I wanted to do a deep dive on Nvidia but I began working on our new app (join as a member for more!) Nevertheless, here are some illuminating charts, photos and links and data for you. My $SOXS are on ready for this to end!

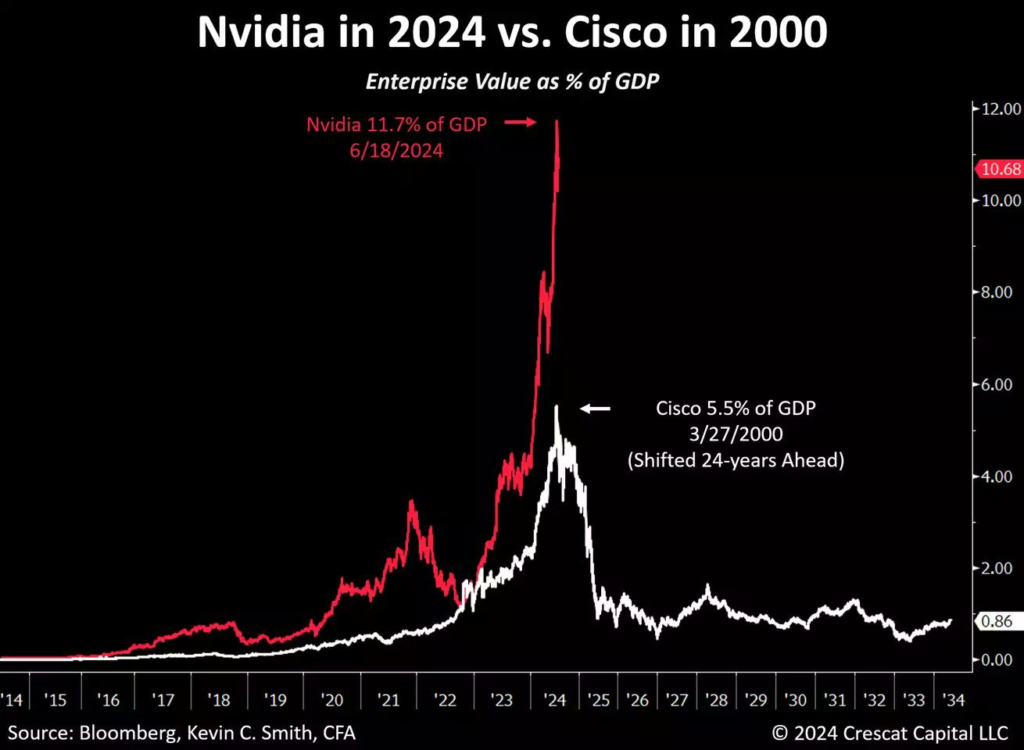

On February 23rd, Nvidia casually added another $35 billion in market cap in after hours trading today. In total, Nvidia has now added $312 BILLION in market cap in 2024. That amount was more than the entire market value of Goldman Sachs, Boeing and Target COMBINED. If you include the after hours move, their largest gain is ~60% larger than Meta’s previous record of $197 billion (see below). Nvidia is currently a company trading with a +$3 trillion market cap.

