The Rising Fastball Effect

Breaking News!

The Dollar is Crashing AND The Dollar is Stronger than Ever!

You may have seen these opposing headlines or have a friend uttering this over and over–and both of them are not exactly wrong because this discussion is nuanced. The dollar, all things considered, is the number one export by the US government–it’s not guns, movie stars, oil, cars or gold.

The dollar is the fuel behind the Eurodollar system whereby a collection of foreign banks utilize shared dollar deposits to usher in more liquidity in foreign markets. For instance, dollar deposits in Sweden, make their way to Japan to make their way to Samoa who are deemed a little short. This is only applicable if the banksters or Eurodollar players deem (in this instance) Samoa to be an adequate counter-party. Admittedly, I’m not well-versed enough on the plumbing of the system to make this post about the Eurodollar but the key takeaway is that the Fed and Treasury have no control over this system once the new dollars are issued and hence, separate from the US economy (perhaps not indirectly but more later). Outside of the US economy, global liquidity is determined here & demand for dollars are mostly for banking collateral, energy purchases or to meet debt obligations.

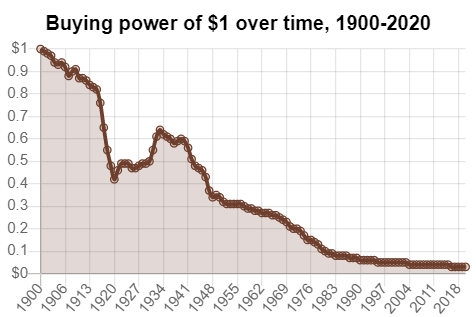

The domestic economy on the other hand, is finding out that orange juice, steel, air travel, diesel, home building, coffee, are all staying relatively expensive–far more than the claimed Consumer Price Index (CPI)–often called the CP-Lie!

Domestically, the total US debt had gone from 23,201 Billion to 32,332 Billion from Q4 2019 to today, a 39.5% increase in total debt in about 4 years. What about the Federal Reserve’s balance sheet? It has also gone up 2.1X! From 3.76 Trillion to 7.861 Trillion. Lots of new debt, lots of new M2. So naturally you’d suspect the dollar to be crashing & prices continuing to rise (A LOT more of them exist now and its likely against a weaker economy).

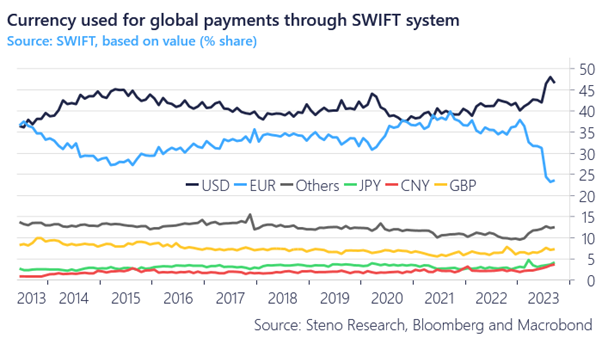

Yet, the dollar has gotten STRONGER by about 9.2% (according to the DXY) from late 2019 to now.

So supply of fresh dollars hitting the Eurodollar and the Repo facilities, debts have never greater and cost of goods are getting more expensive for Americans–you mean to tell me the dollar (DXY) is getting stronger?

Play Ball

I was a pitcher in baseball growing up. I enjoyed playing with lots of different pitches to throw off hitters, commonly known as “junk”. There’s many pitches in baseball [see my nerdy article on it if you’re a sports fan], but all of them focus on generating a spin to the ball that makes it move a way you’d like (sideways, down, in-out, etc).

But there’s one pitch incorrectly named the “Rising Fastball”. Of course, a ball cannot “rise” since the minute it leaves your hand it’s subject to gravity and there’s no more additional force applied. The trick behind this pitch is to maximize the amount of lift the ball generates (to be less effected by gravitational pull). This pitch got it’s name from the hitter’s illusory view that the ball is rising due to the fact that it’s not quite falling as fast as all the other pitchers–or, the junk. Of course, we both know that it is falling, because of the laws of gravity.

How does this relate?

Just like the DXY that is rising and holding strong quarter to quarter, it’s only doing so relative to all the other currencies that are traded out there [the other pitches]. The illusion is that the dollar is rising, but again it’s not a rising motion, it’s simply falling less slow.

The nuance here is that “the dollar” ought to be treated in two categories; the dollar domestically in the US economy and the dollar internationally in foreign exchange markets that are exported throughout the Eurodollar system.

Foreign Markets want dollars to fuel their deposits and grease the system with collateral. On the other hand, this isn’t applicable for John and Jane inside the United States. If German banks need more dollars, this has no bearing on the purchasing power held by citizens inside the United States

You can see it’s still falling by going to almost any store in the United States and comparing prices to what they were 20, 10 or even 4 years ago.

The inevitable expansion of the balance sheets by world banks to keep the global (global is important here) system afloat coupled with an endless round of spending ensures that the dollar (and all fiat currencies) will tend to multiply like in Venezuela or Argentina.

If you want to learn more about how the USA is caught in this debt/spending doom-loop. Check out our Reverse Repo Article!

Goods and Services will increase in price with more currency units chasing that same (or less) amount of production and the average citizen will acquire less and less. But make no mistake, that a strong dollar now or in the future is a relative matter, detached from the local economy. This is how the statements claiming the dollar is weakening AND also getting stronger can both be true.

Just like the laws of gravity on the baseball, the laws of economics are pulling these indebted currencies to reach their desired place in space and time.

Keep your Eye on the Ball & #StayOnTheBall, batters.

I normally try to post a funny photo at the end of articles but this 90 second video is more fitting. Enjoy!