Cartels use Walls, Grandpa uses his Couch & Everyone Else uses the Reverse Repo

Where do we put all this cash? If only we had that problem, eh!

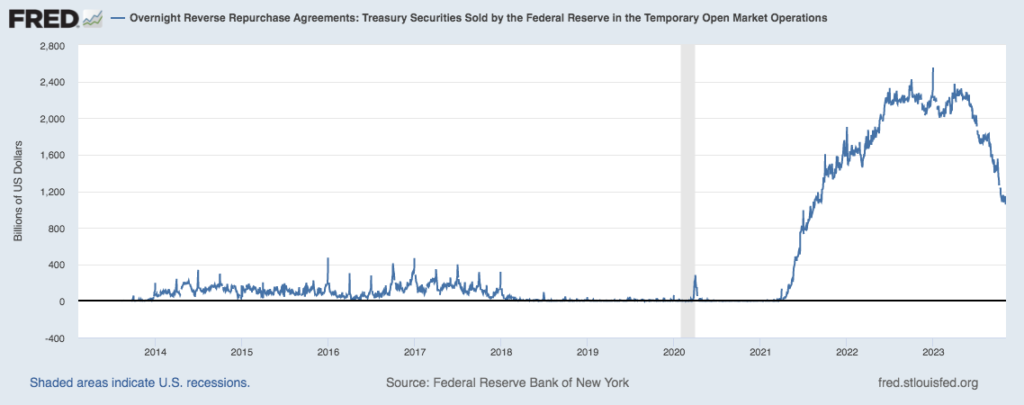

Well, large institutions do have that problem. Money Market Funds (MMFs), hedge funds and large international banks have been utilizing the Reverse Repo a lot since the onslaught of fresh new reserves were created to bail out the economy (due to a ridiculous set of government measures and lockdowns and leftover failures from 2008 but thats another post). In effort to not flood the public markets (and rip inflation FAR higher than where we’ve been), liquidity has been housed in (Reverse) Repurchase Agreement facility at the Federal Reserve.

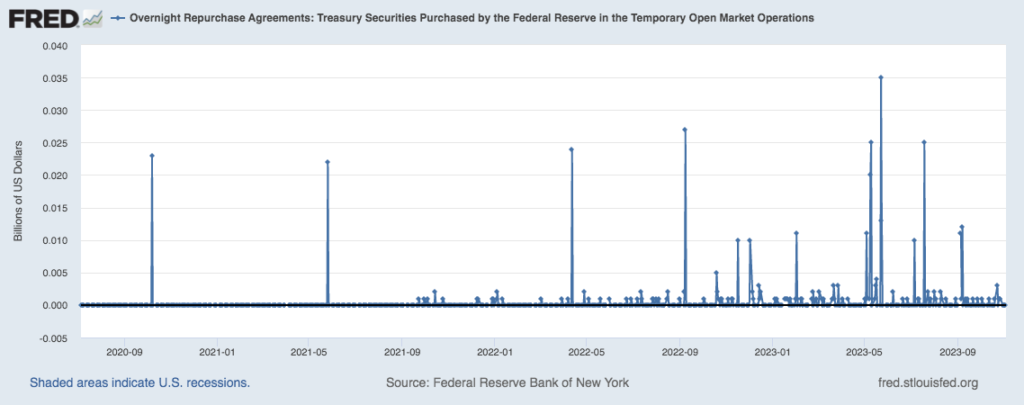

Repo

As a reminder, the repurchase agreement or Repo is when a bank or MMF has collateral, or assets and they’re short on cash. They post their collateral and borrow the cash they need for their obligations and sign an agreement to repurchase the collateral they just sold at a slightly higher price with the person who lent them the cash. Hence the name “repurchase” agreement. Look at the Federal Reserve’s activity in the Repo market, it’s hardly anything… (again, this refers to having too much collateral and wanting CASH).

On the other side, a Reverse Repurchase agreement or Reverse Repo is when there is too much cash they’re looking for good collateral for the asset side on their books.

In essence, the whole aspect of this is for banks and large financial institutions to be made whole–they borrow overnight to meet their reserve requirements and make sure they can pay their debts on time to others/earn a yield. Your bank deposits aren’t necessarily with your bank–they’re with all banks (if they have access to the repo/reverse repo). Money finds a home somewhere. In other words, one should do away with the belief it’s “their” “money” in that “local” bank account.

Want to know how to get started with buying gold bullion or coins? Check out this article and contact us HERE!

But something is changing–this facility at the Federal Reserve is being drained, fast.

Reverse Repo.

The Government/Treasury has been spending like drunken sailors and are looking for ways to spend even more (national deficit is up 122% from last year). In normal circumstances, the borrowing would come from the Federal Reserve, China and Japan, roughly speaking.