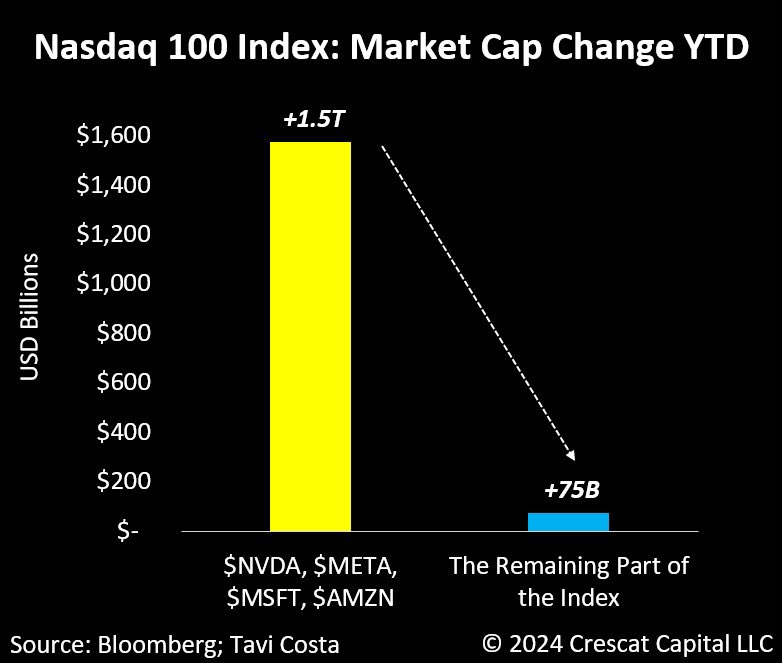

It’s gotten so crazy that 60% of the entire S&P 500s earnings are attributed to the “magnificent seven” (Microsoft, Tesla, Meta, Nvidia, Amazon, Apple & Google). What about the actual price of the market? Well… that hardly matters for the stock market anymore.

Realistically, how low would Nvidia have to fall before investors could call this a generational wealth-building opportunity. I’ll let you decide after you ponder these fantastically absurd numbers

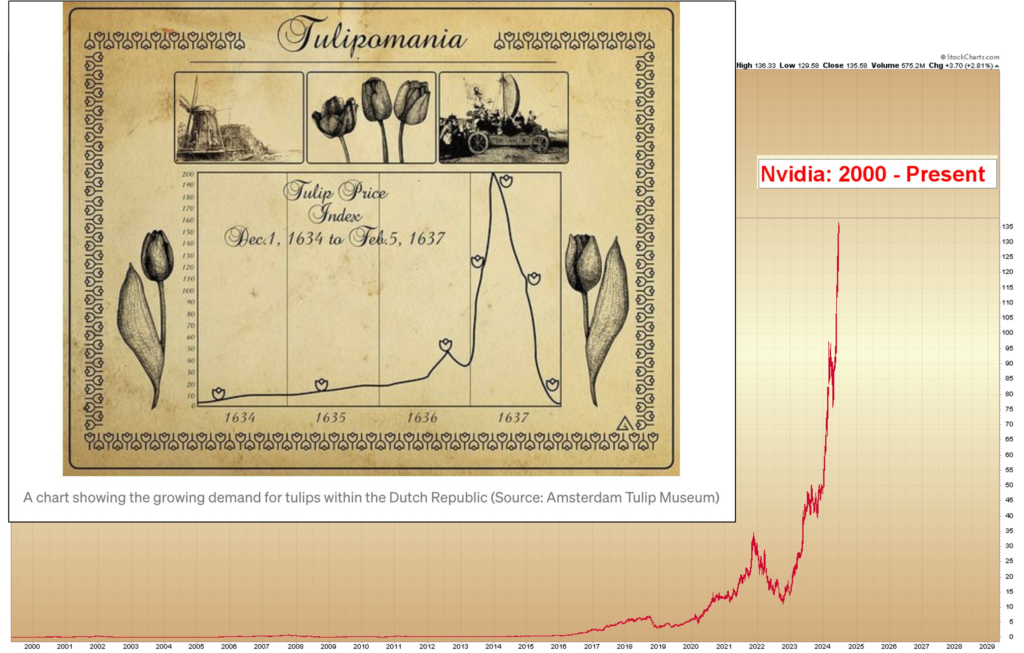

“Hey, there’s a bubble…”

