Dying to buy it

I’ve previously commented on some sin stocks/sectors that I like. The first being a Gun Company, the second being Tobacco, and others are exclusively found in the Subscribers files.

However, with all this chaos going on in the world, I can’t help but remain bullish on ‘sins’– especially as the world dictators remain in power. This article is not for the faint of heart unfortunately as it’s a bit depressing but investor-types can turn it into a net benefit. If its going to happen anyway, better to make something of it.

I wanted to write about why I’m still bullish for this sector in the long-term. Death. There’s one company in particular that I’m looking at for a long term buy and hold.

Why Death?

The incredible and widespread numbers of unexpected or excess death around the world, coupled with violence and disease. Granted, the company below is only a USA company, but the trend still applies as you’ll read below.

There’s also a class of drugs to that are primed to profit as well–don’t miss out Follow our Twitter for updates:

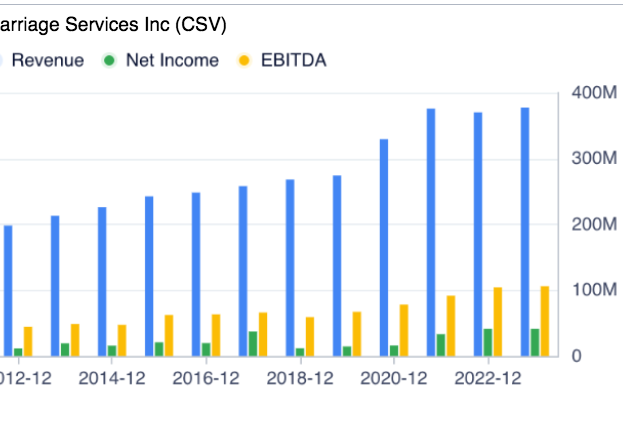

Carriage Services

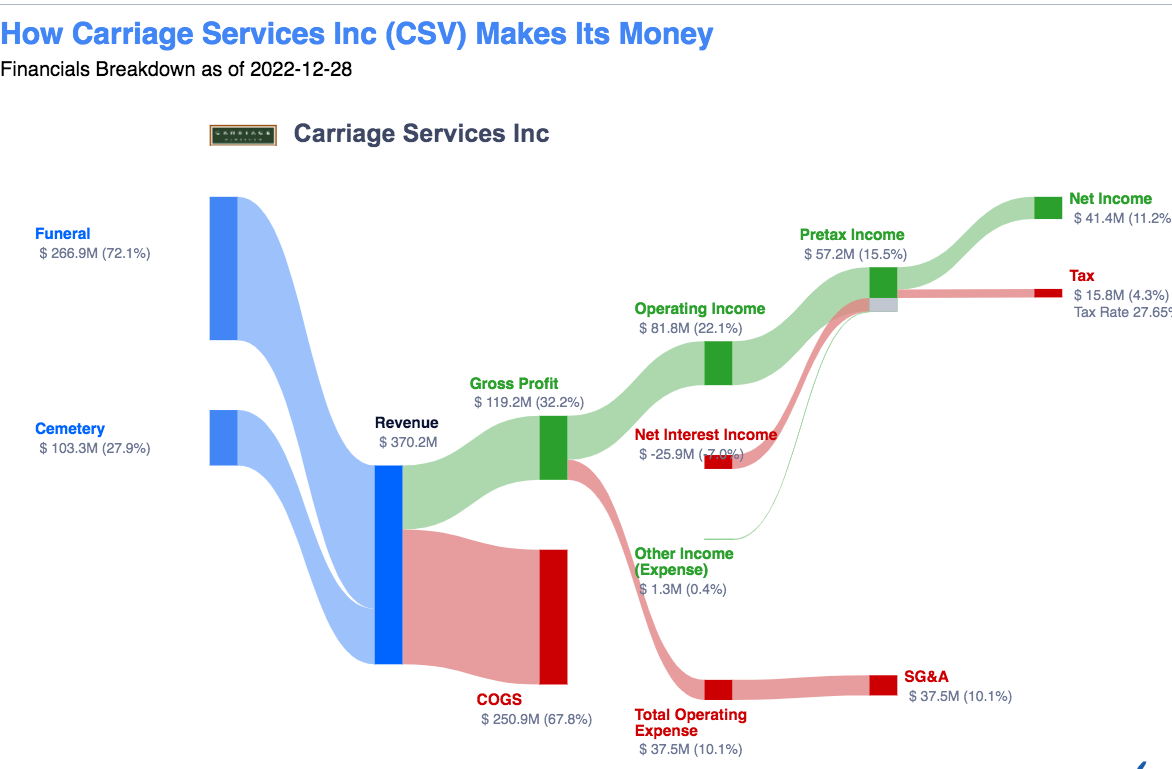

