I wanted to throw caution to the wind with the financial powerhouse of Singapore.

As a disclaimer, I think Singapore is an amazingly impressive country, with some great history, it’s high functioning, with a surreal airport, it’s stock market has some great companies that are undervalued with great dividends (see my article on RE4), it’s been a poster child for banking and gold storage—lots of great features of Singapore.

Please pick this up!

While I don’t think it suffers the same economic flaws or traps that say Japan, Turkey, Lebanon or Egypt (see my article here) may have, I did want to share some data that could be cause for concern.

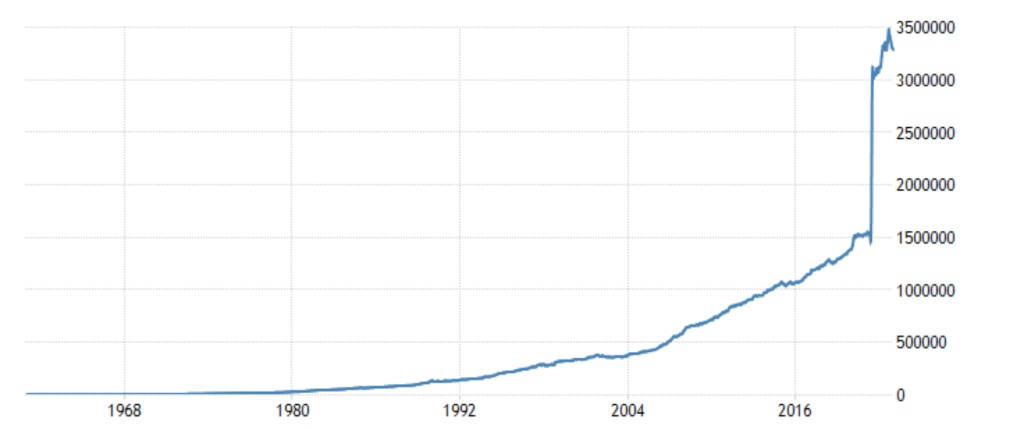

First of all is the M2 money supply, or otherwise known as broad money (money such as notes & coins + short term deposits/debt), This is often used when discussing inflation (cause it relates to immediate spending).

It has been hit with an exponential increase totally different from its normal pattern. Notice how it continues to undergo an increase after 2020, too.

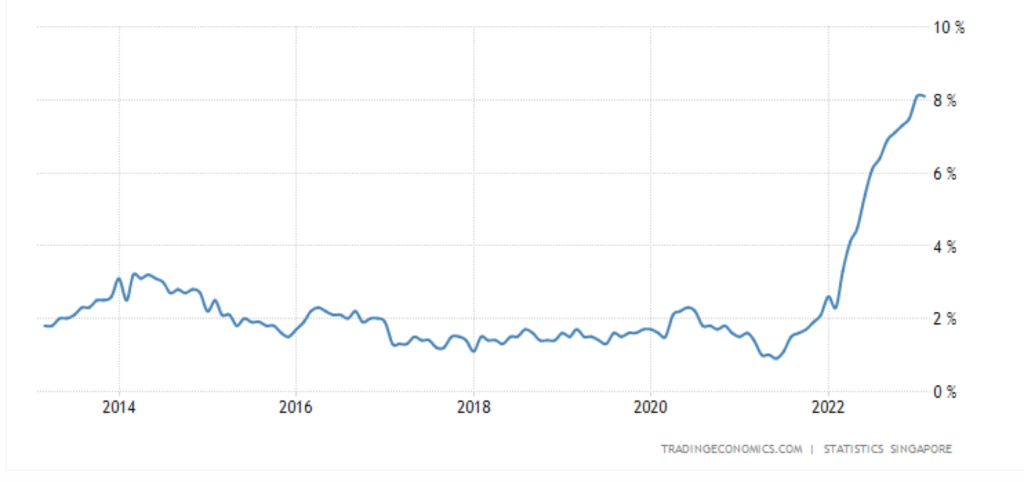

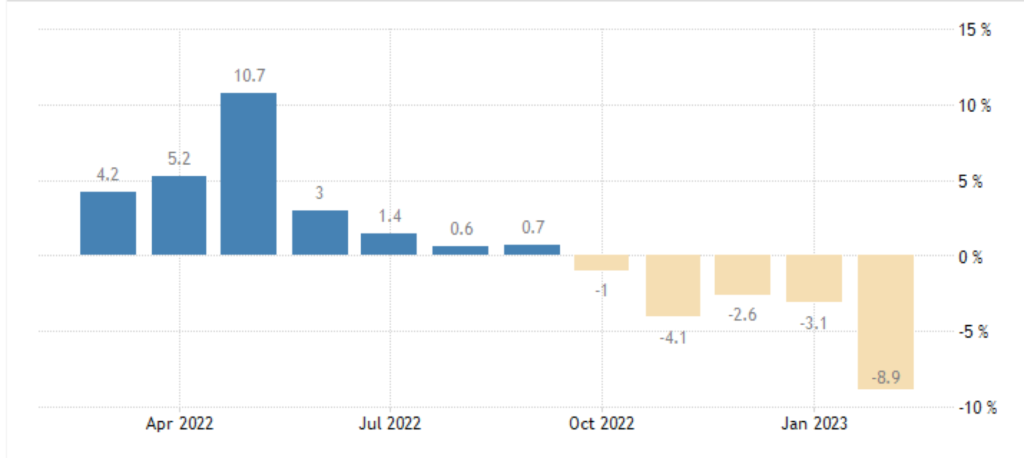

Food Inflation has been noticeable in the country as well.

