78 years old & Back to School

I have a relative by marriage who is from Nova Scotia and is excited to be deriving from the Nova Scotia Teachers Pension. They seemed so confident that they are secure & set for life and arrogantly I figured I’d take a look (already knowing that pensions around the world are for the lack of a better word–>fucked.) #StayOnTheBall for more articles on pensions.

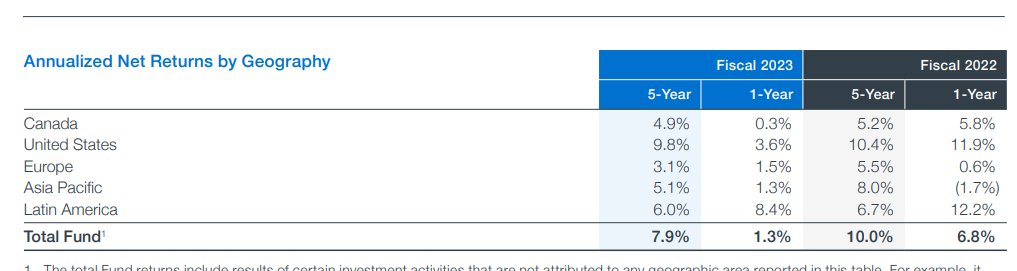

This is so specific as it won’t apply to you directly but from what I’ve seen this is sort of standard for the state of pension funds–many of them hold a large percentage of bonds (who have gotten killed lately and offer a triple threat to capital; inflation, default and interest rate risk) and many have totally bought into terrible zombie stocks or ESG score frenzy. This will only get worse but…as for Nova Scotia Teachers Pension:

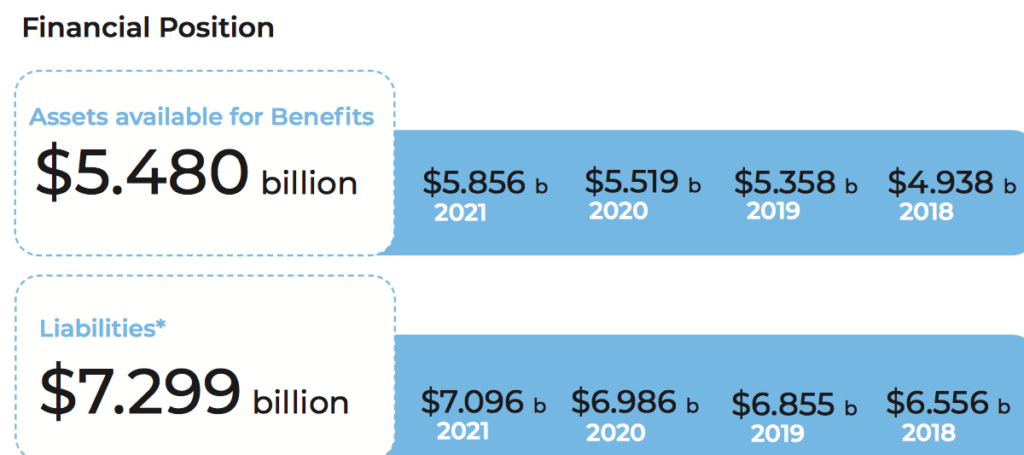

This pension fund remains 75.1% funded–meaning it’s performance since inception is -24.9% and we’re now coming out of a 20-year BULL market.

How long can it continue?

If you look a little deeper you’ll find that there is zero exposure to precious metals, only a 1.43% cash holding (are you kidding me!?) and ~25% into fixed income. Presumably Chinese equities have a >5% bite as well (given their emerging/foreign market percentage).

These numbers are just some to give an initial insight into a major elephant in the room that I hardly see anyone talking about–what are we going to do about pensions?

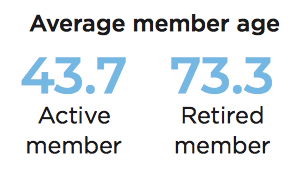

Are people going to return to work? or will the young adults be responsible for the older generations? Can they afford this? Can pension funds make a stupendous return on investment?

If you ask me, it’s better for people to take personal responsibility for their own assets (& their families’) but nevertheless, teachers are in this mess…

#StayOnTheBall

for more content on investing, global travel, world events/trends and much more

Uh-Oh…