171 years and Still Firing

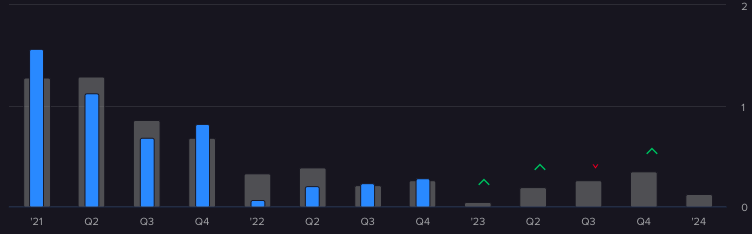

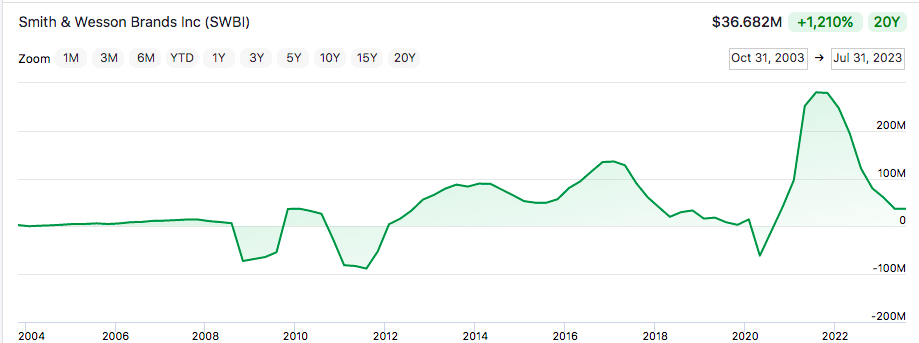

I wanted to bring some eyes to a sin stock that’s not too sexy, ground-breaking or “up and coming”–but at a time when we can expect more and more turmoil in society, sin stocks aren’t too bad of an idea. Smith and Wesson is a company that has 171 years of experience and is pricing itself attractively to the market. As I’m writing this, they have released attractive earnings and it’s after hours is scheduled to open 11.50% higher (good timing)! I wanted to share some numbers and ideas.

I have to admit, as much as I’d like to be well-versed in software & technology, I tend to invest elsewhere in more simple, like “old school” companies. KISS-Keep It Simple, Stupid. I’ve had my eye on $SWBI for some time now–tracking it down to 11USD from 30 USD since 2021. [Since I’ve completed this overview, it has increased 19.2%, so lets hurry up and dive in!]

Please sign up for our Newsletter or Check out this

Company

Smith & Wesson Brands, Inc. is a manufacturer of firearms products. The Company manufactures a range of handguns (including revolvers and pistols), long guns (including modern sporting rifles), handcuffs, firearm suppressors, and other firearm-related products for sale to a wide variety of customers, including firearm enthusiasts, collectors, hunters, sportsmen, competitive shooters, individuals desiring home and personal protection, law enforcement and security agencies and officers, and military agencies in the United States and throughout the world. The Company sells its products under the Smith & Wesson, M&P (being a very popular, reliable), and Gemtech brands. The Company manufactures its products at its facilities in Springfield, Massachusetts; Houlton, Maine; and Deep River, Connecticut. The Company also provides manufacturing services, including forging, heat treating, rapid prototyping, tooling, finishing, plating, machining, and custom plastic injection molding.

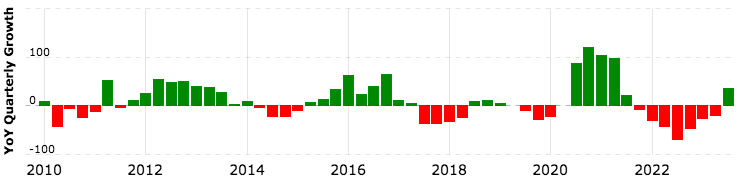

Smith and Wesson has established a name brand that resonates with all gun enthusiasts & users. The company has effectively become part of an oligopoly of gun manufacturers. The proof is in the financials, as while there is some exciting cyclicality in revenues.

From their Fiscal end report:

During fiscal 2022 and fiscal 2023, we generated a total of $154.5 million in cash from operations. During the same period, we invested $114.2 million in cash to acquire property, equipment, and patents, of which $77.9 million was to fund the Relocation, repurchased $90.0 million of our outstanding stock, distributed $33.4 million in dividends,

and borrowed $25.0 million from our revolving line of credit.

