Can This Company Continue to Provide Positive Returns after the Cannabis Bubble?

I should say… I do not like cannabis stocks. I see them as a large frenzy of the “next big thing” with grandiose claims about their success or future. There is a tremendously large black market in cannabis that a highly regulated, highly taxed, controlled system doesn’t compete with at all. Marijuana, unlikely alcohol or nicotine has little psychoactive addictive potential as well; biologically there is no “craving” for a joint. Generally, the valuations of the industry have become absurd with many doing nothing but running deeper and deeper debts.

However, this company stands out from the crowd.

Please Grab Our Newsletter

Company

Green Thumb Industries Inc. manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States. It operates through two segments, Retail and Consumer Packaged Goods. The company offers cannabis flower; processed and packaged products, including pre-rolls, concentrates, vapes, capsules, tinctures, edibles, topicals, and other cannabis-related products under Shine, Beboe, Dogwalkers, Doctor Solomon’s, Good Green, incredibles, and RHYTHM brands. It distributes its products primarily to third-party retail customers and sells finished products directly to consumers in its own retail stores, as well as direct-to consumer delivery channel. Green Thumb Industries Inc. was founded in 2014 and is headquartered in Chicago, Illinois.

They have 20 manufacturing facilities, 96 open retail locations and operations across 14 U.S. markets. Green Thumb employs approximately 4,500 employees

