What is BRICS 11 about?

Who Are They?

BRICS is an intergovernmental organization comprising Brazil, Russia, India, China, South Africa (hence BRICS). It was unofficially named by Golden Sachs in 2001 as a marketing plough to get people to invest in emerging markets, officially formed in 2006 and with South Africa joining in 2010, BRICS was born. The group was designed to bring together the world’s most important developing countries, to challenge the political and economic power of the wealthier nations of North America and Western Europe.

As of 2024, Argentina, Egypt, Saudi Arabia, Ethiopia, Iran and United Arab Emirates were invited to become members. Lucky for us BRICS 11 is easier to pronounce than BRICSAESAEIU.

The adding of the other 5 are very important because it begins to formulate a successful economic union and provides the opportunity to create its own distinct economy. If India and Brazil were trading in Rupees, the only thing Brazil can do after selling corn is buy something from India–however a common currency amongst the other 9 players enables Brazil to service its economic needs. It all comes down to membership so the goods and services can be met by those in need. The European Union has 19 members; would it be as powerful if it only had 7 members? You get my point…

Back of the Line, Pal

Over 40 countries, including Iran, Saudi Arabia, United Arab Emirates, Argentina, Algeria, Bangladesh, Bahrain, Belarus, Bolivia, Venezuela, Vietnam, Guinea, Greece, Honduras, Indonesia, Cuba, Kuwait, Kazakhstan, Morocco, Mexico, Nigeria, Tajikistan, Thailand, Tunisia, Turkiye and Syria have expressed interest in joining the forum, according to 2023 summit chair South Africa.

Among all the nations, Algeria, Argentina, Bahrain, Egypt, Indonesia, Iran, Saudi Arabia, and the United Arab Emirates have formally applied to join the BRICS alliance. The other nations have only expressed their interest in joining the BRICS bloc, but still the interest is real and growing.

Importance

Many critics say that BRICS are still a bunch of corrupt authoritarians running backward countries. All far-leftists or populists who have a common political enemy in the United States. But the BRICS are not a political union–it is an economic union with a focus on trade and currency.

In fact, BRICS may even be the key to the future of the international monetary system. Only 4 years after BRICS became official, they created whats called the New Development Bank based in Shanghai. It began with 50B capital; 50B callable capital; additional available through bond issues. In effect, this is a World Bank look-alike by being able to lend out to all these countries. The World Bank, for as sinister as they are, are a development lender, has a very good credit rating, levers up its balance sheet all the time similar to the goals of the New Development Bank.

Furthermore, in 2015 BRICS created Contingent reserve arrangement (CRA) started off with $100B of capital. Their purpose is to be a carbon-copy of the International Monetary Fund. CRA overseas balance of payments problems or capital outflows–CRA can lend them hard currencies to get back on track.

These structures are under their control with their own communication networks–all distinct from the dollar system (the SWIFT-alike).

Powerhouse Multiplier

What you’re looking at is a well established network that is responsible for:

- Over 50% of the world’s population; likewise, 50% of the global grain production. Overall, they hold major food production/ownership.

- 55% of Global GDP (by PPP)

- 3/5 of the world’s largest oil producers.

- Now controlling 39 percent of global oil exports, 45.9 percent of proven reserves

- Russia alone being the largest nuclear arsenal in the world with other major countries such as Iran and China. Currently, they have 2/3 of the world’s largest weapon arsenals. This is to say nothing about the military strength in numbers and technology as many military experts highlight Russia’s strength and experience relative to other economies.

- They possess 15% of the worlds gold reserves; Russia alone has 25% of their reserves in physical gold. This is not including any future mining on their soil or purchases made from Western countries such as Canada, Australia or United States to add to their pile

- 4/7 of the world’s land mass

- Everybody owns gold and has an incentive to de-dollarize

The implications of this are enormous as being able to have such an influence on energy production and prices enables this alliance to manipulate other global economies indirectly. An economy is a perfect correlation with energy consumption, so what happens when somebody shuts off the tap?

This is no joke, BRICS meet over 100 times per year, every year now.

Changing Times (in trillions)

It’s tempting to believe that the BRICS emerged all of a sudden if you look at the CNBC headlines, but this has been working in the background far before the USA’s foreign policy blunder with Russia using economic sanctions. This alliance has been growing for the last 15 years or so with their frequent meetings every year. Despite that most of the meetings are simply like-minded political types in an echo chamber filled with lavish dining just killing time, the connection between these countries has been consolidating.

Domestic Currency; No

Nobody in this group has an ability or want to conduct trade amongst themselves given the limitation that yuan, rupees or rials place upon the economy. That is, Russians can’t easily go shopping for fighter jets in Brazil using Yuan. This is to say nothing of the fact that rule of law is greatly impaired if not entirely gone in these countries as well.