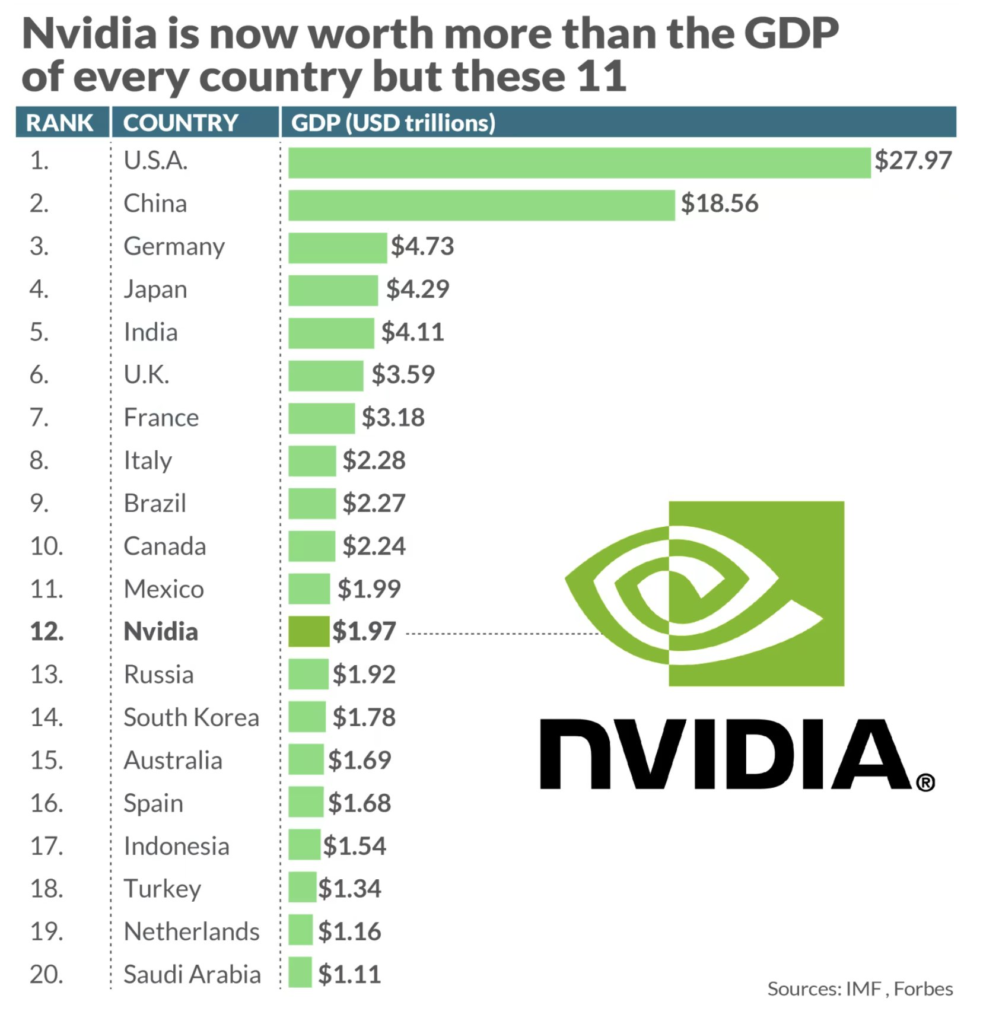

Japan’s entire economy is $4.5 trillion:

$NVDA + $MSFT = $6.79 trillion are currently worth more than the entire Japan economy

As of February 23rd, the company is worth more than the GDP of Canada.

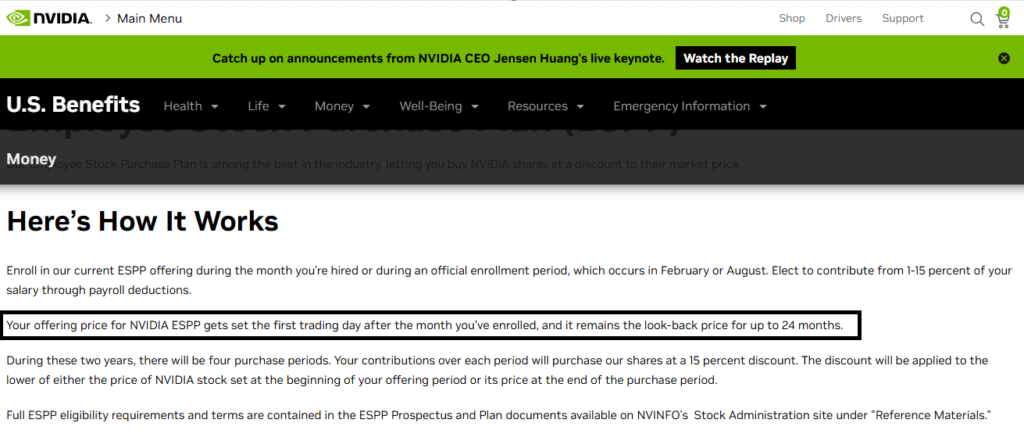

Nvidia’s $NVDA insiders have been selling stock over consistently, too. CEO Jensen Huang, the guy who has received tremendous publicity as of late has sold nearly $43M in shares so far in September 2023 alone. One year later and he’s still selling–>In September 2024, he sold another $26.2 million worth of $NVDA shares which over during the time period of 10 days is over $104M dollars worth of shares.

