Tailwind vs. Headwind–What’s the Weather?

I was a young teenager once, I tried but I couldn’t help it. During this period, stupid ideas came naturally, like mixing high-sugar, high caffeine, B-vitamin drinks with vodka and carbonated water. A sort of shock to the nervous system where it doesn’t know whether it should be alert or sloppy. I heard a joke, “the point of mixing Red Bull and Vodka is to witness & remember when you drove over your neighbours lawn on your way home”. In a similarly stupid manner, we’re seeing these opposing forces go on between the Federal Reserve and Janet Yellen (& Congress’ spending).

Here’s why this matters:

Alcohol

Everybody seems to be so concerned about the announcements (and reaction to those announcements) at the Federal Reserve Open Committee meetings & press releases. The Federal Reserve, a long with virtually all other Central Banks have focused on holding down asset prices by rapidly raising interest rates (or at least refusing to lower them). Please click the button to see how the Federal Reserve may be forced to lower interest rates to bail out not the United States, but the global economy!

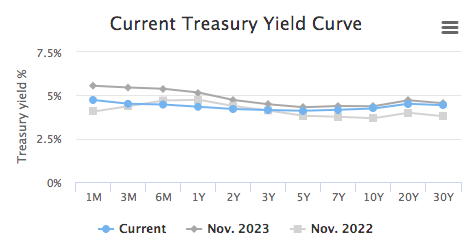

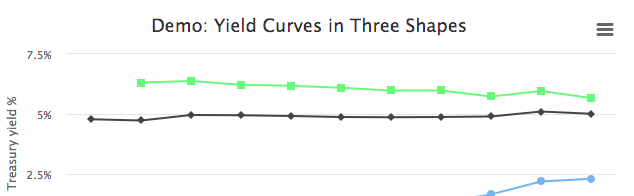

Please note the similarity between yield curves. It’s also worth noting that the 10 year minus 2 year has un-inverted (for a 2nd time) which usually predicts a recession and lower asset prices. Higher for longer means asset prices should be headed lower for longer too. This is the drunken part of the equation or the headwind.