Some of the costs inside of this are meat at 12.5%, cereals at 7.9%, vegetables at 6% and dairy at 7.1%. Even Food services like fast-food and catered services remain elevated at 8.1% & 8.4%, respectively (Data from February 2022).

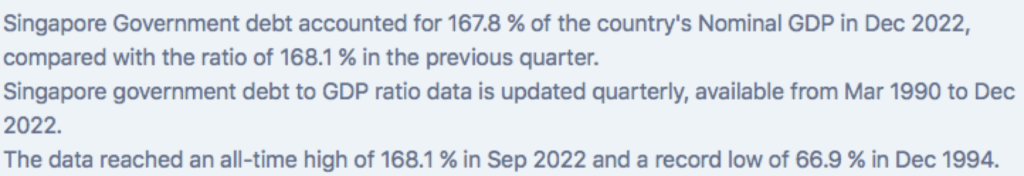

Debt to GDP has been on the steady increase taking after Japan and the P.I.G.S. as well.

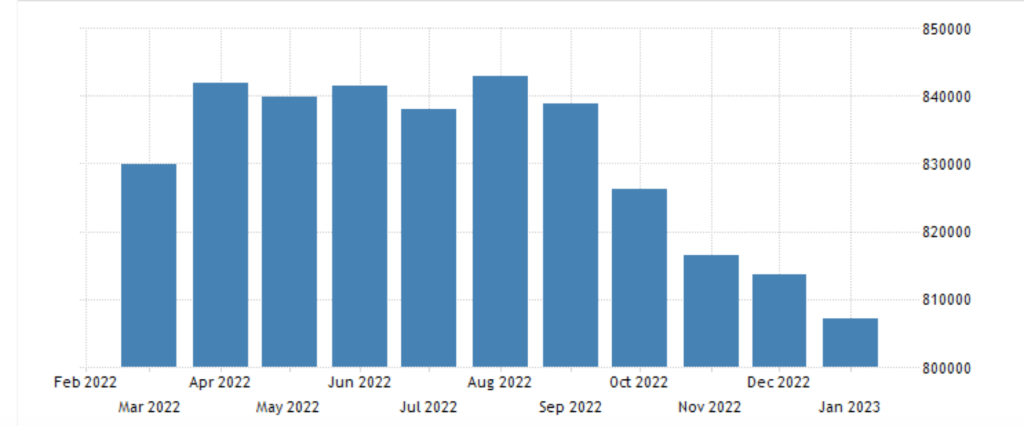

Perhaps as a sign of slowing up, loans to the private sector have decreased, manufacturing production continues to fall & retail sales Y.O.Y. fell negative (as per the Monetary Authority of Singapore, Singapore Economic Development Board & Statistics Singapore).

Loans to Private Sector

Manufacturing Production

Retail Sales YoY

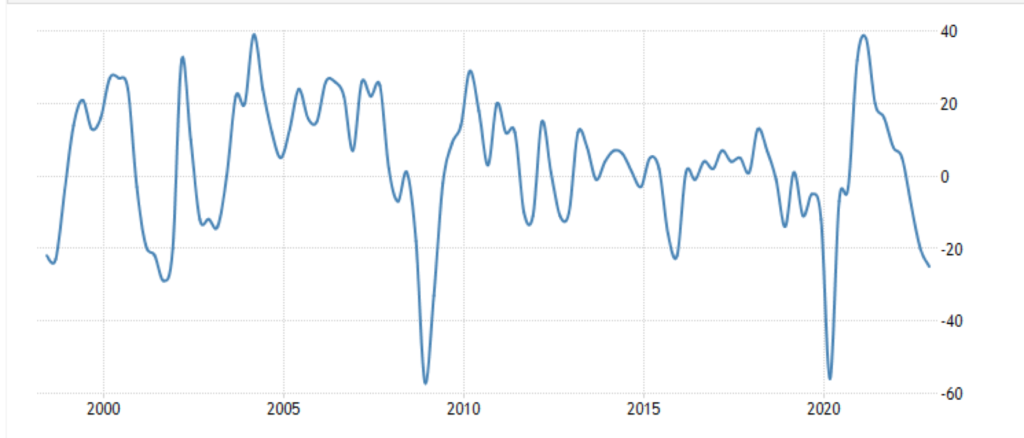

This has been coupled with a relatively recent decline in Business confidence as well as seen below.

