Damned if they do, Damned if they do not

The Federal Reserve is currently stuck between a rock and a hard place with respect to the global economy, interest rates and inflation. Before explaining the rock and the hard place it’s worth reminding everybody that the world hadn’t left a gold standard for the USD as a reserve currency. The USD is what facilitates the current monetary system, but the standard if you will or the life-blood required to “play the game” is banking collateral. The premium form of collateral are US Treasuries (or more broadly, US Debt). In effect, the world requires the issuance of US debt to sustain their ability to leverage their own domestic economies. It could be said that the Federal Reserve has as much of a mandate to sustain the global economy as it does the domestic economy.

Foreign Economies are Burning

Outside of the United States, the allied economies (that is, those with significant holdings of US debt) are struggling with recession, inflation, poor economic figures and capital flight. Given that the current treasuries are yielding at around 5% (and again, this remains the form of collateral that is desired for now) much of the assets are finding refuge into US Debt markets. To add insult to injury, the ability for UK, Germany, Japan & Korea to raise interest rates is greatly stunted by their ability to pay their existing debts. It therefore makes sense for very large investors to borrow money in a domestic economy and then stuff it in US Treasuries to pocket the spread of interest rates. However, this has become doubly attractive when you consider inflation in one foreign currency against the USD. Take Japan for instance.

Not only would you be borrowing at minuscule rates in Japan to pocket a large spread by investing in US Debt, but because of inflating Yen (against USD), you’re paying back your principal using a cheaper currency. In other words, it’s a double win for you as an investor (pay back less and earn more). But, all great stories do come to an end. This arbitrage that is available to large investors will inevitably cause bond prices to shoot up in price and yields to shoot back down. At some point, this arbitrage will no longer be favourable to foreigners and when debts roll over, they will have no further buyers.

At which point, the Federal Reserve will have to step in and create a ginormous number of reserves to monetize the debts. These newly created reserves will effectively flood the markets similar to 2020 when the stock market continually set new all-time-highs. Of course this was not because the companies were organically more sound, but because all of this funny-money found a new home. The market is merely buyers vs. sellers, and if you provide lots of shopping money to go buying–it will go up.

What does this mean for their 2% target inflation number?

The Fed Drops Rates For Everybody Else

It’s quite difficult to keep track of the forecasts and predictions for the number of rate cuts that the Federal will decide by a certain date. Admittedly, I’m not interested in gambling on this race horse. Although, whether the Fed cuts rates or not may be an easier subject to forecast. As mentioned previously, the rest of the world is truly struggling with their own domestic economies with recession, capital leaving and inflation despite lower rates. The Fed, again is also interested in preserving the global economy rather than just the US economy and therefore may step in to reduce rates for the sake of the world’s economies. That is, they will seek to ease the pain of those economies to keep capital “at home” in efforts to slow the burn.

The reduction of interest rates in the US would likely signal to all investors that trouble has hit a tipping point (or will) and markets would crash, to which, we would have another cycle of markets going to the sky. Previously in history, when the Fed has dropped rates the Nasdaq had soared higher. It’s worth saying that Janet Yellen had met with Japanese and British governments/bankers recently.

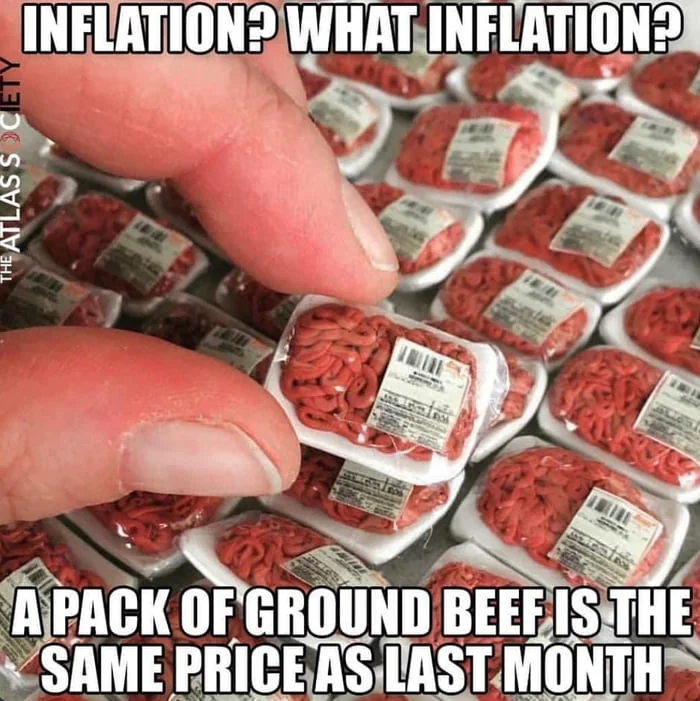

Once again, we’re dealing with an onslaught of money leaving bond markets (because rates are lower) to find a new home in assets such as the stock market, commodities and gold. The increase in asset prices, would eventually trickle down to the average consumer to mean costs of goods become increasingly out of reach.

Both Roads lead to Inflation

Closing

Ultimately, what makes this a problem is not surface level political mockery, protests in the street, income taxes or even current inflation rates. This dilemma relates to three items; The debt load, the debt relative to GDP and the insistence of continual spending [the USA has created such a bureaucracy there is no way to stop these liabilities]. If you and your portfolio are wondering what is about to happen in the long-dated future you must consider the fact that inflation is baked into the cake whether the central planners like it or not. They are trapped, as much as they create a narrative and show short-term numbers, the end result is they have to create more and more monetary heroin to maintain a high for the economy because of the debt & spending. Those who do not own real assets or assets that can generate cash flow will sorely be left behind (we created this article to hopefully help you navigate further! simply click the link).

The reason why they are bringing in a Central Bank Digital Currency is not only to police your politics, behaviours, spending habits but to control you to such an extent that they seek to gain another lever over inflation by disallowing you from spending. “You’re hungry? Too bad, inflation is high this month”. Stay hungry for the greater good. Read our article here on where you can go to dodge this tyranny!

The end result is that we’re looking at a cycle of Argentine-styled inflation whereby further spending only warrants further spending. The freshly created reserves made to monetize the debt (kick the can down the road) are going to push asset prices higher and higher than they otherwise would be in a sort-of “melt-up” fashion. Those who work for (& save in) dollars will be ushered into a new class of poverty. Pondering over the Fed’s next actions are futile as you’re merely lingering on whether you’ll die by the sword or by a rifle. So, what can you do to 'not die'?

Consider following us on Twitter, viewing our other articles, signing up for our Free Newsletter for more articles like this (& updates!) and always, #StayOnTheBall