Cartel Wars: Treasuries vs. Gold

I’ve written about Mexico a lot–no this is not about Mexican drug cartels (because I know that’s the first thing to think about when you think of the word cartel), this is about banking cartels–who seek total control of the world over every aspect of your life. Control the money–control the people. Nothing has changed.

what does this lecturer mean?

People are still consumed by the old notion that countries invade for a countries’ women, art, gold, resources and labour (slaves), while that’s still partly true, especially with respect to resources–the banking cartel of the world do so because they don’t want anyone to challenge them.

So what could initiate this challenging? In short, it’s out with the old dying system and a craving for an alternative system–except these matters take decades to unfold. If you #StayOnTheBall you may have noticed a lot of headlines spoke of the creation of a gold-backed BRICs currency or showing that China, Russia & India have been selling US debt and it’s the death of the dollar like, tomorrow. We’re going to cover a whole other article on the power of the BRICS that many Western media press’titues are underestimating, but the focus remains detaching from the Eurodollar system.

Perhaps why the Western media are not worried right now is because of the hegemony the dollar holds over world commerce. These people often remark that there’s no viable alternative to the dollar since it is still is used in ~70% global transactions (the next big chunk are done using the dying Euro). No dollars= a problem for most countries on the planet. How did this come about?

We do our best to produce these for you–don’t miss out! Free Newsletter below or consider subscribing for ALL the perks!

After World War 2, it was agreed that the USA would operate as the world reserve currency (securities are to be denominated in dollars) due to their substantial gold holdings, their laws and their economic positioning in the world at that time. Later, when US expenditures exceeded (or at least the fear of it) the supposed gold backing the dollar spending, other countries, namely in Europe began to become nervous and started withdrawing their gold from the US. They essentially said, if you’re not going to honour the gold-peg, than we want our gold back. Eventually, due to the Vietnam war and an ever expanding budget of the military empire around the world, Nixon suspended the dollar conversion into gold, effectively detaching the two–but the dollar remained the world reserve currency.

Great Deal for Government

This was a great deal for the USA. Other governments need people to actually produce stuff in their currency, convert it to dollars (because resources are denominated in dollars) and then use the dollars they just bought to purchase the resource (oil for instance). This is also why the US government is so influential in world markets as their issuance of treasury bonds, notes and bills secure the financial system by being the pristine form of collateral that everybody needs. Basically, you have to be in the game to play the game, and the ball is the US Dollar. On the other hand, the USA can just monetize it’s debts and “print” up the reserves to purchase the oil directly. Some have called this the exorbitant privilege.

If the dollar fails to be the global reserve currency, that doesn’t mean it will go away. Dollars can still be used for payment–just like Yen if you’re in Japan right now

The financial system itself developed using the dollar. Banking collateral (assets side of their balance sheet) for a countries’ reserves became US treasuries. Other countries therefore needed the US treasury to issue more and more treasuries to ensure their own banking system was well-lubricated. As a result, a lot of money headed into the US government. Banks all over the world were able to borrow against the US treasury and make great margins, which propelled a lot of countries to prosperity that otherwise would have been limited to their own slow & clunky domestic production. In short, the entire world became financialized & credit expanded tremendously, particularly the United States. People may disagree, but this has made the world tremendously more wealthy, a lot faster. SWIFT is a good name for the clearing system.

But eventually, the gears of this system begin to wear & it doesn’t function as well as it once did due to the reliance on further debt issuance (& higher debt loads). Eventually, there’s only so many good things to put money into and you begin to invest or loaning to increasingly risky assets (non-performing). Additionally, foreign nations spending their own currency into oblivion are in trouble because their own economy (food and energy) and/or their obligations often require US dollars or treasuries to borrow against. The nature of government is spend as much as they can and hand the problems off to the next election–who then require a bailout or have to do what their told from Washington or London. Read our Barbados and Ghana article for some concrete live examples.

So while other foreign governments and central planners were using this as a tool to acquire assets initially, after awhile the citizens of some foreign countries are left with expensive bonds that pay very little, monetary inflation and an economy addicted to the USD, all owned by the bankers of bankers outside of their country.

