A HUGE misstep by the Americans

The imbeciles in Washington have decided to go ahead with another blunder of seizing Russia’s (from the Central Bank) Forex reserves to the tune of around 300 Billion USDs. It is BY FAR the biggest mistake of the USA since they began aggressively weaponizing the usage of the dollar. This policy is a boomerang effect that keeps coming back to cause problems. It signals to the world that:

1) That there is no rule of law in the US

2) Capital will now no longer feel safe being held there

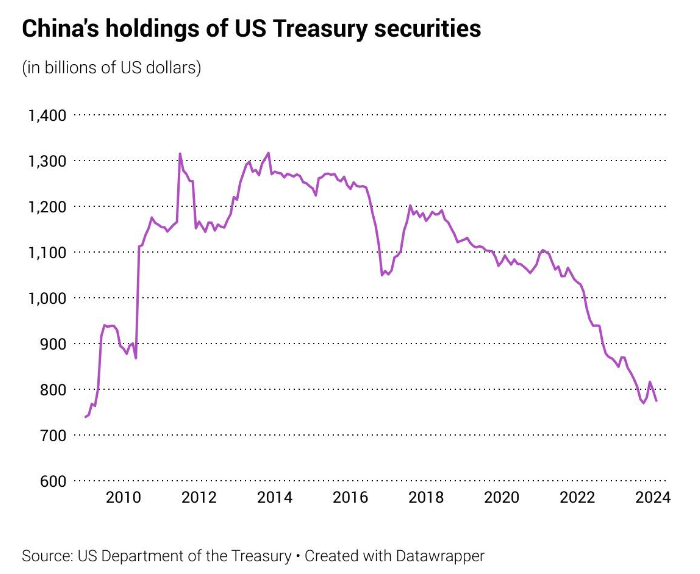

3) Loss of confidence in the dollar ultimately means losing confidence in the treasury markets–why should anybody remain confident if that form of collateral can be seized upon the arbitrarily will of the Americans?

REPO Act

The latest REPO Act by the Bidenistas was the latest spending distraction that will inevitably lead to reduced confidence in the United States as a trustable jurisdiction with both foreign policy & the ability to maintain the current monetary system. Outside of the 61 Billion to Ukraine (which will only lead to more dead Ukrainians) & billions to Israel against Gaza & Iran’s proxies, they have tucked in the seizure of assets from the Russian Central Bank. This bold move goes beyond seizing an oligarch’s yacht in Antigua (something that Putin himself may actually endorse)–this is directly defaulting on the US Debt with 11th largest economy in the world.

1) Lawsuit–Tit for Tat

Interestingly, the major facilitator of the transfer of assets from the Central Bank of Russia to the Americans must go through a clearing system called Euroclear. Euroclear, composed of 78 banks in Belgium, hold approximately 290 billion of Russia’s assets, the majority of what’s to be seized.

It just so happens that Euroclear also have offices in China, Hong Kong, Malaysia, Singapore and Dubai, all of whom are quite friendly with the Russians. Russia has the capacity to sue Euroclear to the tune of 290 billion dollars since they have a jurisdictional presence in the East. This would therefore throw the international clearance and financial system into a rats nest and further split the geopolitical landscape.

2) Gold

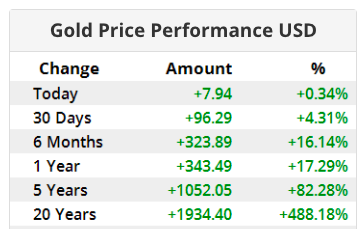

Countries that have remained agnostic during the Middle East and Eastern Europe fighting match are keenly watching the decisions taken place around the world. Some of these countries, who are running surpluses have to make the decision of where to put their excess assets. Do they continue to play the Treasury game and if not, where do they place their new reserves? As the price suggests, they are buying gold. We’ve spoken to a great deal of how Central Banks are purchasing gold to a record degree to sure up their reserves but also as a way to exit the treasury market.