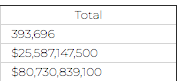

Employees: 1686

The full fiscal year ends on April 30th, 2023.

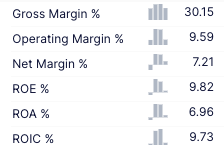

Ratios

Market Cap: 657M

Price: 11.67

P/E: 13.20 (in line with peers)

P/B: 1.30

P/S: 1.28

EV/Sales: 1.30

EV/Revenue: 17.98

EPS: 0.80

Beta: 1.15

Quick Ratio: 0.97

Current Ratio: 3.08

Projected FCF= $29.57

Dividend Yield: 3.5-4.1%

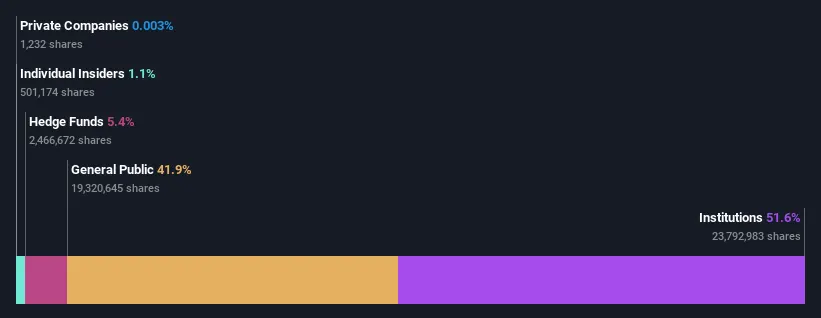

Who are these shareholders? They majority (around 52%) of the shareholders are institutional clients.

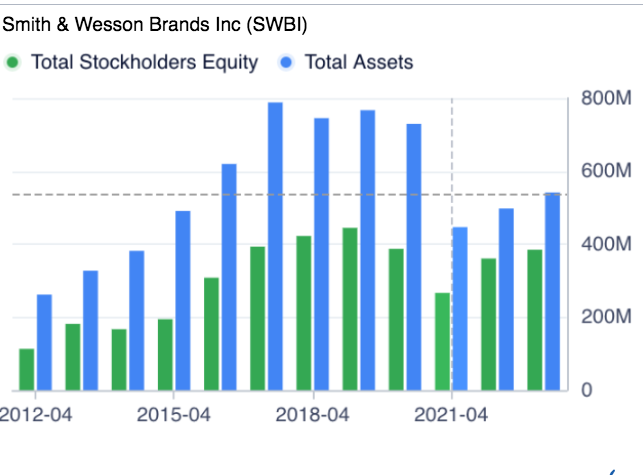

There is very little short term debt (2.46M; Aug 2023). I believe this to be very important because I personally hold a quite bearish outlook for the next few years for US equities. Many companies have wildly negative net incomes, free cash flow and operating incomes with huge debt loads. They will not survive a climate of higher interest rates as they are forced to roll over their debts. Smith and Wesson, different story.

SWBI has 55.48M in Cash which is 64% of their total current liabilities

(Total current liabilities/Total current assets = 32.4%)

Similarly, Total Liabilities are only 30.39% of Total Assets

The company takes every moment they can to pay their debts and buyback stock. They play it conservative.

Net Debt (Cash minus Total debt) equals -5.93M–> -0.13 net debt per share.

Their Altman Z-score is 5.54

They are set to further re-purchase up to $50 million in stock through September 2024.

A reminder that I’d really appreciate it if you could share this article/site!

Sales

Q4 Net Sales of $144.8 Million (Full Fiscal year 2023) (decrease 20% YoY)

New Products launched over the last 12 months amounted to a large 25% of all sales.

