The Coin was delisted? Good News!

Bitcoin’s success have made X [Twitter] virtually unusable lately with the shouts and cheers of “I told you so” on every post. The memes of “have fun staying poor” & “to the moon” & the forecasts of when it is going to his 1 million dollars per coin are quite annoying. While I hope everybody does well, it seems that the community at large is missing the forest for the trees & have become more cultish than otherwise. Everybody likes to claim it to be sound money, independent from the government, decentralized and the sole answer to the question “where should I put my cash?”. However, the minute you unplug from the mania for a moment you quickly see that none of this is true and a lot of young folks are betting everything as it is true.

Consider our Free Newsletter (we are very cognizant of not spamming your inbox)

Bro, Freedom for all? I’m just looking for my Yacht & to retire at age 27

As I said, I hope that people are able to acquire their yachts and live a happy life–but it seems quite clear that this will come at the expense of others who are late to join the game. The whole sector is fuelled by three things: 1) Getting in early 2) Having the best marketing or salesmanship 3) Tether & other stablecoins to artificially pump the value.

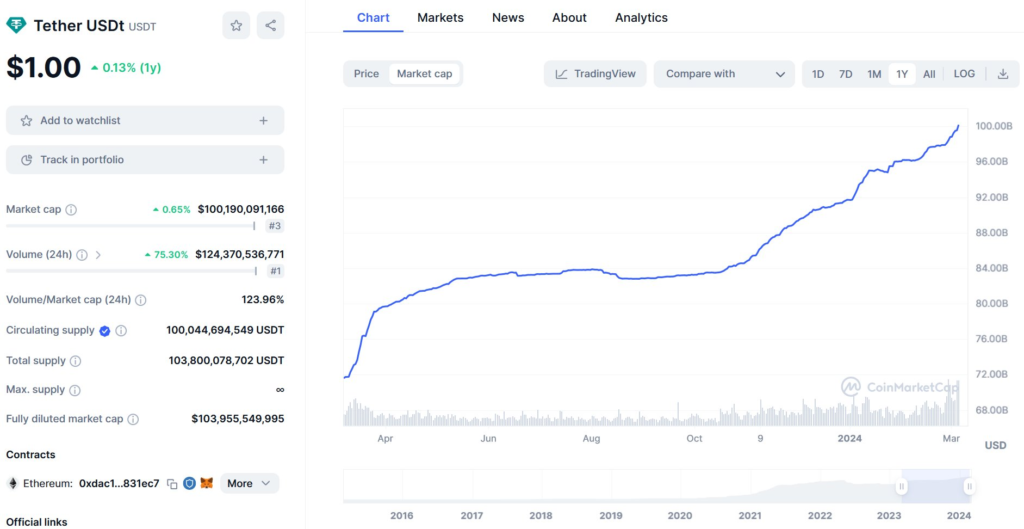

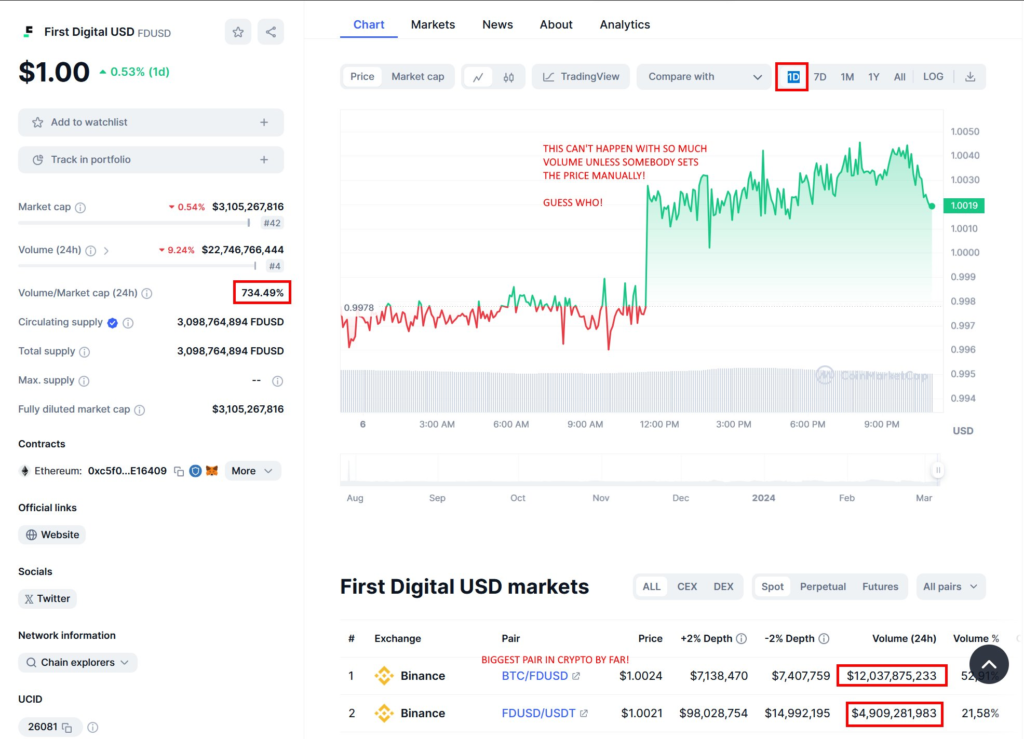

I won’t eat up all of your time but I have been tracking for a few years now the increases in cryptocurrency and at the same time viewing the increase in stablecoin market caps, they are nearly 1:1 correlated without any evidence that there’s real dollars entering. Here is the latest evidence of “printed up” stablecoins to go straight into the crypto

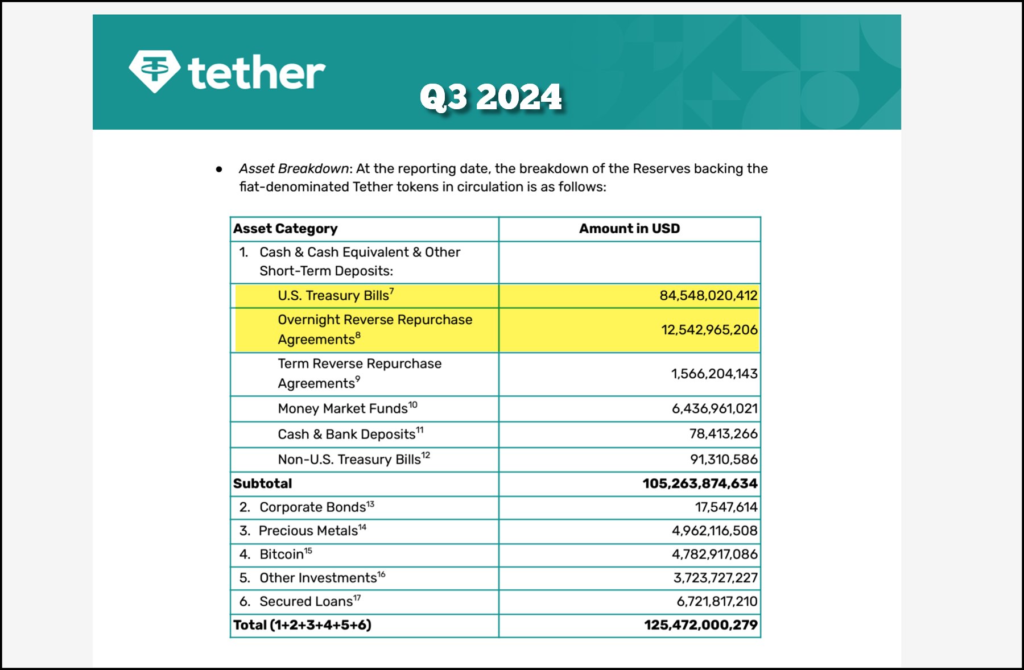

In fact, last year, an audit done by the state of New York revealed that the estimated cash holdings of Tether only amount to 3% of the Tether itself–roughly the same is true for other stablecoins. Other stablecoins are backed by an algorithm but have no real dollars to support their use. A majority of the backing simply came from cryptocurrency (which was bought using Tether). In other words, they print up Tether to buy Bitcoin, which increases the price of Bitcoin, which secures the printing of more Tether to buy more Bitcoin and the tornado continues until it sweeps up enough unknowing buyers seeing the price go up and up. The fact that all of these stablecoins “de-peg” regularly from the 1:1 ratio speaks volumes as well, no pun intended.