Carriage Services, Inc provides funeral and cemetery services, and merchandise in the United States. The company operates through two segments, Funeral Home Operations and Cemetery Operations. The Funeral Home Operations segment provides consultation, funeral home facilities for visitation and memorial services, and transportation services; removal and preparation of remains; and sale of burial and cremation services, and related merchandise, such as caskets and urns.

The company has 171 Funeral homes across 26 states as well as 32 cemeteries. A majority of their income comes from funeral services that you'll see below!

If you’re reading this soon after posting:

Stockholders of record on Monday, February 5th will be given a dividend of 0.1125 per share on Friday, March 1st. This represents a $0.45 dividend on an annualized basis and a dividend yield of 1.92%. The ex-dividend date is Friday, February 2nd.

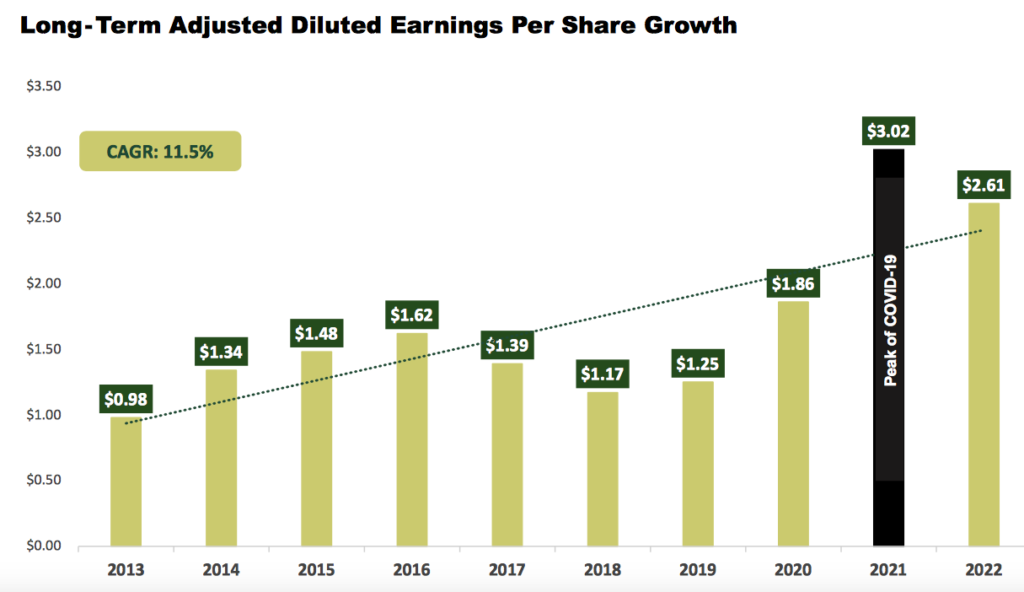

Carriage Services has raised its dividend by an average of 10% per year over the last three years. They hold a dividend payout ratio of 16.8% meaning its dividend is sufficiently covered by earnings. With an expected EPS of $2.32 , the company should continue to be able to cover its $0.45 annual dividend with an expected future payout ratio of 19.4%.

The Global Funeral Services Market is estimated to grow at a CAGR of 4.3% and reach a market size of USD 35.4 billion by 2027, according to the latest report by Verified Market Reports.

