I hope you’re not a stranger to On The Ball, LLC where you’ve found my interesting travel experiences, stories and economic predictions. As part of these travels you notice lots of things, good, bad and sometimes ugly. One thing, that the so-called experts or talking heads get wrong is their assumption that the death of the dollar is imminent. The currency of the global empire is always the last item to break before the collapse can be deemed complete and irreversible. It appears it’s the dollar is keeping the United States together at this point–but despite it’s problems, what’s going to replace it?

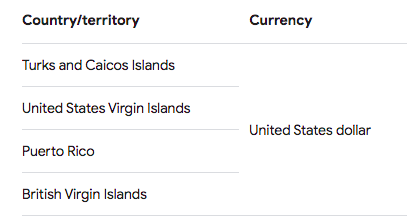

The reality when you travel a little bit is you see that even in the most unlikely places they accept (& want) the United States dollar. Countries like Panama, El Salvador, Ecuador use the Dollar as their domestic currency while unofficially Colombia, Venezuela, Uruguay, Chile and Argentina have largely adopted dollars in their on-the-ground commerce. Some places have created a fix to the dollar such as Bahrain, Cayman Islands, UAE, Curaçao or “Stabilized Arrangements” have been made as with Guyana, Lebanon or Maldives. Even islands in the Caribbean belonging to Europe such as Saba have made the USD are their currency (lists are not exhaustive).

I recall having a ride with a Venezuelan Uber driver who told me the currency used in Venezuela–is the dollar

Legal services or rentals in Southeast Asia are often quoted in USD equivalents, and a shortage of dollars in Africa has lead to a constant demand there as well. But, this is the 1-1 level for the most part. That is, I am talking about the USD being used as a payment currency in global commerce, which is a different than being the world reserve currency whereby debts are denominated and paid in this currency.

Hegemony

The number one foreign policy, especially since they’ve weaponized the dollar, is financial warfare. It is using economic warfare to hold a country hostage through far-sighted, calculated and strategic deals and decisions that ensure a country is dependent on purchasing US debt. A country may not need dollars, but they’re given them anyway in exchange for a valuable commodity or exchange to have control over their state governance. This trickles down to the “guy on the street” who pockets it.

It doesn’t take long to realize that Gresham’s law (whereby good money goes into hiding) takes effect in poorer countries. These people figure if you’re to save in your bullshit pesos or USA dollars, the dollars will be around tomorrow, but they’re not so sure about their 3rd world toilet paper.

So what?

This ultimately means that the demand for dollars is artificially high around the world. A country like Uruguay has no business owning and operating in United States dollars, but investors and real estate buyers may feel secure paying in dollars so it keeps the flow going. This artificial demand keeps the dollar value stronger than it would be otherwise, and hence, alive.

If this were to change as a result of inflation, then we could see huge levels of savings outside of the United States effectively dry up. Remember, Valentino on the street doesn’t have a money printer like they do in Washington D.C.

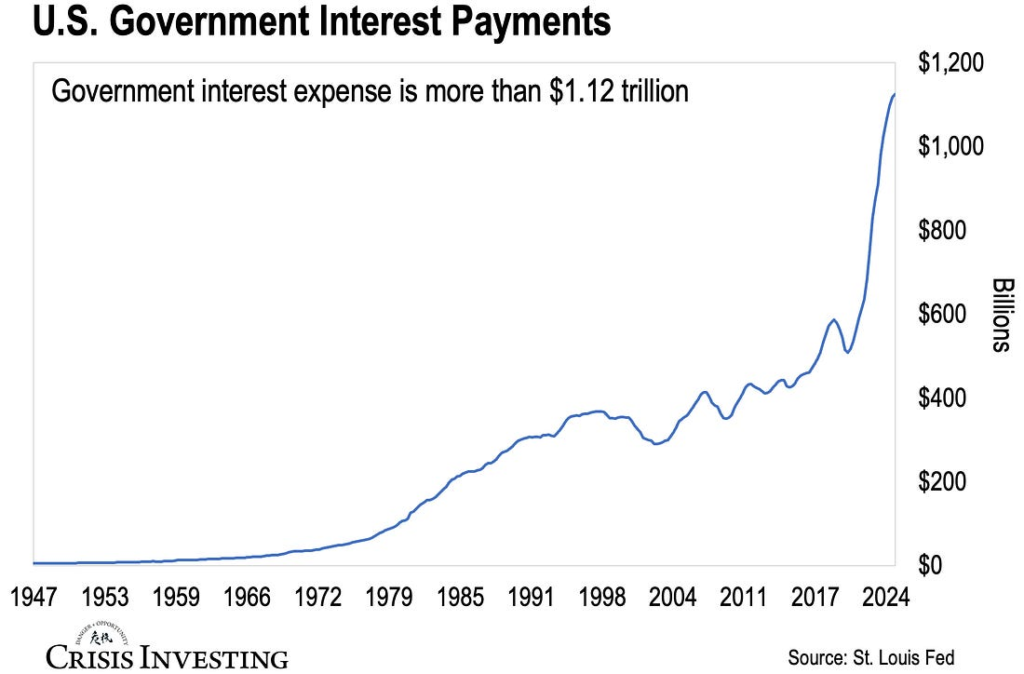

Two Dilemmas Being The World’s Babysitter

Interestingly, to highlight how relevant US Debt is in global markets, there is a dilemma that the Federal Reserve is facing as you read this. It is whether to drop interest rates for the sake of the carry trade in other economies, namely Japan, UK and Germany or allow it to continue to have buyers of their own debt at a higher albeit at a interest payment. In short, the interest rates at the Treasury and Fed are far more attractive than their own domestic economy which creates a questions mark as to who will buy the debt of these countries as they roll over. If you want to learn more about it, click below

