I am primarily referring to Bitcoin here as this is often the most talked about cryptocurrency and most other cryptocurrencies are tightly correlated to it’s pricing.

First a reminder on some mining terminology(Skip this if you're already aware):

Hashrate: Hash rate is the measure of the computational power of a proof-of-work (PoW) cryptocurrency network, group, or individual. It is used to determine the mining difficulty of a blockchain network, gauge security, estimate network energy use, and determine network participation. It is also used to adjust these blockchains’ puzzle-solving difficulty.

The network of Bitcoin is so large now that this is less of a concern for mining companies now. Additionally, some individual miners in years prior have stated it’s less about ones’ device to generate a high hash rate, but rather it’s accepted share-rate or ASR. Accepted shares are a measure of how much work a member of a cryptocurrency mining pool contributes to discovering new cryptocurrency.

Difficulty: Mining difficulty is a unit of measurement used in the process of mining a cryptocurrency such as Bitcoin and refers to how difficult and time-consuming it is to find the right hash for each block.

Proof of Work (PoW): Network participants, called miners, compete to solve a computationally intensive puzzle. The first miner to solve the puzzle adds a new block of transactions to the blockchain and receives a reward. This is known as a consensus mechanism that validates the blockchain. Some mining algorithms are secured by Proof of Stake (which requires people to stake or risk their coins to secure the network).

Mining Algorithm: A mining algorithm is a computational process that secures and verifies transactions on blockchain networks. Many coins share the same mining protocol method.

ASICS: An application-specific integrated circuit (ASIC) is an integrated circuit chip designed for a specific purpose. This is one feature that damages Bitcoin as a cryptocurrency as it centralized mining by default; he who has the most ASIC computers, the largest warehouse, receives the most Bitcoin mined, end of. I much prefer the idea of mining on CPUs whereby anybody with a laptop or desktop can contribute to the security of the network and reap rewards. In this sense, it becomes far more decentralized and difficult to attack. ASICs are very expensive hardware.

Summing

Bitcoin mining is the process by which transactions are officially entered on the infinite blockchain. It is also the way new bitcoins are launched into circulation.

Mining is conducted by miners using hardware and software to generate a cryptographic number that is equal to or less than a number set by the Bitcoin network’s difficulty algorithm.

In short, mining (by way of PoW) is the way to allow computers to establish the legitimacy of the inputs and outputs. The computers are striving to find and solve a mathematic problem to form a “block” in the infinite chain of interactions (hence, the term blockchain). In effort of utilizing a computer (energy) to validate that a transaction is in fact true, a reward is produced and given to miners (those who possess the computers seeking to solve the transaction legitimacy), often in the form of the underlying coins.

Different coins have different hash rates, difficulties and mining pools (groups) at any given time (it varies tremendously) and mining is completed using different consensus mechanisms or algorithms (this can be shared amongst blockchains). I mention these figures because they are often brought up as being the justification for the security, longevity and utmost foundation of the unbreakable Bitcoin cryptocurrency.

While even the most arrogant banker has to admit this is true on the surface, when you look beyond slightly you see that Bitcoin mining (& perhaps Bitcoin itself) has an expiry date.

Bitcoin Mining is Not Sustainable

China, used to be the largest miner of Bitcoin years ago which had been a bone of contention amongst cryptocurrency critics who not only argued that it was a useless digital nothing burger, but that it amounted to a national security threat. Since, China decided to ban Bitcoin in the country to limit the usage of Bitcoin (as it’s still noteworthy in the country) but greatly limit the mining of Bitcoin.

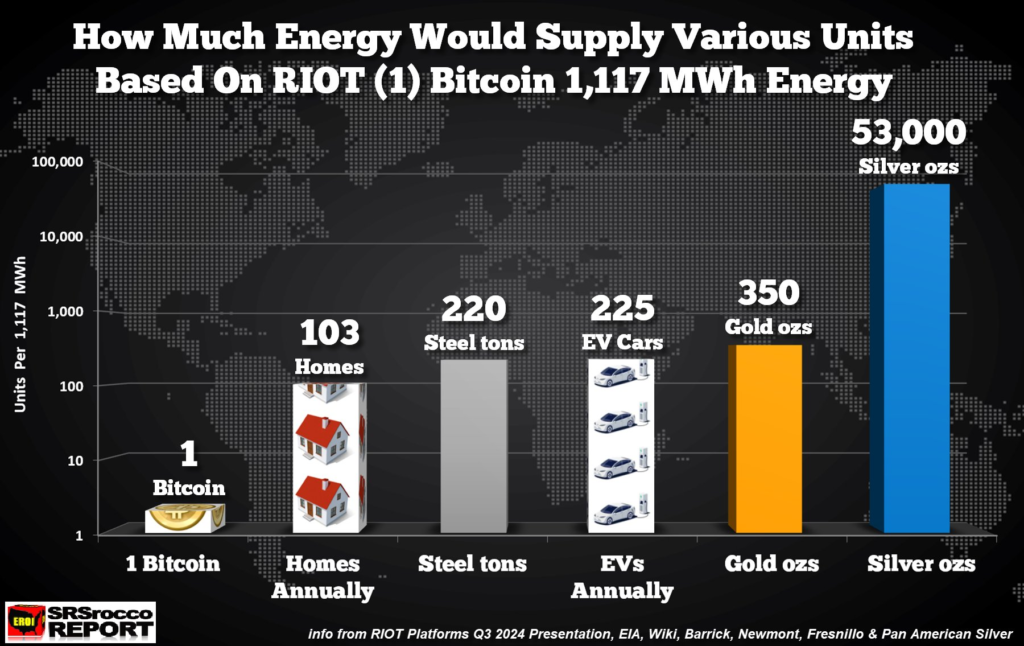

Why? Because it turns out, Bitcoin mining is incredibly energy intensive.

