You’re Gambling on Gambling

It’s been widely remarked that gambling is a recession proof industry since people who are down on their luck gravitate to high-risk, ‘get rich quick’ schemes. I wanted to write this article to go through some of the literature to say that the results are not that simple and that an investor trying to exploit gambling stocks has to be careful.

Overall the evidence favours one side but is a bit murky.

*This is derived from our set of Researched Content for You* Learn more here

Who’s Betting For?

During the recession of 2001 (commonly known as the dot com bust), commercial gaming revenues rose by 3.1% according to the American Gaming Association.

In Capacci, S., Randon, E., & Scorcu, A. E. (2017), the researchers found a positive correlation between consumer confidence index with higher spending on skill-based gambling (more on this later). They found that as long as people are confident in the economy, they will continue to gamble (despite the actuality of the economic figures). In other words, the narrative guided their choices.

It’s long been thought that casinos holding a monopoly on the gambling industry has made them more resilient as well.

The Permanent-Income-hypothesis predicts that people’s consumption is intrinsically linked by their long-term income situation. As a result, business-cycle-induced fluctuations in income which people see as temporary will have little effect on their gambling expenditures, and income should rather have a long-run relationship with consumption. In other words, the public are already allowing for that expenditure.

Any studies that have shown gambling patterns fall with recession periods may have the flaw of being too specific on two factors; the type of recession and the type of game being played. In the former, the housing crisis is often used in data, perhaps the selected subjects were exposed to housing at that period in time. In the latter, perhaps behavioural or preference changes could have explained a reduction in gambling in specific games.

Who’s Betting Against?

On the other hand, research also shows that people may spend less at casinos during economic recessions. This is in line with the decreased revenues the gambling association had witnessed from 2008 and 2009 relative to 2007.

Gu 1999 showed that during the Asian Financial Crisis there was also a slump in Las Vegas gaming activity among all Asians.

Additionally, the permanent-income-hypothesis assumes that people are rational and highly conscientious individuals, whereas an abundance of literature shows that stress, emotion, anxiety all can impact acute gambling behaviour–effectively debunking the previous hypothesis that everyone budgets in their expenditures.

Further adding for the Bet Against category is Capacci et al, 2017. When they controlled for unemployment and the emergence of new gambling options, skill-based gambling did not change much with a delta in economic conditions

People rely on Luck more than Skill

Evidence points that it’s not a clear cut answer that “gambling is good/bad” during recessions or economic troubles. Iceland for instance, showed a large increase in gambling behaviour during their long-lasting financial crisis–but only with respect to “luck-based” gambling as opposed to “skill-based”. Luck based, relates to bingo, lotteries, something purely left to chance whereas skills based involves some prior understanding or skillset such as poker or sports betting.

Further evidence by Horvath and Paap, 2012 using the time series for the period Jan 1st 1959 to Aug 1st 2010 that among the three gambling activities, only lottery consumption appears to be recession-proof. This series is characterized by a vast and solid growth that exceeds the growth in income and the growth in other gambling sectors. Casino gambling expenditures show a positive growth during expansions and no growth during recessions. Hence, the loss in income during recessions affects casino gambling–monopoly or not.

Mark P. Legg & Hugo Tang had demonstrated in their paper that Casinos are not recession proof because their expansion has extended to other areas of the economy such as lodging and convention industries & food and drink (most recently, DJ shows). Upon evaluating revenues in Las Vegas from 2007 to 2010, they found that they were more exposed to economic conditions compared to the dot-com bust of 2001 despite showing heightened revenues across the say time period.

A separate study which you can see again that the rate of expansion was notably larger when observing “luck-based” systems such as lotto or bingo rather than sports betting or card games where there’s an element of skill. In fact, sports betting and EGMs had shown a contraction in their use.

Mikehell (1994) found similar results where despite being in a recession, Americans tended to view lottery sales as being a miniscule loss compared to the large payout they could get (that they viewed they needed now more than ever). Interestingly, he found that for every 1% of unemployment, lottery sales increased by 0.17%. This same pattern was found in Capacci et al (but only with luck-based gambling).

Part in parcel of it increasing may be due to the fact that people are willing to play. Kearney (2005) in Journal of Public Economics quotes “[this result]…provides unambiguous evidence that households respond to the introduction of a state lottery by increasing their gambling expenditures at the expense of a reduction in other forms of consumption”. In other words, people tend to make room for the introduction of a lottery whereas other forms of gambling such as sports betting, EGMs, casinos or poker games do not show such response.

Therefore, if one was to take advantage of gambling behaviour during economic troubles, one should remain cognizant of all the expenses incurred. Aside from the expenses, there is a clear proclivity for gambling behavior to increase during economic recessions but primarily for luck-based or lottery games.

