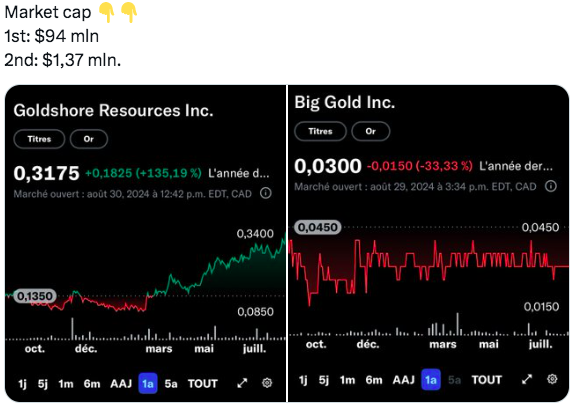

Huge Upside to a Tiny Market Cap

Company

Big Gold is an Ontario-focused junior mining exploration company, which engages in providing mineral exploration and development services. It owns the Martin Kenty and Tabor projects located in Ontario. The company was founded on October 19, 2016 and is headquartered in Vancouver, Canada. It has two main projects with little drilling activity however it is positioned adjacent to prominent mining projects.

Big Gold management and advisors have decades of experience and success defining economic gold resources and financing exploration companies, as well as taking them public.

Projects

Martin Kenty Project: Over 12,000 hectares adjacent and partially surrounded by First Mining’s Cameron Project (464,000 ounces Au M+I & 530,000 ounces Au Inf.) near Kenora, Ontario. There has been mineralization identified historically, yet no modern exploration undertaken on the property.

As of now it has good infrastructure close to the developed Rainy River Mine Complex and forestry industry roads.

Tambor Project, their main focus now (read below).

It trades under:

CSE: BG

FSE: H7L

Interestingly, Big Gold is positioned to become a low cost producer due to the ample deposit and expected high-grade. They allege they are a experienced, well-rounded team.

Historic evidence shows gold findings on their territory

Currently, management and insiders hold 34% of shares whereas retail hold the remaining. Fully Diluted (after warrants) there are 54,007,355 shares. A 54M market cap is a 33X your investment.

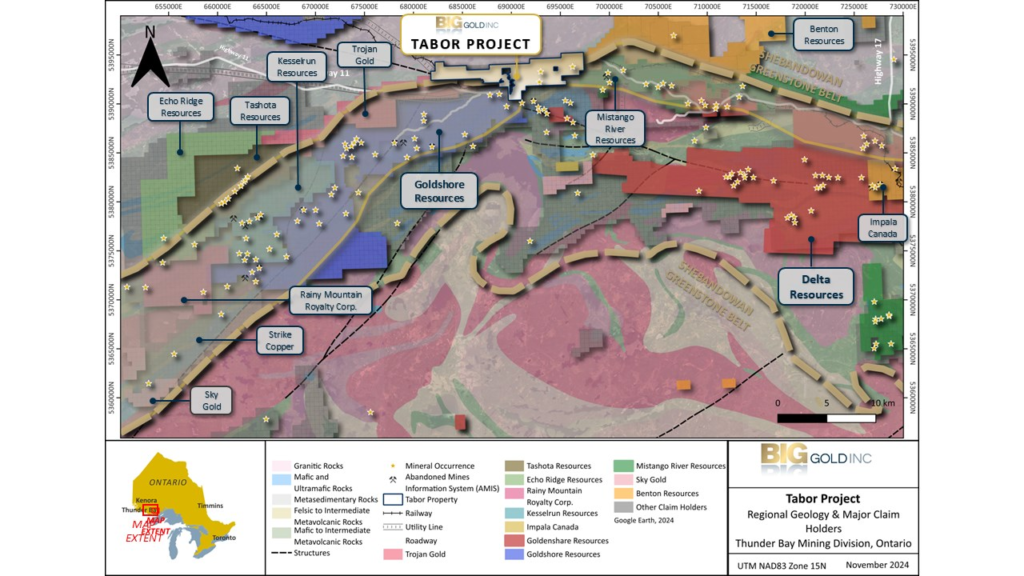

Main Area

Tabor is adjacent to the east, along trend of Goldshore’s Moss Lake gold deposit that hosts current inferred or higher category mineral resources of 6.73 million ounces gold, including an Indicated Resource of 1.535 million ounces gold grading 1.23 g/t and an Inferred Resource of 5.198 million ounces gold at a grade of 1.11 g/t* (~6.7M ounces based upon historic data). Historical exploration included drilling, trenching, and extraction of 47 tons of mineralized material–though this has only been partially explored.

The total area of Tabor is 3,224 hectares.

Gold mineralization on the project is, at least in part, associated with quartz veins, shearing and more abundant sulphides. Geological and mineralization characteristics at Tabor are similar to those found on some of the neighbouring properties, including Goldshore’s Moss Lake project where a recent drill hole intersected 2.17 g/t gold over 50.35 m and at the Delta-1, where Delta Resources Limited recently (March 1, 2024) reported a drill intercept of 15.94 g/t gold over 10 m.