Pick Up Our International Newspaper; 25 dollars for the entire year. Huge Coverage in Brief Points!

The retirement age for men and women was upped from 62 to 63 from 2021 to 2022, perhaps to accommodate the slow-up in business activity and confidence or the new record low fertility rate of 1.05 (2.1 is required to sustain a population)!

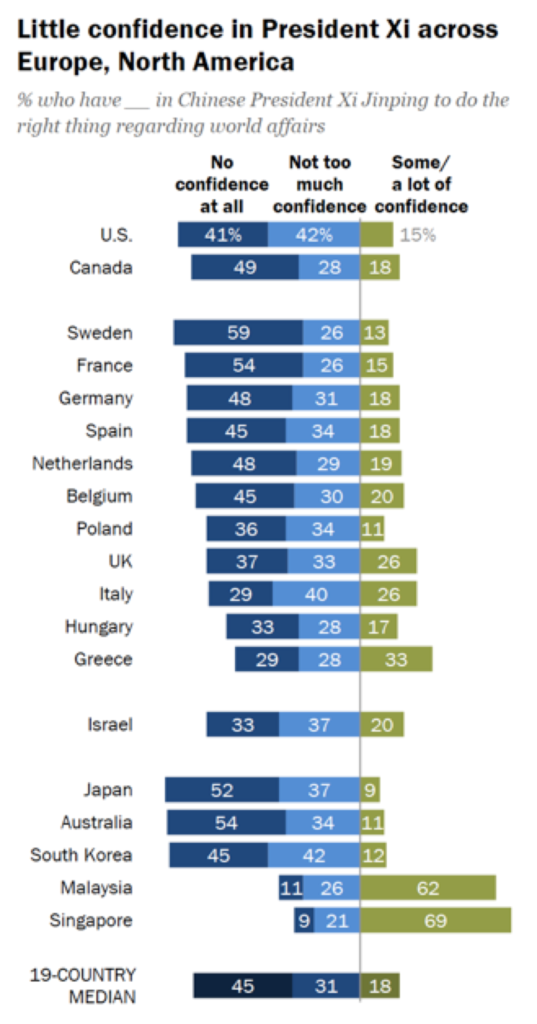

Less to do with the economics of the country and more about its ideological direction pertains to its comfortability with communist China. Singaporeans & their Malaysian neighbors generally seem favorable towards the regime in Beijing. Anecdotally, I have a friend who friend from there who took the whole 2020 charade quite seriously, as did most in China of course. As per a Pew Research Study of 2021, see below.

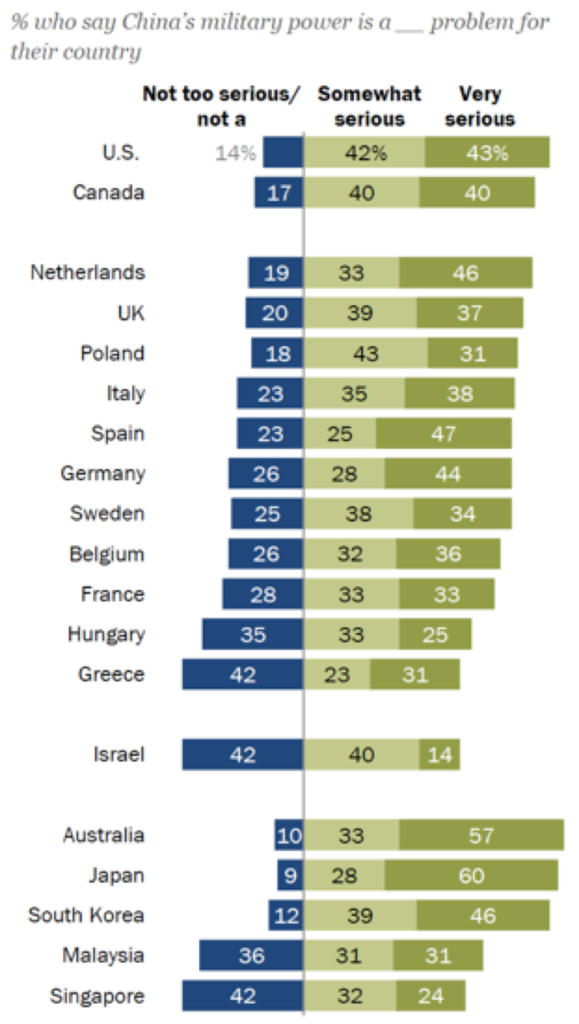

Lastly, I encourage you to have a read about “the Fall of Singapore” or “Battle of Singapore” in case you see a World War 3 like scenario developing. Regardless, here’s some data for you to consider (assuming that Singaporean data can be trusted anymore than the CCP data)!

#StayOnTheBall