I’m going to discuss a stock, but I’m only going to give you some numbers to shield your expectations. I have a position in the stock, but I won’t reveal what i’m doing till the end. I’ll do a type of company riddle

I float on a sea of debt (Total Debt/Total Equity: 606%, Total Debt/Total Capital: 92.5%, Net Debt: 19.67B, Total debt growth 26.4%; 5X industry average)

& I sell as many tickets as possible, how many can this thing hold, I forget? (They have had numerous times with oversold tickets in a number of categories causing stress to customers)

I am a capital intensive industry, totally depending on global economies, healthy employees & the large supply chain.

And the worst of all is every year we have to encounter a damn hurricane.

Post-pandemic recovery has been amazing if you start getting comparative (477% revenue increase (21 to 22), 151.4% revenue increase (Jun22-Jun23), booking volumes for 2023 higher than in 2019)

The money will surely never stop flowing, at least, that is the narrative

My ratios always show that to be a shareholder you must spend a pretty penny(P/E: -13.48 P/B: 7.71 P/S: 2.16 (5.39 5Y avg.) Cash/Share: 12.64 P/FCF: 14.18)

& I haven’t paid out a dividend since the crash in 20-20

Investors who play the charts all seem incredibly smart

but let’s face it without financing this debt, we would all fall apart (Net Financing Cashflow 1.2B, 9.8B, 3.04B, 1.74B for years 2018, 2020, 2021, 2022, respectively)

Most analysts continue to give me a Buy (Barclays, Morgan Stanley, Wells Fargo, Guggenheim & others)

& my Quick Ratio is only 0.18, let’s hope I never have to liquify.

Since June 1st (2023), our Suite down-deposits are being raised for customers, frustrating if you’re a client (Suites are their money maker)

In March (2023), I lost 770M in market cap in a mere week, giant!

The lockdowns have definitely hurt our re-cord (Gross Margin 5Y -83.49% ; Operating Margin 5Y: -328.25% Net Profit Margin 5Y: -497.35%)

Oh, and our Insurance policy is also being raised, in case you go over-board.

I am a consumer discretionary that brings lots of cheer

Even for investors despite my immense losses year over year ( -5.797B, -5.26B, -2.156B (2020, 2021, 2022 net incomes); have only had 1 profitable quarter in the last 8)

My price performance has been nothing short of stellar (3Yr: 65% 1Yr: 151% YTD:102%)

I have so many institutional investors I think one of them is even Hellen Keller (77.9% of ownership are institutional investors)

I welcome all types of passengers since most of my sales are done using a credit card

& though credit card debt has never been higher, our products look better at sea than at the dockyard (Credit card debt for Americans has just touched 1.03 Trillion dollars in 2nd quarter of 2023; household interest payments have reached highest on record; 3 ships in dockyard)

I am packed with food, activity and entertainment, even so, there’s always the threat of vertigo

& I like to remind our investors the importance of Free. Cash. Flow. (-2.2B for 2022; -2.3B for 5y average).

Who am I?

Royal Caribbean Cruises. $RCL

I have been short this company for a long time now, still waiting for things to sink.

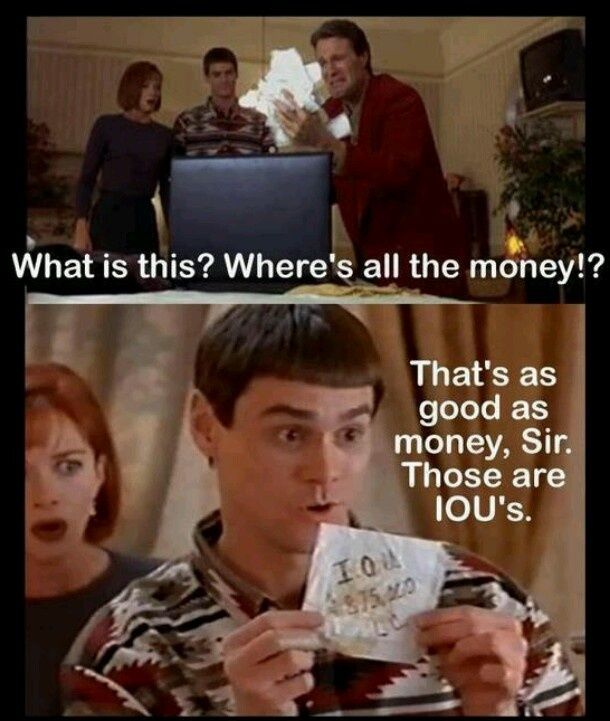

I appreciate it! Thanks for taking the time to read my ridd-Ah Damn, I forgot to mention that Lloyd Christmas was appointed to the Board of Directors!

#StayOnTheBall