Amongst the group, they have no dealer banks, no great currency clearance networks, noteworthy bond or securities markets and therefore, no investor confidence. Of course, you’ll hear this from talking heads why BRICS are simply a big nothing-burger, but it’s precisely this lack of trust amongst themselves that are fuelling their new union.

Currency Bloc; Yes

The use of a new currency that can be recognized and agreed upon between the economies can bypass these limitations while instilling faith in the transactions. Suddenly, the immensity of these countries, their militaries and their energy reserves have formed their own group that have turned their backs to the former Eurodollar system. Interestingly, for people that follow my site and newsletter, is the item that solders this together is gold (which explains the significant Central Bank buying over the last 10 years).

Unit of account (Unit), a platform for international settlements in BRICS digital currencies (Bridge), a payment system (Pay), a settlement depository (Clear), an insurance system (Insurance), and a BRICS rating alliance is on the drawing board

BRICS 11 have explicitly stated that this new “Unit” will have a backing of gold, predicted to be 40% (historically this has been enough to back a currency with enough flexibility yet confidence) and the rest to be a basket of domestic fiat currencies. Therefore, one “Unit” will be denominated in a weight of gold (rather than using the USD as a measure stick). This wouldn’t mean that there is a gold standard where you could exchange your BRIC Units for gold bars for you and I in Beijing, but it does allow this system to operate using trust between untrustworthy parties.

Misnomer

You don’t need a common fiscal policies for this system to work. Do you think Italian vs Finnish fiscal policies are even remotely similar? and yet they remain in the Eurozone together. BRICS will need a Central Bank or issuer with a common monetary policy (Could this be the new CRA?) but each country can still run their own respective game.

It’s Happening

BRICS countries may present instruments for mutual settlements at summit in Kazan this October. The leads on this meeting say, “The key principles in designing the new financial system are decentralization of international interaction and the use of digital technologies”.

The goal is to come up with both retail and business-2-business interactions. However the largest takeaway of the upcoming meeting is their proposal on how to measure a “unit” of BRICs currency. The suggestion is a 40% gold backing (sure enough) and the remaining 60% to be backed by a basket of currencies of those in the new union.

A common unit of account would solve the problem of exchange rate volatility that occurs when cash balances accumulate from settlements in national currencies. Or, said another way, when one country is a net exporter and another is a net importer, this forms a discrepancy in fiat balance that the Unit would control.

“If everything is done in national currencies, then as a result we are left with many billions of rupees, Egyptian pounds, and we do not know what to do with it,” said Andrey Mikhailishin, the head of the task force on financial services of the BRICS Business Council.

Bully No More

Its been said that three criteria must be met to effectively shun a country using economic sanctions.

- They must lack ample resources that they can sell to operate in another currency

- They must lack other options for payment clearing channels for international trade

- They must be a small-to-medium sized economy

Which one of these applies to Russia? Did you scratch your head thinking? That’s because absolutely none of these applies to Russia–but something did happen with the USA’s will to use economic sanctions on everything that moves.

Now, otherwise neutral countries are standing by and seeing if or when they will become the next Russia. Someone who is otherwise friendly with the USA foreign policies, are now showing interest in this new system who oddly enough may have more confidence that the Eurodollar. *Remember, BRICS want as many members as possible to create a larger economy and pool the most amount of gold/fiat reserves to draw upon*

One side wishes to punish, one side wishes to welcome.

No doubt, US sanctions in Iran in 2011 have hurt their economy despite their oil/gas reserves but it’s apparent that Russia doesn’t fit the bill for any of these requirements. Sure enough, the Russian economy is set to more than double in GDP relative to the United States economy, the Ruble still exists, their unemployment is low, all during a border war in the Ukraine and their addition of gold reserves has continued. I believe there’s two things here happening.

As President Xi has said in a recent speech, “No mountain can stop a mighty river”.

BRICS does not equal the End of the United States [Dollar]

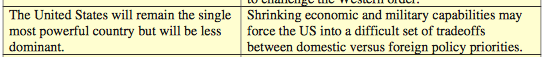

Taken from Global Trends 2025 by the National Intelligence Council:

The United States dollar and a common ground BRICs currency can operate in unison; at least for a little while.

Reserve currency can still be the United States, but a Unit can be a transactional currency without having the global reserve status. In other words, it doesn’t need to achieve “reserve status” to be a success story.

A) The USA government have gotten so used to pressing the button of economic sanctions and getting their own way. A weaponized dollar is a great way to bully the small countries such as Iraq or Nicaragua into compliance–and it’s far more effective than using 50,000 troops along your enemies’ shores.

B) I will go into this in greater detail in our premium service but in essence, I argue that the United States ‘want’ to push these big countries away from the dollar. It’s counterintuitive to think so, but strategic in the long-term. It’s a controversial take.

Thank you for reading and remember to follow me on Twitter & share the article!

#StayOnTheBall