In The Laboratory, Studying Bubbles

There is a lot of effort to find the next big stock to buy now or get in while it’s still hot but it’s quite difficult to find people to find people advocating to sell short now. Of course, it’s a such a game of timing and with the market in bubble fantasy land for sometime now it’s a hard play. It doesn’t help when there’s an underlying expectation of ‘Fed to the rescue’ either. Plus as the saying goes, markets can stay irrational longer than you can stay solvent.

I come from a science background and one thing done in scientific research is to try to reject the null hypothesis. What the hell is a null hypothesis–It’s a hypothesis that proposes that there is no significant different in ‘Y’ due to ‘X’. Hence, if you can reject the notion that there are no differences, this implies there are differences that have occurred (hopefully as a result of your intervening variables in the study). In order to come up with this you have to screen for all the potential reasons why you may be wrong rather than right and if you cannot find data to suggest so, it points that you are right in your thesis–or at least it’s cause another study to suggest to others that the results look in that direction.

I try to take the same sort of approach when looking for stocks to short. I start very broad and then when I find something that may be in trouble, I look more closely. When hey may have an unexpected 30% week performance, lots of insider selling or I see loads of debt, I begin to look further. What I am looking for is the case for this company to do well and come out of a slump. In other words, I try to find as many reasons as possible why you may expect the stock to go UP, not down. If I can reject my null hypothesis (there are factors that investors would find bullish to cause the stock to rise) than it could be a potential short.

I think I’ve found such a company.

Alnylam Pharmaceuticals, Inc. ($ALNY on Nasdaq) is an American biopharmaceutical company focused on the discovery, development and commercialization of RNA interference therapeutics for genetically defined diseases. The company was founded in 2002.

Click here for more Premium content + additional perks exclusively for subscribers at reasonable costs!

Products

Vutrisiran (AMVUTTRA™) is a subcutaneously administered transthyretin-directed small interfering ribonucleic acid (siRNA) therapeutic (also called RNA interference, or RNAi therapeutic) being developed by Alnylam Pharmaceuticals, Inc. for the treatment of amyloid transthyretin-mediated (ATTR) amyloidosis, including hereditary ATTR (hATTR) amyloidosis and wild-type ATTR (wtATTR) amyloidosis. Vutrisiran was approved in June 2022 in the USA for the treatment of the polyneuropathy of hATTR amyloidosis in adults and received a positive opinion in the EU in July 2022 for the treatment of hATTR amyloidosis in adult patients with stage 1 or stage 2 polyneuropathy. Vutrisiran is also under regulatory review for the treatment of the polyneuropathy of hATTR amyloidosis in adults in Japan and Brazil.

Susan J Keam, Drugs 82, 1419-1425 (2022)

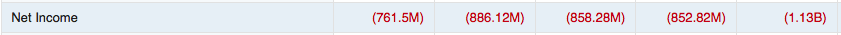

Income Statement

The sales growth is further cancelled out with the Cost of Goods (COGS) (Incl. Depreciation and Amoritization) averaging 129.93% over this same period.

Over the last 5 years, Research and Development costs it increased 74.8% comparing 2018 to 2022 (883M in 2022). At the current pace, R&D costs is set to increase by 8.4% in 2023 relative to 2022. Similarly, ‘Other SG&A’ increased 230% (to 770M in 2022) comparing 2018 to 2022. Collectively this far exceeds the sales growth. They’re spinning their wheels.

Balance Sheets

Total Current Liabilities exceeded cash & cash equivalents by 119% during Q2 2023.

Total Debt/Total Equity: -678.6%

Long-Term Debt/Total Equity: -642.73%

Total Debt/Total Capital: 106.45%

Total Debt/Total Assets: 73.67%

Total Equity: -150.29M

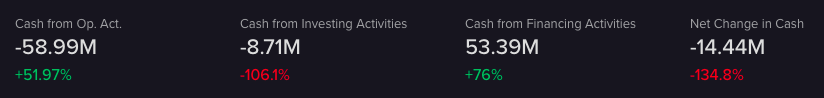

Cash Flow

The majority of the income raised is through financing. Most of this is done by issuing more stock with a contraction thereafter and then another positive issuance (since 2018).