Caffeine

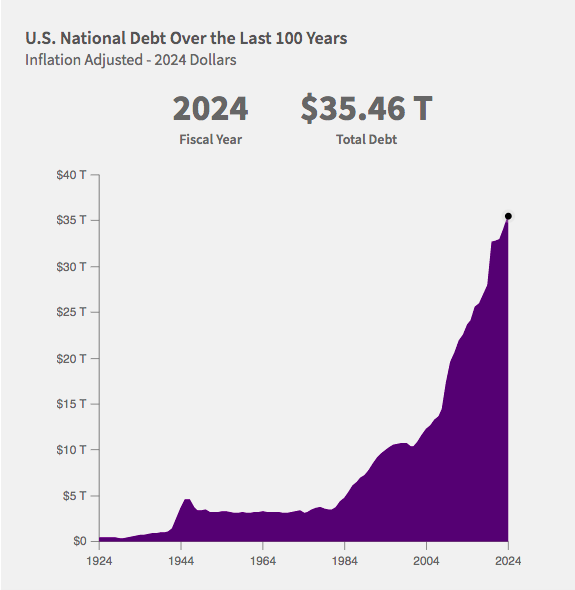

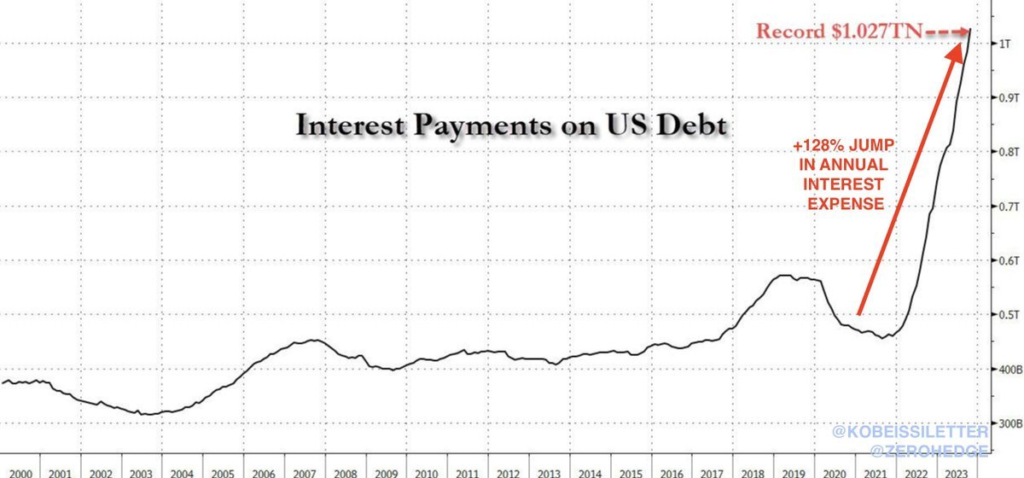

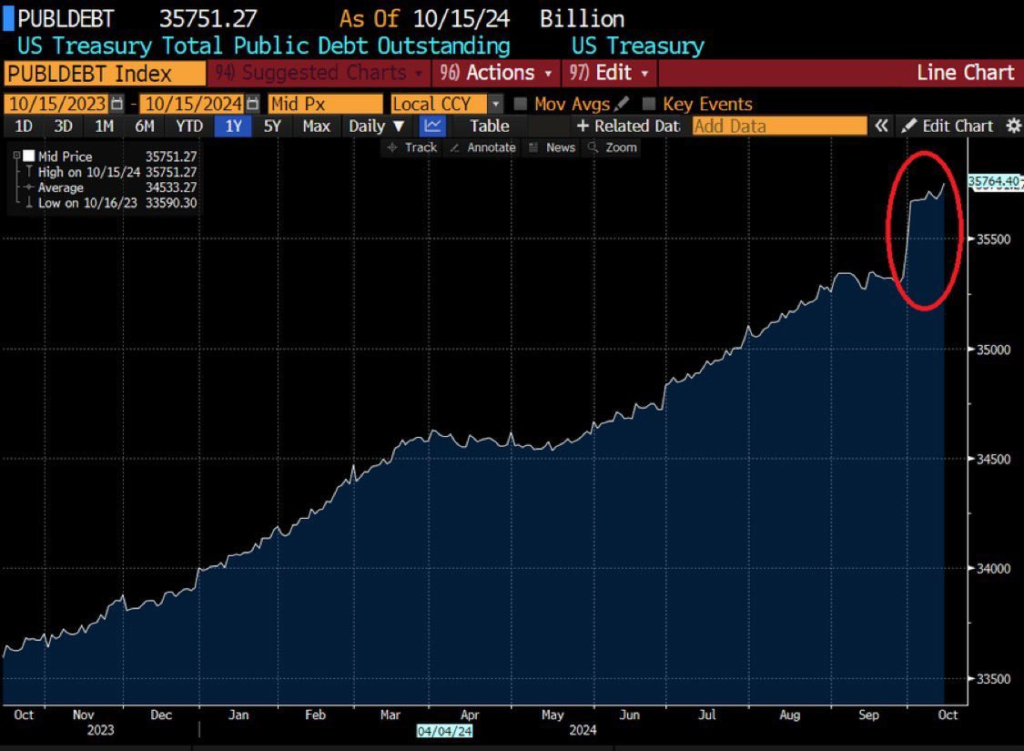

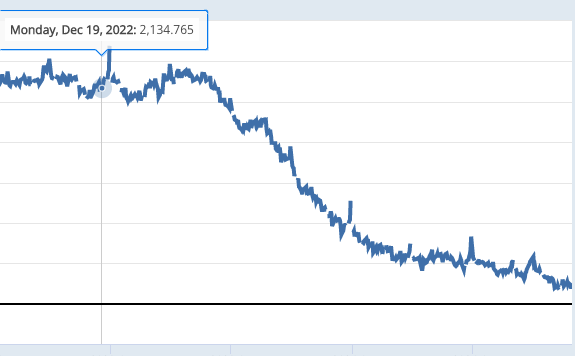

However, as you can see above, spending and debt issuance has only seen growth. As I write here, the number of banking facilities at the Federal Reserve and other banks are so plentiful, that markets and asset prices have seen a “melt up” due to it. I’ve also highlighted the importance of Reverse Repo as a method of accessing liquidity for to leverage up even more and stuff it into markets such as real estate, equities, bonds and gold.

Another factor that few people talk about is a problem that pension funds find themselves in where they only invest in companies with two criteria: 1) Lots of volume and 2) Lots of Market Cap. This is due to the fact that they are swimming against the tide with their redemptions/contributions and are hungry to chase a yield AND the funds are so large, they are limited to these companies and have to shun other value stocks.

So what does this mean?

In short, we have two opposing forces here whereby the Federal Reserve is seeking to get inflation under control. Their tactic by increasing unemployment, decreasing asset prices and velocity by tinkering with half the equation (demand) & trying to avoid the overshooting the unknown terminal rate (the rate by which further rate hikes will not yield any less inflation). This is combated by cracked out Uncle Sam who’s taking spending to new heights & flooding international markets with dollar reserves (& eager to withhold buyers of its debt). Other dynamics such as passive index investing and funding facilities since 2020 have also allowed this to remain longer than prior years, too.

Similar game of Tug-of-War

Something similar is playing out between funds/investors who are seeking a higher return on their investment [on US debt]. Whereas [dealer] banks are okay without considering inflationary risks, instead they are happy with an overnight spread because the immensity reserves floating around the financial system. In other words, inflation doesn’t matter when there’s an unlimited amount of cash to park at the Federal Reserve overnight or T-Bills. Please read more of it here:

Closing

Like I elude in the my title, Caffeine and Alcohol; one is a stimulant whereas one is a depressant. Which force is going to win to determine where the market his headed? I’d be lying to you if I could time the market–but, similar to my teenage self, I can guarantee you that they’ll be a stupid, reactive decision made.

If you want to prepare yourself the best you can please consider subscribing by clicking this link for discounts, Investment Powerplay, Controversial Forecasts and personal chats.