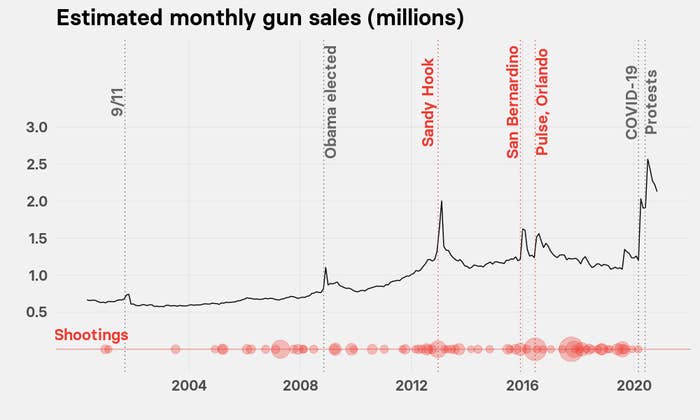

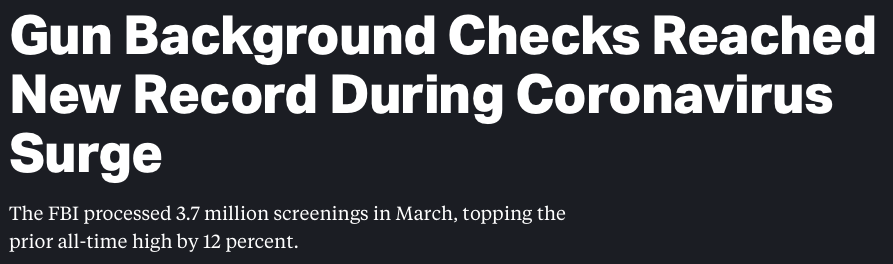

Black Friday appeared to be the firearm industry’s busiest day in November, with the FBI running more than 187,000 gun background checks on the shopping holiday. FBI background check data often correlates with total firearm sales, though not the same.

Gun purchases began soaring in early 2020 and have remained relatively high since

If we look at where the sales take place:

“We sell our products worldwide. International sales accounted for 4%, 3%, and 2% of our net sales for the fiscal years ended April 30, 2023, 2022, and 2021, respectively. Our businesses own tooling that is located at various suppliers in Asia and North America”. –Annual report 2023

The majority of sales are US-based

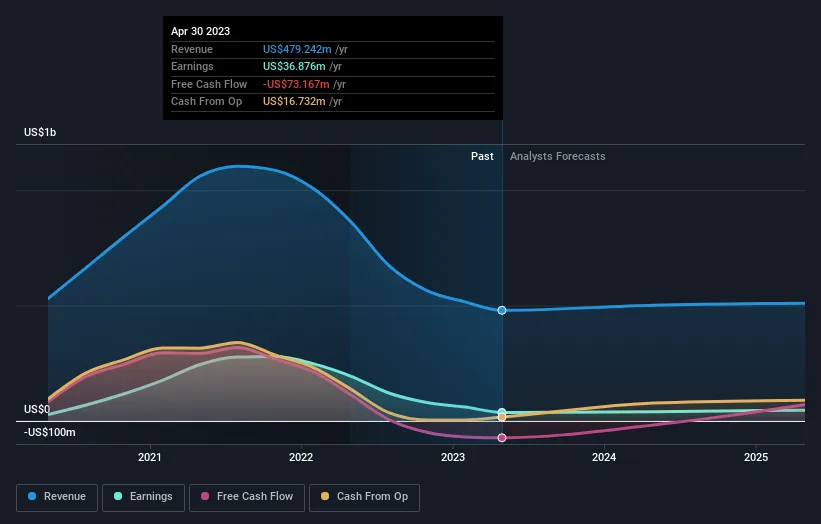

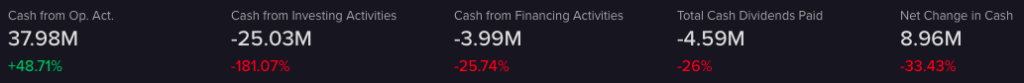

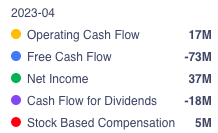

The expectation of Free Cash Flow is to make a flip again but the major take away for me here is the stability or, as some may view, the boring-ness. I think thats it’s benefit as we entering unstable times.

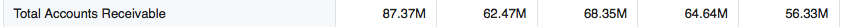

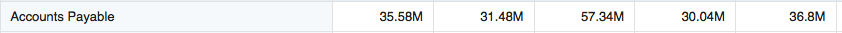

From 2019-2023, Accounts receivable have always been larger than accounts payable.

Shortage

Guns are everywhere, right? What about bullets?

Everywhere, namely the US has been in an ammo shortage. The last shortage lasted almost 8 years (from 2008) that was also fuelled due to panic buying and new laws. The new shortage has begun from the middle of 2020 and hasn’t been back to normal just yet. Panic buying due to the Covid-19 lockdowns as caused the hoarding of ammunition.