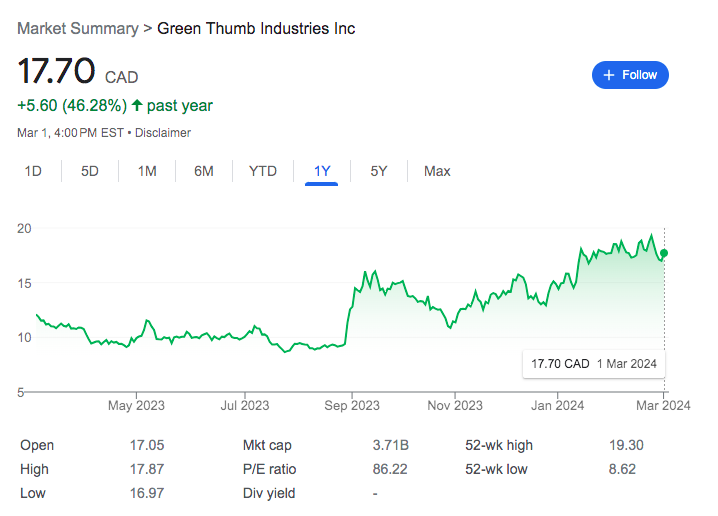

The tickers are $GTII and $GTBIF

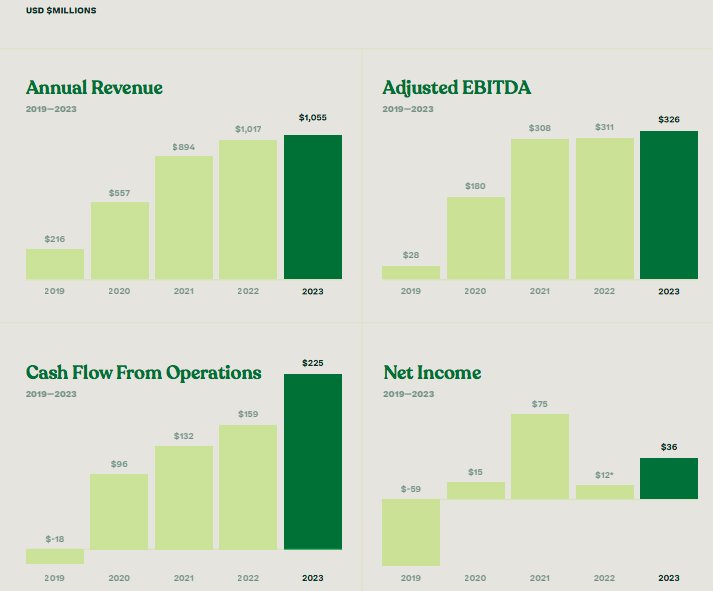

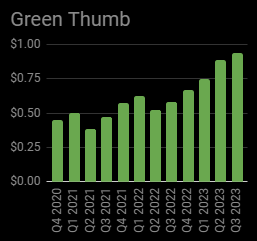

Whereas both Aurora Cannabis and Canopy Growth are still struggling to achieve positive earnings and positive free cash flow, Green Thumb has already achieved both these goals. For three straight years, from 2020 to 2022, it reported positive GAAP profits. The company was also profitable last quarter, and analyst forecasts see positive earnings consistently through the end of this year. In 2020, its free cash flow was also positive, and it came close in both 2021 and 2022, despite contracting retail sales at times.

| Beta (5Y Monthly) | 1.51 |

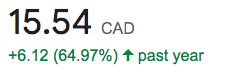

| 52-Week Change 3 | 64.76% |

| S&P500 52-Week Change 3 | 18.96% |

Sector

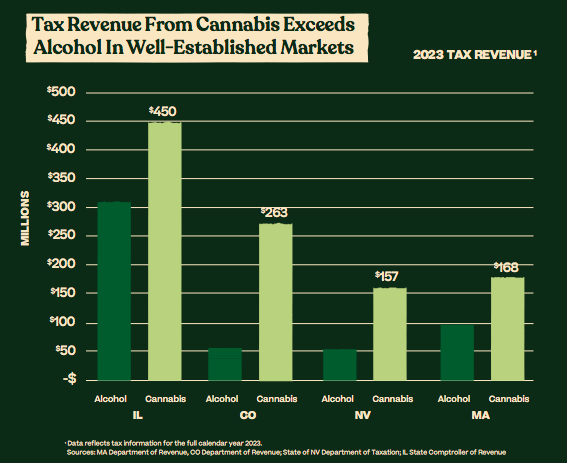

The Green Wave continues to gain momentum, with U.S. legal cannabis sales estimated at approximately $30 billion for 2023, and more growth projected as more states legalize Cannabis products.

Cannabis has the potential to grow approximately 12% in the United States whereas wine (7%) and the others of beer, tobacco and spirits are expected to grow around 4%. There is tremendous variation here however, so I’d take this with a grain of salt–but Cannabis is the only that remains to be fully exploited.

The highest number of Americans accepting legalization of Cannabis has been found last year (at 70%).

The growth could be further improved if taxes are considerably reduced on this market too.

Ratios

Quick Ratio 1.35

P/E: 45.37 (Forward P/E: 28.33)

P/B: 1.53

P/S: 2

EPS: 0.33

Net Debt: $308,523,000

Market Cap: 3.71B (CAD)

Shares Outstanding: 236,396,854

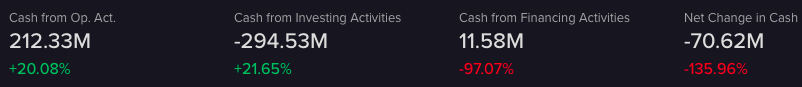

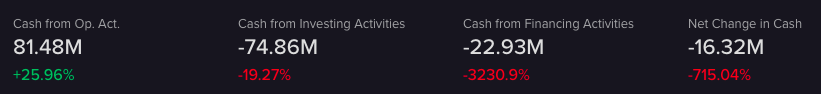

One thing is obvious, they need a new investment division… It looks like they got spanked from the Bond sell-off of 2022-2023.

The net income after tax really has hit them hard.

Balance Sheet

| Total Cash (mrq) | 223.94M |

| Total Cash Per Share (mrq) | 0.94 |

| Total Debt (mrq) | 575.96M |

| Total Debt/Equity (mrq) | 32.97% |

Total debt is more than double their current cash position, however there are healthy increases in revenue to support this debt load.