Shareholder Equity–>137M USD

Total Assets–>1.138 Billion USD

From the latest quarterly earnings call you can see this in their performance. Released in November, the CEO stated, “For the third quarter, our cemetery portfolio delivers impressive growth of 15.5% of total cemetery operating revenue…Total cemetery field EBITDA grew to 9 million or 14.4% over the prior year…we have seen a 5% decline in not need volume as a consequence of the expected COVID-19 pull forward effect on our same store portfolio, our acquisition portfolio and increase in sales average more than made up for it, resulting in total funeral operating revenue of 59.4 million, which is 478,000 more than the same period last year. “

Their EPS has remained flat due to the added interest expense on the debt, but they hold a primary goal of debt repayment to reduce the interest expense. This is all against a quarter over quarter decrease of death too.

“…robust free cash flow generating 21.4 million for the quarter, allowing us to reduce our variable rate credit facility by 16.7 million. However, despite this pay down, we experienced an increase of 2.6 million in interest expense compared to last year’s quarter, significantly impacting our adjusted earnings per share, which ended at 33 cents against 45 cents last year. After accounting for approximately 12 cents increase in interest expense, our adjusted diluted earnings per share are flat”

Ratios

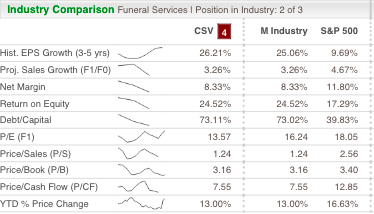

PEG ratio of 0.67

Beta (5YR): 0.92

Current Ratio: 0.84

ROCE: 6.7% (capital employed also increased 31% over the same 5 year period; compounding)

Debt-to-equity ratio of 3.65,

Quick ratio of 0.59

Carriage Services have been profitable 10 out of the last 10 years.

Latest Plans

The company has three plans moving forward; 1) related to the launch of an app service to better deal with customers with enhanced efficiency 2) partnership with National Guardian Life Insurance Company and Precoa on preneed funeral sale strategy (expanding to Western division) which has already added revenue and 3) “strategic alternatives” following board meets.

Reducing CapEX has been high on their list given the added burden of interest expense. Notwithstanding, they are still running a free cash flow of over 20 million each quarter.

Hedgies Like it

- Price T Rowe Associates Inc. MD now owns 236,839 shares of the company’s stock worth $9,391,000 after acquiring an additional 228,855 shares in the last quarter.

- Ameriprise Financial Inc. grew its holdings in Carriage Services by 18.3% during the 1st quarter. Ameriprise Financial Inc. now owns 1,291,979 shares of the company’s stock worth $39,431,000 after acquiring an additional 200,006 shares in the last quarter.

- Millennium Management LLC grew its holdings in Carriage Services by 61.7% during the 2nd quarter. Millennium Management LLC now owns 307,860 shares of the company’s stock worth $12,207,000 after acquiring an additional 117,436 shares in the last quarter.

- Marshall Wace LLP acquired a new position in shares of Carriage Services in the 3rd quarter valued at $2,763,000.

- Vanguard Group Inc. boosted its holdings in shares of Carriage Services by 6.8% in the 1st quarter. Vanguard Group Inc. now owns 946,962 shares of the company’s stock valued at $50,500,000 after buying an additional 60,532 shares in the last quarter.

Hedge Funds and Institutional investors own between 65% and 70% of the company.

Larger Macro Case

Chemical Warfare

Please see my article here to see why that this is an extreme threat to the United States that nobody seems to be taking seriously. I’d be lying if I said it wasn’t mentioned and known–but I don’t believe the general population views it as a threat sizeable to be deemed an act of warfare–which is exactly what it is.