Are you prepared against the CBDC? ACT NOW! Here is a list of countries and their status with respect to the emergence of this Central Bank Slavery

Leverage Over Countries

The dollar system in some sense is a trap for foreign countries. It’s the apple dangling in front of Eve of the financial world for foreign nations as it were. While it is true that sometimes countries run into debt troubles–sometimes they are exploited in whats known as Economic Warfare. The Federal Reserve & US Treasury can benefit because they hold countries hostage by issuing them debts they know they cannot pay or freezing their accounts, deliberately. The term Economic Warfare comes from the seizure of resources via economic agreements rather than seizing them by militaristic means. Lets say Brazil has a lot of steel, gold or soy but cannot meet it’s payments. The US officials, IMF or World Bank can refinance indefinitely (easy to do when you print up everything) and extort the steel production from Brazil as part of payment. You may say, why would Brazil allow themselves to get in such a situation?

It’s important to remember that the people who get into politics are maniacal narcissists who are eager to loot (& spend) as fast as they can while they control other people–they do not want to produce anything–so those types are easy to convince. It’s two gangsters teaming up to rob a bank in some sense.

On one hand they are offered protection with their sons and daughters having reserved admissions to Harvard or Yale & all the entertainment they please– anything that turns their crank, they are offered. On the other hand, they are faced with tortuous threats and “accidents”. As a result, you have great incentives to keep the debt machine going. Notice that monarchies around the world have very little debt–something i’ll write about separately in the future.

Sign up for out bi-weekly newsletter for it!

The second part of leverage the US gains is that they can now freeze or seize the usage of the US dollar in transactions on the payment ledger. This is exactly what the US often does to Middle Eastern countries like Iran, Syria, Iraq and most recently, Russia. In other words, they weaponize the usage of the dollar–behave how we want you to at all times, or feel the consequences. It’s a necessary trap that the world falls inside. Read about our recent article in Iraq to see an example that happened with the last year!

Bad for Americans

I think its always important to distinguish between American citizens/residents and the US government. They are two completely separate entities with their own vision, goals, desires and beliefs. In fact, I highlight here that essentially, banks no longer need depositors similar to how government no longer need tax dollars to function. So how is this bad for everyday Americans working jobs? Didn’t you say this made everybody richer? Isn’t it great that money can be printed up to buy oil, pay for police, for garbage pick up and create new football arenas. Who doesn’t love SuperBowl Sunday, right?

Being the reserve currency of the world, the US has continually expanded their rate of borrowing and investing in other countries to meet the local demand for dollars. This naturally has allowed for the set up of US corporations all over the world. The USA’s responsibility is to essentially monitor the global economy more-so than it’s own domestic economy. Hersheys, GM, Coca Cola and Jabil, may be an American companies, but it’s much better for them to extend out to Mexico, Malaysia and Turkey to save a huge amount of expenses. The end result is that there’s fewer and fewer jobs for American citizens.

In this system, one by which the distribution of deposits between global banks, there is a great expansion of net wealth of countries around the world. Like all empires, everything has been built up tremendously, but like all empires, things come to a sorry end mostly by neglecting the matters at home. Lately, new economic figures, debt concerns and interest payments are developing problems that continue to show its cracks that the system. Similar to dark matter in space, we cannot see what goes on with the eurodollar ledger, we can see the gravitational moves in bond markets and economic figures that suggest problems here and there.

For American residents, foreign governments and investors, there comes a time when many gather together to opt for a new type of system to avoid inflation, economic warfare assaults and financial independence.

The New War

They say all wars are bankers wars. If you’ve read our interview with “the enemy” you’ll have heard the comment that the Ukraine border war is nothing more than a political and financial scam. Many have eluded that the controllers of financialized capital are creating new wars around the world to undo any progress towards an alternative system. It’s a “If I fall, so do you” approach.

We’re looking not at Ukraine vs. Russia, Yemen vs. Houthi Militants, Hamas vs. Israel, “Mexican Cartels” vs. Border officials, Panamanians vs. Canal shipments, etc. We’re looking at flashes of civil disruption and conflicts that are deliberate to dismantle any attempt at transitioning to a new economic system where the existing financial serves little purpose in a dying system. It’s a war between the Current Banking Cartel vs. New Banking Cartel; one who wishes to operate in their own distinct system of trade & politics who challenge the existing hegemony. The former will want to maintain the current system of course whereas the latter will aim to establish their own independence.

In so far there will be another “Empire” arise in the next 50 years. I think this country is interesting:

Do you have interesting topics like this that you wish to write about? You can post it everywhere on the internet now–but with us you can remain anonymous–> MORE Here –> Write for Everybody

It’s taken 30-50 years to feel the effects of this and it will continue to develop throughout the end of this decade. I believe the takeaway is that BRICS are developing their own system to bypass these problems. By analogy, they are not trying to shut or modify the existing tap–they’re just going to a new tap.

