It’s dangerous, poor, hidden in the most dense rainforest in the world but, loaded with gold

Guyana is the only English-speaking country in South America with a population of 813,834. It is defined by its dense Amazon rainforest, cricket sporting, calypso music and it’s cultural connection to the Caribbean region. Its capital, Georgetown, is known for British colonial architecture, including the tall, painted-timber St. George’s Anglican Cathedral.

It has very high levels of poverty and is certainly not known for it’s holiday get-away destination. Crime such as kidnapping, theft or vandalism is not uncommon to Georgetown, with the capital showing one of the highest homicide rates in the world–let’s just say it’s no Singapore or Dubai. It’s no Bogota or Santiago either.

Having said this, Guyana is fortunate enough to have claim to their own offshore oil reserve [Check out my article on this & why I believe offshore oil investments are a smart move], a great deal of mineral deposits, rice, cocoa and for sake of this article, gold!

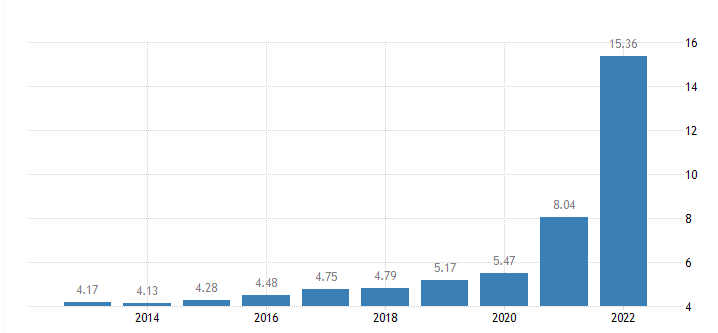

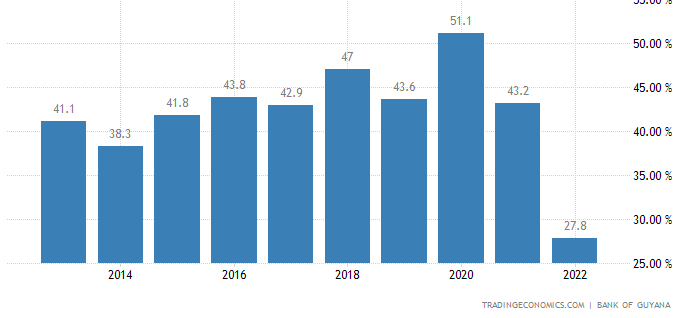

Guyana’s GDP has seen a major increase as of late

Guyana was the only Caribbean country that expressed GDP growth during the Covid Hysteria. Furthermore, the IMF predicts immense forecasts in the next few years. As the saying goes, going from terrible to bad is a better jump than good to great.

