The Saudi Arabia of Clean Energy

Uranium. A market that is poised for a new bull market due to a number of factors and there’s one country in particular that is set to benefit a great deal–but before that, I think it’s important to look at Uranium itself. You may hear the term Yellow Cake being used when doing your own research–>Yellow cake is a type of uranium concentrate powder obtained from leach solutions, in an intermediate step in the processing of uranium ores (this is relevant for something at the end).

Energy is the Answer. Period.

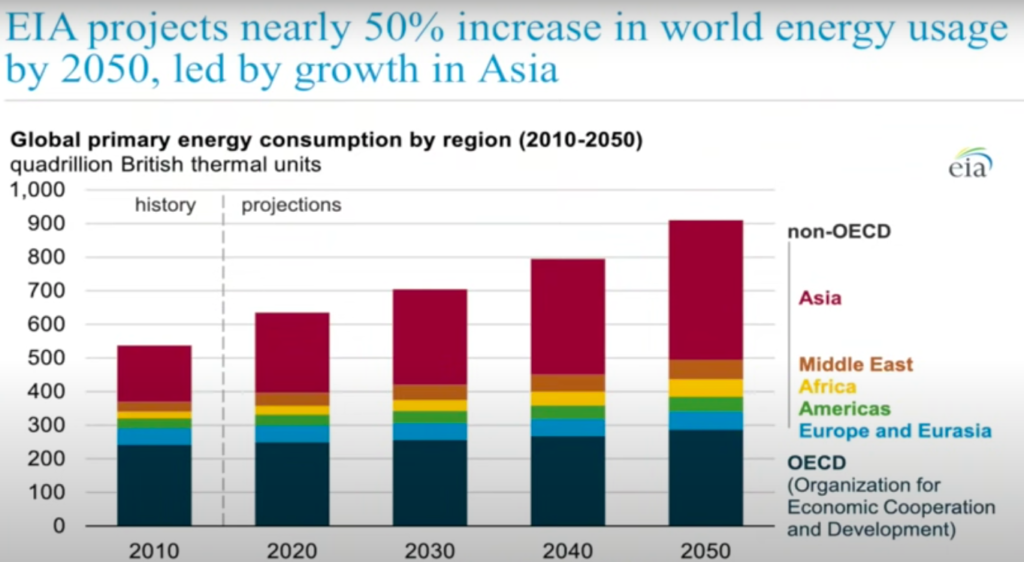

I’ve said this before–but the world needs energy if it wants to continue to grow and support anything resembling an economy. Energy sources have evolved from more matter-dense sources to energy-dense sources. Biomass lead to more cooked food to consume more resources; Coal fuelled the industrial revolution; Oil lead to the globalization of the planet; Natural gas lead to improved efficiency & therefore economic growth. Each phase leads to less pollution, more health and more wealth.

New hype over renewable forms of energy are just that–hype. Wind and solar simply cannot provide efficient base-load carbon-free electricity. To date, solar panels can only harness about 25-33% of the available energy & are not energy dense at all. Solar farms require the use of lots of land (and to kill trees & habitats), which isn’t the most climate friendly. Even if they could steal the solar energy to an amazing degree, it would also immediately disturb plants, animals and weather (by withdrawing their energy source). Solar panels have a lifespan of about 20-30 years which are challenging to recycle to begin with plus they contain toxic materials to manage. Interestingly, to get the same amount of energy the USA produces a year using solar panels, you’d need to cover the entire state of Nevada in solar panels–I’ll bet Vegas odds that won’t happen.

Windmills, aside from there being no wind on some days have even less energy density than solar while still retaining a 20-30 year lifespan. They also do not erode and require landfills to manage their broken parts, once they are done killing off near-extinct birds.

Both solar and wind funnily enough require natural gas consumption. Why you make ask? Because they cannot be turned on and off like natural gas–they are supplemented by burning gas to keep them active during the valley/trough periods. They also require a tremendous amount of mining to receive the materials necessary for their production (which just means burning more oil & gas). It’s my opinion that wind and solar, with some exceptions, are pretty much a scam created to make money & play politics but i’ll save that for another day… the point is that we all need energy and if it’s not coming from more coal, oil, natural gas or these bogus sources–then from where?

In each phase of evolution, humanity sees an advancement–and we are on the precipice of another advancement–that’s not fully appreciated

Uranium.

