Kuya’ja buy it?

Just as a disclaimer, I do not currently own any stock, hold any affiliations with this company nor have any relationship with them in any capacity. See the Disclaimer policy for further details.

I wanted to post about a junior silver miner that has posted some seriously high grade silver results. [Read my articles why I’m particularly bullish on Silver] The name is:

Kuya Silver Corporation

Kuya Silver Corporation is a Canada-based mineral exploration and development company with a focus on acquiring, exploring, and advancing precious metals assets in Peru and Canada. The Company’s projects include Bethania Silver project and Silver Kings Project. The Bethania Silver Project consists of three properties in the same area of interest, Bethania, Carmelitas and Tres Banderas, which collectively cover approximately 4,981 hectares. Tres Banderas Concessions is located in the district of Acobambilla, department of Huancavelica, Peru. The Silver Kings Project encompasses the 100%-owned Kerr Assets (Kerr Project), the remaining assets and the Sunrise Claims totaling approximately 17,854 hectares in the Coleman, Gilles Limit, Lorrain, South Lorrain, Kittson, Barr, Klock, Dane, Cassels, and Riddell townships in north-eastern Ontario. The Silver Kings Project is located in Northern Ontario’s most prolific silver mining camp, situated near the historic mining town of Cobalt, Ontario.

Properties

Just for sake of reference: 0–150 g/t silver is low grade. 150–350 g/t silver is average grade. Over 350 g/t silver is high grade. “Bonanza” grade is not measured by the grams, but the kilos per tonne.

This is a pure silver play if you’re bullish on Silver and the miners catching on due to leverage… Some predict the price of silver to hit triple digits soon, which is amazing given that 70% of their revenues come from Silver

Why I’m excited about this company

- Extremely high grade finds of silver. I haven’t seen grades this high before

- It’s Market Cap is only 22.7M CAD at the time of writing. Comparing apples to oranges, this is 57515X less than the market cap of overvalued Tesla.

- Nobody is taking notice. The CEO is quite active giving updates and interviews, they have nearly monthly updates (hard to keep track of) and it’s seemingly not having an impact on share price. They have 1 project heading towards mine development (all permits in place) and one still in exploration that they aim to take it to development. It’s trading like a pure exploration company

- It’s Price-to-Book sits at a comfortable 1X. Outperforming it’s peers in the junior space.

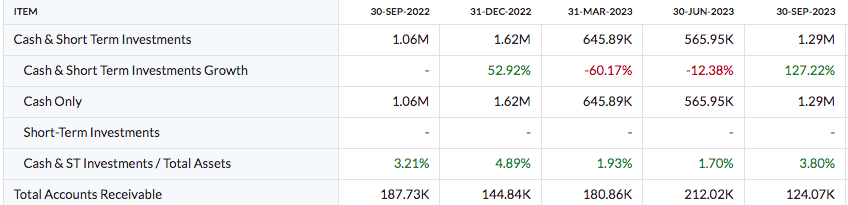

- ~1.62M of cash runway; Exploration (Silver Kings) drill program already financed.

- No short term OR long-term debt (read that again… yea)

- Its price is 88% below where it was launched publicly on April 13th, 2017 (now at 0.24 CAD a share).

- Large, untapped properties (open at depth) to explore with a successful history of previous production