In total, Huang completed the sale of six million shares of the chipmaker, earning a total of $713 million dollars.

Why did a farm animal welfare charity just buy $500M worth of Nvidia chips?

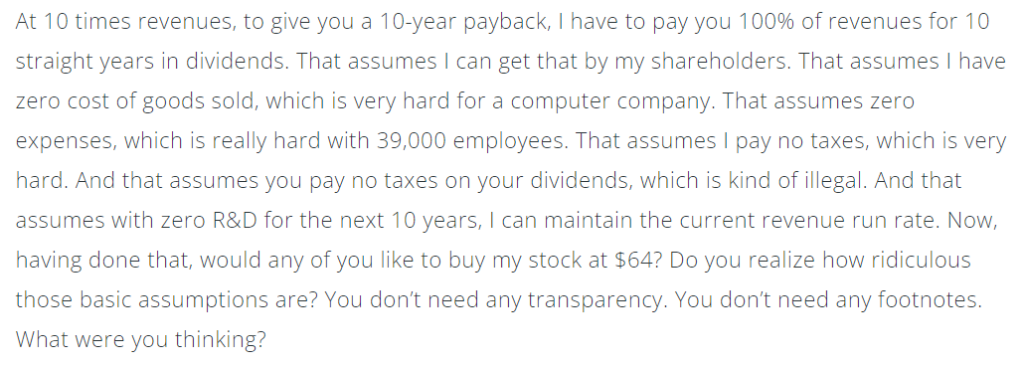

Consider Scott McNealy CEO during the dotcom bubble calling out the absurdity of the 64 dollar price

What’s Nvidia? 33X revenues! 56X Earnings

To keep this bubble going eventually of course you run out of buyers–and are left with only sellers unless you use one thing…leverage.

