Open Door Consultancy: Trends in Motion

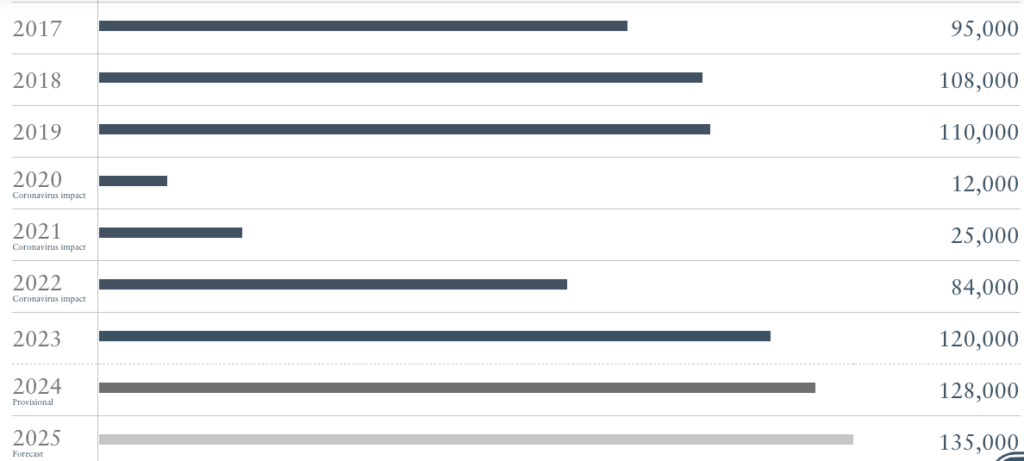

From Henley Private Wealth Dashboard: The current trends of millionaires leaving and arriving their place of domicile.

It’s important to specify what they state in their own methodology:

The data in the Henley Private Wealth Migration Report and Henley Private Wealth Migration Dashboard is supplied by wealth intelligence firm, New World Wealth, which is currently the only known independent research firm systematically tracking global wealth migration trends between countries and cities.

It is important to note that the high-net-worth-individual migration figures in this report and dashboard focus only on people who have truly moved, namely, those who stay in their new country more than half of the year. Many wealthy individuals acquire residence rights for countries but never relocate to those countries. Such individuals are excluded from our figures, which are therefore on the conservative side.

New World Wealth tracks the movements of over 150,000 high-net-worth individuals in its in-house database, with a special focus on those with over USD 30 million in listed company holdings. The database’s primary focus is on company founders (50%+ of the database) and individuals from high-value companies who hold the following positions: chairperson, CEO, president, director, and managing partner.

The firm uses various public sources to check city locations, including LinkedIn and other business portals. Its stats are therefore mainly based on the work locations of the individuals.

Interested in a Plan B but Unsure Where to Start?

I created Open Door Consultancy for folks like yourself. Uncensored, clear and thorough–I consider your wants, wishes and situations and offer the best Plan B planning alternatives and actions for you, affordably!

Comment on Data

It’s important to note that the data is only on about 150,000 people and may only provide shallow insights into the trends unfolding in the world. Someone who stays more than 6 months in one place would be regarded as having moved to that location and their focus on net worths above 30M may have missed many other individuals. It’s also worth noting that a place that has an increase in millionaires may be at a far slower rate than in previous years–so while it may look impressive, such as in Canada–this is far weaker than what it used to be!

The number one thing I’ve thought of, and feel free to contact me if you're interested in privacy–is that individuals with this type of wealth are often concerned about their anonymity and privacy. This would mean that they would not register, report or let anyone know where and what they are doing (let alone update their LinkedIn social media page).

All in all, you can take this with a grain of salt and use as a loose indicator.