Nuclear is the real clean energy

Regardless of whether you’re a greenie, a hardcore coal supporter, whether you think Obama’s mansion in Florida will be underwater next year or you’re a commodity speculator–Uranium is the answer.

I know this is sacrilege to say, but the only scary part about uranium in nuclear energy is that the world isn’t jumping for more of it.

There have been three nuclear accidents there have been in history. Every single one of them have been the result of mismanagement and old, outdated technology. In total, these accidents amounted to 200 deaths. By contrast,

Deaths per year:

150 wind/year

450 solar/year

9M fossil fuels/year

Radiation, from the by-product of using uranium at a nuclear power plant is nothing more than a product of fear-mongering with negligible threats to employees/residents.

I know a worker in the nuclear energy field (in Mexico) who stated that the energy that their plant can produce is equivalent to almost 50 coal mines.

All waste ever created by nuclear power production can fit on 1 football field stacked 5-6 feet high… compare this to a solar farm. Furthermore, this waste is contained away from the ecosystem of living things.

Uranium is energy efficient, cleaner, risks of toxins is low, easy to manage (with current technology) and its output is reliable.

Also, it makes sense there is no political push to adopt nuclear since they are obviously not motivated by science and economics, rather by politics. It’s hard to tax people, restrict their movement and force regulation down their throat if you ‘have the answer’ to your climate questions. I digress.

Until the World Figures This Out, There’s a Bull Market Here

Some uranium bulls are predicted that the price of uranium to head up 3-5X from its current position (it’s already improved a lot since writing) with the mining stocks increasing far more from the leveraged price. This forecast has become increasingly true as for the first time in history, uranium has slipped into a persistent and widening deficit.

Recently (September 2023) the price had shot up $10 per tonne of uranium. Why?

The main producers of uranium are very close to being sold out of material for the next few years. They signed a lot of term contracts that are dated to lock in a price. Utility companies that sign contracts may do so at a good price but in these contracts they offer something known as flex provisions. These provisions often grant the option to receive 20% more material than in the original contract across a 4-5 year period. Of course, if the contract is 20 dollars a pound cheaper, than you’re gonna buy a bunch more while you can. Generally, this meant Uranium was Buyers market… but it’s been eaten up now.

Looking back, this has become the third period for uranium whereby the first two periods also saw the aggressive buying of the commodity due to their own circumstances. This hunt for supply is once again, ripping the price (see chart below).

Please Consider the Newsletter and Subscribing for Researched Content like this!

Supply/Demand

Uranium purchases have been notable since the 1950s. While initially, it was purely for military and weaponry purposes, it began to change in the early 1970s as commercial nuclear power garnered further attention. Private sector utility buying became a dominant source of demand. So much so, that the energy capacity improved 100X in the span of 15 years, as did the demand for mining uranium. Mines naturally went hole-hog pumping out a lot of supply. But wait a minute, this is the 1970s when there was an energy crisis; inventory of uranium was bought all up and stored by commercial utility providers causing the price to rocket amid a glut ($40 per pound; in today’s dollars thats worth $149)

Mining began contracting in 1982, as more and more reactors came on air (between 1982 and 2010 nuclear reactors had an excess demand of 1.1billion lbs of uranium), but obviously problems occurred with Chernobyl in 1986 & the collapse of the Soviet Union in 1991 forcing government actions. One of these actions was to convert a lot of government/military inventory to commercial inventory, flipping the glut and slamming the price down to $7 per pound (2000).

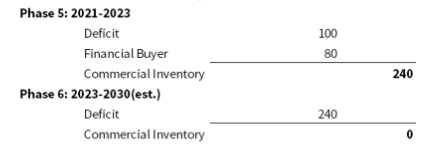

This is when it gets sexy. By the late 2000s, commercial inventories had fallen nearly 70% and stood at only 200 mm lbs. Commercial inventory coverage went from eight years in 1982 (when supply was hot) to less than two years by 2007. Once again, commercial companies swooped in and gobbled up inventory, further expanding the shortage.

If you timed the bottom & the top, the price of uranium increased just over 18X in just 7 years (2.61X/year).

