Crisis + Offshore Oil= Opportunity?

As of October 27th, 2022 Lebanon and Israel have come to a deal (brokered by the United States) to divide up ownership of maritime boundary areas of the Mediterranean; an unlikely event given the hostilities between each other. The settling of these boundaries allow for the transparency to set-up for oil and gas exploration in the East Mediterranean, an area known for existing oil deposits but have been rather unexplored–after all, these two countries have been formally at war since 1948.

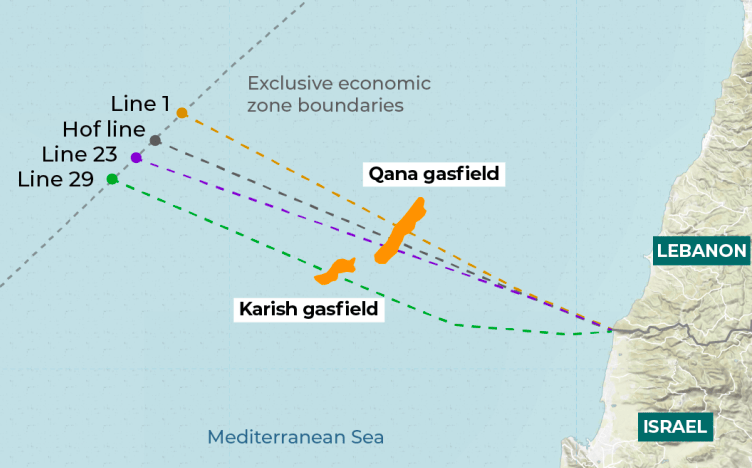

According to the negotiations, Lebanon received the Qana field while Israel received the Karish field in the Mediterranean sea. Israel has full claim to it’s field whereas the much larger Qana field is not entirely the rights of Lebanon.

Territory extending below the purple line (Line 23) is subject to royalties to the Israelis subject to an agreement with the Qana gas field operators. However, it’s not clear who those company operators will be.

As I’m sure you’re aware Lebanon is still amidst a financial, economic and monetary crisis as well as having many insurgency groups. It’s head of state has effectively failed in enforcing any governance and it’s banking system has an ever-reducing purpose. What’s more, given that this is a new acquisition for the failing country, they do not have any infrastructure offshore to exploit this new deal. It is questionable whether they can rally together to build the appropriate infrastructure in the first place let alone receive and sell or utilize the offshore oil without the intervention of criminal groups and corruption. As is the case in Venezuela, (the most oil rich country on earth) oil has simply been used as a crux for their dictator to remain in power; perhaps this may be the same. Lebanon’s current president is set to step down on October 31st this year, spooky.

US president Joe Biden, Germany’s Prime Minister Olaf Scholz and France President Emmanuel Macron commented on the positivity of the move as well, which makes me think there’s something in it for them rather than Lebanon. French oil company TotalEnergies in partnership with Italy’s Eni have already demonstrated their eagerness to begin exploration in Lebanon’s Qana field. The reality is that they are far from production at this given moment–aiming towards the end of the decade. Both of these companies are megalodons, but there may be an opportunity to gain exposure through other smaller companies also drinking from this waterhole.

It’s estimated that at current prices the Qana field is able to yield $3B in total, ranging from 100-200M USD per year for Lebanon, but far from operation (and how much Lebanon sees of this remains to be seen).

Israel on the other hand are experiencing their own civil crisis and have recently provided choice words for Iran about their presence in the Middle East. Colossal protests have taken place in Israel over the Covid measures, a recent street protest with many dead following an Eritrean uprising between two tribes and the police and of course the murders from Hamas have their country in turmoil. Israel had their 5th election in 4 years after the current coalition had failed.

Israel also had immensely dystopian Covid-policies by forcing vaccination to partake in any level of society and was proudly the place whereby the DNA database of all the PCR users were stored to be analyzed (for what purpose–well they leave that part out of course). Though not near as severe as Lebanon, the heightened uncertainty may be deterrent for investors to enter their market as well. On the bright side, this new deal has granted Israel with a new opportunity, and they are well underway with exploration. Energean ($ENOG) has been in the Karish oil field for years now and allowed Israel to export it’s first barrel of crude oil, ever. They area also entitled for 17% of the share.

However, it’s worth noting, that Energean have been in their own dispute, given amendments to Lebanon’s law making the zone under their control (extending their ownership down to Line 29). Energean was ready to go for Q4 2021 after mitigating delays with their floating production storage offloading device and being forced to owe late contract fees for gas undelivered to their domestic and international buyers. Dalia, Israel’s private power station, had claimed that their contract with Energean to had been breached whereby the net debt on the project were increasing with any gas sales production. Outside of this, these companies have to contend with threats from Hezbollah in Lebanon, who have claimed they would attack any ships and equipment in that area

While the world does require energy to survive, do not expect diplomatic resolutions to come about between these countries. Soon following the deal signatures, Lebanon’s prime minister was adamant that while this deal implicitly recognized Israel under their contractual agreement, the state continues it’s long-held position that Israel is an illegitimate entity. It is not common for threats of war to emerge from either nation toward the other–in fact, they are even arguing who got the best deal right now!

So what do you think? Two volatile, indebted countries that don’t get along, forming a territorial deal brokered by Western powers, whereby exploration done by Western companies at a time when the world is needing gas amid supply caps from the Gulf and supply cuts from Russia. These agreements attempt to lay specifics on who has what claim to what field but one should remember that however solid the balance sheet, free cash flow or production a producer (when they get producing) may have, there are many political & historical risks that could enter to cease operations at any moment–just look at the last month!

“Our people sailed these seas 500 years ago… –oh yea? well our people sailed them 1000 years ago!”

Maybe they can’t come to an agreement–but you can, with your website viewers using this policy generator–> https://www.websitepolicies.com/create?in=809

Is this an opportunity at some point or is the uncertainty of the whole region simply not worth it? Please feel free to share below & continue to explore other articles! Keep going over my articles and you’ll find some that talk about investments I like/dislike.

Whatever you decide, remember to #StayOnTheBall