Closer Look

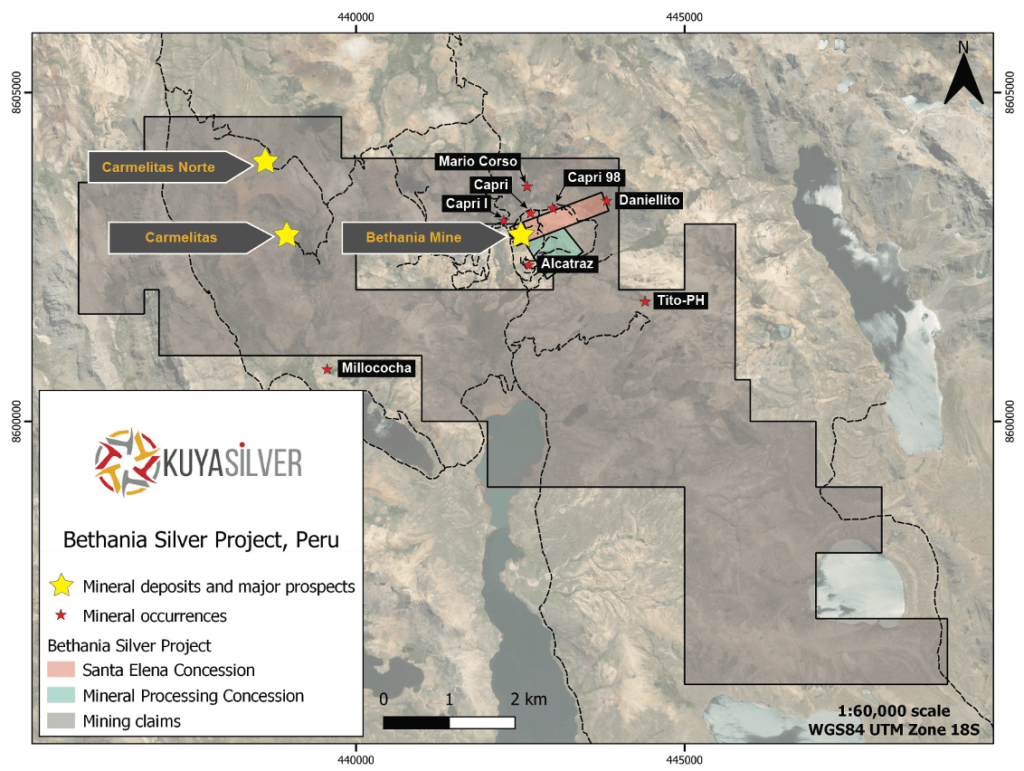

Bethania

Their staple project in Peru.

A 4500+ ha district land package which was an area known to artisanal miners. It is already in development aiming to go into production this year (new plant permitted for construction and EIA/community agreements in place). The goal is to develop it to become over a 1 million silver oz producer per year, with the belief that with expansion it could reach 10s of millions annually.

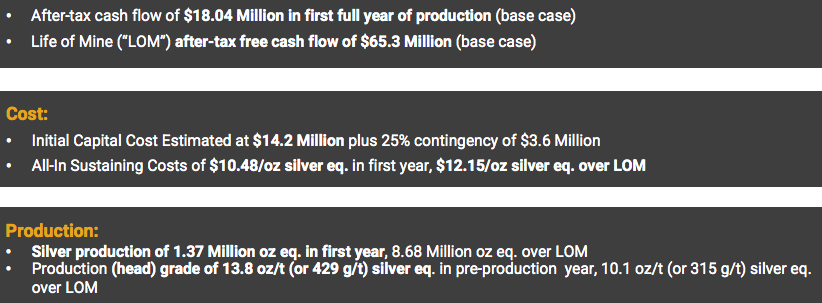

Their Low CapEx $14.2 M + $3.6 M contingency in PEA with a payback period less than 1 year keeps the juice worth the squeeze as they move toward production

It has been acquired by a wealthy Peruvian family who opened the mine in 1977 after two promising veins were found and has proximity to a town to ensure lower expenses.

(IRR= Internal Rate of Return)

Base case ($25.40/oz silver price)

-Pre-Tax NPV (5%) of $77.8 Million and IRR of 227%

-After-Tax NPV (5%) of $54.7 Million and IRR of 188%

[Taken from their Corporate presentation August 2023]–what is obvious is their great margins, low costs, high grades and immediate results that they’ll offer shareholders. If the underlying silver price moves this company will be printing money.

The above assumptions are not factoring in growth potential of the project as well. Less than 4km away, there was a recent discovery of “Carmelitas Norte” prospect, highlighted by 1944 g/t AgEq find.

Bethania has also come across a gold deposit as well in whats called the Carmen Vein. Its a gold-dominant vein parallel to traditionally mined silver-polymetallic veins at

Bethania with up to 6.26 g/t Au at surface.

They have recently signed a Toll milling agreement (6 months ago) and launched their plan for mine development–matters are moving forward. The management team claims that there is the potential to double or triple the resource as well.

