Jones Soda, Just About Gone Flat…

I hadn’t had my eye on this company–I completely forgot about it. It was always the drink of choice for people at a skateboard park when I was growing up–not sure why.

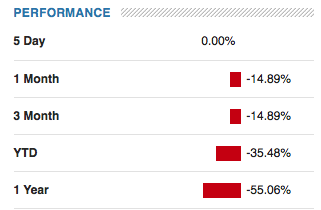

After 16 years of drinking my last bottle with them, it seems that they may be in trouble.

Market Cap: 15.51M (I have some mining stocks that are around here that are in a MUCH better position..)

Price: 0.15 USD

Remember to Sign Up!

Company

Jones Soda Co. is engaged in the development, production, marketing and distribution of beverages. The Company is focused on its core brand, Jones Soda, while also investing in additional initiatives, including fountain and Lemoncocco. The Company sells Jones Soda in glass bottles and cans, with every label featuring a photo sent by its consumers. The Company also sells Jones Soda on fountain, utilizing consumer photos on the fountain equipment and cups. Its fountain offerings include traditional flavors such as Cane Sugar Cola, Sugar Free Cola, as well as cane sugar sweetened Ginger Ale, Orange & Cream, Root Beer and Lemon Lime. Its Lemoncocco is a non-carbonated, naturally flavored beverage with the extracts of Sicilian lemons and a splash of coconut cream. The Company also sells various products online, including soda with customized labels, wearables, candy and other items, and it licenses its trademarks for use on products sold by other manufacturers.

It’s listed on the Canadian Securities Exchange and amongst the Pink Slip stocks in the US.

Oh, I remember, thats why Emo kids at skateparks would drink it

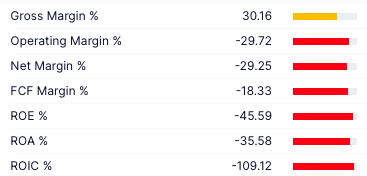

Drowning Expenses

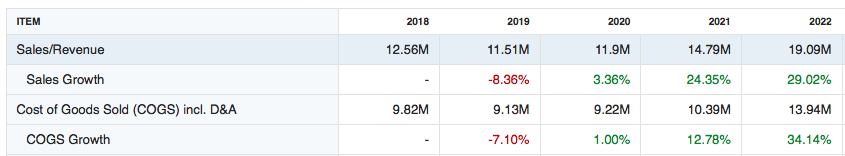

On the surface, they don’t seem to bad for a micro-cap stock… but the SG&A is just too much for it.

As a consequence they’ve consistently held a negative net income steadily. You often see this with pharmaceutical stocks who have such high research costs but for soda?

Q3 results

- Revenue fell from $4.8 million in Q3 2022 to $4.5 million–attributable to a decline in sales velocity in the company’s food-service channel & grocery channel

- Net loss improved from $1.7 million to $900,000 in the comparative quarters.

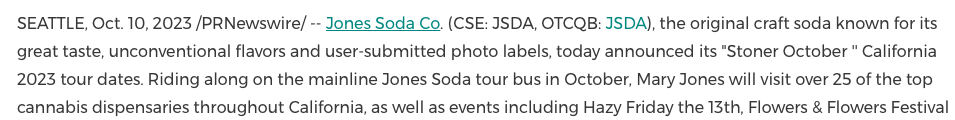

- The company’s cannabis brand, Mary Jones, generated approximately $220,000 in revenue compared to approximately $400,000 in the second quarter of 2023.

Some other scary stats:

-170.62K per employee (June 2023; Net loss decreased 23% to $2.4M. Lower net loss reflects reducing General and administrative expenses–> layoffs?)

Altman Z Score is -5.51

MacroAxis calculates their probability of Bankruptcy at over 60%

Investors Observer ranks it lower than 96% of other stocks

Pouring Through Their Cash

The company has no debt. Their Cash to debt sits at an impressive 25.3 with a quick ratio of 3.03

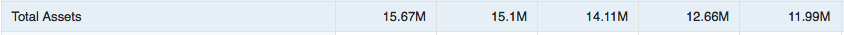

Of their Total assets, 95% of them are composed of current assets. Across the same time frame, accounts payable is about 40% of accounts receivable.

Total Assets/Total Liabilities is about 30%

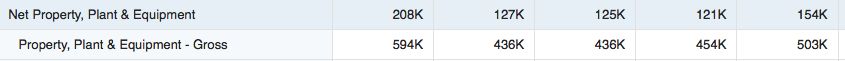

The value of their fixed assets has been depreciating rapidly though.

Inventory has shown a steady increase from 1,439,000 in 2018 to 2,621,000 in 2022, a 81% increase, whereas the growth/revenue is only 52% over this time frame and never touches the inventory expansion. Perhaps this is suggesting over-buying, inaccurate projections, cancelled orders from a worsening economy via unpredictable consumer demand or still feeling effects from unscheduled delivery of goods from years prior.

Institutional investors and Strategic Entities hold about 15M of shares a piece, whereas 71M shares are held by presumably retail–a large majority. A few insiders have been buying modestly over the last 6 months. SOL Investors Corp sold 1M shares in March 2022 and another 1.5M shares in August 2022, significantly reducing their holding.

Sure, they can afford it with their no debt, but the real growth in this company is simply financing cash flow–which begs the question who is going to be willing to lend to them if their growth machine begins to fall.

According to last quarter, if we use the current COGS, their sales would have to increase 54% to offset SG&A. If we use their 2019 pre-lockdown world, sales would have to have increased by 41%, further highlighting the increase in expenses.

Closing

It seems that this is one of many stocks that are dependent on an endless cycle of financing and reliance on investors thinking in terms of purely revenue but letting the bottom line slide.

One can’t overlook that they do have ample cash, lots of current assets, no debt and can finance further–but if they cannot drastically get SG&A under control or spark huge sales growth–to what end? As the credit card debt surmounts, student debt payment resumes, recessionary indicators pile up, turmoil in streets, warfare ramps up, mom and pop become squeezed on their grocery bills. Or perhaps, I should say the punk rocker dope smoker becomes squeezed. Uncertainty ahead could hamper the growth that this company absolutely needs.

Now I’m remembering why I forgot about it in the first place

#StayOnTheBall