However, China and Japan have been allowing those debts to be repaid & deciding to not role it over again. At the same time, the Fed has been holding a reduced level of treasuries (same as July 2021). So, more spending = more borrowing, but from where?

Reverse Repo

As we can see, up to 2.4 Trillion dollars made its way into Reverse Repo at the Fed during the whole hysteria–but it’s coming down continuously. It’s almost down one trillion dollars since the beginning of this year. In other words, government (Treasury) is borrowing from the reverse repo.

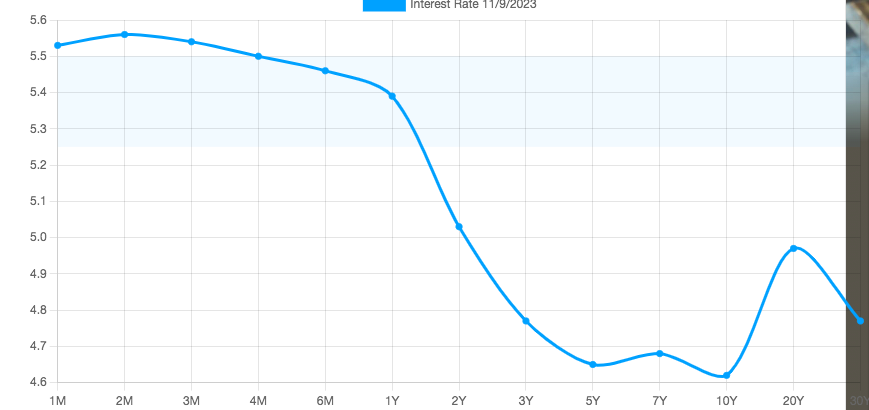

Excess government borrowing and spending (the Bidenistas raised the national debt by 1.45T in 3 months alone) has caused interest rates to rise. As interest rates rise, more and more investors will decide that it’s a better yield/risk at the Treasury (as opposed to the Fed) and will purchase those T-bills/Notes/Bonds. But this buying will bid-up prices for Treasuries to lower interest rates back down.

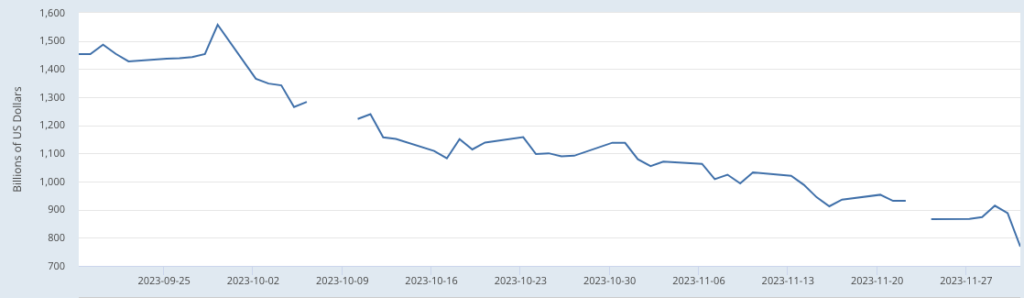

Buying treasuries and government spending are a sort of tug-of-war. So how long can this ‘up and down’ in interest rates last? $700B and some seconds…

You can see that Reverse repo at the Fed now has approximately $700B left to be borrowed upon. Remember, 1.45T was spent in the last 3 months, now add elections, Russia/Ukraine, Israel/Palestine, many protests everywhere + a worldwide migrant crisis–what are the chances the government will borrow/spend responsibly now?

Why is this important?

The 2008 Financial crisis was ultimately a Repo banking crisis where banks posting collateral (to access cash) was hindered by the fact that nobody trusted the collateral in Repo (garbage mortgage-backed securities). Essentially, no banks could access cash when they needed it, and a chain reaction of defaults occurred.

Similarly, as long as the Reverse Repo continues to fall, this means that there’s less and less cash around for borrowing (or receiving collateral). Without being able to receive collateral, the entire financial system grows precarious once again, interest rates rise rapidly and than markets begin to crumble amid higher debt payments rolling over.

This is why many speculate that inflation will run hot for some time, because to sustain this system of zombie collateral, the Fed will be required again to inject another round of cash (and/or cut interest rates)–some of which will flood into real markets such as commodities–which means higher gas, food and rent prices for you and I. And so the cycle repeats.