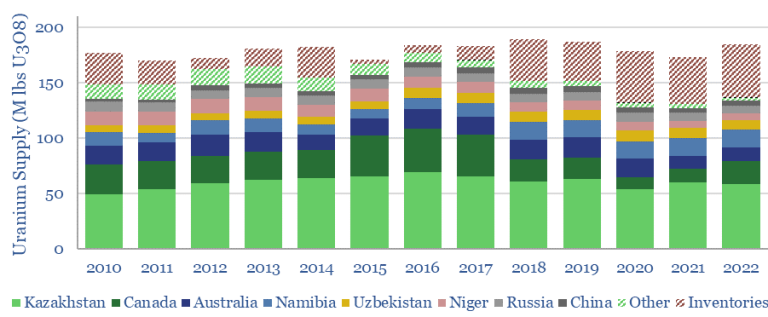

Fukushima’s disaster occurred in 2011 which caused Japan to shut down all their nuclear reactors and sent shockwaves around the world to look unfavourably towards the commodity. Things got sleepy as you can see in the chart on the demand side and then Kazakhstan jumped on the opportunity since they had such rich resources.

Primary supply grew for the first time in decades. In-situ leach production in Kazakhstan grew by nearly 50%, or 20 mm lbs, between 2010 and 2016. Primary production nearly satisfied reactor demand in 2015 – a first in over twenty-five years.

Commercial inventory began buying this fresh new production since the bottom and reached 415 mm lbs. by 2018, covering reactor demand for three years.

Things remained calm, till 2020 where reactor demand began picking up again (predicted to reach 188 mm lbs this year). Since, there has been a deficit in Uranium supplies (mining and recycling) in every year, with the gap widening larger and larger.

Over the past twelve months, spot uranium advanced 12% while oil, natural gas, and coal all fell anywhere from 30-70%. Uranium prices extended their recent surge to over $86 per pound, rising nearly 80% on the year to levels last seen well before the Fukushima disaster in November 2007, as high demand coincided with risks to supply.

Current Predicament–>Supply

Now, there’s a new player (no, not you and I)–Sprott Physical Uranium Trust. They are a financial buyer of the commodity who are closed-ended fund meaning when they buy, it’s effectively off the market. They have been buy 25-30 million lbs. yearly since 2021. Kazakhstan have launched a similar fund to purchase physical uranium who are sitting on about 250 million pounds of uranium–Singapore and others have done the same in smaller, yet significant quantities that add up.

Large of Korean & Japanese utility providers are also looking to begin purchases of 7M lbs. each starting in a few years amid a long-planned phase out of other forms of energy (which is significant given Japan’s history with nuclear power plants)

Additionally, the implications of France withdrawing from uranium mining in Niger may also add to the shortage. This could remove around 3,000 tons of uranium supply from the market. With France heavily reliant on nuclear power, they remain a major uranium consumer. The mining decision seems politically driven, but the supply will have to come from somewhere.