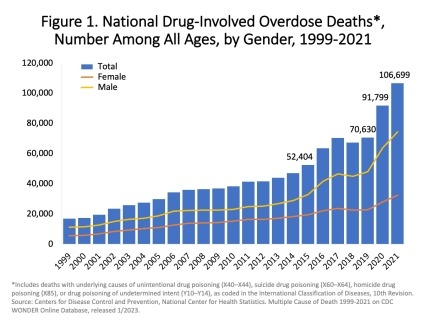

The United States account for 4% of the worlds population and yet, they’re responsible for 27% of the world’s death due to drug overdose.

Drug overdoses are killing hundreds and hundreds of thousands. We explore it more…

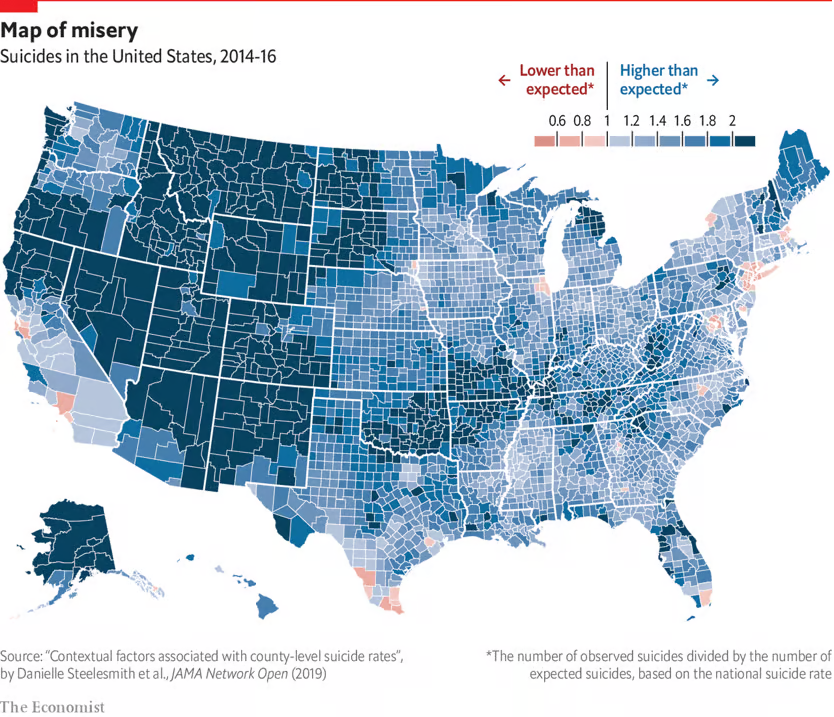

Suicide

The United States has a massive suicide problem. The suicide rate increased by 1% in 2022 to 14.3 deaths per 100,000 from 14.1 per 100,000 in 2021, marking this as the highest rate seen since 1941.

An even larger rise in suicide was found with the 4% jump from 2020 to 2021 which amazingly adds to a 13-year-old consistent increase in national suicide figures.

