Smooth Sailing but Unable to Dock the Stock

Most of the world does not produce anything themselves and rely on imports; this is especially true when it comes to resources. Russia accounts for a meaningful percentage of the world’s commodity production as Europeans have found out the hard way over the last couple of years.

So how do you get those Russian commodities to market. Russia has practically a single rail spanning their country and little further development on this front. Air travel is expensive and impractical for large orders and trucking limits the available distribution. It doesn’t help being the biggest country on earth either. Well, they have to ship it! And that’s what I’d like to discuss below.

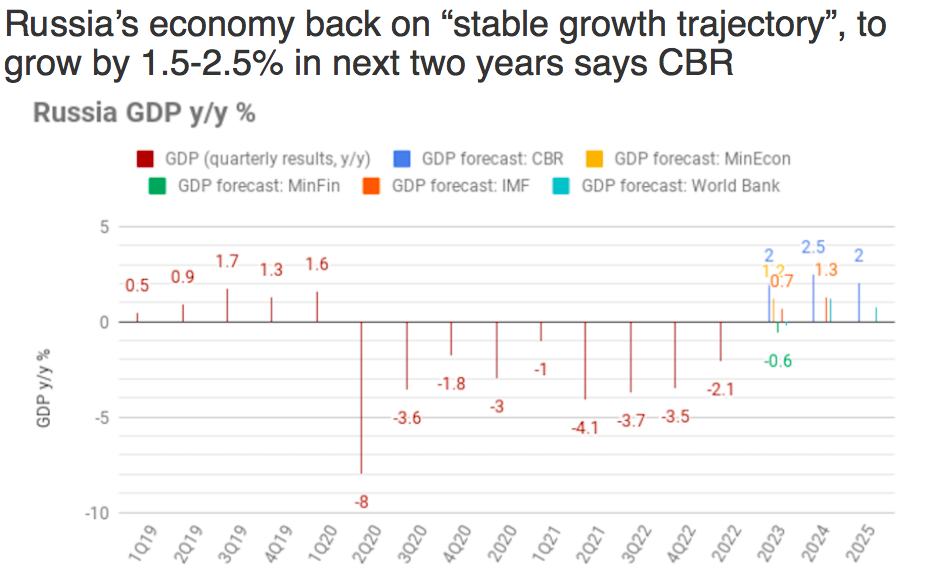

The Russians have witnessed a resurgence of inflation and I’ve been told by boots on the ground that there’s a feeling of uncertainty of the future by business owners, after all, Russia has been at war practical since her existence, whats another one?

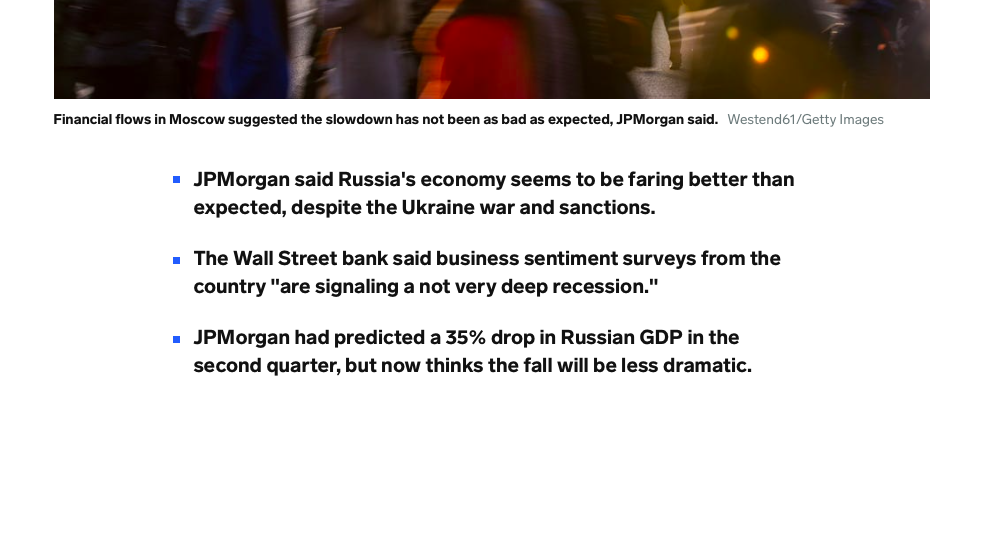

Despite this, Russia has stomached the sanctions quite well with their economy showing signs of growth, gold reserves remaining high and the gas pump, pumping. Before the sanctions (that continue to be added), I was interested in the Moscow Stock Exchange for some attractively valued companies that paid dividends and relatively small amounts of equity were interested. Investing in Russia sounds like putting everything on red in the casino but comparing how Western markets have gone (e,g. London commodities exchange halting Nickel futures trading, Canadian citizens having their deposit accounts frozen, Sam Bankman-Fraud showing the two tier legal system in the USA and French citizens told that they cannot sell their real estate unless they renovate it to become more “climate friendly”), I was willing to take the risk. Plus, it was a great moment to diversify away from US markets.