Tether’s contraction after this was revealed was met with a timely response by USDC coin and BUSD coin filling the gap to keep the market artificially sustained. The market has gotten so out-of-control with printed stablecoins that you have multiples of more stablecoins (securing the whole crypto market) than you do actual real dollars (as mentioned in the short video). Put into practice, it’s not so much about those who buy the crypto first win, but also those who jump ship first (to get the real, actual dollars still left on the exchange) win too. After all, what’s the sense having Bitcoin at “the moon” if you can’t receive dollars to buy real things with it? The real players know this all too well. I suspect the people behind the stablecoin printing are not too keen on ‘direct democracy’. Instead, they quite literally hold the fate of the crypto market (in so far it can be considered a market). We wrote about this briefly here:

Getting Stuck in the Crypto Arcade!

Tether is simply a way to “buy” US debt and stuff the excess money printing from crushing the USD–in effect, Cryptocurrency, is a release valve for the broken financial system that requires more and more money printing to sustain it.

Who launches the ETFs? Not Bitcoin Folks

At the same time of the price pumping, the large hype surrounding the launch of Bitcoin ETFs is proving to be the ultimate example for “be careful what you wish for”. As I wrote in this post here: those in cryptocurrency are not motivated by the potential it holds as a transfer mechanism or the ideology of freedom, if so, they’re just parroting their idols in the space. Rather they are motivated by two factors: HoldOnForDearLife & PriceGoUp. That’s it. As long as they hold Bitcoin and the price is going up, they’re happy. For someone with myopia (as I argue many in the crypto space do when it comes to macroeconomics) they fail to see that their “decentralized” project is now being bought up by the most powerful, influential, centralized globalist entities of all. Hardly a win.

They miss the forest for the trees.

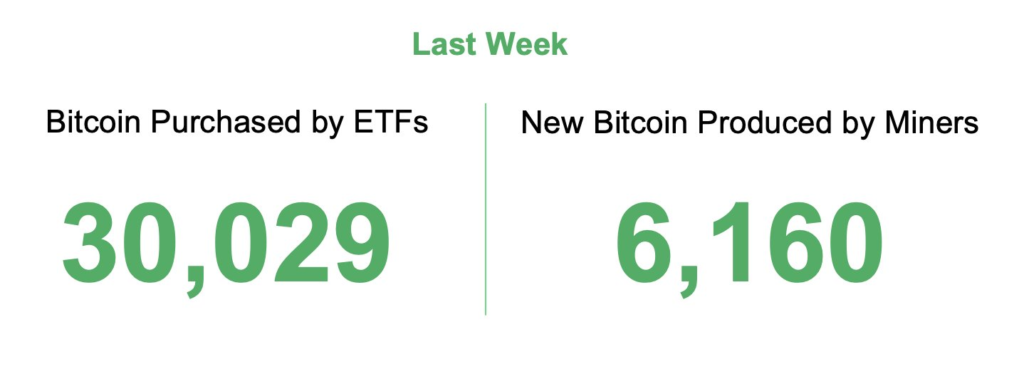

In a major milestone, spot Bitcoin ETFs, within merely 20 days following their market debut, have accumulated $10 billion in assets under management (AUM), illustrating the strong investor enthusiasm for this new investment avenue. “This surge in ETF activity signals a growing trend of institutional investment in Bitcoin as the launch of spot ETFs has made it easier for investors to gain exposure to Bitcoin without directly owning the asset”. Without directly owning the asset & institutional investment would have been the antithesis of the Bitcoin community just 5 years ago–now it’s celebrated.