Centralized Economy

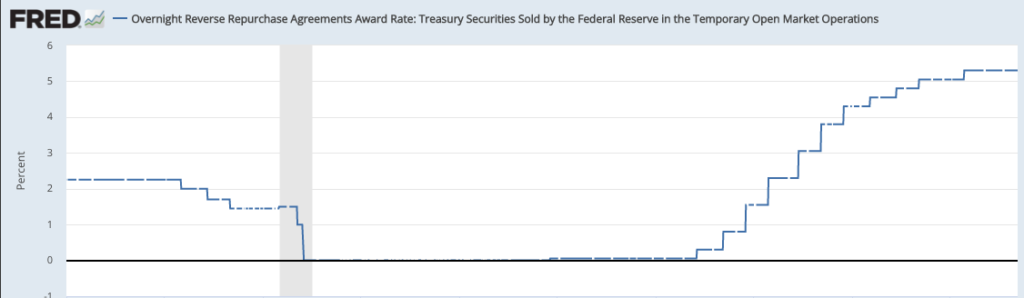

Another problem that we can derive from this is seeing the big players with big cash not in the “market” per se. Why would you be in the market if you’re getting 5.3% in Reverse Repo overnight when the market is giving you 5.4% over 1 month. While the government treasuries are known as the risk-free rate, there still exists risk in the form of government closures, defaults or interest rate risk. The Federal Reserve on the other hand is truly risk free with their digital money printer–like the game of monopoly, the bank never goes bust.

The game is return relative to risk–not absolute return. For large banks, receiving less interest from the Fed rather than the debt markets may be a better deal given their ‘Money-printer’ level risk (zero!). This ultimately means that there’s a growing detached economy that operates independent from goods and services otherwise known as ‘The Real Economy’.

If fewer and fewer hedge funds, MMFs and banks are trusting the collateral of other counter-parties–and are instead electing to park their cash for yield (even if it may be smaller) at the Federal Reserve, than this must signal they believe something is fundamentally insecure.

It’s challenging to point to one problem in the economy, but if I had to, it would be the fact that there is far too much debt & spending.

The Debt Doom-Loop

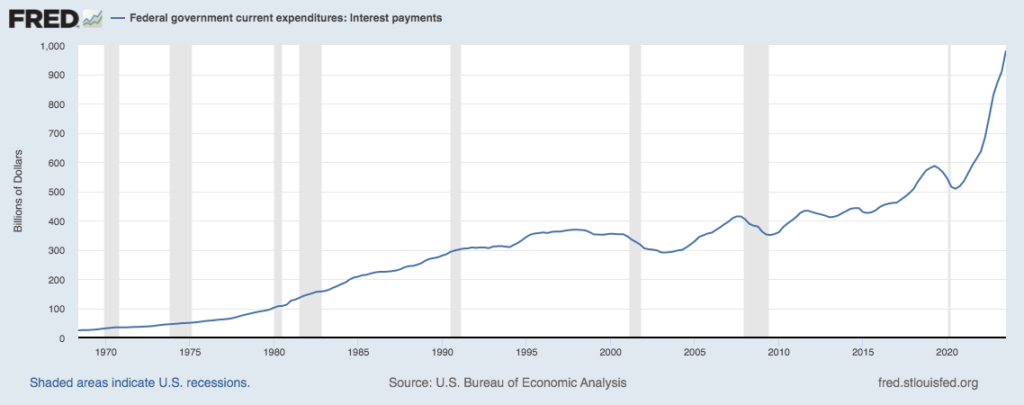

Essentially, more spending means that there’s more debt.

More debt means there’s more nominal payments to be made on that new debt load

Which means more borrowing must be done to service the pre-existing debt

Which means the issuances of more Treasuries must be done, flooding supply.

A greater supply of Treasuries signals that prices fall, and interest rates rise.

Which causes the “price” of the pre-existing debt to rise (due to higher interest rates)

Which means more borrowing

Which means more spending to compensate for the higher interest payments & higher nominal debt load

Restart from the top.

This is not speculation. It’s happening. Look at the interest payment on the total debt compared to prior years.

Closing

So bottom line, the players in repo markets have lots and lots of cash and have been hunting for a shortage of collateral (explaining the Reverse Repo being far more active than the Repo). Although, this is changing and cash is finding a new home.

At the same time, Uncle Sam is deficit spending like never before and running huge debts. To fund their spending addiction, they’re issuing more treasuries to draw out more cash from the Reverse Repo.

It will be interesting to see which point financial institutions decide to park their cash with government debt instead of at the Fed (at what interest rate?). I suspect that the Federal Reserve will wish to keep the interest rates higher (for longer) by ensuring that these money market funds & banks don’t elect to jump to the higher paying treasury. [Sure enough, the Fed continued to award 5.3% since August 1st]. You can begin to see that while the Fed aims to reduce asset prices/inflation, the government borrowing and spending is increasing inflation. Like I said, a tug-of-war.

All of this is due to Uncle Sam and his gambling addiction to spend more and more–effectively running the borrowing machine to a point where it overheats and hits a crisis. Someone has to lose.

A lot of people are looking for indicators that may tell of a higher or lower stock market. I think it may be useful to watch the Reverse Repo facility. If we see how much cash is being drained, we should see the yield curve respond accordingly and get a sense of the available collateral in the system.

#StayOnTheBall