Alright, that’s all fine and dandy, but what the Americans have missed is the fact that Russia holds a lot of gold. This circus act from the Bidenistas has generated a staggering 50 billion USD of value given Russia’s current gold reserves in Moscow (which sit at approximately 3,000 tonnes). For the last 10 years, Russia has been a net buyer of gold in small increments and now hold one of the largest gold reserves to total international reserve ratios (now over 26%). You can’t freeze gold.

We’re writing about the BRICS + who are working on their own alternative to the US Dollar system. This rise in gold will surely serve as a tailwind for this goal! Receive our (bi)weekly newsletter to be informed when we publish that!

3) Energy Assets

Since the US just passed a law to confiscate Russian assets and give them to Ukraine, Russia quickly has said it now has the right to confiscate all Western assets in Russia, worth more than $288 billion. What may this be?

We’re talking about all of the energy assets from huge companies such as BP oil, Total Energy, Enel as well as many mining companies. These companies and operations have deliberately been left operational by the Russians. Rather than getting too emotional, Putin has left this as a valuable lifeline by not touching any assets throughout this period. However, now that the Americans are eager to steal these banking funds, Putin now has the opportunity to take all the infrastructure, banking assets, telecommunications, drills, mines, innovations, intellectual property, acreage, mineral resources from these huge Western companies. All told, it’s assumed that Putin (simply on this acquisition alone) will turn a profit.

Not only would he turn a profit in terms of valuation, but he would greatly impede the leverage of Western nations who were previously sourcing this diesel, petroleum & minerals from Russia to their home nations. What would you rather during a war, costly producing oil wells with significant reserves, or digital US treasuries?

4) Dollar Drugs

Finally, I like the analogy I’ve come up with that the US dollar (or rather, US treasuries) have become a form of drug for the international economy. You need it to function from day to day, week to week, month to month, but overtime it is ultimately destroying you from within. It’s destroying your own organic economy, it’s raging inflation, its playing politics with a monster and it’s loosening control over your own monetary situation. As we’ve written before, the world went from a gold standard to not a dollar standard but a US treasury collateral standard. The degree to which people are on this standard greatly varies.

If we fast forward outward, you can see that economies like Japan, United Kingdom, Germany are heavily involved with their holdings of US Debt, whereas China, UAE, Saudi Arabia and most notably, Russia have less of a US Debt position. If we liken all the largest economies gathering together for a drug rehabilitation process, we can consider the latter Eastern economies further a long in the process of “kicking the collateral habit” than the Western economies. In other words, if interest rates rise and political risk continues to rise, the “symptoms” of this are less disruptive for Russia and their allies. A clean head moving forward.

Closing

Amazingly, Europeans and Americans in Washington continue to underestimate the Russians’ ability to navigate what’s thrown upon them. Amid the dozens of rounds of sanctions, Russia is now the largest growing European country. They have even proved able to hold inflation to a degree that would set Jay Powell’s legacy. (We wrote about what the sanctions have done by speaking to a Russian here).

Despite the upcoming loss of 300 Billion of Russian treasury reserves which will likely used against them in Ukraine and abroad, a more careful examination reveals that the Western powers are the ones to lose. They have gave every country in the entire world reason to question the rule of law in the treasury markets (which is the lifeblood of the current monetary system). This future amount, I suspect, that is turned away from buying the inevitable future debt will exceed the amount that they’ve stolen from Russia. This is to say nothing about the obvious default on the interest payments either.

If we consider Russia’s position, we can see that again, they’re in a position to come out on top. They now have cause to seize valuable assets (politically valuable too) from major foreign corporations still operating in Russia, they have the legal grounds to sue for damages that exacts the amount stolen and in the process, they’ve raised their reserve valuation by owning a considerable amount of gold. The last point relates to our long-winded article we wrote here that argues the next major conflicts seen in the world will be a result of countries leaving the Eurodollar/Treasury collateral reserve and will seek to establish a distinct reserve by using gold.

Once again, the American Empire have become accustomed to their actions not having consequences & pushing the liability off elsewhere. This time, I don’t believe they will escape such a blunder. The decision to rob these assets will send a shockwave against the confidence in the US Debt markets and ultimately backfire against their declared public enemy, Russia.