Qatar Player

It’s very easy to get trapped in on one market or worse yet, 20-30 stocks that come up on the CNBC ticker at the bottom of our televisions. God forbid you listen to Jim Cramer. Perhaps because there are just so many companies to choose at any given moment it is easy to miss the opportunities everywhere. Much of the world are not as financialized as US markets; this makes them a lot less likely to see fast, rapid growth but a lot more resilient in times of crisis.

Whatever the reason, I’m writing to bring some attention to the relatively small stock market in Qatar. Qatar, one of the wealthiest countries on the planet by per capita has witnessed substantial GDP growth over the last couple of decades. Perhaps you think of the World Cup, desert, bitcoin millionaires and kanduras & hijabs–but there really is a functioning country behind all of these images, one who has focused on reinvestment of their riches into global markets.

Qatar had done well regardless of their economic sanctions placed upon them by their neighbours (which appear to have largely normalized) & has proven their ability to mediate between Iran and Saudi Arabia & UAE on political and economic matters.

Qatars success has largely come from their natural gas discovery that accounts for the largest ever found in the Gulf and are 3rd of the world’s reserves (871,585,000 MMcf) . Qatar also supplements these enormous profits with oil as well. Cleverly, the government has focussed on reinvesting these profits into real hard assets. Some jaw-dropping evidence:

Qatari government own>>>

- Qatar’s sovereign wealth fund sits at 475 Billion

- Qatar owns 40B GBP worth of UK assets such as all their major banks, British Airways, 20% of London Heathrow and more than 4,000 title deeds to both existing real estate and real estate development.

- The Al-Thani family owns so much of an area of London it’s called Little Doha

- All 5 of London’s most prestigious hotels are partially or wholly-owned by Doha

- 865 Million dollars of the Italian Luxury brand Valentino Fashion Group

- They own half a billion dollars of the Empire State Building

- SC Barga, the Portuguese football club (owning 22%) & Paris Saint Germain is owned by the Qatar Sports Investment Chair, Nasser Al-Khelaifi.

- 300M of Le Grande Hotel in Paris

- Even possess two of the world’s most expensive paintings ranging from 250-300 million dollars.

It is strange that we may hear about Qatar’s success, but its quite difficult to hear about gaining exposure to their markets. This quietness has collectively perked my interest—a player who doesn’t draw crowds (outside of soccer), who is not known for a large economy or makes much news in the Western world but one who has steady performance. Turns out—for purposes of this article—they have a stock market, too.

Upon looking at their market, I found 2 stocks that are interesting to me (will provide more in the subscriber’s articles). I should declare this is not investment advice nor should it be taken as such—the purpose of my article is to generate discussion & aid you in thinking about your own investments after doing your own due diligence, research and consulting with professional advice (see the disclaimer).

Foreign Ownership limit is maxed out a 49% unfortunately, however if you’re not an institutional-sized investor this shouldn’t be an issue. If you want to know specifics of the numbers below, use the contact page to ask!

Here are two stocks I found–there’s many more out there. Qatar’s absolute monarchy does limit the listing of foreign businesses however. State-run or Qatari nationals are definitely primary in everyday life there. Financial data is not always up-to-date or that reliable as well, so please bear with me.

- Industrials

Qatar Cement Co. ($QNCD) A cement company created in 1965 to meet the growing domestic demand for cement in Qatar. The company is a major produer of sulphate resistant, calcinated lime, hydrated lime and washed sand in the State of Qatar.

Let’s have a look at their Financials for Q2 2023:

Income Statement

Gross Profit= 144,837 (QAR ‘000) (Q3 2023)

Net Profit= 151,621

Total comphrensive income= 145,463

EPS= 0.35

Assets

Total Current assets= 1.55B

Total assets= 3.47B

Total Equity= 3.08B

Liabilities

Total Current liabilities = 252.61M

Total Liabilities = 392.3M

Total Liabilities/Total Assets = 11.3%

Cash flow

Cashflow from Operating activities (gross)= 101,273 (QAR ‘000)

Cashflow from Operating activities (net)= -14,401

Net Cashflow from Investing activities= 59, 401

Net Cashflow used in Financing Activities= 196,059

Net increase/decrease in cash for period= 341,827

Market Cap: Approximately 2.421B QAR

Ratio

P/B: 0.86

P/E: 12.04

Dividend Yield= 8.09% (0.30 QAR)

Trading Price= 4.00 QAR (approx. 1.09 USD)

Majority shareholders (All majority are held in Qatar).