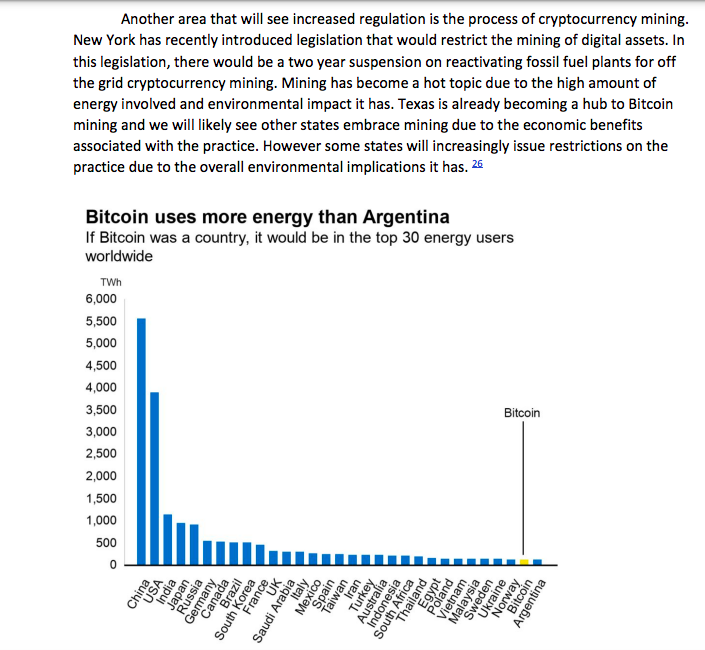

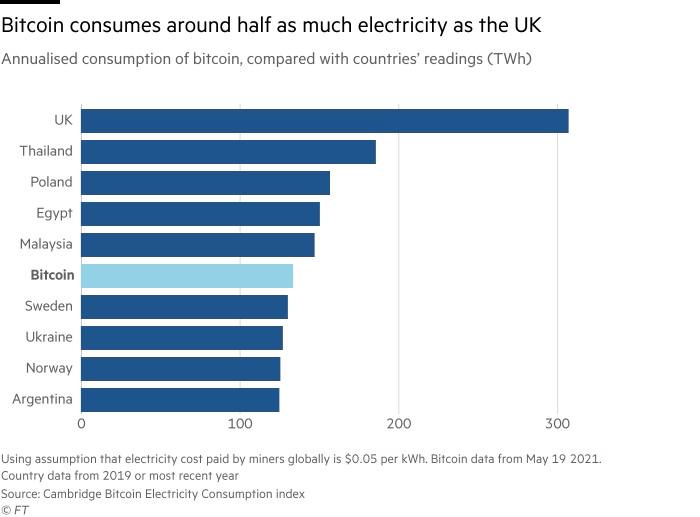

Look at it’s energy consumption compared to that of other countries. It’s already greater than Argentina!

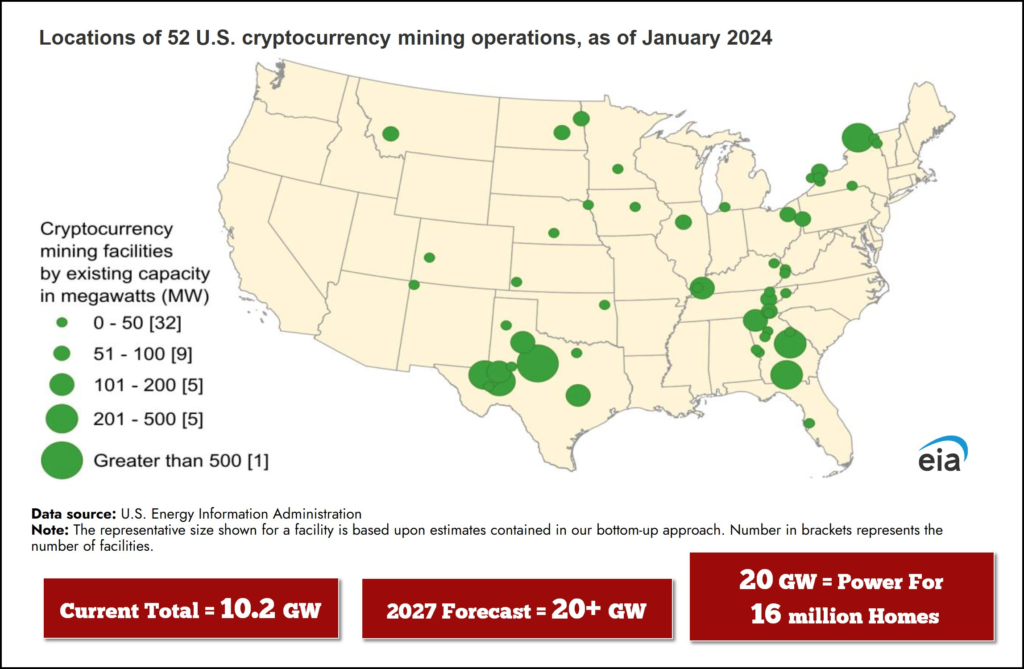

According to the US Energy Information Agency (if we assume them to be accurate), Bitcoin mining is consuming between 1-2% of all energy consumption in the United States.