Additionally, due to the government induced disruption of the supply chains, bullet imports to the US fell by over 34%. The Bidenistas also perfectly timed a sanction of bullet imports from Russia, China, Iraq and other countries, further tightening local supplies. Imports that did finally make it through, were said to have been delayed for up to 1 year.

Perhaps the most important (that nobody is fully appreciating) is the sheer copper shortage that the US (but the world!) is facing at the moment. Be sure to check out our subscription service to learn more (take advantage of the discount while it still lasts).

The global small caliber ammunition market demand was valued at $10.8 billion in 2021, and is projected to reach $14.2 billion by 2031 equalling a CAGR of 2.8% from 2022 to 2031 (as per Allied Market Research).

This shortage coupled with demand, albeit in ammunition, could instil further fear in buyers looking to get their firearms ‘now’ and spark a sudden sales rush.

What about a Shortage in competitors?

A perfect storm of debts, lawsuits and demand slumps have lead to some bankruptcies in major producers as well. In US Markets, the stocks below are the only ones who are publicly traded related to firearms (note: some only manufacture bullets but not firearms)

Remington, one of the biggest gun and ammo manufacturers in the U.S since its founding in 1918 (and a major Smith & Wesson competitor) filed for Chapter 11 bankruptcy protection in 2018 and 2020. The bankruptcy proceedings led to losing investors and revenue, and the company could not keep up ammo production either. Vista Outdoors acquired Remington since, with Sturm & Ruger getting one part of the weapons business & two other small private companies getting other elements of what was left.

For $SWBI this took out a powerhouse opponent

What if there’s a shortage of employment?

According to The Firearm Trade Association, the number of jobs created (full-time, well-paid and kept) amounted to over 390,000 since the Great Financial Crisis. The interesting aspect was that the growth in available jobs was independent of economic conditions or brief downturns.

To add, Payroll for Smith and Wesson has remained largely consistent for the last 5 years.

Performance

Revenue: $479.2 million (Yearly)

Q4 Gross Margin of 29.0%

Revenue: 114.2M (Quarterly)

Smith and Wesson has performed 3.1M (USD) in earnings for its first fiscal quarter (2024)

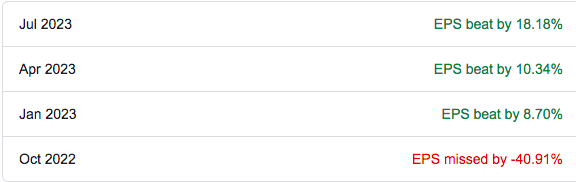

EPS= 0.13 (18% surprise) (Q1 2024)

Net income was 33.4% higher (2023) than in fiscal 2020 (when the stock was trading between 7-18USD).

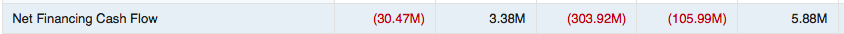

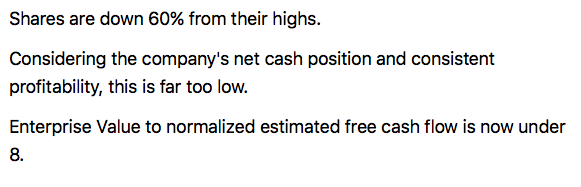

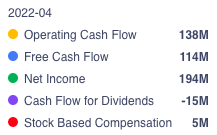

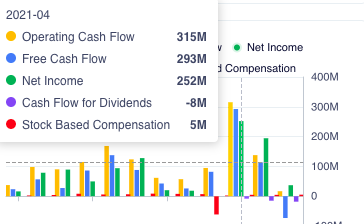

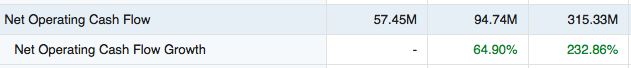

Cash Flow

SWBI has had significant losses with respect to their investing activities but their operating activity has shown a pick up.

As of recent, you can see that there hasn’t been much volatility as the VIX has held steady. However there was a wide variance just three years ago: The stock made a huge gain from its March 12 low of $4.24 to its Sep 2 high of $22.40 (2020)–but as you can see below, things have calmed down tremendously.

And I know you may be seeing red numbers or negative signs and thinking what is he talking about? I want my all my stocks acting like Nvidia!

Well consider that in the last 20 years (including what you’re looking at above), the company has only had negative net income for 11 quarters.