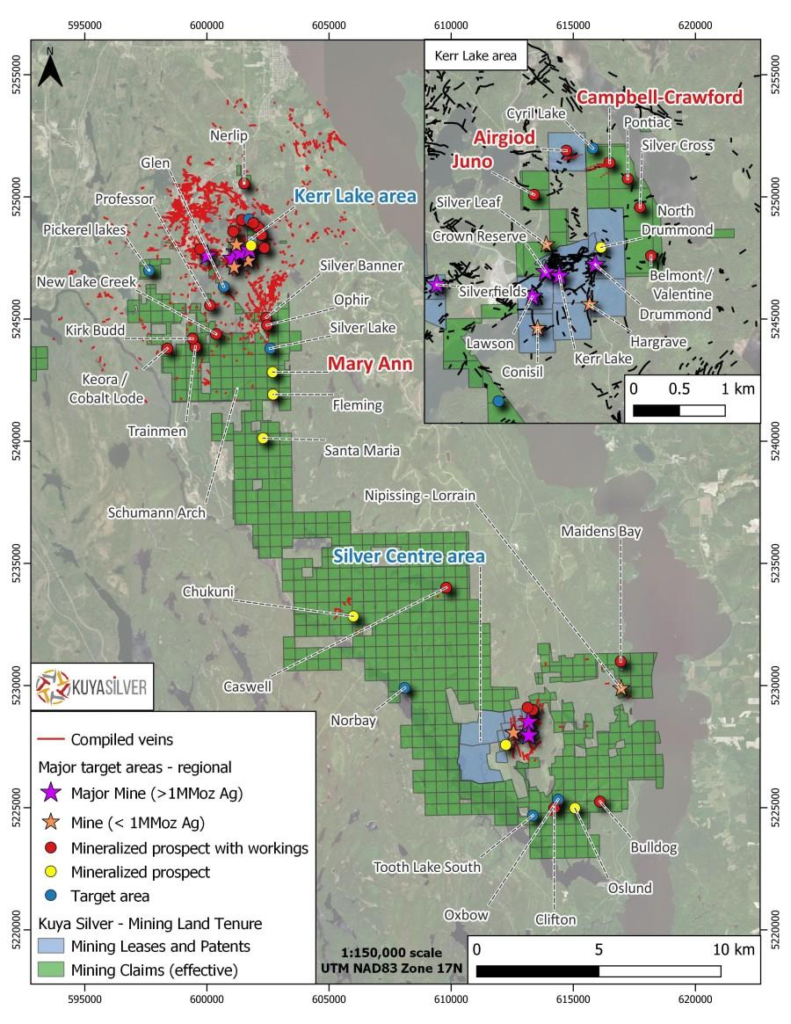

Silver Kings

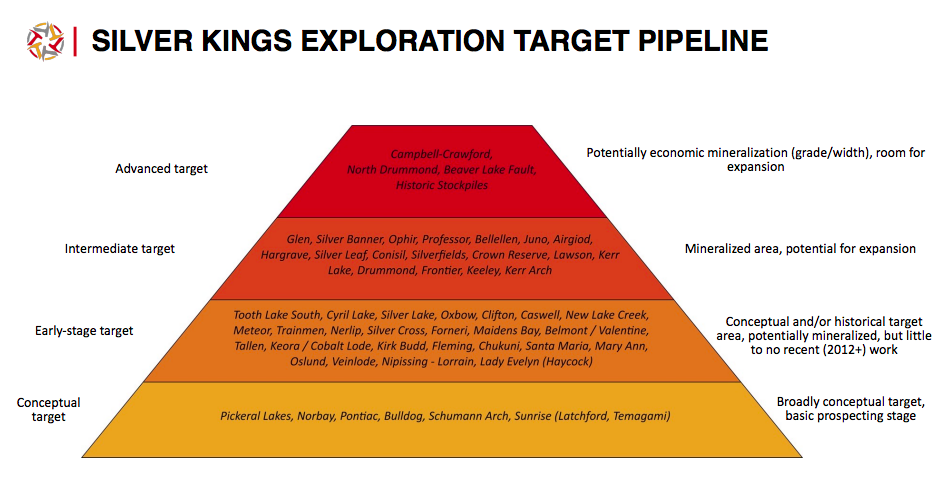

100%-owned property in Northern Ontario, Canada. Patented mill site with Ag-Co resource targets. They were given the right to acquire on January 4th, 2023 by Electra battery minerals and it has progressing quickly with various targets. This is a 18,000 ha property in the Cobalt, Ontario silver mining district, including properties and claims that have been staked or acquired by Kuya Silver since 2021.

Previous operator identified several bonanza-style silver intercepts while exploring for cobalt at Kerr (First Cobalt Corp which later became Electra Battery Minerals). Here they have four major target areas near Kerr Lake: North Drummond, Crown Reserve, Fleming, and Hargrave (See above).

