If you’re reading this you may be a bit familiar with “offshore havens” or a concept known as a territorial tax regime whereby you are only taxed on locally-sourced/produced income.

Costa Rica is one of those territorial tax countries that have attracted thousands of foreigners every year for many reasons. However, recent legal changes are an almost death sentence to wealthy and/or privacy-oriented individuals seeking to utilize Costa Rican entities for their international strategy.

If you find articles like this helpful, let us know with the form at the very end. We’re soon launching a consultancy company to assist you in your Plan B Planning–Stay Tuned!

The Costa Rican Treasury now requires inactive company owners to complete their tax returns & file before a specified date. Inactive companies are those legally constituted or registered with the National Registry which “do not exercise economic activity before the General Directorate of Taxation”. In other words, this includes companies used for asset protection purposes by holding assets such as cars, paintings, gold, stocks and companies that are incorporated in Costa Rica to take advantage of their territorial tax policy by not having Costa Rican substance behind their earnings (& therefore pay no tax).

Inactive company owners are now required to make a declaration (by way of Form D-195) to detail if they own memberships, precious metals, jewelry, art, properties in Costa Rica or abroad, balances in bank accounts, debts, monthly balances outstanding, owning corporate stock, the list goes on…

Companies who only receive capital income from one definitive source can remain exempt from being an inactive company but they still require their activity to be registered with the appropriate tax authority directly revealing a slew of personal information. However you draw it, these changes are quite invasive & demanding by the authorities. The balance sheet information is also now obliged by the government for a company that typically does not have an lucrative activity.

Unfortunately, new requirements go further than the D-195 Form. Corporate income tax filings (Form D-101) are made mandatory with refusal to file likely to receive an audit from the Tax Authority and a list of potential financial penalties. There is also the declaration of the Ultimate Beneficiary Ownership to determine the physical person (deemed the final beneficiary or face of the company). Several sanctions are in place such as fines, removal the registration of the company from the registry and others by not filing this declaration or filing the declaration on time.

In my opinion, the purpose of the changes may be less about regulation and more about the initiation of expenses and potential economic sanctions. These sanctions can be present a mere 10 business days after incorporation if the D-195 Form is not filed (increasing the chance the state will implement such sanctions and seize the assets).

At the end of the day, businessman have to question whether any of this is worth it

To avoid this, one can become an “active” company which is to say pay local tax, relocate inventory, personnel, etc. I imagine the government gathering together and one proposed the question, “How do we create more active companies and stimulate our economy?” To which the answer is, “We will make them active”.

Perhaps the most disturbing changes are when you begin to look for specific criteria on who triggers non-compliance for tax/filing purposes. In addition to filing due dates, inactive business owners who has:

- participation in 50 or more companies (50 stocks qualifies)

- any business holding shares of companies in “tax havens” or low or no tax jurisdictions

- a commercial company registered in the Public Company Registry but not registered with the Tax Authority (very possible if someone did not intend on paying tax under the territorial tax laws)

- failure to identify all persons who hold 15% or more of the inactive company

- & worst of all, inactive companies who have assets registered with the Public Registry that evidence a “presumed increase in net worth” or reflect “high-net worth”

The last point is worst of all because there are no specifications in Income Tax law with regards of what an “unjustified or unusual increase in net worth shall be” nor are there legal definitions of a “high net worth status”. In this sense, for wealthy individuals the tax authorities have created a free-for-all hunt to punish, sanction and/or tax individuals when they deem there’s enough meat on the bone to reasonably do so.

It’s worth reiterating that this is using Costa Rican registered entities, so it’s very possible to obtain/preserve all these assets in another entity.

Contact us to Learn More!

For Costa Rica however, this is bound to have indirect consequences that may impact your time living there. Increasing surveillance over public finances likely will lead to increase distrust in the state itself & promote crime to bypass it. There will be reduced legal/accounting work as people incorporate elsewhere, less employment & ultimately lead to less tax revenue which starts the cycle all over again to punish taxpayers. This war on wealth language usage is not uncommon throughout Latin America unfortunately.