Tambor has been the project that caught my eye because of the size of ounces they have inferred in the ground relative to their market cap.

Initial areas surveyed have returned highly anomalous readings indicating the presence of very chargeable bedrock containing sulphides and/or graphite. Further evaluation of the data will be completed as the survey progresses and after it is completed.

Just because companies divide up their properties, doesn’t mean the structures on the land are also divided–Big Gold is banking on the fact that previously found veins on Goldshores extends to their property.

The company is calling itself ” Low-Cost, Strategic Gold Explorer in the famous Rainy River Mine Complex”.

Story

Sporadic exploration over the past 70 years with drill programs first undertaken in 1955, then again in 1960s, and in 1983. It’s quite difficult to find information on the full reasoning why the property changed hands beyond lower gold prices.

In 2022, the company has significantly expanded its property package located near Kenora, Ontario, The new claims (“Property Expansion”) increase the Company’s holdings by an additional 6,100 hectares (“Ha”) resulting in Big Gold now controlling over 10,000 Ha of highly prospective gold exploration land in Rainy River/Kenora Mining District of Ontario.

Also from their property expansion 3 years ago:

Two claims were also acquired proximal to the Wicks Lake gold occurrence within the First Mining property where an underground decline was established in the early 1980’s to explore the extent of high-grade gold mineralization.

Another land parcel that was acquired covers a gold occurrence discovered in 1974 by Roy Martin more than 10 km to the west of his original Martin-Kenty gold occurrence. Historic work in that area and on the surrounding claims held by third parties identified a number of gold occurrences collectively referred to as the Peninsula gold occurrences.

A 1983 historic report on behalf of Welcome North Mines Ltd. reports that Roy Martin sampled one trench at the “A” zone with a result of 0.41 ounces of gold per ton over a sample interval of 10 feet (12.8 grams of gold per tonne “g/t” over 3.0 metres “m”). The report also details the presence of a gold in soil geochemical anomaly that extended for at least 1,600 feet westerly from the A zone trenches at the Peninsula gold occurrence.

Just years later, in 1987 and 1988 Canadian Nickel, operating under an arrangement with Fort Knox Gold completed geological mapping and over 6,000 m of drilling in over 30 holes in the area of the Property Expansion and beyond the current holdings of the Company. A number of the drill holes intersected gold values in the 0.5 g/t to 5 g/t range in association with strong carbonate +/- fuchsite alteration, quartz carbonate alteration and local pyrite and tourmaline. Canadian Nickel’s best find was a reported a gold intersection grading 31 g/t gold over a core length of 0.49 m. These previous finds match those found at the Peninsula gold occurrence several kilometres to the west along the same trend as the Peninsula gold bearing alteration zones.

Discoveries So Far

The up to 1,200 metres of the maiden drill program, is focusing on the East Divide Target Zone which sampled 11.4 g/t Gold (Au) from surface during Phase 2 exploration and 1.46 metres of 10.9 g/t Au, 34.1 g/t silver, 0.5% copper, and 1.8% zinc from historical infill drilling.

This is from a drilling program that commenced in middle November.

NEWS: Big Gold is pleased to announce that another mineralized intersection has been drilled at the Tabor Property in the Shebandowan Greenstone Belt in Northwestern Ontario (Figure 1). Drill hole TB-24-004 intersected an interval that contains mineralized quartz vein material with up to 4% pyrite and 2% pyrrhotite.

Things I don’t like

- The story behind the property is challenging to find (how they came to it; why here? Why hasn’t it been bought up before them, details on land, etc.)

- There is very little media presence besides their recent drill results that beginning to show ore

- Permitting and licensing barriers before taking this to the next level

- Struggling to make a move despite higher gold prices and some mining stocks making a turn around

- Their market cap may have crossed a threshold of being so small that small institutions and funds will not bother

- I know many will disagree with me–but I’m increasingly less confident that Canada will remain regarded as a “Tier-1” mining jurisdiction. By the time they receive all of their drilling, PEAs, permits, licenses, studies and plans; the country may be very anti-business. Here’s one explanation in action:

Closing

The company is very small, very cheap and very unnoticed. It’s caught my eye however because of their interesting tactic of putting their geological expertise to work by not necessarily acquiring property that has been drilled extensively but by a different plan. Rather, they’re taking advantage of old data that paints a picture of veins and systems that flow onto their property. Others have been pleased of buying early since slight stock price moves can be radical returns for people.

The matters we know right now are that they are in with some major gold belt districts with lots of capital in the region. We can compare other players nearby with much higher market caps and price action.

Their land package has very recently pulled out high-grade gold with additional minerals and we await further assays. Whether this company could bring on the next phase of exploration to reach development or pitch their findings to a major company for purchase, remains to be seen. However, what seems increasingly the case is that the land they are sitting on, with their gold in the ground, is far more valuable than what the market is pricing them at the moment (December 27th). In other words, even if this property doesn’t mature into production like Red Lake in Ontario, it is still an undervalued opportunity to pick up shares, especially if you feel that the underlying gold price is set to increase.