This is Headline News, but Not For These Reasons

If I were to ask you, have things gotten better or worse over the last 20-25 years, my guess is that you may be inclined to say worse (since this is written in English). Trust among neighbours has declined, mental illness has shot up, more job insecurity, more social inequality, higher cost of living, more propaganda and media lies, more fake wars, the list really goes on. Life was more organic, true and simpler years ago.

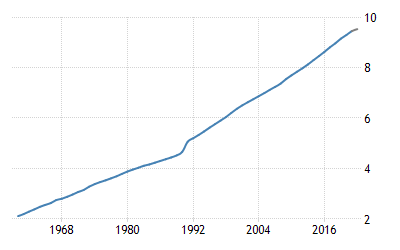

There’s a country, oddly enough in the most unstable of regions who have seen nothing but growth in their economic figures. This country borders a country who experienced hyperinflation, and another who are about to experience it. They neighbour a state and actively share missile fire back-and-forth as well as another state that has experienced one of the largest humanitarian crises in the last decade. They themselves are inherently unstable, and their existence themselves remain controversial to hundreds of millions. They have a lot of negative opinions thrown their way and civil unrest is certainly not uncommon. Although, despite growing up in the country-equivalent of Harlem, if you zoom out and just look at economic indicators, they’re doing tremendously well compared to other countries. Not just in their neighbourhood–but the entire world.

Can you guess?

Israel

I first noticed this after some very loud Jewish people were screaming at a soccer game on television in my hotel in Georgia (stay tuned for the Georgia article). I thought… well at first I thought, ‘Would you shut the F*ck up!?’, then I thought–what are they doing in Georgia? What’s going on in their home country, is there trouble? –Turns out it was a Jewish-owned hotel so they were visiting family. But I still searched Israel and found these numbers below:

I am not undermining the events that have occurred in Israel & Palestine the last months (or many years prior), strictly want to highlight the economic discrepancy of Israel relative to the region.

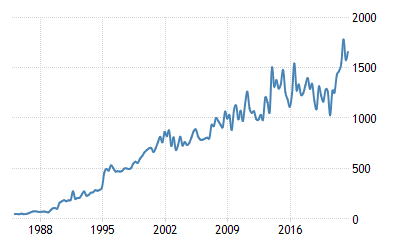

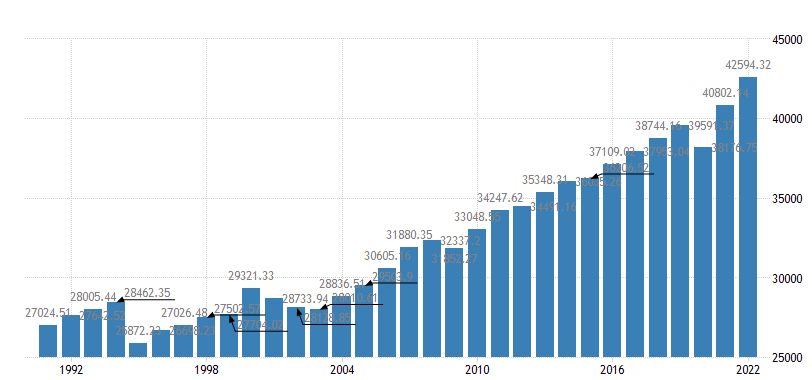

Money has been piling in there since around 2011

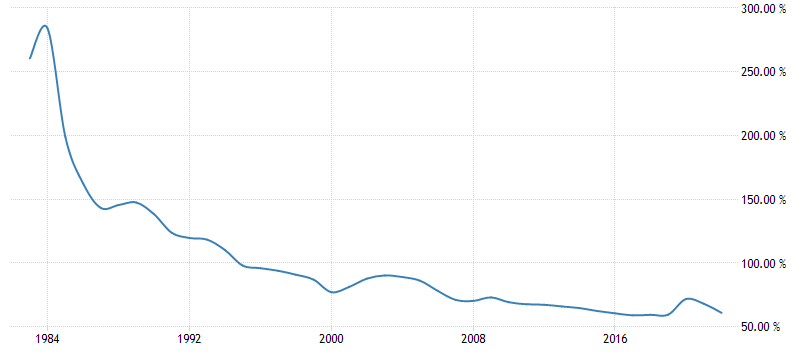

“Well surely with more people there is going to be a larger GDP and more people to receive remittances… they’re probably just another stupid high debt nation that prints their success“