Scam of Mining Equities

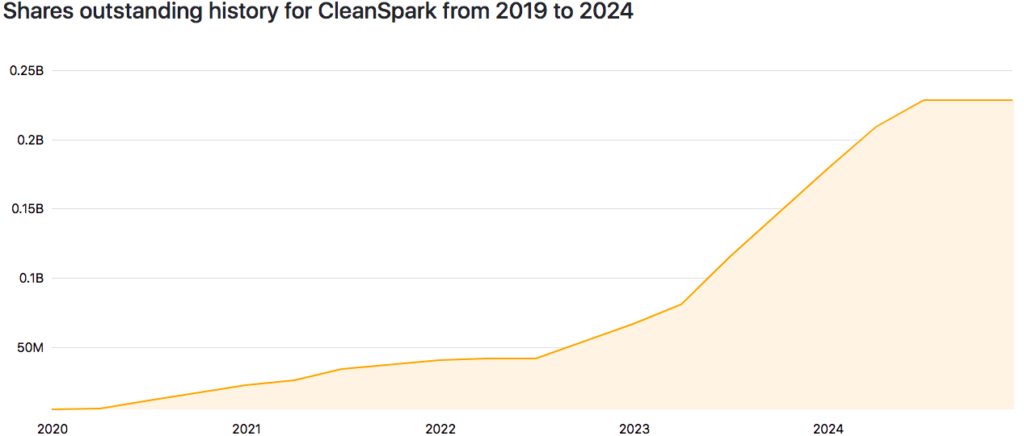

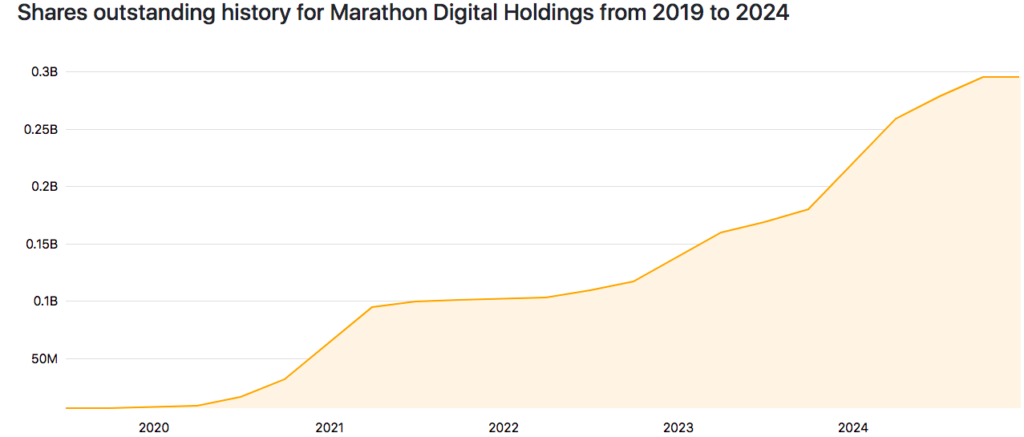

Even if we overlook the considerable amount of energy diverted towards sustaining this cryptocurrency, we see that Bitcoin mining equities (a significant % of overall production of Bitcoin now) are essentially a short-term ponzi scheme. Whilst relying on higher and higher prices of Bitcoin (since the Bitcoin has no commodity consumption per sé), they are using shareholder equity to fund capital expenditure to obtain such coins. While you may be inclined to relate this to junior mining company, it’s different because the assets utilized in possessing the digital asset are depreciating extremely fast (about 2 years or so) and require more and more investment for the a shrinking amount of production. Said another way, they are spending a considerable amount of investor capital on a shrinking amount of slice of the cake.

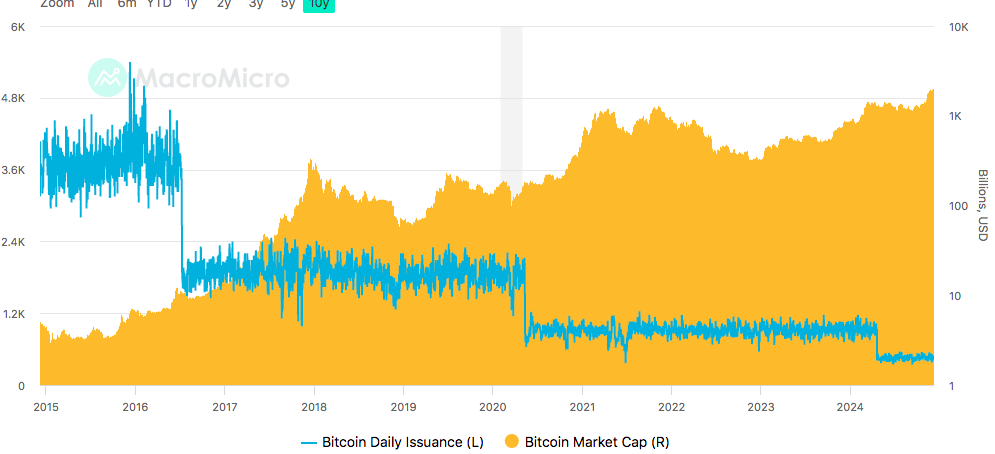

Metal mining companies are seeking to withdraw the most amount of material as they possible can economically. With Bitcoin mining, the halving mechanism means that miners are guaranteed to receive less and less supply the longer they remain in business. Similar to a Ponzi, to compensate for this supply downside, the network requires more and more newcomers to enter the system to continue the scheme running the same. It’s worth reminding that zinc mining has many use-cases whereas Bitcoin use cases are limited.

Decline in Production

One reason why I spoke of ASIC miners (vs. GPU mining using GPU computer chips) is critical because of the efficiency in the hardware. It’s a centralized technology given that the deepest pockets can acquire the most devices for any specific purpose, but notwithstanding this, there is a large decline in their durability.