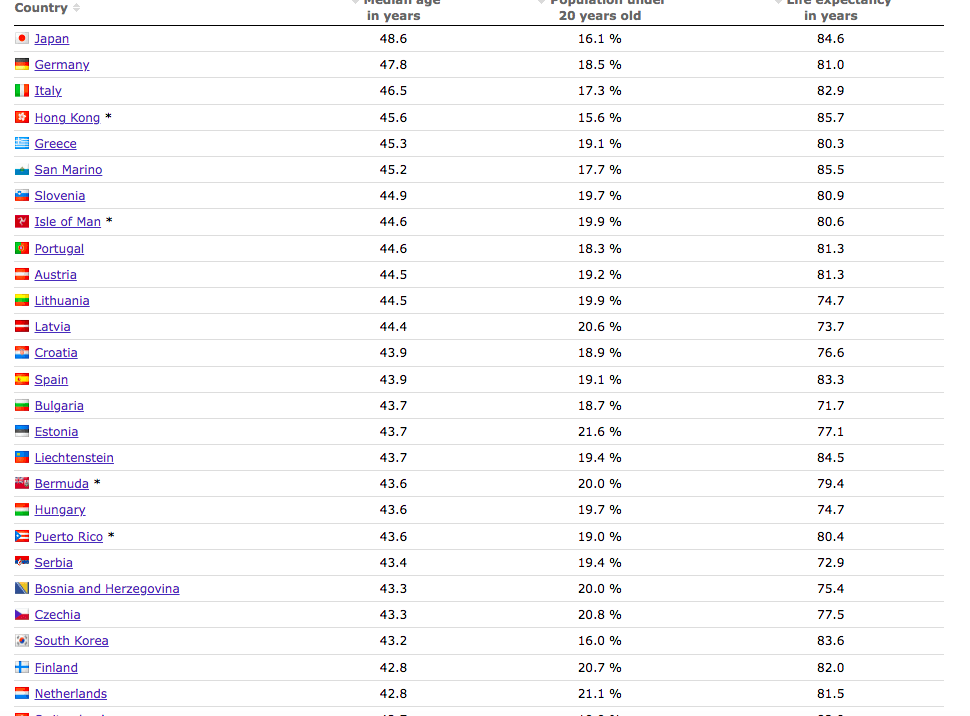

Life Expectancy is not Increasing Anytime Soon

Americans reliably eat fewer vegetables, fruits, whole grains, dairy products and oils than recommended. Nearly 42% of American adults are obese (not overweight). If we include overweight scores as well, it means that over 66% of the country qualify. The trend is so bad that the average life expectancy of your average citizen has declined in just the last 2 years.

Here’s a little fact that will demonstrate how F*cked up American health is: A majority of Americans think it’s easier to file their taxes accurately than to explain what constitutes a healthy, well-balanced diet.