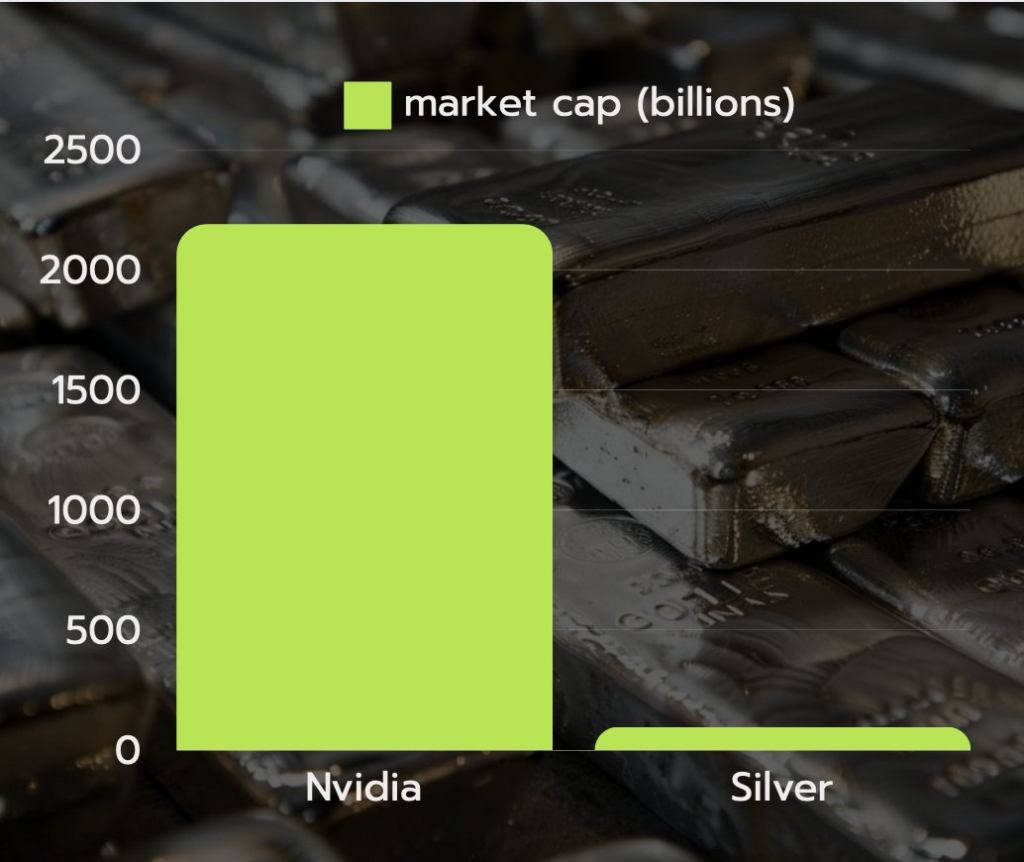

This is a more systemic issue however because it involves unsuspecting lenders against depreciating semi-conductors and an ever-increasing supply of Graphic Processing Units, not exactly a treasury note or bar of gold.

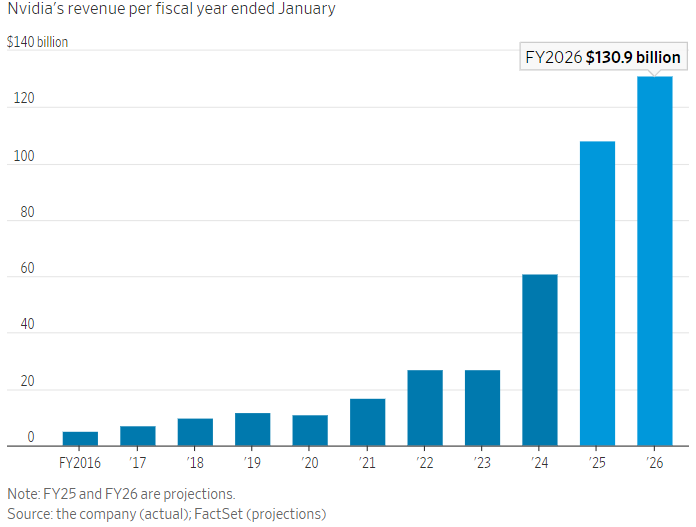

With current annual revenue of $60 billion, to justify today’s stock price according to P/E, its revenue would need to reach $5.87 trillion in 4 years. This means revenue needs to 1,857% this year to $1.174 trillion or, said another way, its revenue would need to become $293 billion per quarter.

A Scam like ’08

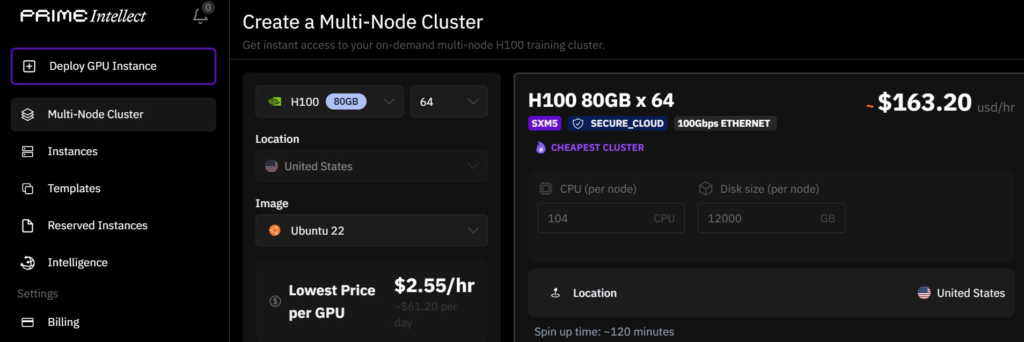

This Twitter user shows he can buy computing power for only 2 bucks an hour.

PwC, the auditor of Nvidia states in the 10K filing reports of Nvidia that there has been “Critical Matter” taken during the auditing process. They define this as “critical audit matter are the significant judgment by management when developing provisions for excess or obsolete inventories and excess product purchase commitments, including developing assumptions related to future demand and market conditions. This in turn led to significant auditor judgment, subjectivity, and effort in performing procedures and evaluating management’s assumptions related to future demand and market conditions“. In other words, they’re able to cook the books by displaying the value of their industry, assets, whether tangible or intangible, or whether they even exist in a subjectively determined manner. We're worth what we say we're worth.

As of early March 2024, Wells Fargo in first place following by numerous mini “funds” from Singapore such as “Symmetry Investments” with a $10 webpages. Probably the same Singapore funds buying those overpriced graphic cards, and dropping hundreds of millions in stock, no?