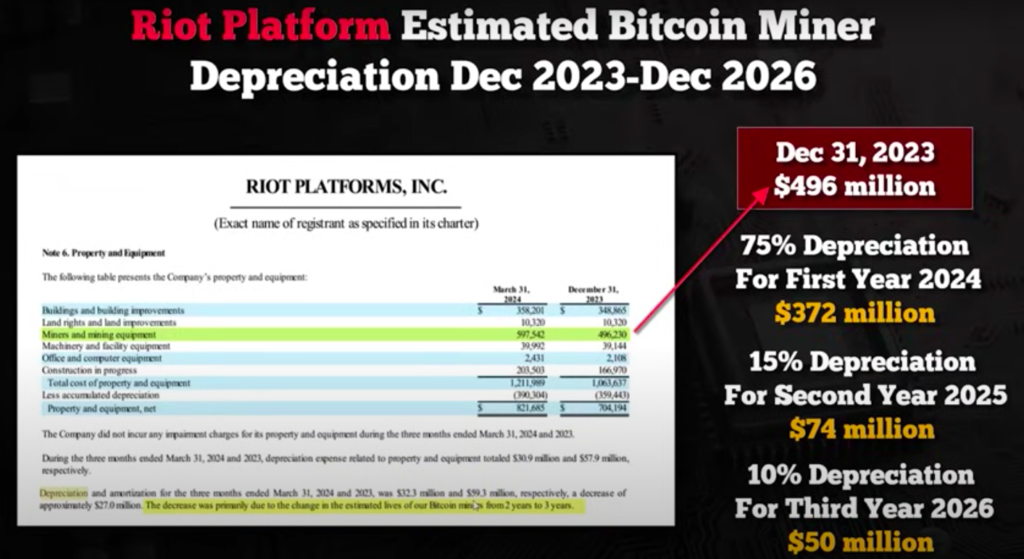

For these large companies, their main tangible asset is the ASIC assets and to appease shareholders they’ve “cooked the books” as one big accounting depreciation from year to year. This obscures the true balance sheet they would otherwise be holding by buying expensive hardware and running periodic deficits on ROI. If I pick on RIOT for a moment:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Accumulated Depreciation | 6.16M | 6.48M | 21.31M | 16.62M | 196.2M (Big Jump?) |

The Secret

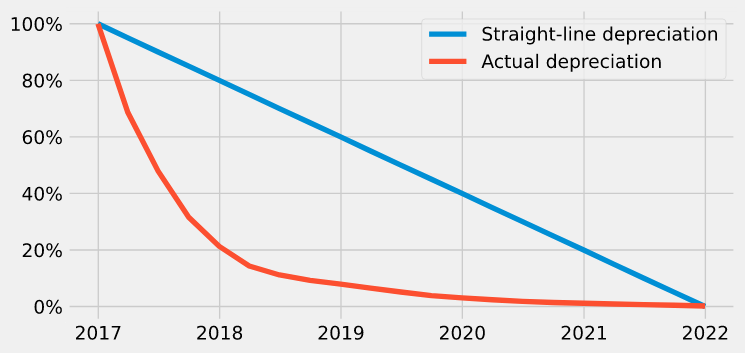

Taken from Paul Butler’s page (www.paulbutler.org), he found out that the majority of Bitcoin produced by large mining companies is at the inception of mining with the new hardware. After about year 2, mining efficiency is tremendously poor. However, mining companies have the ability to spread out this depreciation as though it were a linear drop (similar to a vending machine or ATM).

Knowing this, mining companies are eager to tell investors that they are investing in growth, but in reality they are investing in skewed depreciation of their assets, which may or may not translate into company profits.

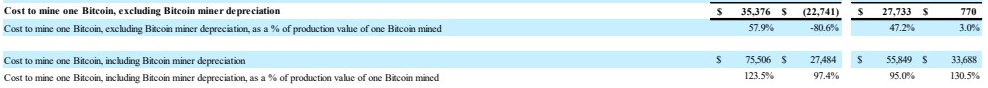

The following table from RIOT Platforms latest SEC 8K report tells all. Take a look at the difference between the cost of mining Bitcoin excluding the depreciation of their asset vs. including this expense.

The price of mining including the mining hardware (AISC) DOUBLES the OpEx and thus makes the operation against the price of Bitcoin itself near or beyond profitability.

Cookin’ The Books

This is taken from an interview done with Palisades Gold Radio on YouTube

Essentially, if we assume the viability of the miners to only last a few years, we can assume the depreciation figures to be as follows on the right (above). To once again pick on RIOT Platforms (I cannot speak for others), they had decided that the ASIC life of their asset is no longer 2 years (as previously stated in their 8K filings), but now it is 3 years. This has allowed them to reduce the depreciation of their assets on the books by 10s of millions of dollars every quarter/year even though they know their production capacity is suffering.

Fewer Players?