(As of Early this year) Since launching the project in 2021, Kuya Silver has drilled a total of 5,084 m to scout various targets (3,344 m at the Kerr Project), re-assayed certain diamond drill intervals from the previous operator which had been capped at 1,500 g/t silver and completed extensive surface mapping & 3D geological modelling of the area to better refine targets. They have added their new Angus Vein discovery as well which contains cobalt deposits.

These lands produced over 60 million ounces of silver between 1905 to 1950, but not one time was drilling beyond 200m depth. Nearby (around 1KM) is also the Campbell-Crawford area which produced 48.2M ounces of silver but without any mine development and consequently, no deep exploration to find its fully potential. It’s a main advantage is having the proximity to the town for workers and equipment.

The Best Part–> Findings

North Drummond has been the 2023 focus as well as testing at Silver Kings of 6,000m

22 g/t Ag, 0.68% Co / 0.30 m (471 g/t AgEq* at 260.7 m) and 186 g/t Ag, 0.50% Co / 0.30 m (515 g/t AgEq* at 282.0 m) (North Drummond).

251 g/t Ag, 0.77% Co / 0.30 m (759 g/t AgEq* at 77.7 m) in 21-Kerr-008 (Crown Reserve target across from North Drummond)

Santa Elena Vein: ~500m from furthest underground development. Up to 3675 g/t AgEq (Bethania discovery)

Re-assays of overlimit silver (>1,500 g/t) from the 2018 drill program included a composite of 1,042 g/t AgEq* / 2.20 m including 2,420 g/t Ag, 0.05% Co / 0.30 m in FCC-18-0093 (173.6 m). Less attractive but still amazing finds from the re-assay

- 5,390 g/t Ag, 0.59% Co / 0.30 m in FCC-18-0094 (20.7 m; Drummond target)

- Composite 1,097 g/t AgEq* / 2.00 m

- 1,910 g/t Ag, 0.51% Co / 0.30 m in FCC-18-0106 (31.3 m; Drummond target)

- Composite 876 g/t AgEq* / 0.90 m

- 1,810 g/t Ag, 0.02% Co / 0.30 m (65.4 – 65.7 m) in FCC-18-0111 (65.4 m; Drummond target)

- Composite 1,083 g/t AgEq* / 0.60 m

- From 66.0 m, intersected 2.50 m of 1441 g/t Ag in FCC-18-0174 (North Drummond Target)

At the new Campbell-Crawford find, they came up with findings that made me scratch my eyes

15,372 g/t silver over 3.34 m & 2,424 g/t silver over 2.49 m

The high grade enables the processing with reduced tonnage which will enable easier permitting and reduce CapEx if or when they decide to turn this into production behind Bethania.

One thing I’ve found interesting is these findings have not been lucky strikes, but rather have shown some consistency. They’ve had great recoveries as well–Based on historical metallurgical testing and subsequent analysis, average recoveries for various metals are modelled in the Bethania PEA to be Silver 92%, Lead 90%, Zinc 81%, Copper 64% and Gold 34%.

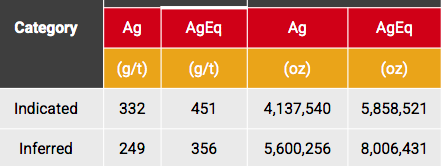

A great summation of Kuya’s Silver Project (taken from their 2023 September Corporate presentation)

They have their hands full at the moment but the prospect of acquiring new properties has been thrown around too, though I reckon not for another couple years.

Performance

| 52-Week Range (C$) | 0.195 – 0.77 |

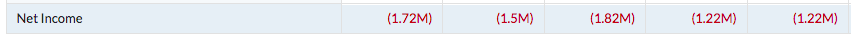

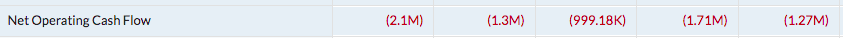

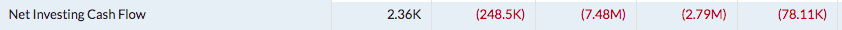

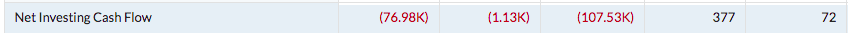

-1.5M net income holding steady from quarter to quarter

As of the last 5 quarters, they are acting quiet

For the most part, the stock has moved sideways over the last 6 months.