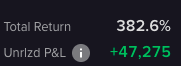

If anyone has been holding Russian stocks, you know how this story ends. You may have not been checking the status of those frozen stocks (unable to purchase or sell) but if you go look you may be actually up on them after a violent 70-90% drop in share price. One, however, a shipping stock, never really fell… in fact, it WONT stop going up.

I remember getting a short lesson from a hedge fund manager who said “never be afraid to take profits” so you can imagine that the photo below is a little troubling, in a weird way. In the event that we have access to Russia again, I wanted to share this company.

The company is Far East Shipping ($FESH on MCX) which is a Russia-based transport and logistics company. The Company’s activities include: sea freight transportation, operational management of sea vessels, maritime agency services and maritime mediation; liner transportation and forwarding services; railway transportation; operation of port facilities and container terminals; and services for the sale of petroleum products for fleet bunkering.

Be sure to take advantage of anonymous-posting! Build a writing name on our platform –> Private Posting

Balance Sheets

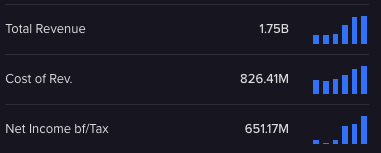

Total Current Assets: 742.43M USD

Total Assets: 1.749B

Total Current Liabilities: 393.83M USD

Total Liabilities: 796.7M

Market Cap: 3.36B

These numbers are in Rubles, but I just wanted to post the growth trends of Free Cash Flow, End Cash Position, Operating Cash Flow & relatively small Issuance of Debt.

Ratios

P/E: 5.9

P/B: 2.6

P/S: 1.92

P to FCF: 12.28

EV to FCF: 4.23

Total Debt to Total Capital: 23.41%

Debt-to-equity: 0.44

Cash-to-debt: 0.77

Cash per Share: 0.06

Quick Ratio: 1.83

Cash Ratio: 0.78

Performance

Ending Jun 2023, revenues increased 9% to RUR91.74B (930M USD). Net income increased from RUR14.4B to RUR31.08B (150M to 312M USD).

Revenues reflect Liner and Logistics segment increase of 6% to RUR77.09B, Ports segment increase of 34% to RUR12.66B, Railway Services segment increase from RUR499M to RUR1.05B. Net income benefited from Corporate segment income increase of 42% to RUR4.54B.

Also Q2 2023 performance: Basic earnings per share from continuing operations was RUB 10.531 compared to RUB 4.879 a year ago, more than 100% increase.

Q1 2023 had even higher figures: For the full year, the company reported sales was RUB 162,639 million compared to RUB 113,709 million a year ago. Net income was RUB 38,613 million compared to RUB 37,306 million a year ago. Basic earnings per share from continuing operations was RUB 13.084

90% of the net income is purely derived from operating activity. This is likely due to their small debts in a capital intensive industry. “Net debt as of June 30, 2022 decreased to 9 259 million rubles from 22 942 million rubles as of end of 2021” (93,978,850 USD Net debt)

Further performance metrics are as follows:

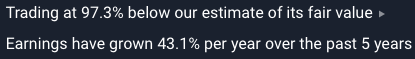

EPS Growth: 37.08% (TTM; 3.51% 5 Yr Avg)

Net Margin: 33.04% (15.08% 5Yr Avg)

ROE: 58%

ROI: 43.18%

ROCE: 45.6%

ROA: 34.48%

SG&A/Sales: 11.96%

No dividend in the last 3 years

Shares outstanding: 2.95B (no change in at least 5 years)

Ownership

Ownership is split 50/50 between two strategic consulting firms and Other individuals. Only two recorded institutional companies are present and priced as zero (due to the sanctions).

It is quite challenging to find up-to-date information on the company as so many people have been locked out from that market. I’m sorry I don’t have more for you but I wanted to write this for 2 reasons.

Message

The first is to highlight to remind people to take profits when they can. It’s easy to let emotions take over and become attached to a stock–as my father has remarked once “Oh, but I don’t want to sell it, it’s done so well for me!”. The second is that I am still bullish on the Russian market–as you can see from these ratios. I was listening to an interview with Dr. Dave Collum who said, “If those markets [Russian] ever open again, i’d be willing to jump back in”

To me, if you can gain exposure, Russian equities have gotten more attractive since so much foreign equity has been squeezed out (or spooked away from ever returning!) to remove a lot of competition for you to get it while things are still valued nicely. As these sanctions have come in, companies like this one have literally doubled their earnings per share. It’s also important to note that this increase in share price occurred without any European or Western capital.

I do not see the Russian-Ukraine war being strenuous to the Russian economy very much in the future either (many investors now think its in a state of collapse).

To further my point why I am bullish on Russia is partly from the case I am making that Russia is not the primary objective in the Ukraine war, you’ll also find that article on the subscription level, please don’t miss it!

I wish to close by saying an investor & close friend of mine has found an interesting way to play Russia and it is not what you’d expect! It is also available for you on our subscription service. I suggest following him at his Twitter too –>

Thanks for reading & remember:

#StayOnTheBall