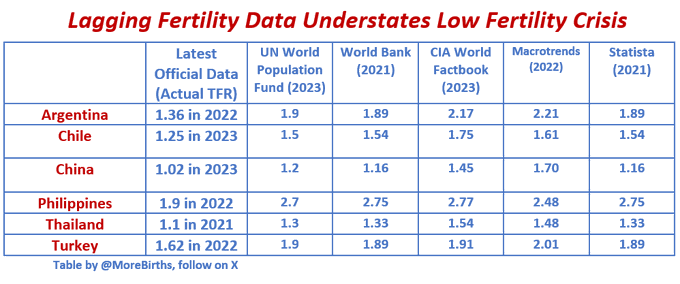

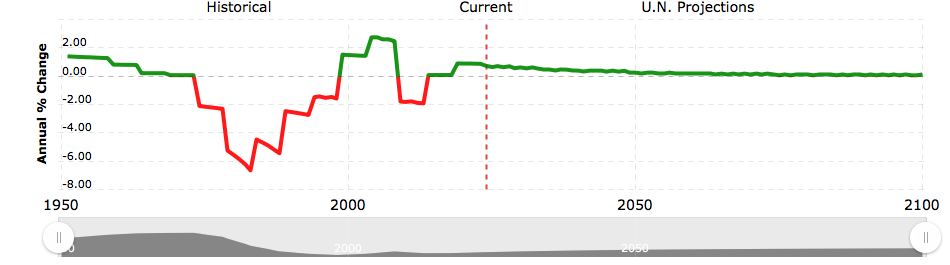

And perhaps you are thinking sure yea we get it, it’s declining, it’s not good, blah blah… but a closer look has the analysis even worse than the forecasts.

A major problem is that the data sources to follow fertility trends haven’t kept up with the dramatic decline of recent years

I have seen data of previous years that have shown tremendous volatility and declines–however the UN and World Bank often predict gentle slight linear declines all the way to 2100. How can anybody predict ANYTHING in 2100 with any accuracy, let alone this.

In fact such data is so dissimilar it looks to be a separate graph entirely. I am not clear whether there’s an agenda at play here but even if not, the forecasts for investors are vastly off their mark. In fact, it’s funny because the prior predictions leading up to the current year is way off, but it hasn’t been adjusted for the future forecasts

Generally, it can be said that the only areas replacing their population are obscure islands and the African continent both with weak infrastructure or sophistication. The exception however, which seems increasingly obvious to me is Central Asia and West Asia. Both regions hold a level of cleanliness, orderliness, pro-business laws, low taxations, safety and affinity for foreign capital that the others do not.

The New Opportunity

These two locations have a level of modernity to them, and hold an abundance of resources. They have been increasing their business-friendliness, privatizing their economies and generally have taxes that don’t spark above 15% on anything. While you are forced to play politics in Africa amongst war Generals or start from scratch in rustic Oceania, there is a more clear cut long-term investment in Kazakhstan, Azerbaijan (click link to read about it) Uzbekistan, Kyrgyzstan, Israel, Saudi Arabia, Mongolia and others.

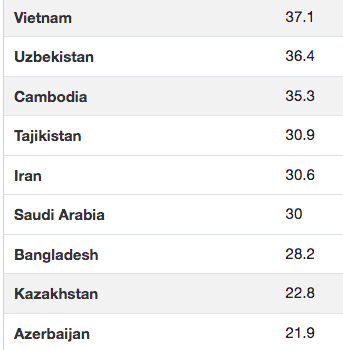

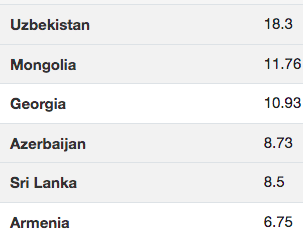

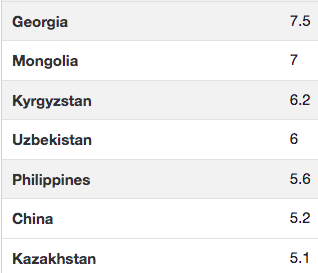

More specifically, I find Kazakshtan, Uzbekistan and Mongolia most interesting given their budget surpluses, abundance of untapped resources, neutral politics towards both China/Russia and Europe/USA and of course, their fertility rates. I am also expecting a bull cycle with respect to commodities, which will also benefit these countries. Interestingly, their population is quite young and hungry, too (its not a bunch of 50 year olds having children in other words).

The population of Central Asia experienced significant growth over the past three decades, surpassing 79 mn people, with an average annual increase of 1 mn in the last ten years alone; the average age of the region is now 27.9 which is 59.1% younger than EU states

I wrote about Uranium and Kazakhstan here

And I am not saying this because I just bought Kazatomprom stock or real estate in Tashkent, the results are right in front of us. As per the site named Daryo, “over the past 20 years, Central Asian countries maintained an average annual economic growth rate of 6.2%, outperforming developing countries and the global average”.