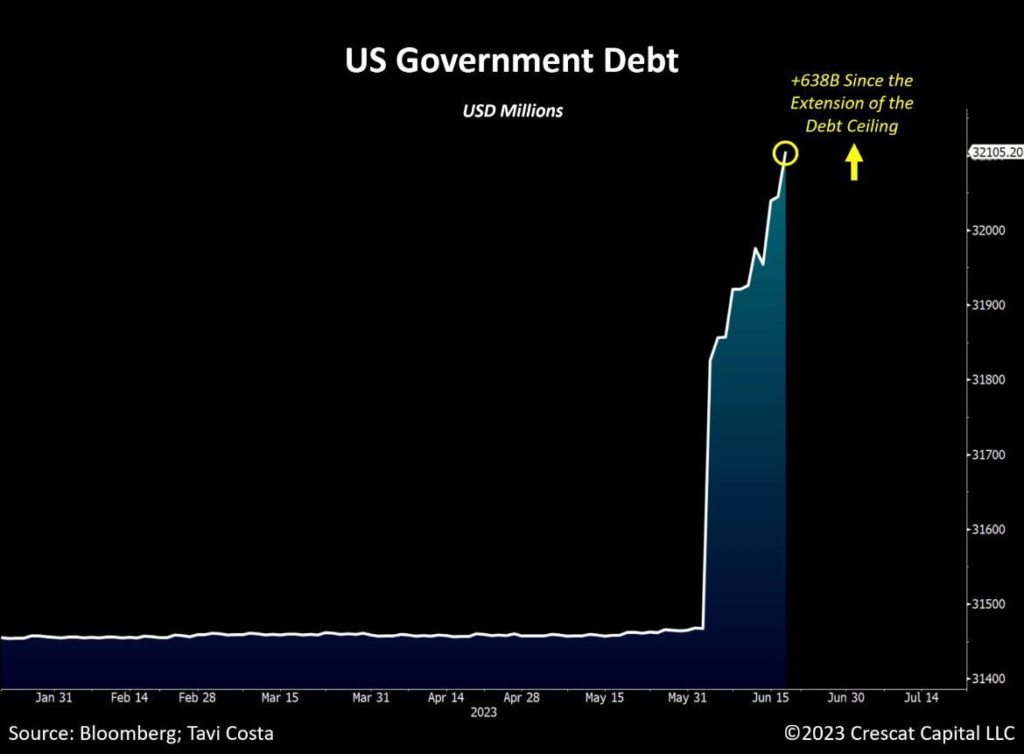

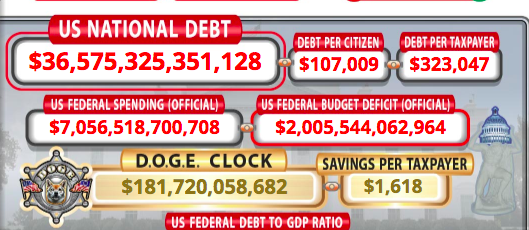

However the question remains, what is going to be the real catalyst that causes the banks of the world to shift off of the existing Eurodollar system and over to an alternative–and what is the alternative going to be? What can unite other parties who may have nothing in common like the BRICS countries? Eventually, the US deficit spending 1 Trillion dollars every 100 days (without a war declared & after a so-called pandemic!) and bank/industrial failures around the world that cannot be helped by more liquidity will place pressure on this transition. Look what’s happening already:

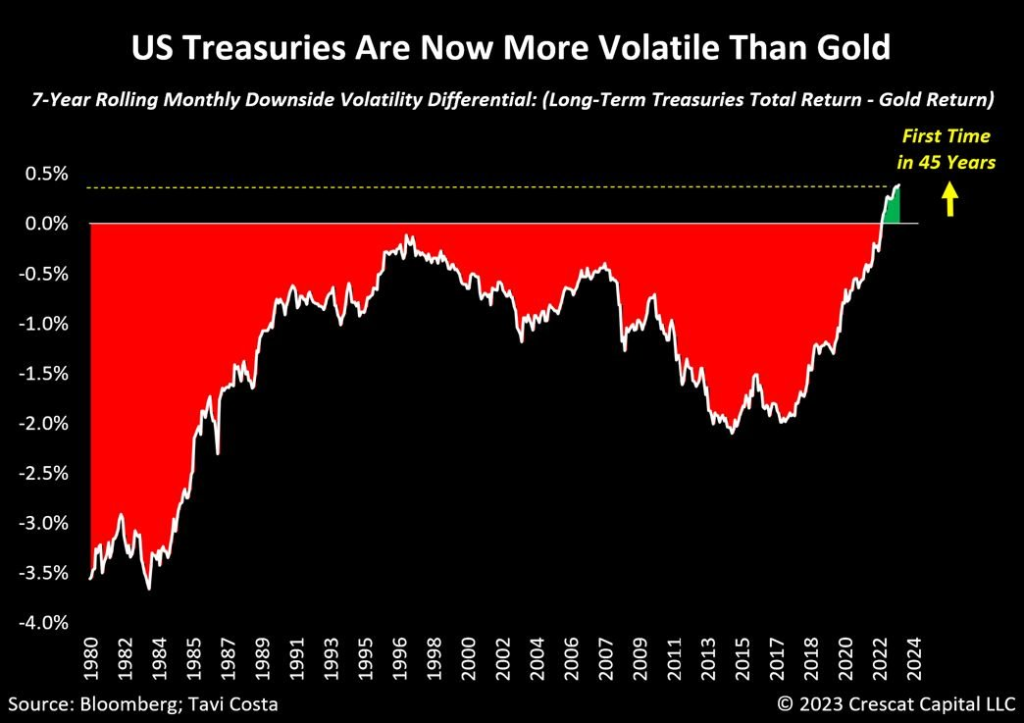

Team Treasuries Losing for the First Time

US Government Debt is Up Over 24% in 3 Years

January, 2021 $27.7 trillion & Now: $34.5 trillion

When Not Selling, Who is Buying?

Themselves. The Federal Reserve is the largest owner of US Treasuries, followed by Medicaid funds and then Municipal Governments–all domestic. Imagine running a business where you could be your own customer–you’d sell all your inventory in no-time!

Just a couple years ago the Cayman Islands moved up to being the #5 foreign creditor of the US, the first time it has ever been in the top 5 in history. The Caymans hold ~2.5x more USTs than Saudi Arabia–you know, that oil-rich huge nation in the Middle East… I beg to differ that this is in fact ‘not’ the Cayman Islands behind such tremendous purchases (since this is much larger than the Cayman economy).

Flashback

This is nothing new–it’s like 11 years ago when the “Belgians” bought treasuries in excess of their own current account coincidentally at the same time that Russia & China drastically dumped theirs. Cayman Islands, like Belgium a decade prior, are a front to prop up treasury market. Who’s the mystery buyer?

Since, China, Japan, UAE, Saudi Arabia all have sold off US treasuries from their balance sheet in 2023 and continue to do so this year. So it’s becoming more clear that the international demand for US treasuries is falling flat. In fact, they say so themselves–straight from the insects’ mouth:

“Foreign investors—both official (governments, central banks, and sovereign wealth funds) and private-sector investors—were significant contributors to the broad selloff in U.S. Treasury securities in March 2020 with $417 billion of net sales, a marked contrast to foreign investors’ net buying at the peak of the GFC”.

Stanley Druckenmiller, famous hedge fund manager made a comment that I won’t forget. He essentially noted that foreign investors/governments didn’t just into the US treasury like prior international crisis events, instead they rushed to US equities (particularly growth stocks).

Druckenmiller also commented on the bailout of the Silicon Valley Bank collapse, “In four days they printed enough money – they basically wiped out the entire reduction of the balance sheet they had done for five or six months.