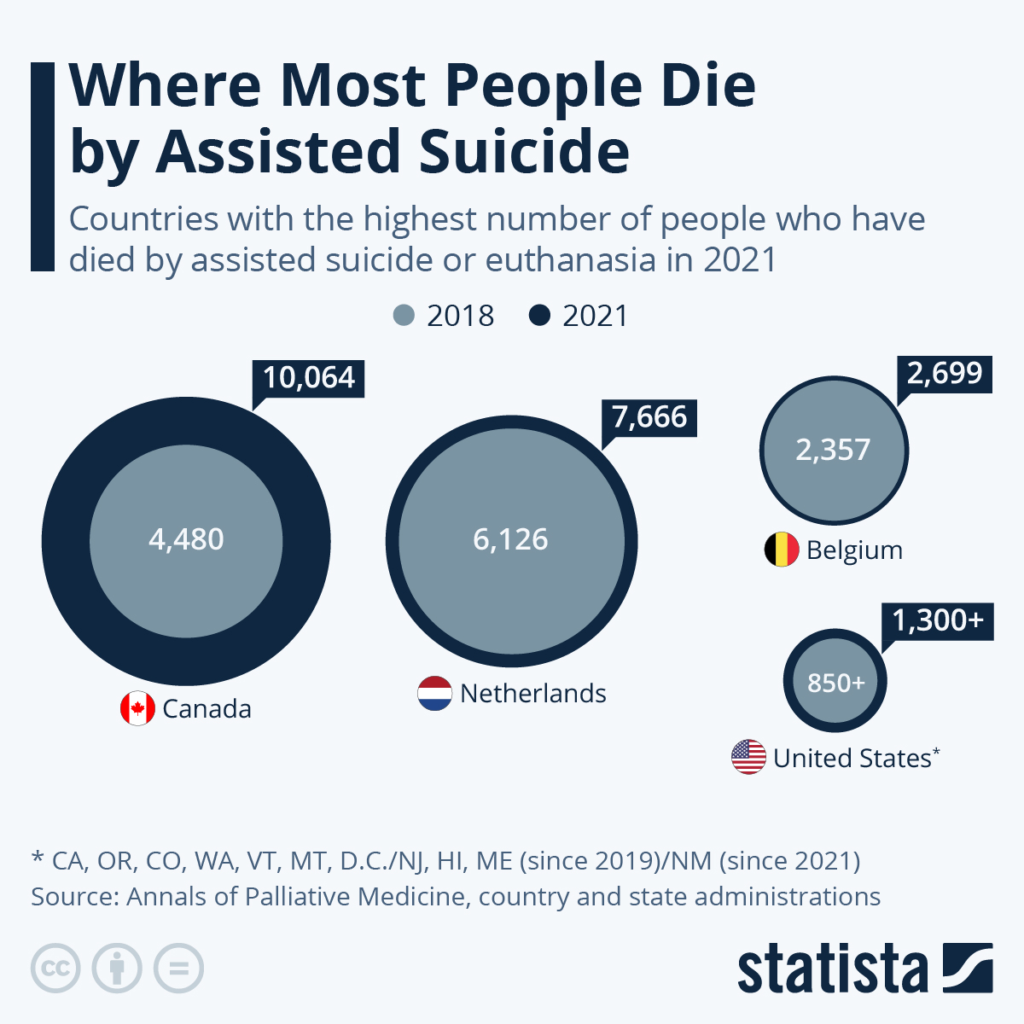

Assisted Suicide

A study completed in 1998 (Meier et al) in the New England Journal of Medicine found: “A substantial proportion of physicians in the United States report that they receive requests for physician-assisted suicide and euthanasia, and about 7 percent of those who responded to our survey have complied with such requests at least once”

This has been seen particular in Canada where 4.1% of deaths last year were government sponsored suicide