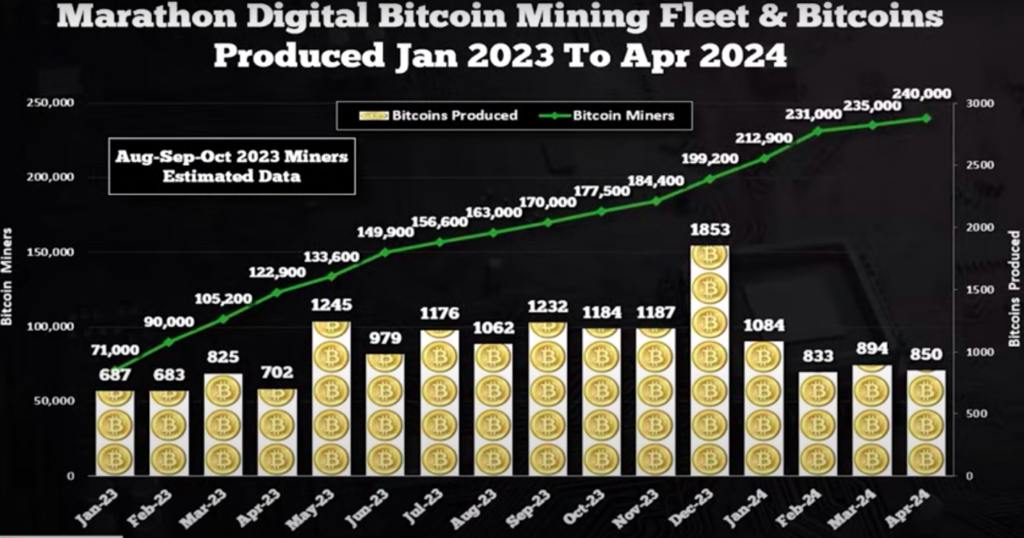

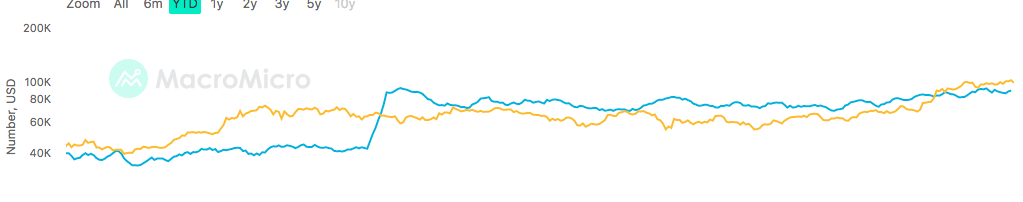

This has translated into a large drop off in the number of Bitcoin produced. Yes, the halving plays a role (where the new supply is halved every 4 years), but we’re not seeing those spikes of supply like years prior. What will it look like in 10 years from now? What about 50 years from now? Investors who are satisfied with storing their capital in Bitcoin for their children’s children must consider this equation.

Trapped and Eager

As fewer and fewer miners partake in mining fewer and fewer Bitcoin, they will be demanding a larger and larger percentage of transactional fees for securing the network. Currently, this accounts between 1-2% of the big mining companies’ revenues. We’re looking at a negative feedback loop whereby higher transactional fees will disincentivize the use of Bitcoin itself which further reduces the demand for the coin which reduces price and hurts the miner’s capacity to continue operations in a profitable manner.

Take the Money and Run!

ASICS, like all pieces of technological hardware such as a computer or phone lose efficiency with use. This realization is amongst executives is apparent and they’re eager to loot shareholder value while it lasts. A quick google search reveals that CEOs are hungry to pay themselves huge amounts in a short amount of time (why may this be?).

MARA Holdings’ CEO is Fred Thiel, appointed in Apr 2021, has a tenure of 3.67 years. total yearly compensation is $36,120,000 USD

Riot Platforms’ CEO is Jason Les, appointed in Feb 2021, has a tenure of 3.83 years. total yearly compensation is $13.49M. This makes his compensation 249 times more than the median employee’s pay at Riot Platforms

Let’s compare that to the CEO of Exxon Mobil

Salary: $1,615,000

Bonus: $3,142,000

Stock awards: $13,505,225

Change in pension value and deferred compensation: $5,137,153

All other compensation: $173,110

His total compensation of $23,572,488

The same total compensation of Chevron’s CEO was ~$22,500,000 USD. Does this add up? Look at the impact of both of these energy companies compared to Bitcoin mining.

"The average salary for a tech company CEO is between $150,000 and $250,000 per year.

Bonuses for CEOs can range from 25% to 100% of their base salary, with the average being around 50% which may make their total salary between $250,000 to 500,000 a year on average"

In 2022, one MARA executive earned over $220 million in cash and stock-based compensation, in a year when the company’s total REVENUE was $150 million. RIOT’s top five executives collectively took home a more modest $90 million in a year with a net loss

Ask yourself:

Why would you need to change the technicals of your equipment from 2 to 3 years? It’s exactly what I would do if I wanted to squeeze another huge payment to myself for another few quarters/years out of this industry burning out, literally.