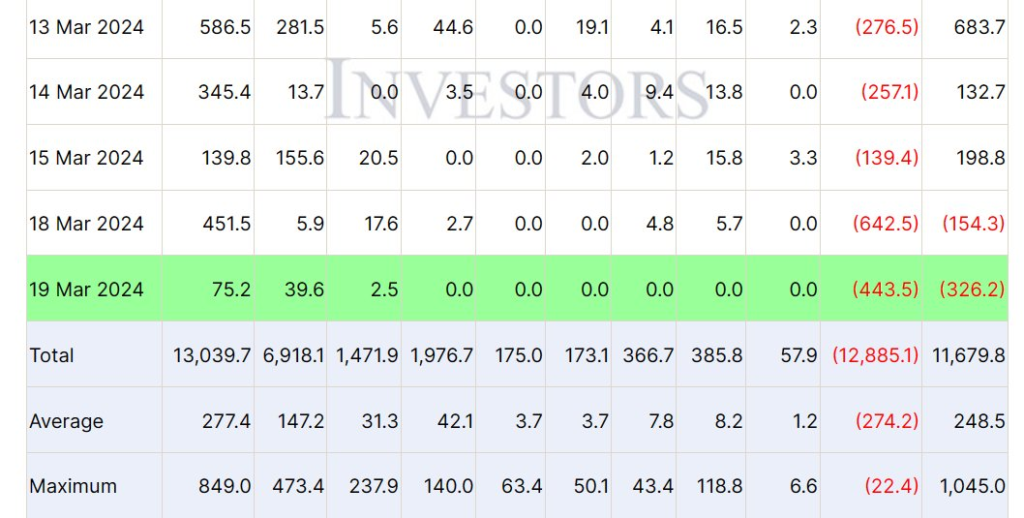

Much of the world’s problems are due to the over-financialization of everything–Bitcoin has become another financial derivative in the cloud controlled by the owners and financiers of global wealth. They’re already seizing people’s wealth with the huge hype & the high fees. People in the know always cash out at the top. Look at the selling from Bitcoin ETFs (and the big investment firms walk with their 2% fees).

We’re not the only ones who think the ETFs are gameover

A reputable, known Bitcoin Twitter account recently created a thread on Twitter saying the following (clipped)

Everyone is cheering on the bitcoin spot ETFs – but I think they’re the end of bitcoin as we know it…Everybody wants the financialized ETF products, they’re liquid and can borrow against their ETF equity. They just want the price-exposure and could give a damn about Bitcoin. It’s just numbers on a screen

I’m not a quant by any means but it seems like this cannot continue–>

The fact of the matter is that the only people gobbling up Bitcoin will be the state-regulated financial firms themselves (who work in partnership with the government).