Are there any lottery stocks?

Some stocks that grant exposure to lotteries are below (not recommending them, just wanted to give some names for you to check out!). I gave some numbers, but not a complete breakdown.

- $NGMS NeoGames: NeoGames S.A. provides iLottery solutions worldwide. The company offers various technology platforms, a range of value-added services, and a game studio that provides a portfolio of games through personal computers, smartphones, and handheld devices. It also develops and operates online lotteries and games that allows lottery operators to distribute lottery products through online sales channels using the company’s technology. In addition, the company offers software development and platform services; and regulation and compliance, payment processing, risk management, player relationship management, and player value optimization services. The company was incorporated in 2014 and is headquartered in Tel Aviv, Israel.

- P/E: -84.2

EPS: -0.41

P/B: 6.47

P/S: 4.03

Sales/COGS 2022: 165.7M/133.19M

Gross Profit: 32.51M

SG&A Expense: 38.95M

Net income (2022): -18.7M

Net income: (Q3, 2023) -10M

Total Current Liabilities/Total Current Assets= 77.5% (91.5% as of Q2 2023)

Total Liabilities/Total Assets= 68.47%

Net debt: 190M

Against all the censorship, blocking and banning you see today? Publish with us, anonymously

www.imontheball.com/user-submitted-articles/

- $IGT International Gaming Technology: International Game Technology PLC, formerly Gtech S.p.A. and Lottomatica S.p.A., is a multinational gambling company that produces slot machines and other gambling technology. The company is headquartered in London, with major offices in Rome, Providence, Rhode Island, and Las Vegas.

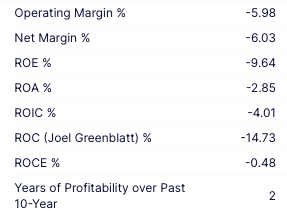

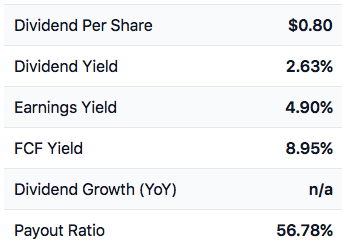

P/E: 21.27

EPS: 0.45

P/B: 4

P/S: 1.29

P/FCF: 11.18 - Revenue: 4.69B

Gross Profit: 595.23M

Net Income: 295.6M

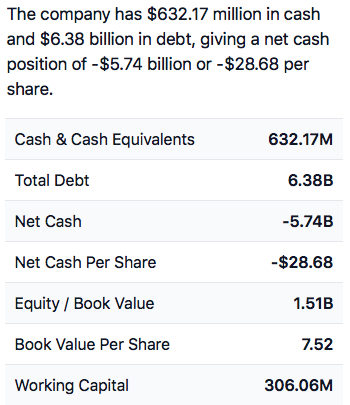

Market Cap: 6.09B

Enterprise Value: 11.77B

Total Liabilities/Total Assets= 81.07%

200.29M shares outstanding

- $GDEN (Golden Entertainment doesn’t look too bad but I believe there’s better options out there since it has large asset exposures; it has been rocketing as of late): Golden Entertainment, Inc., together with its subsidiaries, engages in the ownership and operation of a diversified entertainment platform in the United States. The company operates through five segments: Nevada Casino Resorts, Nevada Locals Casinos, Maryland Casino Resort, Nevada Taverns, and Distributed Gaming. The company was formerly known as Lakes Entertainment, Inc. and changed its name to Golden Entertainment, Inc. in July 2015. Golden Entertainment, Inc. was incorporated in 1998 and is headquartered in Las Vegas, Nevada.

Revenue (2022): 1.12B

COGS (2022): 737.27M

SG&A (2022): 235M

Gross Income (2022): 384.45M

Net Income (2022): 82.35M

Net Income (Q2 2023): 12.25M

Total Current Liabilities/ Total Current Assets: 54.7%

Total Liabilities/Total Assets: 76.6% (unchanged last quarter)

Closing

I am normally a fan of sin stocks because I do believe people revert back to primal instincts–our brains are on autopilot and we are simply along for the dopamine ride. Having said this, the data simply does not suggest that it’s a clear cut recession-proof sector. Even when we look at the lottery/gambling stocks, their numbers aren’t too impressive by either not making any money or having a crushing net debt on their books–there’s better options elsewhere in my opinion.

Click here to read about one you probably missed Free from the Subscribers Section!

One should tread lightly when jumping into this sector if they hold a bearish outlook on the economy. It seems when you’re investing in gambling, you’re pretty much betting on the underdog!

#StayOnTheBall