Panic Time

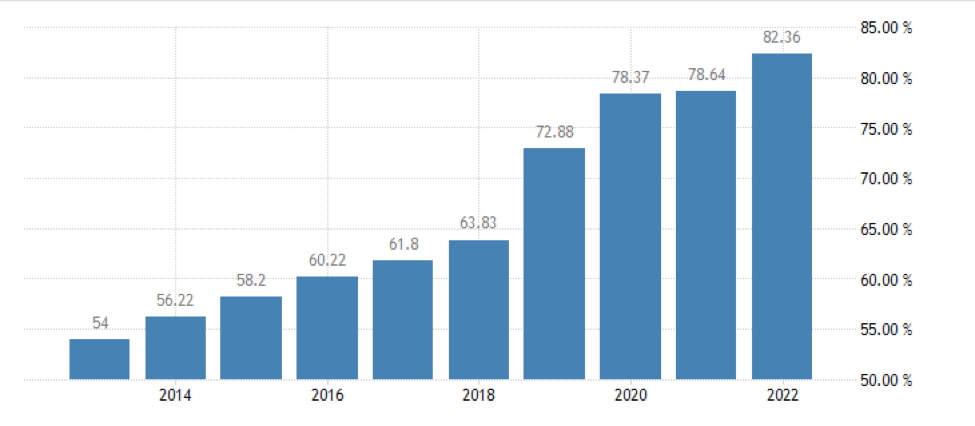

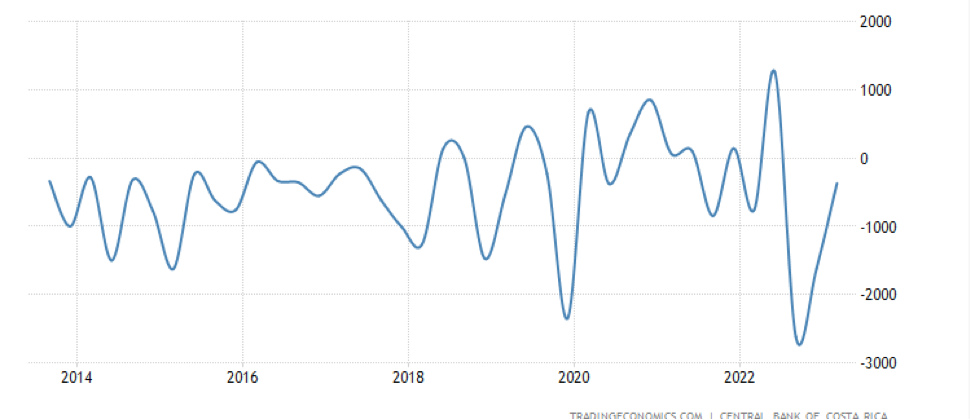

The fact that the government have resorted to arbitrary legal practices that reveal the entire personal assets of beneficiaries in attempt to extort them or at least execute fines for not filing appropriate documents on time tells me that there may be symptoms of problems in the economy. Looking at their Debt:GDP and Capital Flows (respectively, below) it may suggest so.

Update: It’s worth mentioning that Costa Rica has also declared a state of emergency due to the thousands of migrants that are heading through their territory en-route for the United States. Many costly resources have been deployed to manage this issue.

To paint a more complete picture it’s worth finally mentioning that Costa Rica had joined the OECD (the global thieving tax cartel) in 2021. As a matter of fact, they’ve not simply joined…

We use the OECD criteria to support and base its administrative resolutions; consequently they hold significant importance for the Costa Rican tax system.

If you’re a hammer, everything looks like a nail

They’ve also extended a broad definition of “Costa Rican sourced” in recent years whereby economic activity abroad (having its economic impact abroad with abroad entities/persons) may be considered Costa Rican-sourced in the event of having a permanent establishment. What’s a permanent establishment?

This ‘permanent establishment’ may be an office, branch, factory, workplace and will apply if the work is only ‘partially’ done through here. There is a great deal of specificity here—although know that the trend is that territorial concept is increasingly becoming erased in Costa Rica–the punishing regulation on inactive companies is further proof.

Closing

Costa Rica literally translates to “rich coast” & the name has debatable origins. “Pobre” in Spanish translates to poor. So, as long as Costa Rica continues to tighten its regulations, increase taxation and deter asset holders it may very well be in for a name change.

I Would Appreciate your 30 seconds. Click even if the bullet points do not show:

Be sure to also read my travels to Costa Rica (& other travels!) and my thoughts of it. Please share and consider subscribing for future content to help you!

#StayOnTheBall