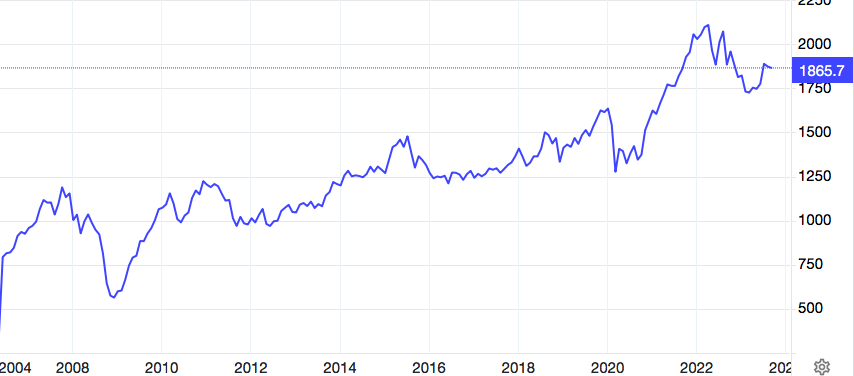

Alright alright, well why haven’t I heard about their stock markets? Surely their stocks would be hot — Yes they are hot. Since 2004 they have outperformed the S&P500. The S&P 500 since Jul 2002 (benchmark of chart below) performed 4.54X but:

Tel Aviv markets have outperformed the S&P500 for someone who has bought in 2002 and held by 50%.

For sake of comparison for household debt to GDP… Canada sits at 102%, USA is at 74.4%, UK is at 83.5%, Germany is at 55.8%.

Do You Enjoy Uncensored Truth Reveals?

Join as a Member then!

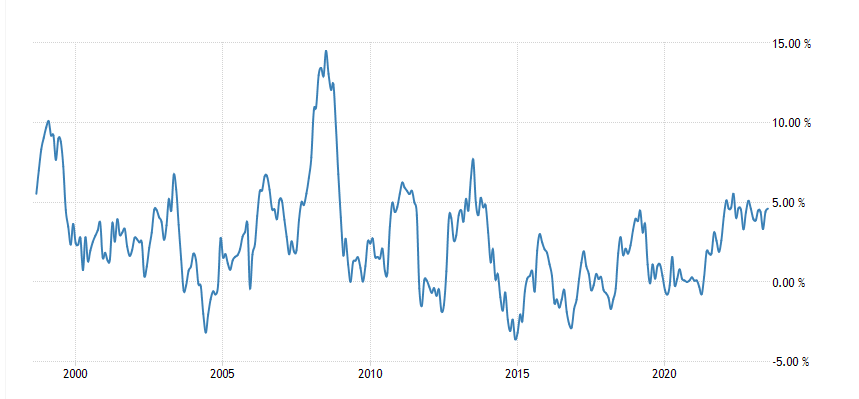

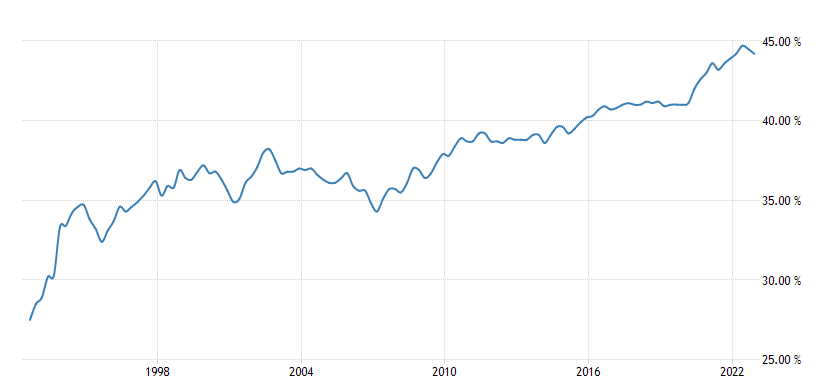

Another interesting figures is that Retail Sales YoY never seem to jump, nor decline. They are quite steady and have been for nearly 3 decades.