At the end of the day, people = production and robots cannot solve all the problems of depopulation. Not that I wish taxes on anyone at all, but robots do not pay taxes either. For the indebted situation that most of these infertile nations find themselves in, no tax revenue does not bode well for their already constrained budgets. Again, take a look at the countries below and remember 2.1 is the minimum to sustain your population.

I believe there is a stigma around these other economies compared to ones such as Ireland, South Korea or Germany.

Will the younger populations pick up the slack?

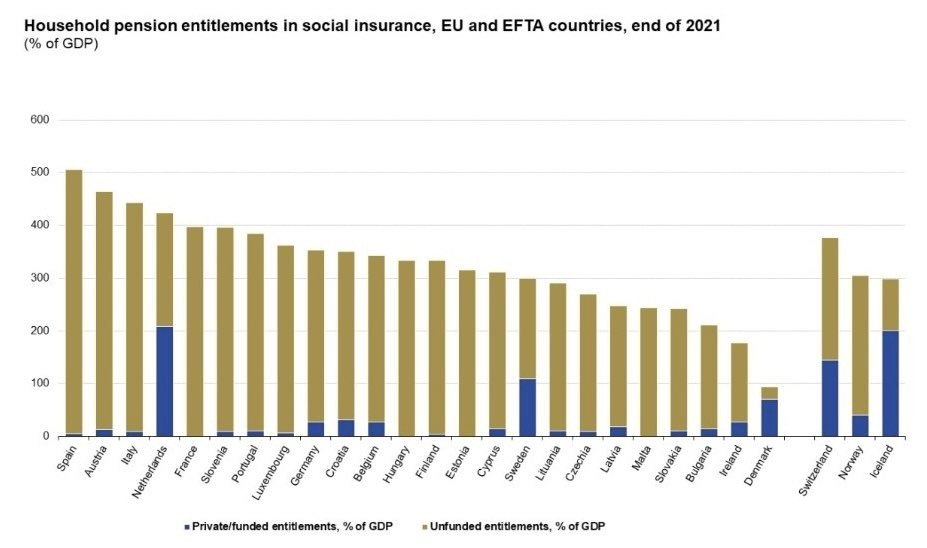

I have wrote about this here and here for further reading, but the fact of the matter is that rather than outright default, there’s a high probability that current activity will be taxed out of existence to fund the high entitlements across Europe (or inflate out of existence). In addition to low fertility, the same is true for all Western economies with their high debt loads & unfunded pension schemes. In other words, capital will head into this rather than funding new innovations and start-ups that venture caps like to see.

A Region With Economic Runway

Closing

In my opinion, this is not a factor that many are considering given the fact that we are coming off of 20 years of “buy it and it goes up” and cheap access to capital. The larger macroeconomic bull market is currently hitting a wall due to the amassment of liabilities which are compounded by the fact that there are worsening numbers of intelligent, capable personnel able to grow the capital as years prior.

The locations where debts is low, business innovation is relatively streamlined and birth rates are high will have a good crack at success in upcoming decades. Like I said, People= Production.

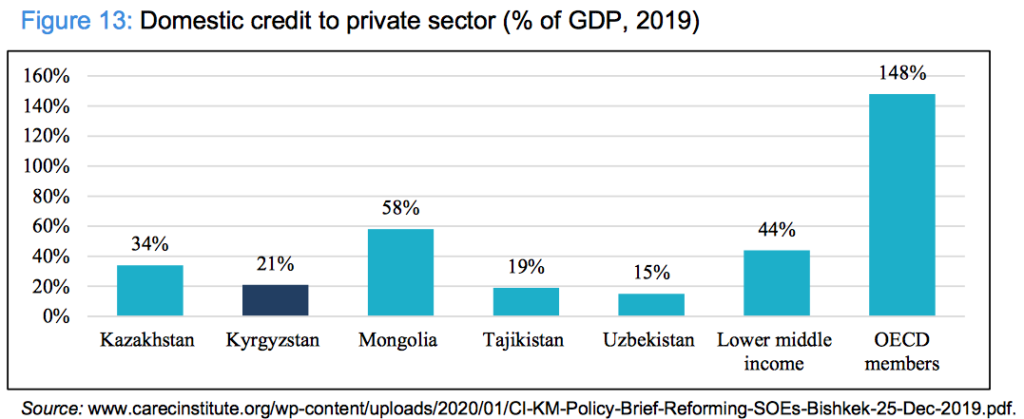

These countries are certainly not without their problems however, in fact, I wrote about one major one right here. Notwithstanding, if we take a macro approach we can see that they are in a position for credit expansion, they’re supported by higher commodity prices as they export abroad and most of all, they have a positive trend with respect to their population growth domestically. Many people are critical to highlight that the only people having children are those from backward, disgusting third world countries and while It’s about 90% true, I believe these countries in Central Asia, tucked away in their vast territories are the exception.

Perhaps this could be buying real estate in Singapore in 1990; a seemingly stupid idea at the time, but it went on to earn millions.

Thank you for reading and be sure to follow me on Twitter (X), Instagram, LinkedIn and click the link below to get our free newsletter by only requiring your email!

https://imontheball.us22.list-manage.com/subscribe?u=5831e2c1676ffa4590250462a&id=8c571bb7c1

#StayOnTheBall