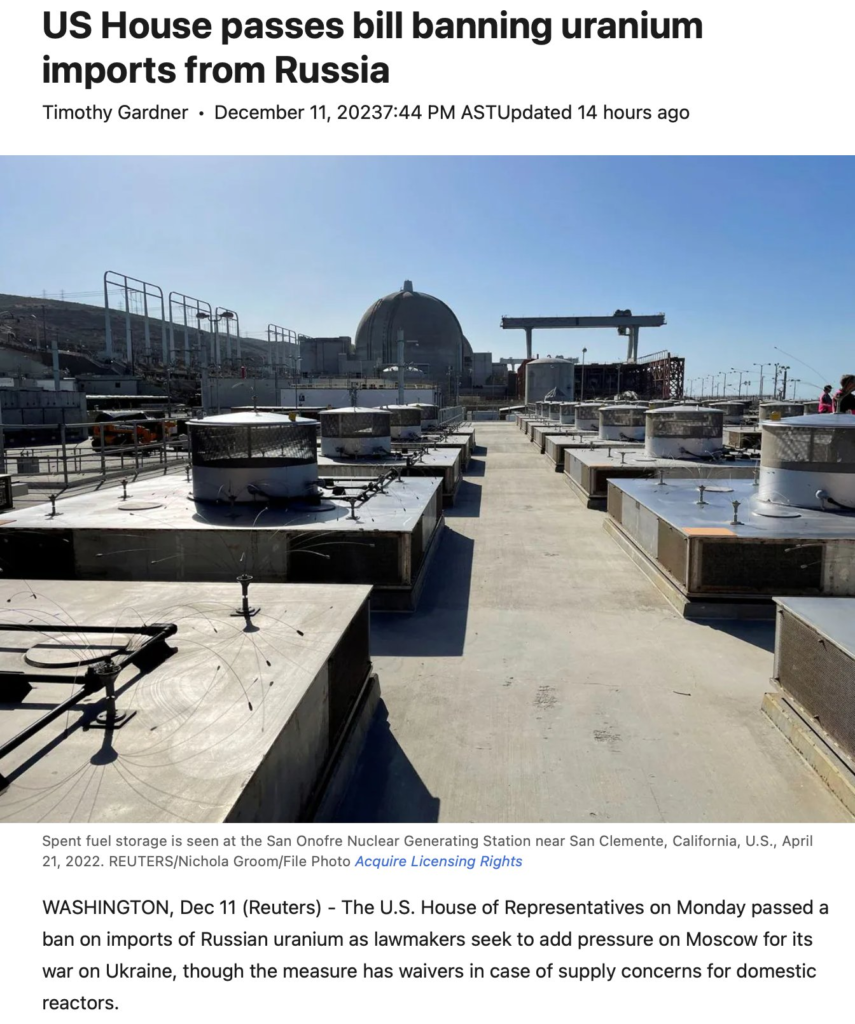

The US/Russia geopolitics throws import of uranium from Russia into a quagmire, too. The world’s top supplier (Russia) of enriched nuclear fuel, magnified shortage risks as Western enrichers already face a capacity crisis following voluntarily shunning Russian imports. Also, lower than expected output from Canada’s Cameco has impacted markets in a perfect storm.

The point here should be clear that either production or export is reduced or any supply that is out there is being bought up immediately. What if another institutional investor wants to drop a few billion dollars and corner this market? What’s stopping them? and if someone were to do such a thing, what’s going to be the lid on the uranium price?

Other analysts predict that the deficit to be larger in 2023 and onward; even if they are remotely close, it’s the exact same situation that took Uranium to 137USD/lbs in 2007 (Approximately $201 in todays money). Although add the investment trusts of yellow cake and the development of nuclear power plants throughout Asia to this story.

To quote natural resource investors Goehring & Rozencwajc, “If every uranium-producing country gets back to its maximum output (a big if), primary production will only grow from 140 to 174 mm pounds by 2030”. At the same time, global reactor demand is set increase by over 27% and outweigh this lenient number.

And did you know that every new reactor requires three years of uranium fuel for its initial core loading?

This will require even further supply just to get the newly constructed reactors built so they need to purchase supply. Where is it going to come from?

Kazakhstan; Kazatomprom

Kazakhstan’s resources are becoming increasingly crucial in the world’s transition away from hydrocarbons. With 12% of the world’s uranium resources, the nation has emerged as a dominant player in the uranium market. The government has big plans to adopt nuclear energy at home too, in addition to their inventory fund.

In 2009, they have been responsible for almost a third of the world’s uranium supplies. Ten years later this number jumped to 46%, showing that they punch above their weight.

In 2021, Kazakhstan produced approximately 21,800 tonnes of elemental uranium (double the year prior).

In 2022, the production was roughly the same at 21,227 tonnes. Contrast this with the number 2 producer (Canada) at 7,351 tonnes and less than half this in 2020. Namibia (number 3) produced 5,613 tonnes in 2022 and continue to show slight improvements but Kazakhstan remains top dog.

These resources are done through National Atomic Company Kazatomprom, the world’s largest producer and seller of uranium. Kazatomprom has access to 70% of uranium resources in Kazakhstan. Amazingly, National Atomic Co. Kazatomprom JSC (Kazatomprom) has a global market share of 24% in attributable production. There’s little reason to be skeptical about this former soviet nation.

“Kazakhstan adheres to the International Atomic Energy Agency guidelines and has been responsible for safely dismantling around 1300 nuclear warheads since the fall of the Soviet Union“.

Kazatomprom has recently announced that 20,500-21,500 tons of uranium is its production volumes which they state is below their target (2023). Their 2024 target is aimed to be 10% lower than their 2023 target yet again. The reduction is due to geopolitical supply chain challenges & the signing of new mid to long-term contracts with new customers. Still, they expect a 50% increase for the 2025 year reaching levels of production not seen since 2018. The added production could amount to 6,000 tonnes of uranium re-entering the market. However, this amped up production may have already been bought up by the market via contracts (not known at this time) bearing no impact on inventories all that much & the ramp up is expected to be gradual.

