Why Inflation is never going away

Sick and tired of paying for expensive groceries, fuel, tuition and rent? Aren’t we all.

But. It won’t get better. It’s actually going to get worse. Why? Because of debt. Many countries around the world, particularly advanced societies have never carried this much debt before, especially relative to their GDP. The scary part of this is when you begin to look at the rate of debt expansion (looking at credit and household debt) relative to incomes. Turns out, a fast change in debt is more dangerous than a lot of debt keeping steady–I digress. Debt. It’s a big problem & whoever tells you otherwise is trying to pull the wool over your eyes.

So, you have to pay your credit card, you car payment, your mortgage, you have to make your debt payments… but how does the government pay their debts?

Sign up for a list of financial & global commentary to #StayOnTheBall!

How can the government pay its debt? (& why it can’t…)

- They borrow from other countries–This cannot be done because of political reasons and few foreign countries are willing to lend to other nations. Especially since 2020, the US Treasury has been relying more on the Federal Reserve and less on China & Japan to purchase their bonds. It’s as if they’re all at Alcoholics Anonymous (except it should be Spending Anonymous) and you’re asking for someone to guard their alcohol. Nobody is willing to do it. ❌ Won’t happen ❌

- They can tighten their belt and pay it off–This cannot be done because the size of the debts are so large that it would absolutely eat into a huge part of their economy. It would also call for extreme austerity measures, a radical reduction in the quality of living, very unfavourable policies like increased interest rates and taxes. You’d be looking at 100% tax rates for years with all economic activity going towards the debt–The most important reason why this won’t happen is that the spending would have to grind to a huge halt. They would be accountable for their budgets, slash a lot of unwanted departments and whatnot. The reality is the size of the government is so immense and so many people are interconnected that you cannot reduce the size of the beast without destroying it–and what person wants to destroy it when they’re getting Elizabeth Warren rich from it? They want to loot and steal as much as they can as fast as they can and get the hell out of there. ❌ Won’t happen ❌

- They can default–Similar to the previous one… what politician wants the whole economy, absolutely everything to crash down on their watch? Who is willing to commit to Friedrich Nietzsche’s saying That which will inevitably fall, deserves to be pushed? Nobody. ❌ Won’t happen ❌

- They can grow their way out–It won’t happen because of the Keynesian multiplier effect. This states that once a country hits 90% debt burden to GDP that they actually experience declining growth per unit of debt. In other words, the more debt you take on at this point, the less you are able to pay it back proportionally. You spend a dollar but only get 95 cents in return. You climb out of the whole 4 feet but sunk down 5 feet. Most of the world economies are at or far exceeding this debt load at the moment AND this is not even factoring in a countries off-balance liabilities with respect to healthcare, medicare, welfare, disability and so forth. ❌ Won’t happen ❌

- They go old-school and conquer a country for the gold–The world is not made of knights and catapults anymore. It is far too digitally connected and vulnerable for someone to pillage a country for its gold reserves. There is an equal and opposite reaction if someone were to truly seek to destroy someone else. Even if they did (overlooking the added cost of 100% conquering a country which the USA failed to do in Afghanistan let alone a country like Iran or China), the gold reserves would only be a fraction of the outstanding debts. Plus they would destroy their own debt/bond market by losing global investor confidence which leaves them in the same position as problem number 1, nobody wants to lend to them anymore. ❌ Won’t happen ❌

- They inflate their way out–It’s the only option left isn’t it… This is where the treasury prints up new dollars in the form of bonds, notes or T-bills and the Central bank (Federal Reserve in USA) print up reserves (fugazis) to buy those bonds. This may be referred as Quantitative Easing or QE which really took hold ever since the Great Financial Crisis of 2008. The purchasing of the bonds allows the central bank to not only own the assets of the US government but also to control interest rates in the economy. Why would they continue to do this?