Just to show you where the money is coming from in a short period of time…

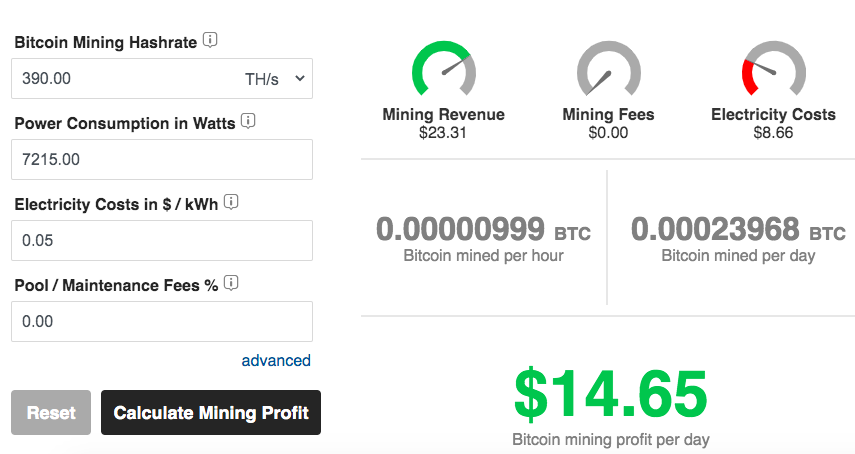

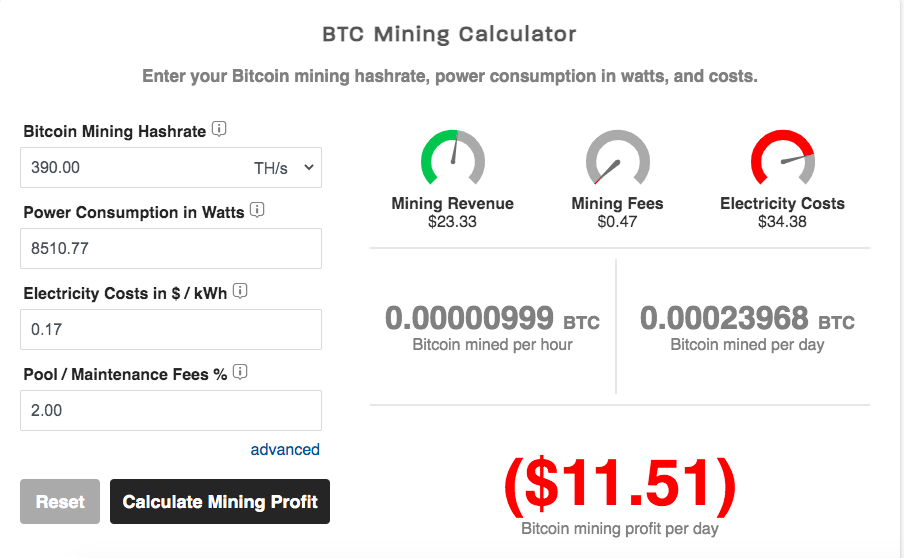

I came to a Bitcoin Mining Site

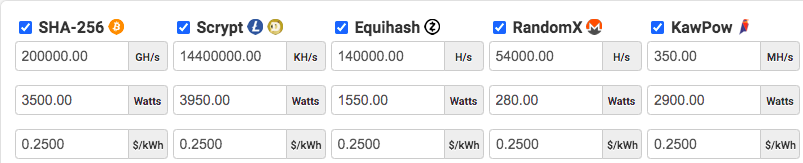

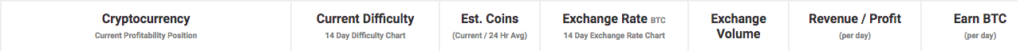

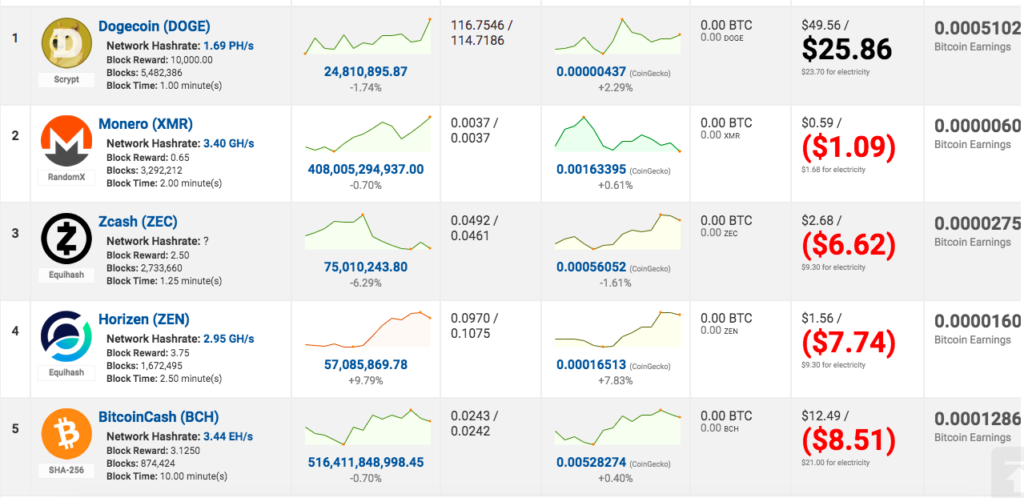

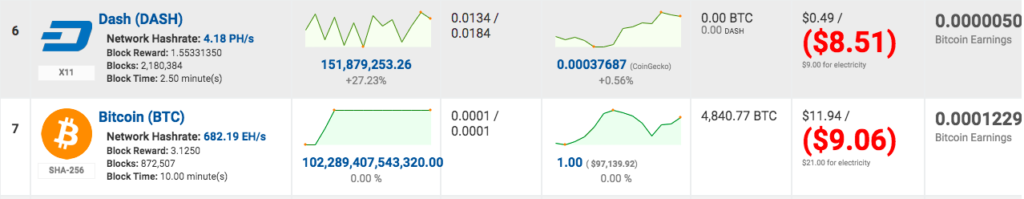

It’s default setting shows that it is profitable. But if we assume the average costs for the United States, average cost for 1 Bitcoin and pool fees of 2% (varies to 0-4%) we receive a different picture

ASIC miners (for those at home) range between $550-$15,000 dollars each

In fact, even if you remove the pool mining fees altogether, you’re still at a large deficit.

Average Bitcoin produced per day was 16.5 in November, a 1% monthly increase and a 10% yearly decrease–RIOT Platforms (2nd Largest Publicly Traded Bitcoin Mining Company)

Bullish Bitcoin but not Metals?