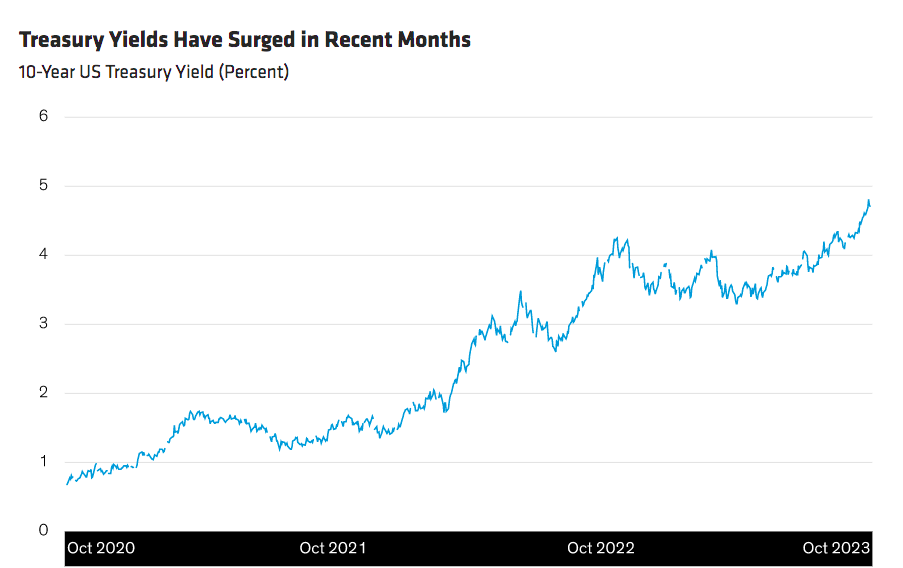

Druckenmiller who is known for his far-sighted approach and clever arbitrage spotting opportunities has calculated some simply but mind-blowing figures that will make you second guess your whole future. This quote is one of them–> “Given the fact that the US Treasury hadn’t refinanced their treasury insurance, when the debt rolls over by 2033, interest expense will be 4.5% of GDP (at current rates). By 2043, interest expense will be 7% GDP, again at current rates. To put 7% of GDP in perspective, this would total 144% of ALL current discretionary spending. The USA debts will surmount to a point where confidence has to be lost at some point” It goes back to that meme that circulates on #fintwit, “We pay our old debt by printing up new debt”, except this would be to an extreme degree.

This would mean that the interest expense alone would exceed 100% of all of the spending on national defence, education, transportation, foreign aid and other items–and 2043 is only 19 years away. What we’re considering here is the complete lost of confidence in the US government to sell it’s debt to support their inevitable spending [for the interest alone!].

Ultimately, what this comes down to is the American Empire losing its twinkle. In Hedge Fund billionaire Ray Dalio’s The Changing New World Order he highlights that it’s the currency [of a world reserve power] that is the last item to go (far after cultural norms, common people & trade expansion go).