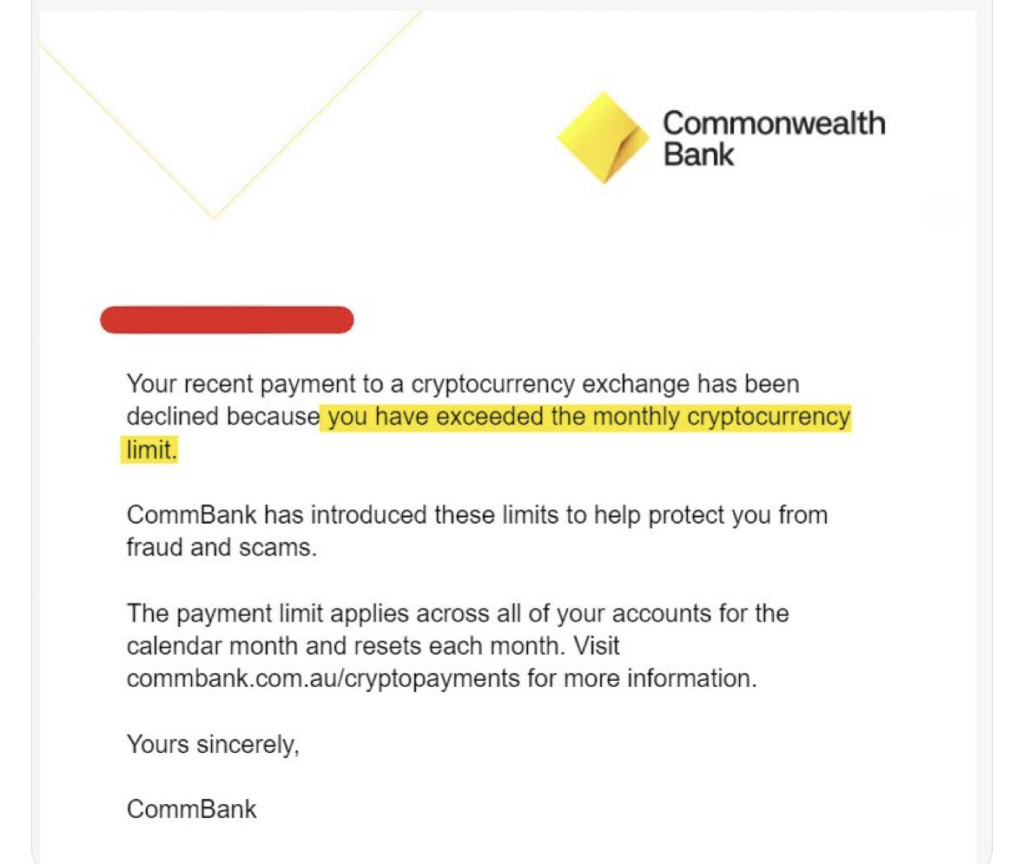

Who Controls the Wallets/Exchanges?

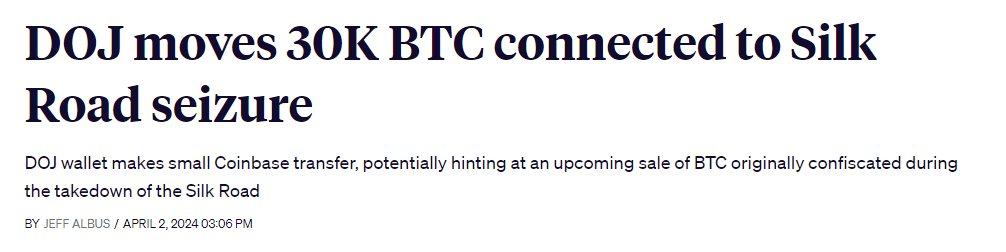

It boggles my mind that few realize that Bitcoin (actually, 99.99% of cryptocurrency) operates using a transparent ledger. In other words, all the transactions are publicly visible for everybody to see as are the wallets involved in the transactions. You can see the amounts from whom to whom, indefinitely. Would you sign up for a Visa or Mastercard if your banking information was displayed for the masses (what you purchased, in what amount, and your counter-parties information as well)?

On January 24th, the Department of Energy issued a statement, saying that bitcoin mining was likely to cause “public harm”. The Federal Government then used its emergency powers in collaboration with the EIA to force miners to report their location, energy use, and energy supplier.

In response, the Biden administration is proposing a 30% tax on electricity used by #bitcoin miners

EU Seeks to Squash Privacy

To combat money laundering (they claim, which is laughable given the amounts laundered in Ukraine), the EU recently proposed a few changes:

💶 limited cash payments to 10,000 euro and banned all anonymous cash payments above 3000 euro 👛 banned all self custody crypto payments which are anonymous

Anonymous self hosted wallet payments through crypto were also banned. Which impacts cryptocurrencies like Monero (the 0.001% of private currency), whose thesis is that of providing people anonymity while transacting on the internet (it’s important to remember that this WAS Bitcoin).