It has been lumped into the pack of junior miners getting absolutely slaughtered. I think investors threw the baby out with the bathwater here.

However, it’s important to understand that this is more-so a speculation rather than an investment in an established, stable company with positive net income at this given time.

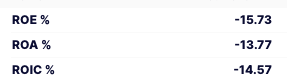

Ratios

Total Assets (3rd Quarter 2023): 33.81M (1.59M Current Assets)

Total Liabilities (3rd Quarter 2023): 3.75M (1.19M Current Liabilities)

Total Liabilities/Total Assets: 11%

FCF yield: -31.4%

Common Equity: 30.06M (Sept 2023)

Current Ratio/Quick Ratio: 1.33

Interest coverage-None

Accounts Payable- None (Last 5 quarters)

Updates/News

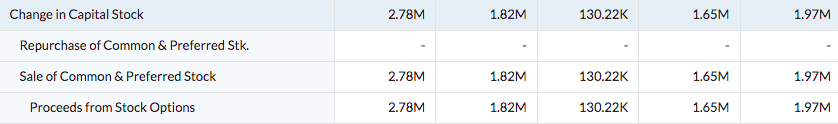

You can see they are moving fast to raise capital for their expansion.

Latest is they are launching their development mine program from Bethania to be in operation this year!

December 29th:

Announced it has closed a non-brokered flow-through private placement for aggregate gross proceeds of CAD$450,240 with a single investor. Under the offering, the Company issued flow-through units at a price of CAD$0.28 per Unit. Each FT Unit is comprised of one (1) common share in the capital of the Company and one-half of one (1/2) non-transferable common share purchase warrant (each whole warrant, a “Warrant“). Each Warrant entitles the holder to purchase one (1) non-flow-through common share in the capital of the Company (each a “Common Share“) at price of CAD$0.37 per Common Share until December 28, 2025.

December 21st:

Announced it has closed the second tranche & final tranche of a non-brokered private placement pursuant to the listed issuer financing exemption, by issuing 3,572,000 units (each, a “Unit“) at a price of $0.25 per Unit for aggregate gross proceeds of $893,000. Collectively under the Offering, the Company issued 13,921,000 Units for aggregate gross proceeds of $3,480,250. This offering contained one company share and one common share purchase warrant. Each warrant entitles the holder thereof to acquire one additional common share at an exercise price of CAD$0.37 for a period of 24 months from the date of issuance.

December 11th:

Announced it has closed the first tranche (“First Tranche“) of a non-brokered private placement pursuant to the listed issuer financing exemption under Part 5A of National Instrument 45-106 – Prospectus Exemptions (the “LIFE Exemption“), by issuing 10,349,000 units (each, a “Unit“) at a price of $0.25 per Unit for aggregate gross proceeds of $2,587,250.

November 6th:

USD $1.2 Million Investment to Assist with Restarting Production at the Bethania Silver Project in Peru by Trafigura.

August 2023:

It has closed the second and final tranche of its fully subscribed non-brokered private placement. In this tranche the Company issued 390,000 units (each a “Unit“) at CAD$0.27 per Unit for gross proceeds of CAD$105,300. Under both tranches, the Company issued 2,781,300 Units for aggregate gross proceeds of $750,951. Pursuant to the Offering, each Unit entitles the holder to receive one (1) common share in the capital of the Company and one-half of one (1/2) transferable Common Share purchase warrant (each whole warrant a “Warrant“). Each Warrant entitles the holder to acquire one (1) Common Share at CAD$0.50 for a period of two years from the date of issuance, the second tranche warrants expire August 31, 2025. Note the public share price is beneath this private placement.