Kazakhstan Mines Bitcoin with Coal

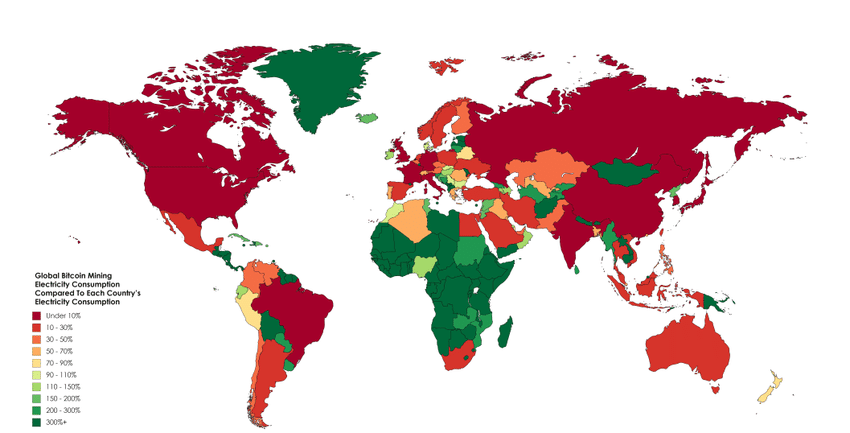

Kazakhstan is a bitcoin miner powered by coal as coal is cheap and its power efficiency is driving the bitcoin mining business in the country. It is also home to a desert where 50,000 computers are established in Ekibastuz so that the miners can get temperature down.

Here, Bitcoin miners work 12-hour shifts for two weeks straight until the Bitcoin is mined. This is not going to be criminalized any time soon, with Kazakhstan ranking in the world as a leader in this industry. It accounts for approximately 12% of mining hash for Bitcoin.

I have included this because if some are convinced that the world is going to be some green, utopian, sci-fi cypherpunk world, you may be misguided in what goes into that equation (like burning coal). Some estimates say that over 40% of Bitcoin produced is a by-product of coal consumption.

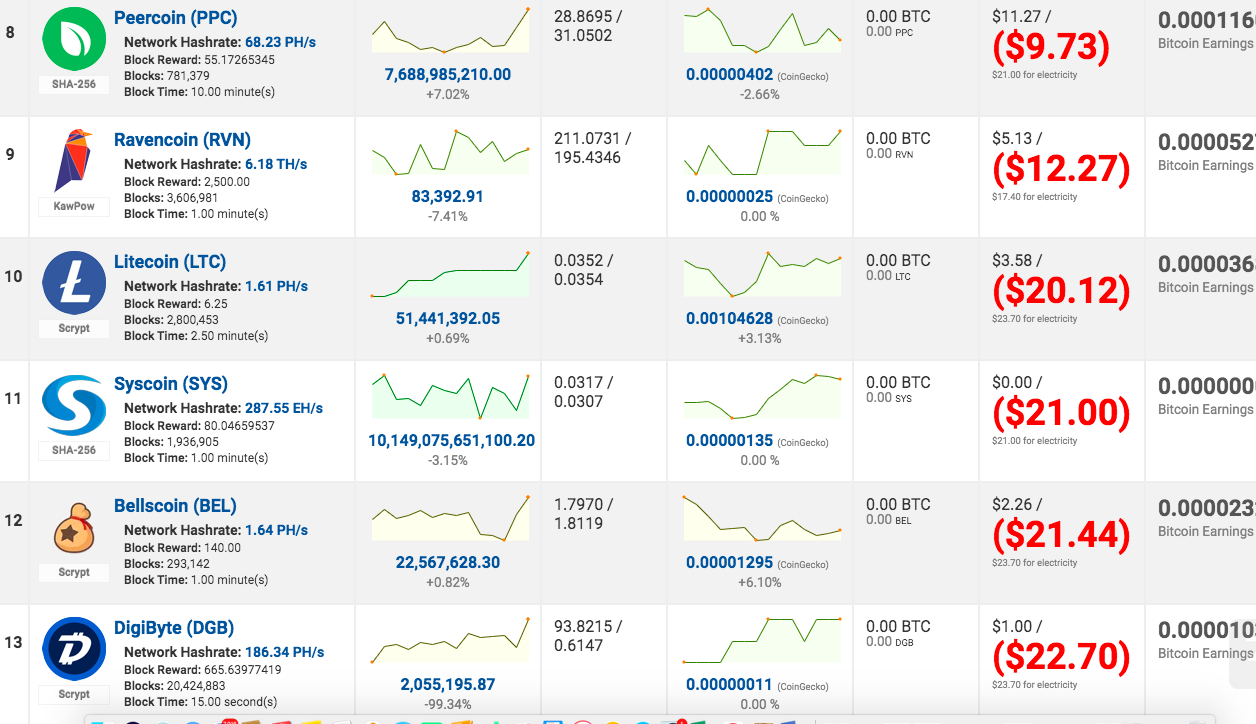

I said I wouldn’t talk of other coins but just to show that other operations require ‘price go up’ to make sense, too

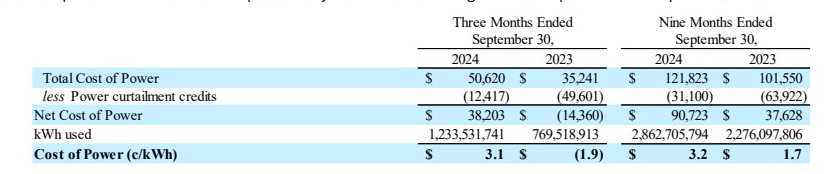

While I assumed 10-25 cents per kWh, Riot Platform and their competitors are far above this. They are mining for $3.10 per kWh…

Honey, do you want the lights on tonight or are we mining?