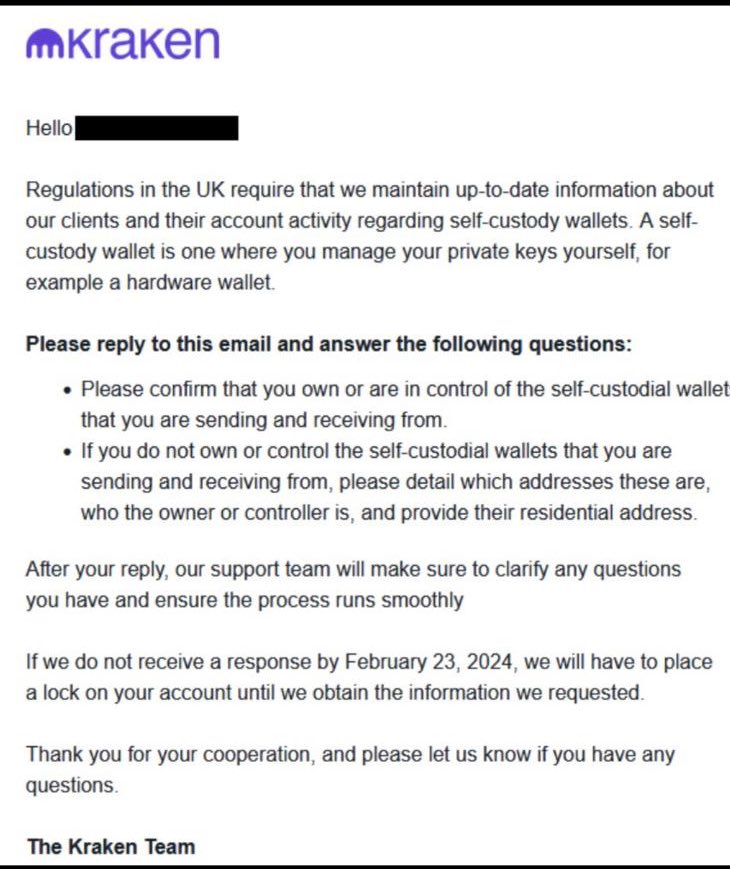

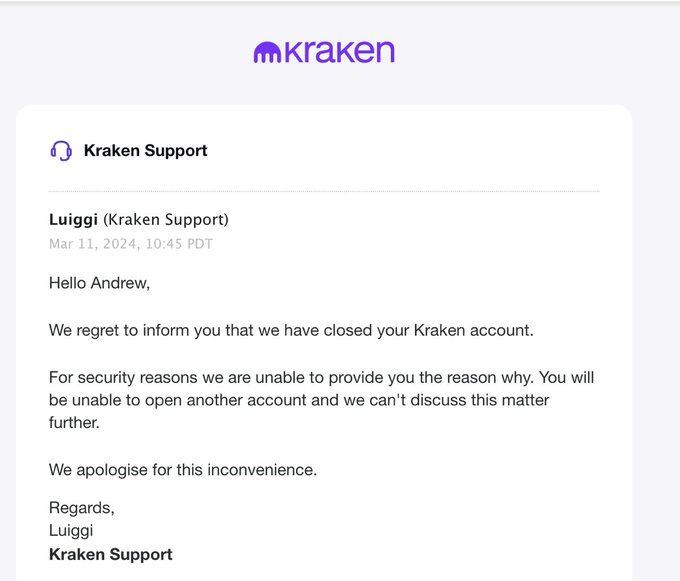

Everywhere in the European Union, crypto exchanges are expected to do a full KYC of all users,who chose to move their cryptocurrencies to self custody wallets (which is to say, private property!). Meaning, you are still allowed to control your money, as long as the state decides so depending on your net wealth.

In possessing, transacting, holding & exchanging Bitcoin, the state is involved in every respect of the process. Again, most ignore this as a problem because for the time being their wealth seems to be increasing–but show me an instance where the government has ever had ones’ interest in their heads and hearts, ever. Bitcoin, has a money distinct from “the system” is laughable–it quite literally is as part of the system as any JP Morgan account. It's actually worse than that because of the lack of fungibility & transparency, but we'll write about that in greater detail later

Uncle Sams IRS arm

Yesterday, the IRS issued the long-awaited draft Form 1099-DA, the first tax form specifically designed to collect your ID and detailed transaction data at scale from “brokers”. Brokers (CeFi exchanges, certain DeFi exchanges, and wallets) will be required to generate this form for each sale transaction and submit that info to the IRS and you (similar to stock brokers) starting 1/1/2025.

In effect, in the United States, every single wallet is legally required to document all transactions in and out of a wallet to the tax authorities–this is simply no different than any other bank account in the United States. More specifically: the form captures data points such as date acquired, date sold, proceeds, and cost basis of crypto assets sold. The collection and reporting of the following additional data points (especially wallet addresses) to the IRS at scale leads to major privacy and security concerns.

Sales-related data points (on the form):

Box 11a: Sale transaction ID (TxID)

Box 11b: Digital asset address from which the units were sold

Box 11c: Number of units sold

Transfer-related data points:

Box 12a: Transfer-in TxID number

Box 12b: Transfer-in digital asset address

Box 12c: Number of units transferred in

Going forward, you will likely have to provide KYC (Know Your Customer) information before creating an un-hosted wallet and/or when interacting with platforms via un-hosted wallets. We hope to have highlighted the beginning that cryptocurrency, namely Bitcoin, has such a level of state-intervention that it has ceased to become a tenet of freedom and liberty. It has merged in with a dying tyrannical system. Wait until we cover what’s next…

CLICK BELOW

#StayOnTheBall