Additionally, revenue and EPS has been surprising estimates the last three quarters after a big pullback in 2022 & 2023.

I wanted to lastly post this here because it shows how rapid ‘event driven’ sales can expand the balance sheet of $SWBI. This is from 2019 to 2021 (in the thick of the hysteria).

Election time, Chicanery & Gun Crime= Stock in its Prime

As I said, I believe Smith and Wesson to be able to stomach be problems in the markets but it’s better than that–> the more volatility the more products they’ll sell. Plus, I suspect the bolshevik types in Washington, D.C. have just begun with their antics.

If you would have timed the bottom of Smith and Wesson before the Covid hysteria, you would have made over 400% if you sold at the 2021 top. Their inventories were emptied on this event.

I’ve said to friends, “If you’re bearish the US economy, you have to be periodically bullish on gun stocks”.

Over the 81 years between 1926-2006, US sin stocks outperformed by 3%−4% per year (if you want to know what tobacco did… click here). It’s been argued that given various risks associated with sin stocks, investors won’t touch them and they trade at a discount. This discount ultimately allows them to be more profitable and potentially pay higher dividends which compound over time.

Above are the background checks by the FBI going back to year 2000. You can see the constant progression upwards. If we assume 2022’s monthly sales for the remaining of 2023, than this number is still 8.9% higher than 2019, setting a new bar. As of 2022, there were 4.2 million new gun owners in the United States.

And we are coming up on an election cycle…

In 2012, 2016 and 2020 small business owners around the country (mostly “blue” states) all described immense line ups for their products and declared all of their customers were doing so with “panic”. Panic that their neighbourhoods were becoming more violent but also because of tightening regulations when it comes to owning/utilizing a firearm. This time around, virtually everybody knows that things are wrong in the country.

Feel free to also read my FREE article regarding theft in America. I am positive you have seen the videos of heaps of people filling a bag and walking out as though they deserved the right to steal. At minimum this has forced many retail stores to close their hours & lock their products behind glass and at worse completely shut down operations because they simply couldn’t turn a profit any longer. Theft, from all corners, is largely normalized in society at the present moment–one must beg the question, how long until home invasions become the new norm? How many will respond by arming themselves. This is aggravated by the fact that now adults have been coached their entire life in dogma that seeks to divide people upon oppressors and oppressed.

But this is not just me shitting on the American society/culture; Americans have taken notice & responded. Look at the primary reason behind owning a gun now compared to prior years or other purposes.

When I see that, I am reminded of the video clip of a pizza boy at a doorstep who says to the woman “Let me just say, it’s a pretty nice house for a 5 dollar tip…”. When she says “You’re welcome..” he barked, “F*ck you!”. Aside from the fact that a 5 dollar tip for a small pizza is (in my opinion) crazy and the fact that it’s his job to delivery pizza… I’d hate to be in a location with any sort of wealth, unarmed.

I’ll leave you with this chart. When panic does strike, people enjoy ol’ Smith and Wes.

Closing

Smith and Wesson is an interesting stock that does well in more uncertain times without running the risk of shorting or paying Put premiums. Despite obvious pull backs in their assets, sales, free cash flow & relative fair value, they are still more than capable to manage debts’ in the event of a corporate debt crisis. Furthermore they hold the potential to thrive in a myriad of chaotic situations and shareholder equity remains consistent for the long-term due to their conservative management of their balance sheet.

Even though sales are cyclical in nature, it looks like they could be in another boom ahead of the election & worldwide uncertainty; even if this upcoming “event” remains flat, they remain profitable and are clearly not overvalued. The company may simply not be exciting to catch eyes (I remind you why sin stocks outperform) which frees up some competition for their public float. Meanwhile, with sales picking up + it’s higher beta–this stock could continue to surprise to the upside. As I said, since writing the stock is already up >19%.

Smith and Wesson management have proven themselves to not over-leverage during cyclical bubbles and has taken a long-term approach. They are conservatively positioned, but by nature of their industry they are set up for event-driven results as millions of new gun owners register every year.

In the meantime they are paying a 3.5%-4.5% dividend (0.12 USD a quarter) which is a nice little benefit to support your portfolio. I think Smith and Wesson is not going to be the stock you’re eager to tell your friends about (you should still share this article though)–but it will be a stock that not only survives any downturn in markets, it may even thrive as people are more cautious of thy neighbour.

Here’s to another 171 years!

Keep your safety on & #StayOnTheBall