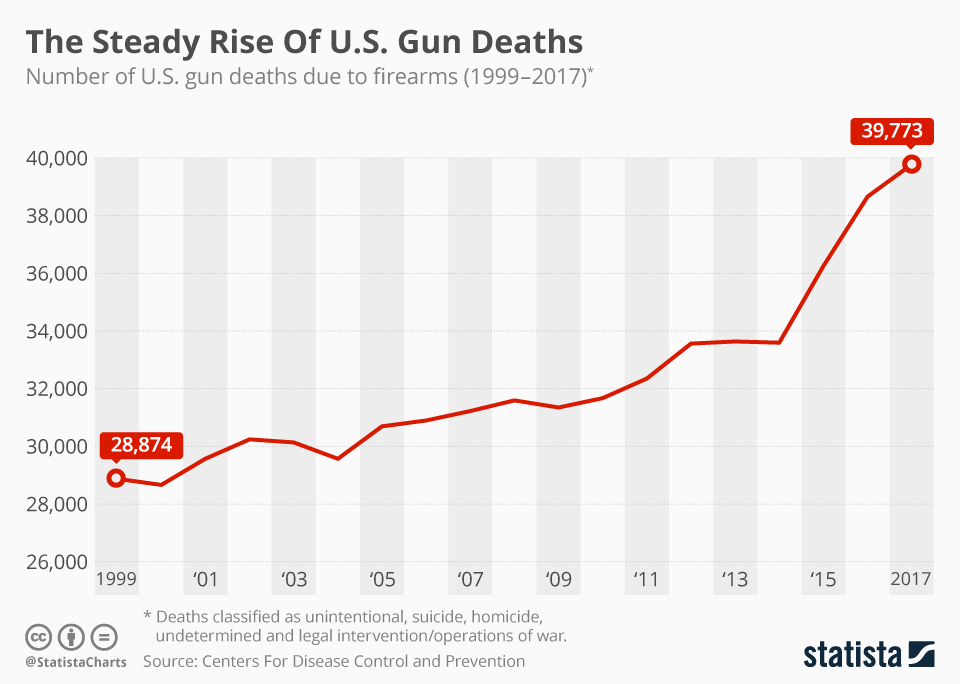

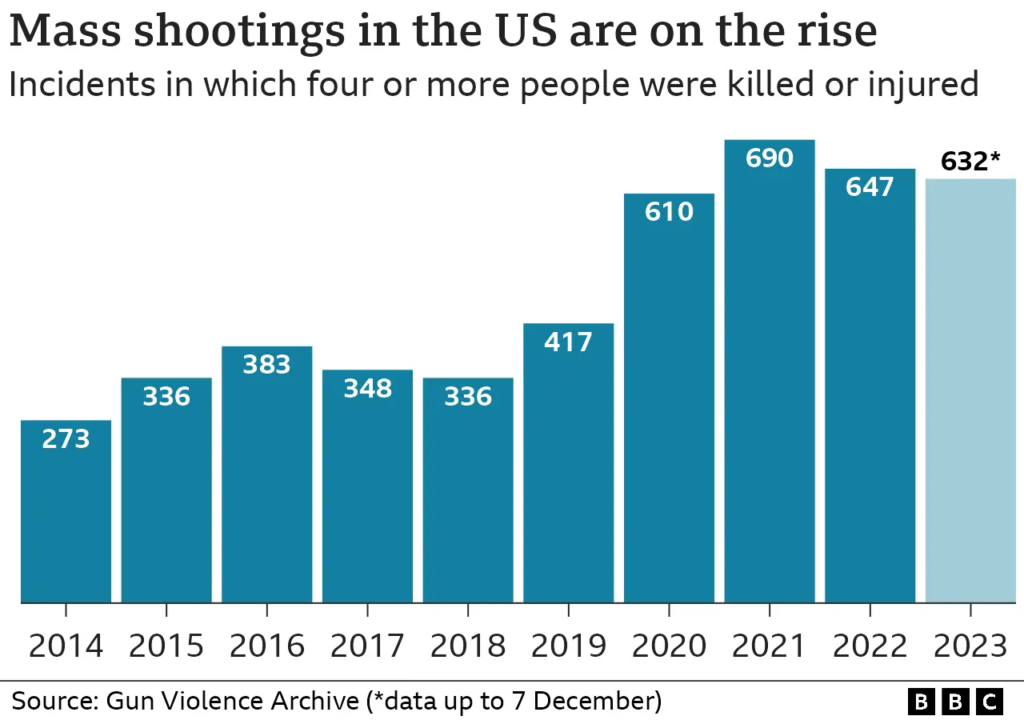

Gun Crime

Crime rates changed dramatically across the United States in 2020. Most significantly, the murder rate — that is, the number of murders per 100,000 people — rose sharply, by nearly 30 percent… More than 75 percent of murders in 2020 were committed with a firearm, reaching a new high.

FBI Crime Statistics

People are getting older

I am working to produce a set of articles all pertaining to the declining birth rates from reduced sperm counts, reduced testosterone an overt assault on neo-natalism as well as launching (what I think) is a large proposal to exploit the next inevitable baby boom.

It’s a disaster for the economy when you pull out the population rug and venture cap types are absolutely unprepared for less backs, less minds and less productivity as a result of not enough people. The populations of the developed world are increasingly aging (we do not see the population decline apocalypse because people are living longer). The median aged citizen of the US and Europe will be close to the average age of death in 30-40 years; a VERY large chunk.

It’s already begun. In 2021 and 2022, deaths outnumbered births in half of the 50 US states. What’s it going to look like in 2035? There’s a market for Life (so I argue in my Fertility Series); but also one for Death.

Investor Place.com writes that $CSV is ” A leader in a necessary sector with demographic tailwinds”

Fauci Medicine

I started writing about this with tonnes of data, charts, videos, anecdotes, graphs, clinical data highlighting the excessive death and side effects from the so-called vaccine. It’s worth mentioning for the sake of this post…

In my subscription service, you will find far more data (again, not for the faint of heart) on the results of these gene-engineering vaccines. The interesting part for you as a subscriber however, is that I pitch a proposal to take advantage of life instead of death.

Closing

It’s sad to say, but I believe that this market is going to absolutely shock people. It’s unpleasant; people don’t like teetering on unpleasantries for too long–and the government sure doesn’t want you questioning the number of deaths. There is a complete and utter disconnect between the so-called mainstream or legacy media with facts and reality. People will “wake up” when they’ll have to believe their eyes instead of believing their ears [listening to the talking monkeys].