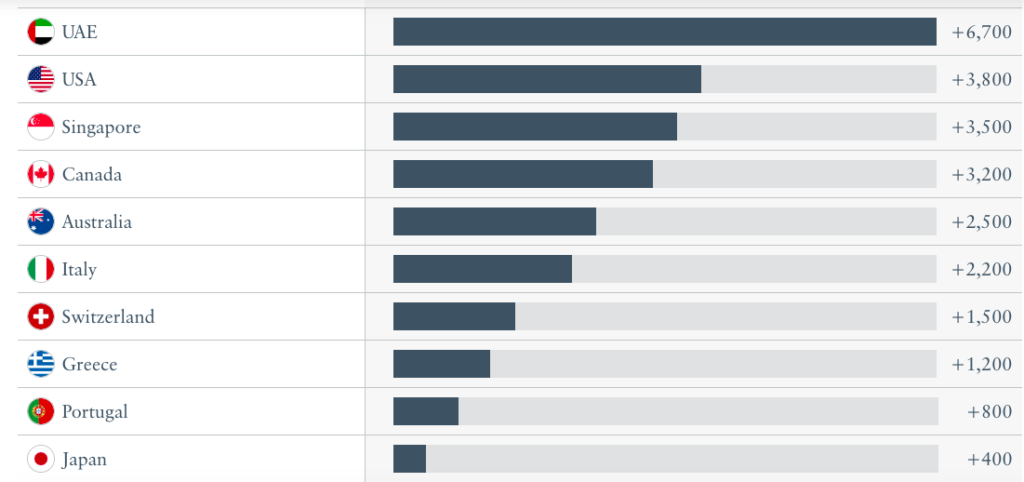

Inflows

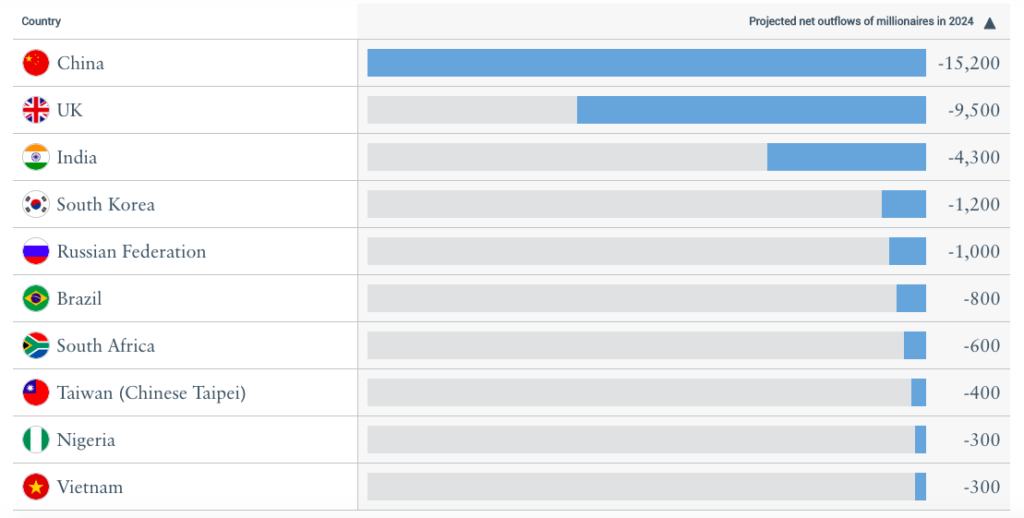

Outflows

Comment

What’s interesting is that for the time being, the wealth still remains largely in the West. This is not to say that people aren’t investing, speculating or setting up abroad and again, this is a tiny percentage of the real big money–but if we assume that these are high net worth individuals from their role as an executive, CEO, or Director, we can still see that Western nations dominate this positioning where the most wealth still resides. The most noteworthy exception of this is the UAE–but subscribe to get our REAL thoughts on there…

In terms of the outflows, they are not surprising–threats of war, economic collapse, inflation through socialistic governance and a general unfriendliness towards capital and ideas has been the main driver of those countries. These countries, are interesting for part of someone to diversify but it doesn’t make sense to have entire sums of portfolios residing there.

When the Going Gets Tough, The Tough Get Going

Quiet Trends

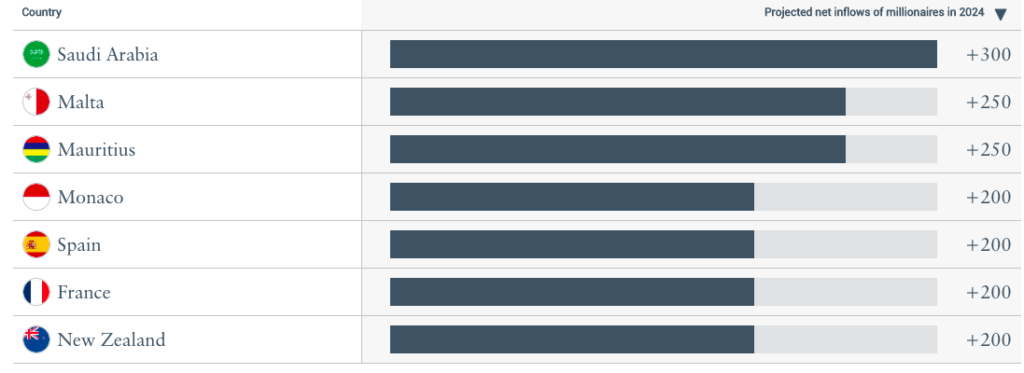

Here are some interesting listings. Saudi Arabia, despite being an extremely restrictive and oppressive country (with respect to individual freedom and personal autonomy) is gaining more and more millionaires because it is becoming more economically free; like UAE and Qatar. I’m reluctant to say that Saudi Arabia is going to replace Singapore anytime soon however. Mauritius, Malta, Spain, New Zealand all have problems and arguably poor trends in their favour but still offer more than other countries and thus are attractive more capital-oriented individuals. Monaco–> no surprise there. France? No clue.

Closing

This is meant to be a slight insight into where the money is leaving and where it is arriving. While it may only be a small insight into the real movements of capital, I believe the important takeaway here is that capital IS IN FACT moving. We are in extremely volatile times not just financially or economically but politically–and people with capital understand this. The times are changing before our very eyes. It’s time to do something, fast!

Once again I recommend contacting my subsidiary if you’re interested in formulating an affordable plan for you… before it’s too late. If you’re interested in starting into investing so that you can join the list above (!), pick up my investment starter guidebook–its made affordable for you so you can get your money back in no time.