The other dilemma is that the United States need inflation to handle their own debts. Somehow or another, they’d like to remove this artificial demand for dollars produced by big investors, banks, but also the layman on the street. Why? They have some money to owe.

This money is far easier to pay with cheaper dollars which is why I believe, Trump is trying to re-industrialize the country. READ MORE HERE:

But, the bottom line is that there is immense demand for the US Debt around the world, particularly in the most unexpected places in the world, they’re not getting the Bloomberg headlines saying “death to dollars”.

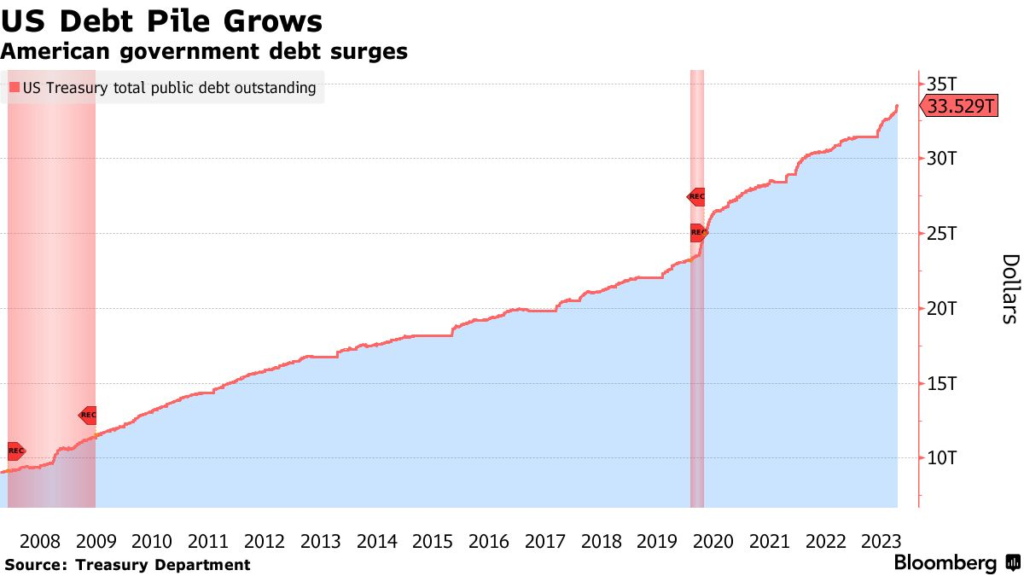

Loss of Confidence

This post was meant to serve as an anecdote of my travels to find that *most* of the world, even if they hate the United States or have little in terms of trade, they still accept their currency because of its “cleanest dirty shirt” status. The debt inside of the USA will ultimately mean a loss of confidence in the USA to service it’s debts and the end of the empire–but when exactly? What is the difference between 33T and 34T exactly? When do we hit the point where the poor person selling tacos on the side of the road would view the dollar as no longer money-good and refuse to feed you for it (hard to imagine happening soon). To my mind, there are four ways this could happen and they are all attributed to a loss of confidence in the Treasury and debt markets.

- Debts are so large that they cannot find foreign economies with a balance sheet to buy the treasuries required to make the payment.

- Alternatives are present (BRICS, Gold)

- The Sanctions are a little too powerful where it seriously scares people or Trump’s reshoring plan takes effect.

- A digital currency is created for control purposes

Closing

The dollar is the most important fiat currency that circulates the world today. This is in a large part due to the American Empire exerting it’s will upon both friends and foes by means of lawfare, economic warfare, sanctions, threats, bribes and frankly, being far more industrious than everybody else. The American Empire is almost entirely finished however, the dollar is the last pillar holding everything upright.

I realize a lot of this post was simply redirecting you to other content I have written about to further solidify my case; but I did want to write this giving my opinion of the many embellished headlines about the dollar being doomed tomorrow. It has an expiry date as this point, we know that, in fact everybody should know that. But how and when we get there remains anybody’s guess. For what it’s worth, my guesses are that Washington beats its chest a little too tough with sanctions, its debts run too high and/or an alternative comes online for Central Banks, hedge funds and large dealer banks around the world.

Don’t forget to grab our International Monthly Newsletter. It’s only ~2 dollars a month (1 time payment) which is far cheaper than what an average sloppy DoorDash meal costs now!

#StayOnTheBall