Team Gold

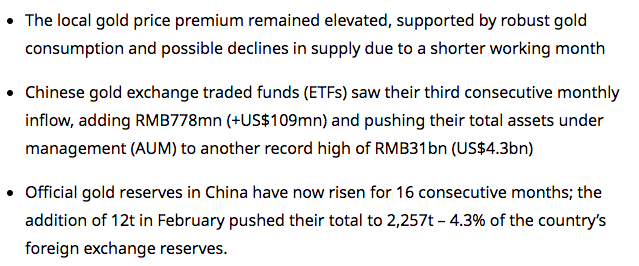

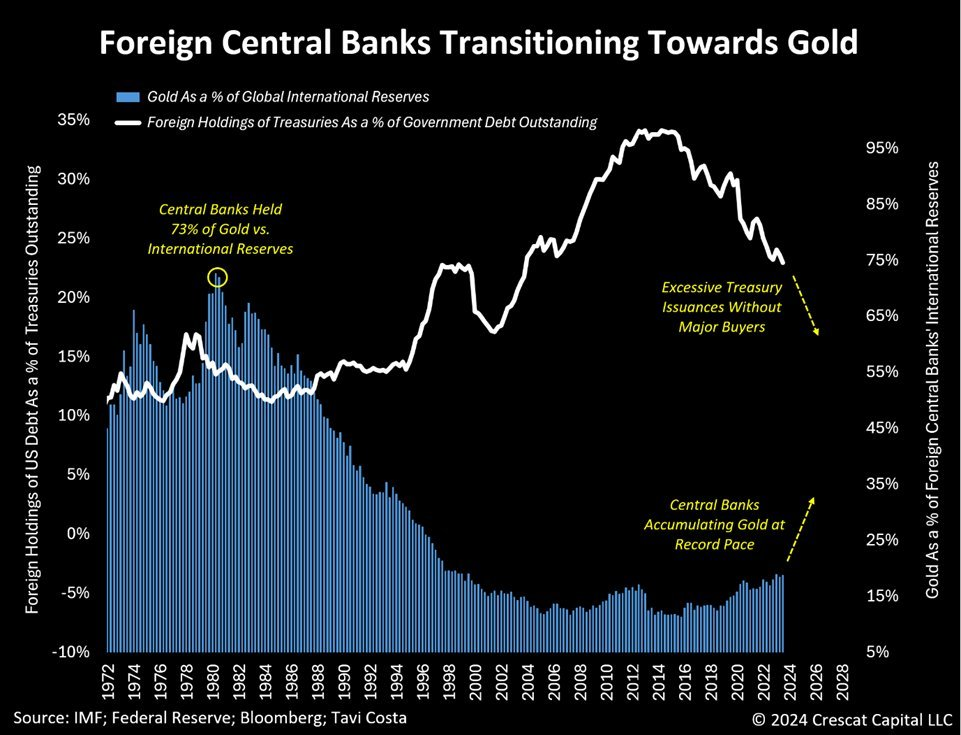

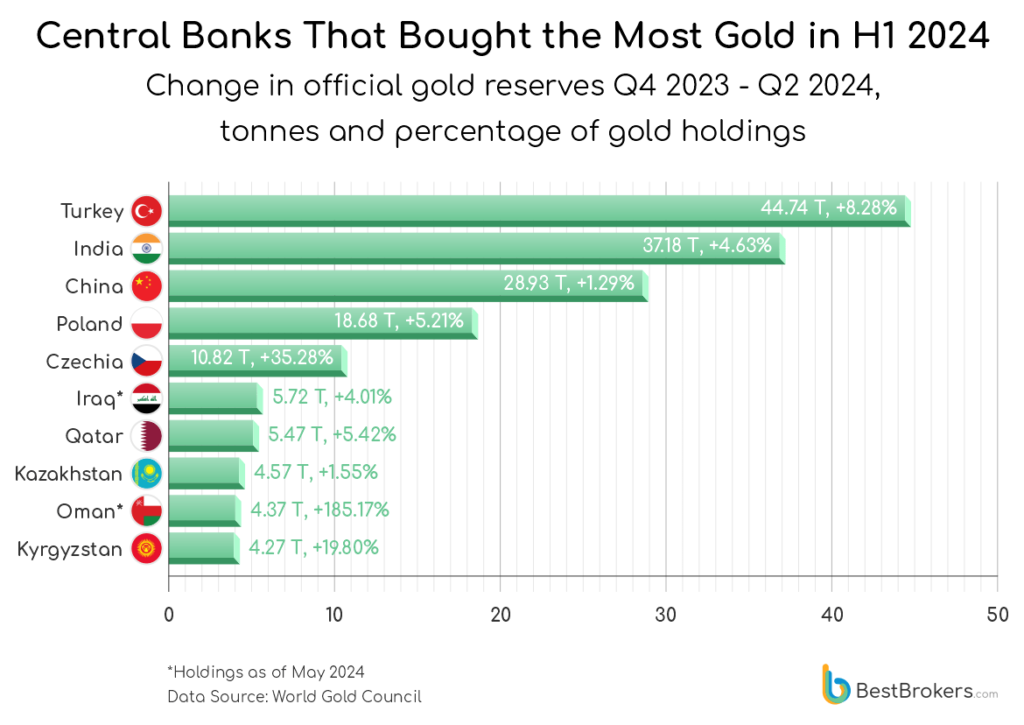

I should preface by saying that Central Banks have a hate/love relationship with gold. They have been buying it at an absolute record rate for the last 4 years now–but they detest it due to it’s limitations (what you might call, acting responsible).

Many have eluded that the natural place where “a new system” will end up is back to gold. Since the Russians can’t reeeally trust the Chinese who can’t reeeally trust the Iranians who can’t reeeally trust Brussels–gold is a common denominator of trust–the new ledger if you will, which isn’t simultaneously each others’ liability.

You’ve begun to see this

Perhaps they’re strapping in for tough times but one must ask themselves–why gold? why now? If the banks of the world are buying at a record pace, it’s a pretty good indication they’re getting ready for something while the price is still affordable. What do they know that we do not?

It’s worth reiterating that in 1933 owning gold went from a symbol of wealth to a criminal act in the USA. All for the greater good of economic recovery, or so the story goes. Buy yours while you still can!

Final thoughts

It’s really easy to get caught up in nation states or religious conflicts on a small scale but if you pull back to a 40,000′ view to see what really drives chaos it’s so often financial factors, control for resources (energy) and control for the flow/supply of money. As the US continues to spend into oblivion, weaponize their dollar (with fewer and fewer willing to accept it’s collateral) and reasonable allocations throughout the Eurodollar system become fewer, there will be a need to find an alternative system to run the world economy upon. No matter what this looks like, it’s hard to see the US dollar ledger remaining on the top forever. My bet [and perhaps the bankers’ bet as well] is on…

gold!

I appreciate you taking the time to read–I hope you enjoyed it! What can you do now? Here are some options (click below)

A friend of mine wearing a T shirt reading “Cash is Trash” while being the Banker for a game of Monopoly. Just like the real world!!

Always #StayOnTheBall