This is just one of the many funds that seemingly nobody has ever heard from with the following webpage:

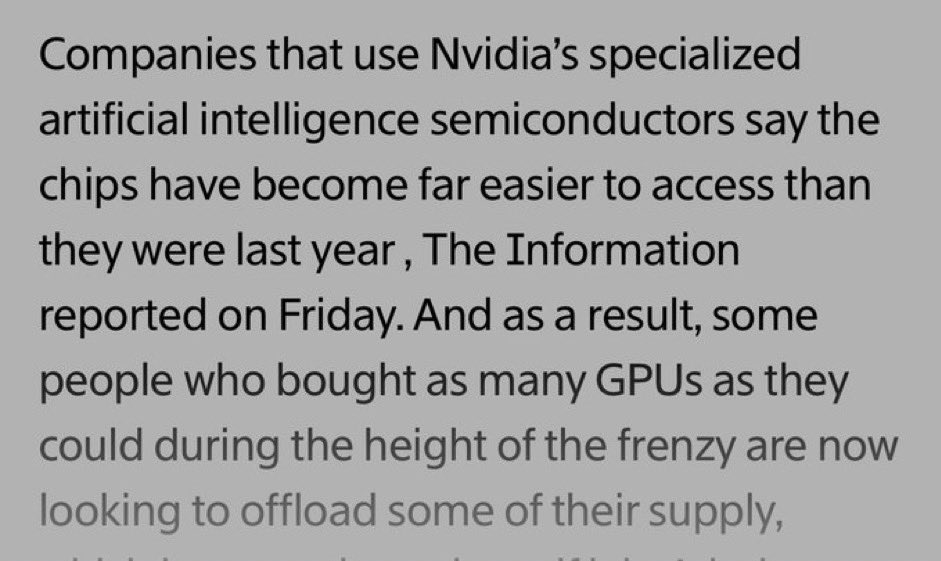

Just months ago, UBS analysts have received reports from Databrick’s that GPU prices are about to plummet since GPU lead times have “fallen substantially in recent months”. Despite this, the banks have paradoxically RAISED their price target for company.

Investment bankers have also facilitated the purchase of a holding company by Nvidia which turned out to be a major pump and dump scam–> but Nvidia responded positively to it

All the big money interests behind the scenes are involved for this thing to keep going up. The least likely sectors or interests, often with dodgy pasts are absolutely emptying piles of cash into Nvidia (even though their own revenues bring into question where they received all this money for Nvidia).

“NVDA said it will make 2 billion more in profits. Yet its Market cap is up by 250 billion in single day… the profits are minuscule compared to the mania”

Scam

I could have your eyes all day writing about why Nvidia is likely a colossal scam, but for both of our sakes, I’ll hand you over to “Nobody Special” or JG_Nuke on Twitter/X who did a fantastic job at investigating the ins-and-outs of the dealings, history and peculiarities surrounding this company. My part to you is I have selected the most revealing of the finds he has come across:

Supplementing explanations

I have wrote two articles that touch upon why these nothing-burgers continue to go up and up and money being almost knowingly misallocated:

These are not singling out Nvidia, rather, a current trend that has to come to an end at some point.

Changes Coming?

New rules announced by the USA from the 13th of Jan are aimed to shut the loophole so far exploited by NVIDIA. They were using this to utilize 3rd party countries in order to circumvent selling restrictions into specific countries (and to fabricate a good deal of fake revenues). This was stated in their 8K filing statement to warn investors (albeit in the fine print).

Losing Runway?

The narrative fuelling semiconductor tech companies FOMO had little to do with AI! Every time $NVDA chip inventories build up, “coincidentally” a new “narrative” surfaces and the company can then unload its unsold products.

When the gaming hype faded, the next related to crypto mining use and then recently to AI. However, under the hood, insiders obviously know it’s all a bunch of BS and the narratives catch up to them.

Lawsuits Coming

Super Micro Computer $SCMI, a major chips producer who was critical in Nvidia’s supply chain has been charged by the SEC and risks becoming delisted entirely. Furthermore, their auditor resigned soon after to not have the blowback come upon them (Ernst and Young).“The Securities and Exchange Commission today charged Super Micro Computer, Inc., a producer of computer servers, and its former CFO, Howard Hideshima, with prematurely recognizing revenue and understating expenses over a period of at least three years” is the beginning of the outlining of all SMCI fraudulent accounting prior to 2020.