‘Okay great, you go shopping and someone blows the store up’, well:

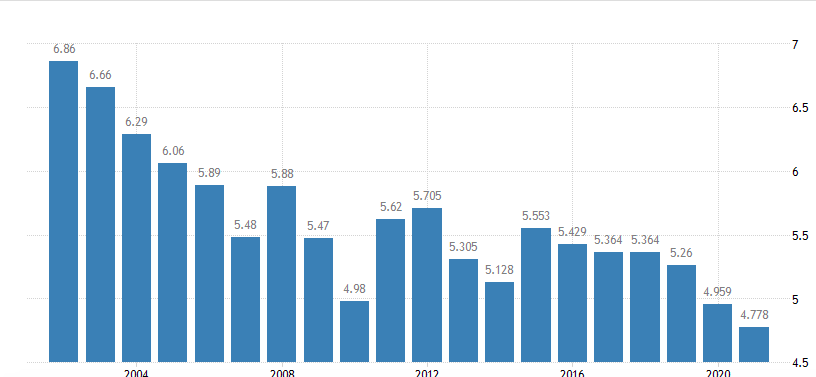

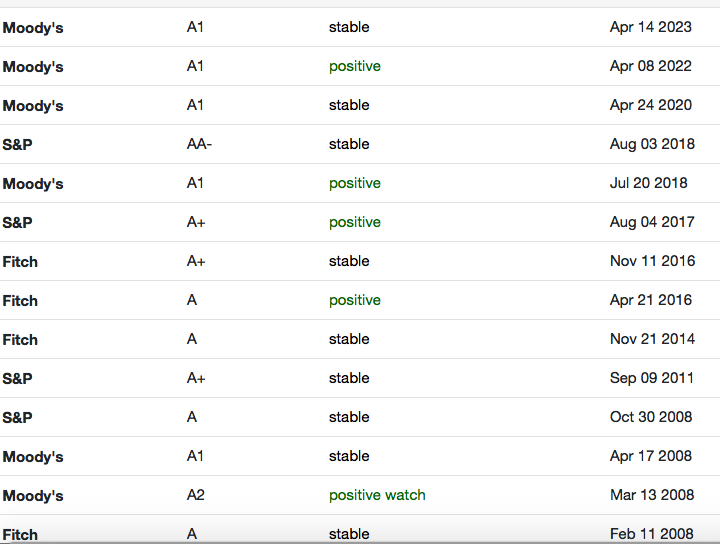

The last time they had a negative credit rating was back in 2001… as of late, it’s stable or positive:

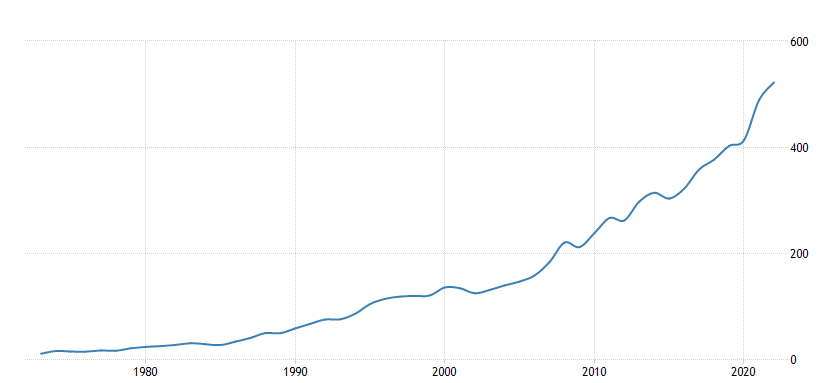

From the Israeli embassy on their economy:

The most recent global financial crisis in 2009 produced a brief period of recession in Israel, but the country’s prudent fiscal policies and regulations, combined with a particularly robust banking sector, allowed the economy to recover quickly…Israel consistently ranks among the world’s economies in terms of its technological readiness, venture capital availability, and the quality of its research organizations. The country ranks #1 in availability of scientists and engineers, number of start-ups per capita and venture capital investments per capita

Israel could almost pay off it’s entire DEBT with its bank reserves right now. Debt as of December 2022 sits at 294.7B whereas it’s foreign exchange reserves (as of Jul 2023) sits at 200.1B

The Problems I could find

The negative numbers are that relative to 20-30 years ago, it’s corruption rankings have increased, mining production is quite flat, consumer confidence remains negative, price to rent ratio has gone extremely high and they have murdered their tourist industry with the severe covid policies. Despite a raise in GDP per capita, it’s estimated that 21% of their population are poor, however it’s thought that a majority of this population are Arab or other ethnic groups who are temporarily present for employment.

Additionally, I cannot find that they hold any gold reserves at all, which seems odd (perhaps it’s amongst the foreign reserves just simply undeclared).

Closing

Nevertheless, there’s a lot of positive trends occurring here once you zoom out to see the big picture of their growth. It’s truly unique for not just the unstable region but for the entire world. Could it have been better? Yes of course, but generally they haven’t stopped growing as a country over the last 20-40 years. They got through 2001, 2008, 2020, their own domestic issues and are managing through existing geopolitical uncertainties.

Oy, could this be a long-term safe haven?

#StayOnTheBall for more information! Be sure to share!