Importance of Decentralization

I am not a cryptographic expert or software engineer type–but I have studied a decent amount with this field, asked many questions and have experience with my own coins. Apart from transparency being a catastrophic issue before becoming viable currencies, another issue is the decentralization of their production and possession. Bitcoin, as I argue below, has become a new USD ponzi scheme that survives and thrives on more digital funny money being printed (Tether/USDC/Binance coin) and the people in charge of that process is the same state actors who are closest to the firehose of money printing from the Federal Reserve.

This is why it’s critical to decentralize mining supplies (and pools) to reduce the chance that any actor (or collective) can control the direction or price of the underlying asset. The fact that this added financialization has hit public markets really throws a screwball after a curveball into everyday life for your average citizen (who doesn’t grasp the gambling going on with their money) who owns this cryptocurrency.

Still Bullish? Napkin Math

If you’re bullish Bitcoin for a number of reasons I didn’t cover–I can grapple with that, but not so much that you should still be bullish on these mining companies. Let’s do some math with lots of assumptions. Right now, 1,099,950 BTC remain to be mined (till the end of time) (over 5% of the current supply).

At the current rate (remember this will fall due to the halving), 164,250 Bitcoin are mined every year.

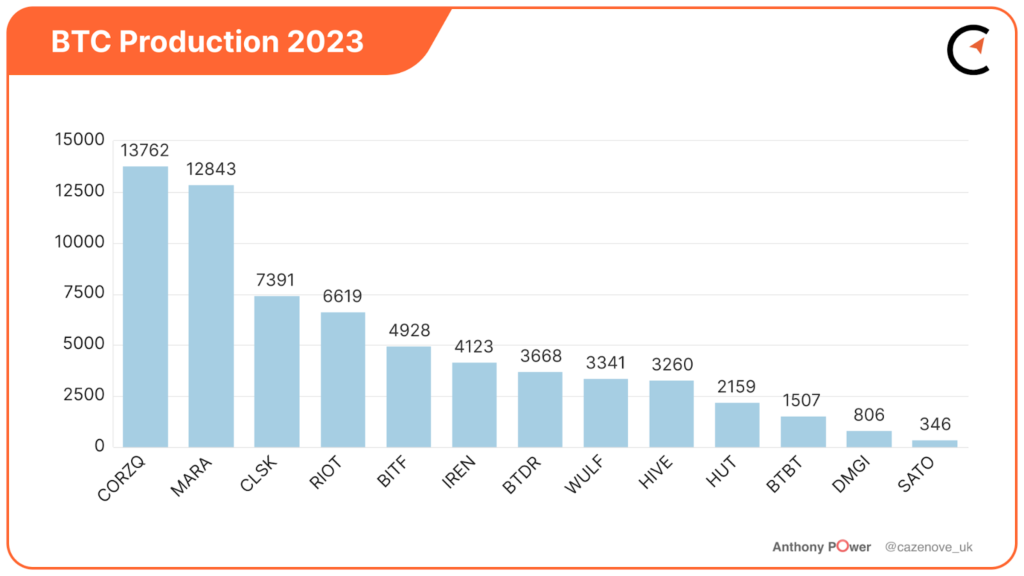

RIOT Platforms produced exactly 4% of the yearly supply as of 2023. MARA holdings produced 7.8%, core scientific over 8% and HUT 8 Mining around 1.25%.

Let’s assume that the Bitcoin mined every year will stay at 164,250 (ignoring the halving) and that RIOT platforms, to pick on them yet again, retain their 4% holding of the remaining supply (remember this supply won’t be reached till year 2140!!!). This means that they’ll possess 43,998 BTC coming their way if they can last that long.

At today’s price of 97,000 USD thats a huge 4.267 Billion Dollars of value coming. BUT the market capitalization of RIOT right now is a huge 3.732 Billion Dollars. We’re only looking at a 14.3% valuation upside IF we assume NO hiring expenses, no new hardware, no electricity costs, no real estate expansion, no fines or lawsuits, no halving ever occurring and a sustained market share of 4% for 115 years.

You can do the same with MARA–> under the same assumptions they’ll have 8.32B in earnings coming their way, but their market cap is already 7.68B.

If you’re bullish on Bitcoin, buy the actual Bitcoin and store it in a private wallet rather than play the miners who have little runway left.

Closing

If we only look at Bitcoin’s hash rate, it’s mining algorithm, difficulty setting and total number of mining participants, things look pretty promising. It’s why some say “There is no second best”. However, if we factor in the amount of energy required to sustain this system, the inefficiency of the centralized mining mechanisms and the shadiness of the largest mining businesses, Bitcoin’s future is in a precarious position. Apart from the problems I have with cryptocurrency, namely Bitcoin‘s transparency, Bitcoin has a major problem that few people are addressing–> It’s energy consumption.

This energy consumption will increasingly grow as the coin supplies fall (with every halving) and the equipment runs more inefficient/expensive. At some point, it will be no longer economical to continue spending borrowed capital to receive a negative return on investment (especially if the price of the coins fall considerably). This is to say nothing about the amount of energy proportional to a countries’ needs at a time when energy supplies are not the most secure in the world. Without mining, it’s main use case as a transfer mechanism would be immensely slow, expensive, clunky and the network itself becomes inherently less secure.

In the meantime, a large chunk of the mining supply is done by publicly traded companies. The companies are using an accounting trick of depreciation to provide the illusion that matters are normal but their balance sheet weakness is compounding. In the meantime, they are paying tremendous sums to their executives relative to their companies’ profits (or lack thereof). As we can calculate with some simple napkin math and a few assumptions, their equity upside is limited and I believe they realize this.

I like to share my favourite coins with members on here, be sure to join!

This is a long, complicated subject. If you disagree with me, take time to post why ON our website below

#StayOnTheBall