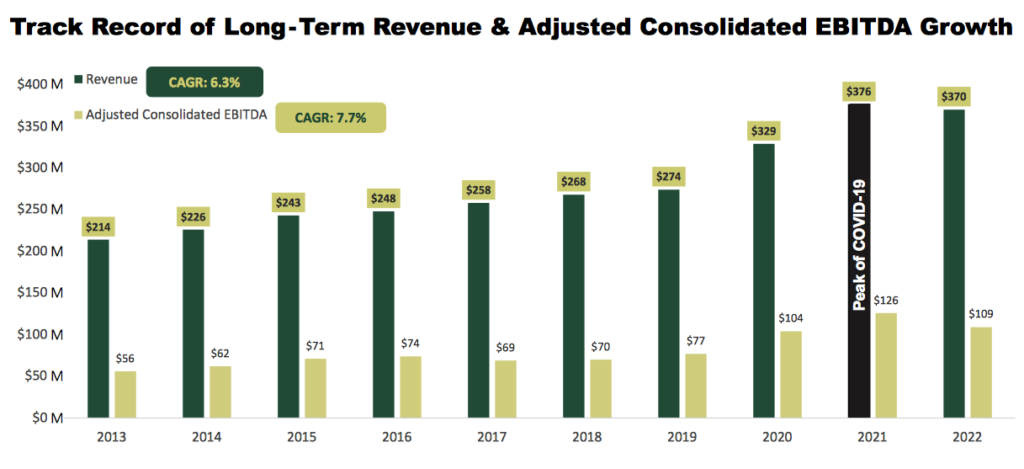

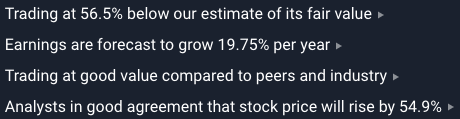

Carriage Services have demonstrated growth in the past and continue to expand their portfolio. They have done this during increasingly uncertain times while still holding healthy valuations, paying a small dividend, running positive net income (consistently) & retaining shareholder equity from institutional investors. It’s worth reiterating that they are growing in the face of increases in capital expenditure, too.

Between the bioweapon introduction, wars & gun crime, aging populace, suicides, unhealthy population (Gee, are you depressed yet!?), it’s already begun to show in the CAGR, sales, returns & dividend raise. At the time of writing, they’ve beat the S&P thus far and my hunch is they’ll continue to do so given the nature of their sector.

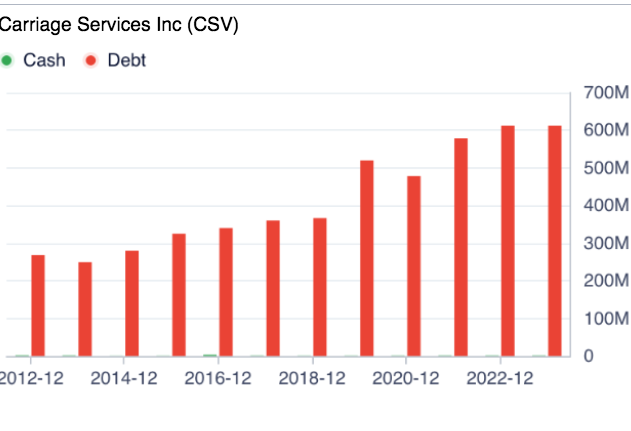

The negative? The debt is a little spooky relative to their cash. While their assets almost double debt, most of it is found in property and equipment with fewer current assets (40.2M USD); both assets and shareholder equity have held strong however and as we said, their focus is tackling the debt. Actively employing capital and paying down debts have lead them in a position without much cash on their balance sheet (holding around 1M for a long while).

It’s boring, it’s controversial, it’s unorthodox (buying a business consumer services during a recession?)… but a perfect storm of distressing pressure is building in Carriage Services’ sector. I like trying to find companies where you can buy, forget about it and let the world play out.

As they say in Canada, Pass the puck where the player is going to be, eh.

Please share this article & always #StayOnTheBall