*Stock Prices/Performance may have changed since the date of publishing*

Company

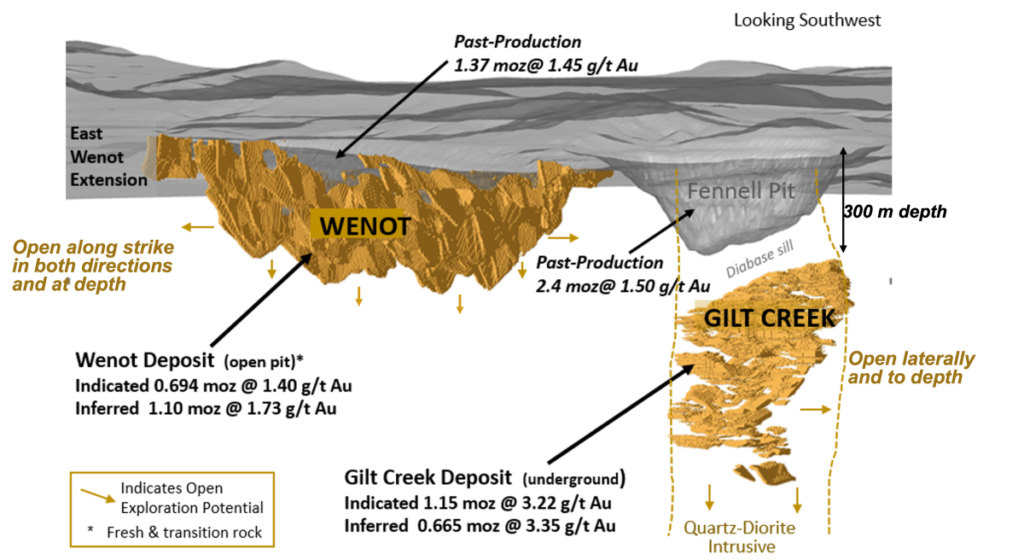

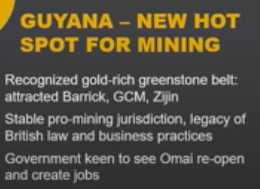

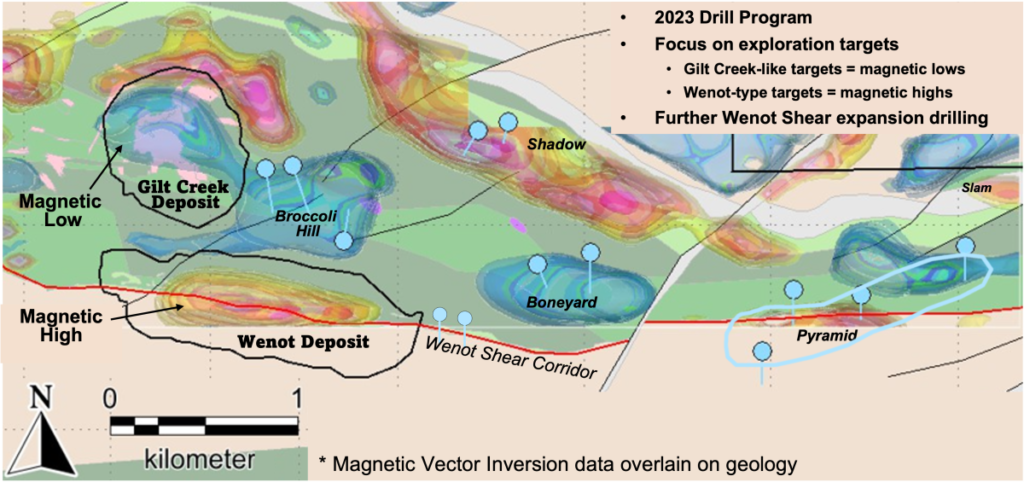

Omai Gold Mines Corp. ($OMG.v) holds a 100% interest in the Omai Prospecting License that includes the past producing Omai gold mine in Guyana, and a 100% interest in the adjoining Eastern Flats Mining Permits. The Company announced an updated Mineral Resource Estimate (“MRE”) October 20, 2022 that includes a 14% expansion to the Wenot shear-hosted gold deposit and an initial NI 43-101 MRE for the adjacent Gilt Creek intrusion-hosted deposit. The Company’s priorities for 2023 are to drill the key exploration targets that hold potential for significant new discoveries while continuing to expand the Wenot deposit in anticipation of an updated resource at the end of this year.

Omai has 100% ownership of one 4,590-acre prospecting license & two mining permits for medium scale operations totalling 1,519 acres.

An ‘OMG’ Story

I first became interested in this company because of it’s past history and the fact that few people were picking up on their prior success at this deposit– NVDA, Tesla and Jim Cramer steal the show.

Once South America’s largest producing gold mine, Omai produced over 3.8 million ounces of gold between 1993 and 2005. Mining ceased at a time when the average gold price was uneconomical at less than US$400 per ounce and the two current large-cap miners made the decision to move over to the neighbouring country (Suriname) for another promising discovery. Due to this, Omai benefits from good access and a wealth of historical data that provides knowledge of the geology, nature of the gold mineralization on the property, as well as metallurgy and historical recoveries.

An NI 43-101 Resource Estimate in December 2022 of 1,907,600 ounces of gold (indicated) averaging 2.07 g/t Au and 1,777,600 ounces of gold (inferred) averaging 2.10 g/t Au, is contained within the orogenic shear-hosted Wenot deposit and the adjacent Gilt Creek intrusion-hosted deposit. This study was completed in a mere 9 months. Interestingly though, the indicated and inferred updates were a 171% and 89% increase from a year’s prior–and of course the market slammed the stock for it…

They also have four other exploration targets.

-Broccoli Hill shows similar magnetic lows to Gilt Creek (300m east of Gilt). Broccoli hill has been a focus for artisanal miners for the better part of a century.