Despite being a major player, I remain skeptical of their ability to raise supply all that much given the geopolitical uncertainties & their staff hindrances. A new CEO was also excited to make some big promises after resuming the top position, too.

Quality

Kazatomprom contains one of the best grades and high quality of uranium among other private companies in the uranium space. Additionally, their ability to extract this high grade is consistent and efficient. Many professional investors hold it in high regards for it’s managerial talent and it’s personnel as well.

The company benefits from access to the world’s largest uranium reserve base (up to 350,000 tons) and a low-cost of operation position.

Perhaps upside does have a limit though, since it’s front and centre of geopolitical risk between the US/Europe and Russia

Exposure

Kazatomprom is the National Atomic Company of the Republic of Kazakhstan, and the main customers of the group are operators of nuclear generating capacities, and the main export markets for products are China, South and East Asia, North America and Europe.

The US government made sure they were getting a slice of the yellow cake before prices reached their point today. In 2015, Centrus Energy, one of the joint venture partners signed a deal with Kazatomprom opening up a supply stream of Kazakh uranium to hit the US. Another US deal was brokered between Coverdyn a year later.

The EU and Western countries are major consumers of energy and they are addicted to their own narrative of reducing CO2 emissions at all costs. As a low-carbon energy option; securing a stable supply of uranium is vital to maintain the continuous operation of their nuclear reactors & their economies at large.

To further threaten supplies however, Russia has banned uranium exports to these EU & Western countries. This has forced local sources in Namibia, Niger (well, not now thats for sure), Canada and USA to extract their own resources–but they don’t compete with Kazatoprom’s quality. Interestingly, Russian entities own over half of some Kazatomprom subsidiaries, with China owning more and more as the days go on.

In total, Kazatomprom has 13 mining subsidiaries, 3 are wholly owned by them and ten are joint ventures with foreign shareholders/entities–one must wonder if the new contracts are signed with US parties or not.

We know Kazakhstan are getting along with China and Russia. Halfway through this year, two recent Kazakh uranium deals — one the sale of a 49% stake in the country’s second-largest uranium deposit to subsidiaries of Rosatom (Russian), and a long-term sales agreement with a Chinese nuclear champion were approved— demonstrating Astana’s deepening relationships with both China and Russia. Moreover, Kazakhstan has become the post-Soviet Switzerland since the Ukraine War. They have been accepting business both from European countries but also Russian ones. A Russian friend remarked, “When in trouble, just move the business to Kazakhstan”.

Perhaps not everything is so diplomatic though. Russian troops quelled the furious street protests that threatened to bring down the government of President Kassym-Zhomart Tokayev in January 2022. Tokayev has resisted Moscow, by not formally recognizing Russia’s annexation of eastern Ukraine.

As you can see, its not just investors who are fighting over securing uranium supplies!!

Closing Thoughts

Energy is absolutely critical for everyday life & economic output. Demand for new alternative forms of energy are high but nuclear energy (uranium) remains fully unappreciated for its cleanliness, energy density and safety profile.

Reviewing the history of this commodity, I view this as a perfect set up for the uranium price and a leveraged play for the producers. Just like the times before it, supply is being gobbled up by the market and the deficits are widening day by day. The emergence of funds (& going public!) allows buying physical uranium to become easier to widen this supply hole.

Kazakhstan’s position as a leading uranium producer makes it an attractive partner for long-term supply contracts, ensuring these nations’ energy security and diversification–I believe the Kazakshtan to be in a great position. If we look at the spectrum of companies positioned for this market, Kazatomprom is wearing the crown. They have almost half of the world’s production, the highest grade, the complete support of the government & agreements for supply exports in place.

Of course, this supply constraint has received attention of political heads who are also looking to secure a supply for their country. So far, Russia seems to be in the lead with influence.

Even if you don’t like investing in energy, this should all excite you– energy supply crunches are also present in coal, offshore oil, nat gas and crude oil (amid cuts).

Till then, get your hands on some uranium! IF you can…

& as always

#StayOnTheBall