Because of preexisting debt, or bonds are expiring, they “roll them over” to keep the money printing machine moving by paying off old debts with new debts. It’s the equivalent of you constantly opening credit card accounts to pay off your previous card, just to the tune of billions of credit cards, each with 10,000 dollar credit.

This inevitably creates more and more debt (paying old off with the new over and over again) but what this does is it ensures the balance sheet of the banks around the world increases indefinitely. This new fresh hot money makes its way into the economy chasing goods and service (things we buy at the store). To make matters worse, a bank may borrow from the Central Bank at 0.5% (because the Central bank now have assets of bonds from the Treasury) and uses this money to issue you a mortgage for 5% (the bank grows bigger because of you with a 4.5% on this lending) and these new fugazi stimulates the housing market to grow. The same goes for all markets.

Ultimately, what happens is that the people who own assets, housing, credit, commodities, land, gold, crypto benefit because this new hot money finds a new home in these markets. So the owners get wealthy.

But hang on… what if you don’t own your own gasoline pump, or dairy farm? You’re paying MORE for the gas or milk in the store because the previous monetary policy forced this new form of printed money into these sectors but the supply of gasoline or milk was unchanged.

Why can’t this stop? Because the level of debt is so large that the governments and banks of the world need and want to print up and spend (spending part is critical) more and more and more reserves into the economy to keep it alive– more reserves chasing fewer goods and services–inflation.

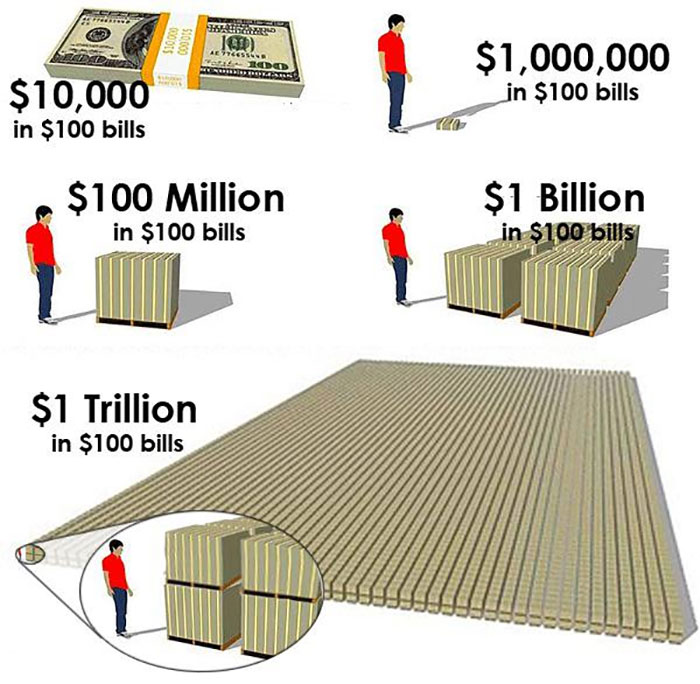

Does this help with the debt at all? Yes. Because the dollars of year 2000 were worth more than what dollars are today–but debt is a fixed number. So let’s say that a government owes 1 Trillion dollars and has 10 Trillion dollars in reserves. What if the government doubled the money supply? It would still owe 1 Trillion dollars but it now has 20 Trillion in reserves; this is what they mean when they say inflating the debt away, it’s easier to pay a fixed amount when the underlying value of that is changing. Of course, this comes out of your pocket.

Inflating the debt– ✅ Will Happen ✅

I hope this made sense–basically, since you are working for currency… you are screwed. By the time you earn the thing, it’s already lost some of its value and certainly will lose a sizeable amount by the end of the year.

| Governments/Banks | You |

| Paying off fixed amount of debt with “cheaper” money (inflated money) Great!–>Easier to pay debt to take out more debt | Saving by using those cheaper dollars (inflated money) Terrible–>Incapable of saving money because it’s always losing more and more value in your bank account. |

#StayOnTheBall