-Boneyard is another target similar to Broccoli Hill with artisanal miners

-Wenot extensions surround the open-pit mine to the West, East and along the flank.

-Pyramid is an extension of the Wenot shear line

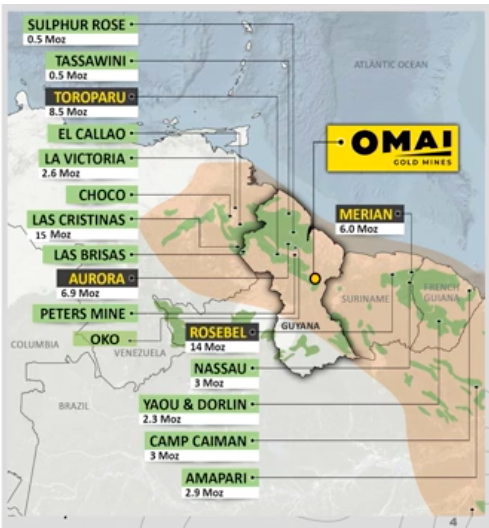

Why do I find this story interesting? Because not too long ago, Guyana was ‘the next big thing’ for gold exploration. It was the new discovery on the planet but because of market conditions, prior corruption and frankly, better yields elsewhere, it has been almost entirely forgotten. Though, gold mining persists. The Guyanese/local indigenous have been mining since the 17th century for a reason.

Rick Howes, CEO of Reunion Gold, talks to Mining Journal about why he quit retirement to join the company and why Guyana bucks the prevailing trend in Latin America when it comes to political risk.

Many players are allocating capital to this region partly due to it’s undiscovered potential.

Latest discoveries

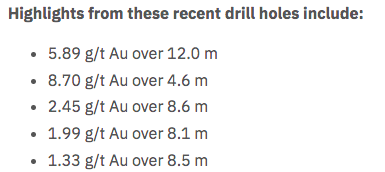

Since the New Year this year, OMG has had 16 promising drill results, totalling 6131M

-Some Omai drills

4.54 G/T AU over 27.5 M,

1.83 G/T over 25.5 M

& 2.37 G/T over 12.5 M in Hole 23ODD-065 AT WENOT

-One drill strike confirms the continuity of their open mine Wenot gold mine bearing structures to at least 100 metres below the current resource model. In this explorative test, they found an impressive intersection of 5.18 g/t gold over 20.2 metres, including 12.7 g/t gold over 7.9 metres. This intercept reinforces a new model of evidence that the gold grade concentrations at Wenot increase with depth.

-5.86 g/t gold over 13.0 metres; 2.03 g/t over 9.5 metres; and 1.77 g/t over 9.1 metres were also found on the same hole drilled.

-Other results previously showed a very wide 42-75 metre zone of gold mineralization at the West side of the deposit, about 1.6Km away the finding above (110 metres to 290 metres depth)

-OMAI GOLD DRILLS 4.07 G/T AU over 31.1M, 3.38 G/T over 9.6M AND 14.21 G/T over 1.8M AT WENOT

Since 2021, 16,650m of drilling in excess of 50 holes were completed, 34 of which were focused on delineating a new Wenot deposit, lying below, adjacent to and along strike of the past-producing deposit which has proved successful.

So far, Omai is consistently coming up with gold–it’s not super high grade but the findings are consistent and they have a great deal to explore.

*Update!* The results are getting more and more promising as they explore outward

October 2023 they had a hole yielding 2.26 g/t Au over 70.0m (158 g x m); another of 16.8g/t of AU over 6.0m

Five drill assays have yet to come back but will before the new year.

News

The CEO has recently stated plans moving forward following the existing strikes thus far “…we believe our drill budget is best focused on: testing some of the undrilled gaps within the Wenot deposit model; expanding the western starter pit area; and providing evidence of the blue-sky potential for the Wenot deposit at depth. Results to date are already expected to positively impact the resources as we move forward to an updated mineral resource estimate to be followed by a decision on a preliminary economic assessment (PEA) later this year”

In a recent presentation, it was stated that their goal is to retrieve 4-5 million ounces

Government plans of upgrading the road between Linden and Lethem is underway as of May 2022 after the Government signed the US$190 million contract. An initial 122 km from Linden to the Mabura Hills will pass the Omai turnoff and this segment is scheduled for completion in December 2024. It will greatly save time connecting the airport to the property.