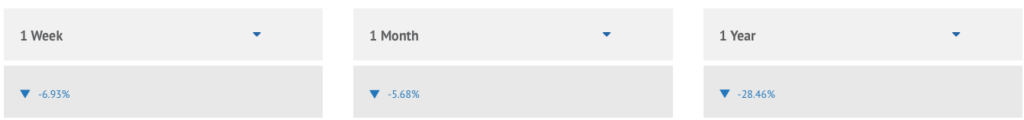

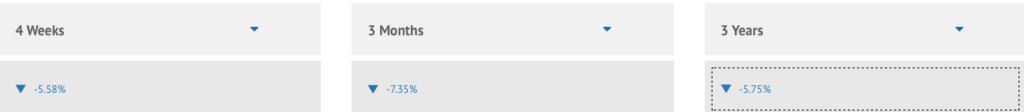

Performance

Cement sales in Qatar are expected to have a 5.2% CAGR from 2022 to 2032. It also helps that they’re in the desert for materials.

2) Transportation

Milaha: Qatar Navigation ($QNNS) Milaha is one of the largest and most diversified maritime and logistics companies in the Middle East with a focus on providing integrated transport and supply chain solutions. Milaha has a rich history, starting as a shipping agent in 1957, and strategically building a strong regional foothold in transportation and logistics through a growing fleet, state-of-the art equipment, dedicated staff and world-class partners. Milaha’s current activities include Maritime and Logistics; Gas and Petrochemicals; Offshore Marine; Marine and Technical Services; and Capital.

Market Cap= 11B QAR

P/E= 10.88

P/B= 0.685

Dividend Yield= 3.58%

Trading Price= 9.79 QAR (2.69 USD)

Let’s look at their Financials for Q2 2023: downloaded (in ‘000 QAR)

Income Statement

Operating Profit= 343,658

Profit for Period= 647,855

EPS= 0.57

Other Comprehensive income= -85,696

Total Comprehensive for period= 562,159

Assets

Total Non-current assets= 14,960,048

Total current assets= 3,197,865

Total= 18,157,913

Total Equity= 16,248,266

Liabilities

Total Non-current liabilities = 539,718 (3.6% of non-current assets)

Total Current liabilities = 1,369,929 (42.8% of current assets)

Total Liabilities = 1,909,647 (10.5% of total assets)

Cash flow

Cashflow from Operating activities (gross)= 647,855

Cashflow from Operating activities (net)= 381,648 (207% increase YoY)

Net Cashflow from Investing activities= 169,347 (-54% YoY)

Net Cashflow used in Financing Activities= 554,521 (paid back) (29% increase YoY)

Net increase/decrease in cash= Decrease of 12,285

Cash or Cash equivalents at end of period= 217,767

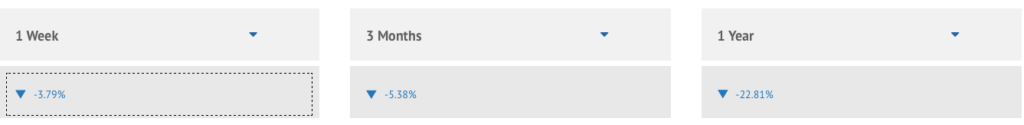

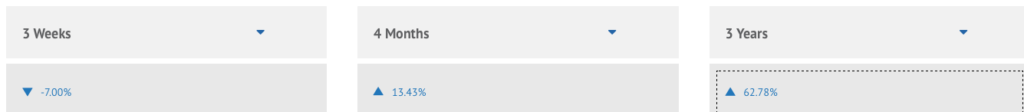

Performance

Closing

Qatar have yet to become the tourist haven & business hub that the UAE currently has (Are you ready to hear about our controversial article?), however it is working on this with its launching of Qatar Free Zones which may be attractive for entrepreneurs.

Still, in what it lacks in advertising, name brands, tourism & fancy cars, it may make up for in yield & steady growth for your portfolio. To this effect, it may be possible to add a small position to part of your portfolio as a diversifier to your existing positions and become a long-term play as the world economy transforms from a Western-centric economy to one that originates from the Global South. It’s too risky to go all out–but for exposure its interesting. I am unclear how I feel about the future of the middle east right now. On one side of the coin they have a volatile, militaristic history whereas on the other side they are taking some real empire-building foreign policy actions. Keep your eye On The Ball to see what we think in the future.

I’m actively seeking to get in touch with some local brokers to find out how I can get exposure myself. Contact me to learn more!

#StayOnTheBall