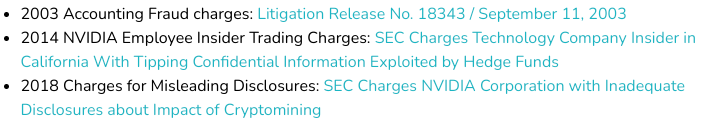

But surely this means Nvidia is honest? Well not really. Look at their track record.

As further evidence that this is not about the Chips–you can see that some producers of computer chips are actually down 5-12% YTD. Intel corp is an example:

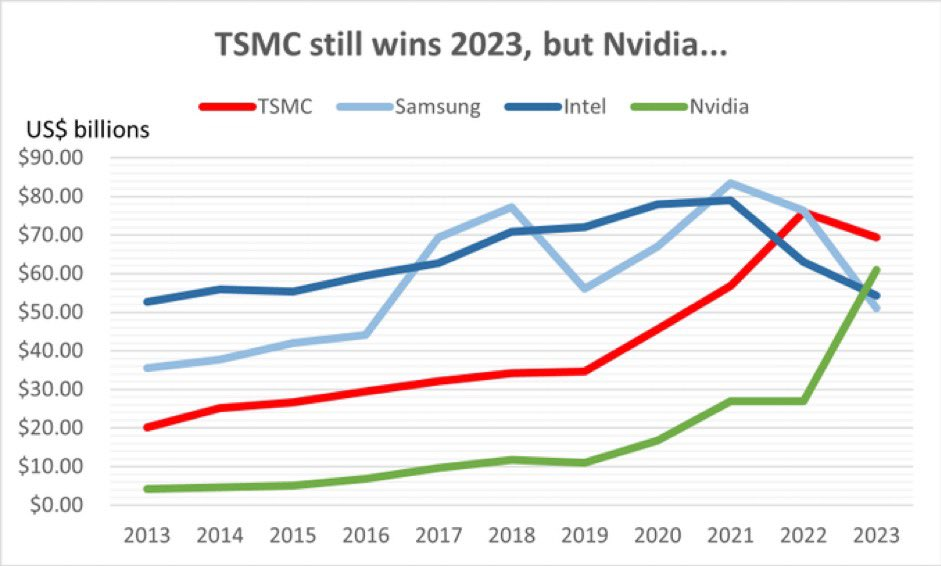

Revenue Growth. Peculiar that NVDA bucks the trend, especially since the GPUs they buy are from TSMC!

Doesn’t add up

Investors, retail or otherwise seemingly only care about narrative, just like the politicians who lie that the economy is on fire.

The companies who will benefit from AI won’t be chipmakers since the computing power available to develop is already way more than what’s needed. Those that will thrive will be the ones who will manage to leverage the new technology to deliver meaningful cost savings replacing current “iterative” jobs in the service sector with virtual automation. This will be presented in the same way repetitive human factory jobs have been replaced by robots and machinery 130 years ago.

The lessons of history are that people forget the lessons taught by history

Closing

Despite AI, data centres, semiconductor chips and an abundance of energy for the cloud being the future we find ourselves within, it seems that Nvidia is supporting the mother of all bubbles just living off the narrative.

I suspect part of this extreme bubble is due to the dynamics I wrote about before (pension funds), pure frenzy of “Fear of Missing Out-FOMO” and what I surmise the most, fraud. This is particularly serious given the fact that a significant percentage of the entire stock market is held alive from this company and the expectation that it will continue to rise to the clouds.

You and I know that things don’t touch the clouds and that at some point the truth about this company will be revealed. When it is, it’ll be a race to sell and I believe the whole general market will go down with it, extinguishing trillions of dollars to money heaven.

I wish I had more time to spend on this but you’ll have to trust me when I say it’s a rabbit hole of peculiar investment behaviour. Let’s wait and see!

For members of On The Ball, I write some stock breakdowns that I think are interesting investments and why--don't worry, the picks are not this sketchy!I’ll leave you with this chart:

#StayOnTheBall