There is also a planned hydro plant that will be only 30km from Omai’s property as a potential source of fuel for mining operations (but I wouldn’t hold your breathe on this being completed anytime soon).

3,600m completes the rest of this year (2023) which will explore West Wenot

The CEO’s remarks on the latest drill results:

These results from the Wenot drilling, together with the string of recent strong results, give an indication of the scope of untapped potential of the Omai gold project. The grades and widths are very favourable for developing an open pit operation, particularly considering the benefits of a brownfields project such as Omai. We have commenced our updated Mineral Resource Estimate, expected before year end. This will be the third NI 43-101 Mineral Resource Estimate in less two years.

Specs

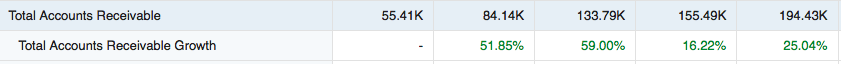

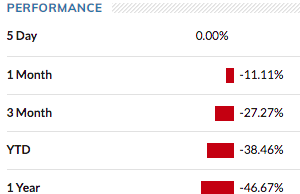

Price: 0.04 CAD (TSX.v)–>It’s gone public in 2020–began drilling in 2021.

Market Cap: 13.32M CAD

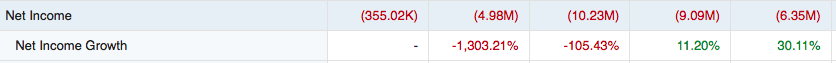

Net Income (June 2023): -964.03K

June 2023–> 2.23M CAD cash

Total Assets (June 2023): 7.2M

Total Liabilities (June 2023): 1.22M (100% current liabilities and no long term debt)

Being a Junior miner they are burning through around 1.3M of negative operational cash flow

It should be quite clear that this is a speculation, rather than an investment. It’s a company operating in the third poorest country in the Western hemisphere, not shy to corruption & crime and you’re speculating that these gold deposits will provide more than the cost to operational extract them.

Shareholders

18% institutional investors

9.1% Silvercorp

5.3% Sandstorm Gold Royalties

3% Insider Management

64.6% Other

Amid mine development, if we assume that they have 3,000,000 ounces of gold in the ground (almost 2 have been inferred) at 1980 an ounce and an all-in-sustaining cost (AUSC) per ounce of 1180 + their property value + net debt (of -1.01M)–this totals 3,284,709,624B CAD

Than their market cap 13,320,000/3,284,709,624 would give a P/NAV of a mere 0.004.

Perhaps a more reasonable figure may be 1900 AUSC and a 1980 gold price… where p/NAV still equals a mere 0.0541.

Furthermore, Omai trades at $3/ounces in the ground (divided by outstanding shares) whereas their regional competitor trades for $12/ounces in the ground [as I write this gold is over 2000 per ounce]. Interestingly, Atrium Research continues to hold their Buy rating and price target of 30 cents. Of course, this is still a speculation that they’ll be able to get permits, find the gold, develop a producing mine, deal with the state actors, raise the capital & weather inevitable problems, etc. etc. But an interesting one, especially if you believe the gold price to go higher– and this asset will continue to develop. It’s promising that this property reliably produced years ago and that so much capital is headed to the region.

Closing

Omai Gold Mines have a large set of properties with lots of promise from drilling results moving forward. The heightened grade at depth and gold strikes upon wide exploration gives a taste of the potential at stake here. The stock quite literally has. not. moved. to positive news but this allows you to speculate cheaply. Whether they can compile compelling & accurate models for the financing required to develop a producing mine remains to be seen. However it does seem that investors (not miners) have forgotten about the gold potential that Guyana offers and in particular, that this property has produced 3.8M ounces over 13 years of prior production. Although still a speculation, the potential upside is tremendous.

Like I say in the title, it’s a poor, crime-ridden, backward, rainforest and without any redeeming features for a tourist industry. It’s a country with few international connections, few people know where it is exactly and it’s main resources of oil & gold are voodoo as far as money managers are concerned.

In other words, it’s a speculators hot-spot looking for ‘OMG’ returns.

#StayOnTheBall

Our Subscription platform offers more in-depth stock analysis as well as many perks for your international planning–check it out and please explore more articles!