…But where can I use Gold?

All of us at some point were looking for some liquidity to make payments–which may be especially if difficult if you’re happy with your portfolio and are reluctant to change it.

But, I’m no different and I needed some cash recently. I had some gold bars that I am reluctant to sell, so I thought what if I could borrow against them? I logged onto the internet and see that a gold backed loan is possible with an international bank in Belize. I found another in Singapore, but generally, it was a challenge to find someone willing to engage in this trade, let alone the minimum bullion holdings required.

But you want to know where this is pretty much common? India.

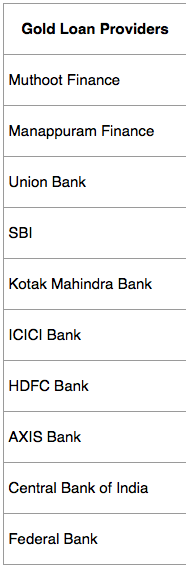

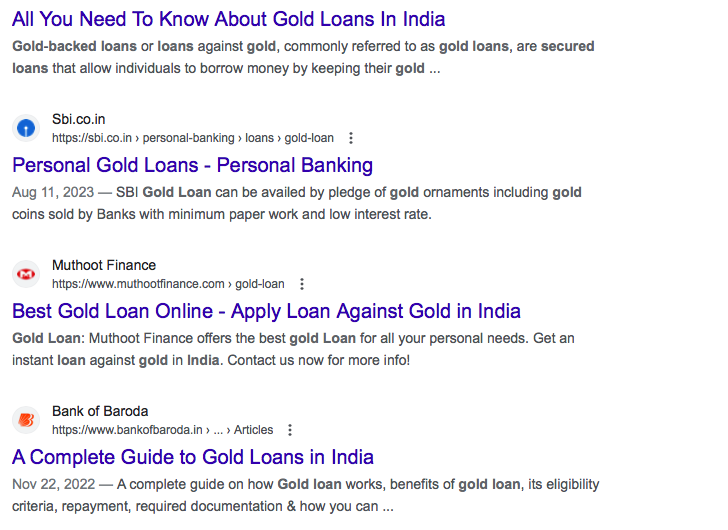

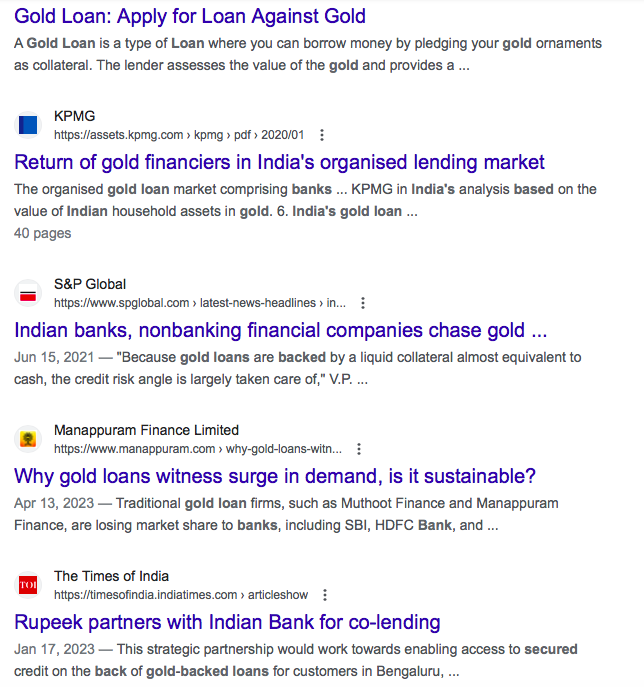

India has countless banks that offer a transaction to deposit your gold and receive a loan, from what I’ve seen, straightforward applications and not outrageous interest rates. A simple google search will bring up hundreds and hundreds of viable options and data suggesting that the application of gold in finance is ample in India.

All of this may not come as surprise to those gold bugs who are tracking the big purchases of gold bullion. Just the first quarter of 2023 alone, the Central Bank of India (RBI) purchased 7 tonnes of gold adding to their enormous pile of nearing 800 tonnes. In fact for all Central Banks, this Q1 demand struck a record with all major central banks being net buyers of the shiny metal.

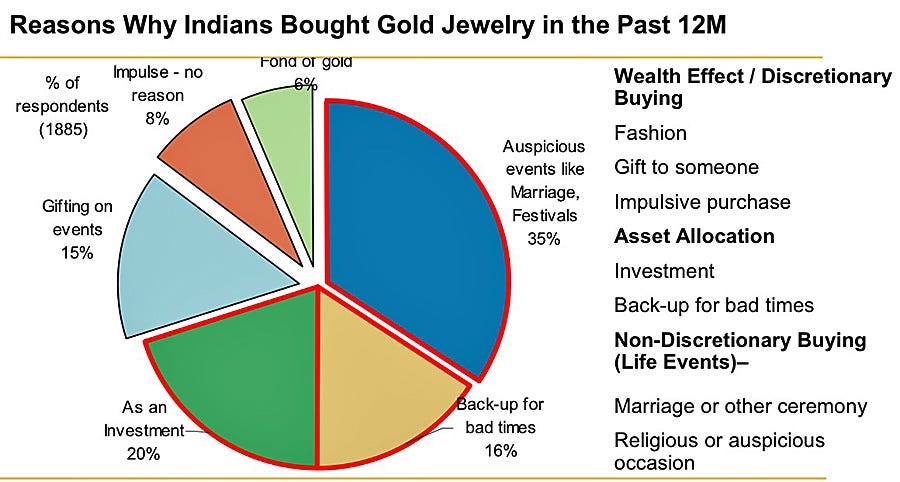

While PancakeCoin gets the attention in the USA, India’s culture is engrained with gold as they are the world’s largest consumer.

An almost unbelievable number estimated by the World Gold Council, India believe that Indian households possess approximately 25,000 Tonnes of gold. Assuming their population to be 1.4B citizens, this works out to be over half a troy ounce of gold for each individual citizen (around 17 grams). By contrast, consider how many people you know who have any physical gold at all. It’s no wonder that the banks would be offering loans when possession is so high.

As many speculate Gold will be headed for a new bull run, India may be positioned quite favourably. Till that happens, they’ll continue to get their car loans backed by their bullion bars. We’re in the midst of writing an article on India–Is India is positioned to be the next Asian superpower or will they degrade into civil war? Stay tuned!

Do you like gold too? What about gold mining stocks? Click here to find my article on an abandoned gold property starting up operations again!

#StayOnTheBall & with any luck you’ll be looking like this fella!