From September 2022 to September 2023

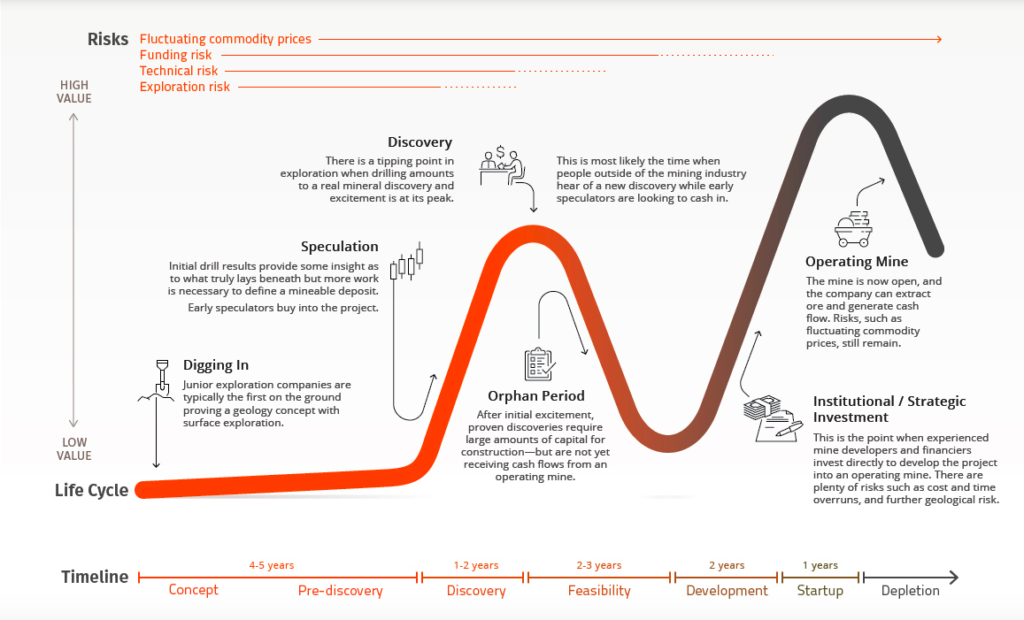

Their CEO commonly refers to the Lassonde curve a number of times in interviews to highlight where they are in their process:

Silver Kings is still in the speculation phase trying to make great, exciting findings.

“Kuya Silver is pleased to present an update on drilling at the Silver Kings Project, Canada. Drilling at the Silver Kings Project is following up on the Campbell-Crawford target, where early 2023 grassroots drilling intersected significant silver and cobalt mineralization, both with uses in renewable energy”

This is the largest drill project ever at this project site.

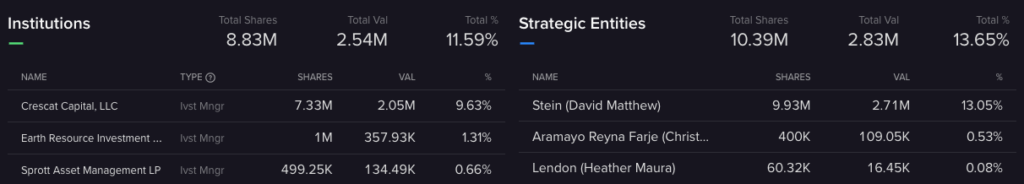

Ownership

Three institutions are involved and the majority is retail investors or public float as ‘other’ (65-74%)–big money is absolutely not looking at this current moment. There is little competition for shares. Management and Advisory roles total over 23% (not considered strategic entities in photo above).

To date there are only 34 employees in the company with a strong insider ownership.

Fully diluted they have 100,149,226 shares (76,145,183 are currently outstanding)

Closing

This is speculative in nature. You’re speculating that the company will be able to raise enough cash for their goals, equity, continue these great strikes, that silver will increase in price, expand their projects and perhaps allure the interest of the big players.

However, towards the end of this year they have been raising cash at-or-near their publicly traded share price and as I said, they’re moving fast forward. The share price is pretty beaten up and we’re at a time when junior miners are about as tasteful as dirt to investors who still have their eyes on growth & tech. In other words, competition for these shares may be at a low point.

The most exciting aspect for me is that they’re holding two deposits with unusually high-grade silver–and nothing appears to be a fluke given the reliability of their finds. These bonanza-grade finds allow them to chop away a significant amount of operating expense which leverage them to benefit from silver price increases & suspend them from silver price decreases. They have the diversification of mining jurisdictions, diversification along the Lassonde curve, potential findings at depth & healthy predicted margins even assuming a low silver price.

Perhaps their rapid growth went unnoticed as they are currently developing a mine for production this year whilst still holding the valuations of a pure exploration company. Their plan is to produce a significant amount of silver to quickly run free cash flow for investors from the start.

It may not the company to best bet your retirement on, but I’m extremely excited about the great upside in the years to come!

Find out about Silver here and Platinum here

Thank you for reading and I look forward to producing more articles for you! Follow us on Twitter & Instagram!!

#StayOnTheBall