Financial Data

Key Financial Results FY2023

- Revenue: US$1.05b (up 3.7% from FY 2022) (278M Q4)

- Net income: US$36.3m (up 203% from FY 2022). (3.22M Q4)

- Profit margin: 3.4% (up from 1.2% in FY 2022). The increase in margin was driven by higher revenue.

- EPS: US$0.15 (up from US$0.051 in FY 2022).

1st Quarter/24

- Green Thumb Industries reported earnings per share of 13 cents. This was above the analyst estimate for EPS of 4 cents.

- The company reported revenue of $275.81 million.

- This was 2.77% better than the analyst estimate for revenue of $268.38 million.

- Most interestingly, their revenue shot up 11% while their OPeX fell by 9%.

| Profit Margin | 5.38% |

| Operating Margin (ttm) | 25.62% |

| Return on Assets (ttm) | 5.36% |

| Return on Equity (ttm) | 3.46% |

The next earnings call is scheduled for August 5th, 2024

Green Thumb Industries Inc. (GTBIF) Earnings Expected to Grow Again

Points

The company had just became profitable this year. While there are debt loads and a mediocre margin to work with, there still holds the potential to continue this grow into the future without investors having to wait for an ROI. Some of their competitors are purely financing their survival but this is not the case for Green Thumb.

Green Thumb articulates in their annual report that they are focused on the customer and incrementally improving their products around customer demand. They are going straight forward with trying to expand sales rather than waiting to see how government will respond surrounding their industry.

Another interesting point that will surely propel revenues is the involvement with the New York market. Green Thumb recently announced the expansion of Beboe, its luxury cannabis brand created for those looking for a “mindful and elevated experience” to RISE Dispensaries across New York and select licensed retail partners. Consumption of Cannabis is rather high in these markets relative to other places in the country.

No-moat Green Thumb’s fourth quarter exceeded our expectations, especially from a profitability perspective. While fourth-quarter revenue was roughly flat sequentially, the adjusted EBITDA margin expanded by about 300 basis points to an impressive 33%, the highest margin ever achieved.

Morning Star (March 1st)

Two much control elsewhere?

While $GTI has lagged its peers, it has benefitted greatly from the share expansion of AdvisorShares Pure US Cannabis ETF (MSOS) over the past several months. However, they remain vulnerable to the share expansion of the ETF, now 23.5% year to date.

The inflows into MSOS have resulted in purchases of GTBIF. The fund currently owns 18.58 million shares through a swap. This is up 23% since year-end, in line with the inflows, effectively cancelling out any dilution.

Fifteen institutions hold a total of 4,339,695 shares (Twenty-Seven Institutions in total).

Institutions–>9.8%

Strat. Entit–>12.39%

Others–>77.81%

Due to the reasonable institutional ownership, I don’t think that the company will get the rug-pulled from under them nor has the share insurance of the ETF seemed to have called for redemptions against them.

Is The Great Taking Going to Happen?–>

My Research

…we are short on brains and logic in D.C.,

which makes it hard to predict how or when this

will happen [Cannabis changing its legal status]Ben Kovler, CEO, Chairman, Founder –I agree!

Closing

The company seems to have a decent business and an interesting balance sheet with many products compared to others in the MSOs Funds. However, with the great price action, the company seems to be less of a bargain it once was…

The net margins, return on assets and equity are not anything to be very blown away about. Simply Wall St writes that Green Thumb holds, Reasonable growth potential with adequate balance sheet–which I think pretty much sums up the situation.

I think Green Thumb is better than the majority of cannabis stocks, this is clear, but unless you have to be allocated into this sector, there are better places to put your capital. The stock is up a lot since 2023, and while it’s far from a ‘zero’ it may not be the best investment to allocate your capital right now. It’d be really interesting to consider a position if the retail investors decided to take some profits as the company continues to display more products on shelves throughout the states.

The alternative I am really excited about that has yet to see a rush of capital? A micro-cap growth machine, perhaps? Nevis Brands ($NEVI). A cannabis beverage company that nobody even heard about! Please Subscribe to our Silver or Gold plan to learn more about this one!

#StayOnTheBall