Ratios/Details

Price: 176.45

Market Cap: 24.34B USD

P/E: -27.6 (P/E 2024 estimates: -56.2)

P/S: 27.88

Book Value Per Share: -3.27

Revenue Per Share: 10.01

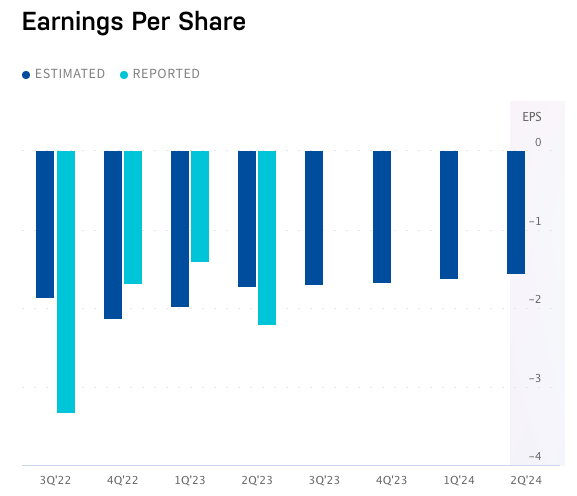

EPS: -8.96 (5Yr average -7.83)

Total Debt: 1.02B

Total Debt Growth rate (5y): 102.32%

Total Debt/Total Assets: 28.68% (26.37% above industry average)

Short interest: 5.38M (4.32% of float)

Quick Ratio: 3.34

Cash Ratio: 2.86

Days payable: 98.25

Days of Inventory: 177.54

No Dividends paid

Altman Z-Score: 0.17 (A score below 1.8 signals the company is likely headed for bankruptcy within two years)

Performance

Stock performance

3M: 4.29%

6M: -0.48%

YTD: -16.75%

1Yr: -7.39%

3Yr: 26.74%

5Yr: 58.52%

Beginning a correction?

Operating Margin: -75.68%

Net Margin: -109.04%

ROA: -31.47%

ROE: -526.14%

ROIC: -44.64%

EV to FCF: -42.94

Income Per Employee: -$565,013 USD

Number of Employees: 2,002

Shares Outstanding: 125,000,000

Ownership

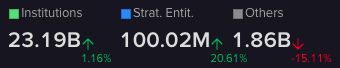

It is virtually all owned by institutional investors (97.34%). Other entities own just less than 2B and strategic entities only own 0.38% (around 100M).

According to Refinitiv rankings, 21 of 26 analysts have given this a buy whereas 5 have given it a hold rating across the last 6 months. The last Sell was given by CFRA in July 2022 which marks the only Sell rating in the last 2 years. Everyone is content with this negative margin.

Tipranks have it a Strong Buy with 12 calling for buy and 2 calling for a hold.

Money CNN has all 24 analysts giving it a buy rating as well.

However, as per Simply Wall St, it seems these analysts are off track.

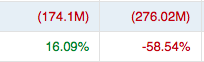

The predicted EPS growth rate is way off. Over the last 12 months they have had an EPS change of -5.3% as we head into 2024. To give you some further numbers: The reported EPS as shown below have been -3.32, -1.68, -1.4 and -2.21 by quarter. The following estimates sit around -1.64 until halfway into 2024.

Return on Equity is almost 800% off of it’s market

Revenue growth rate is beating expectations at 63.05% (5 year; 67.75% 3 years), however as I’ve shown this is not translating into earnings growth. COGS and R&D is simply out-racing the sales/revenue pace. This company is not breaking even by 2025.

Cases

Bulls argument is tied to their first-mover innovative technology (RNA interference) that corner a set of unique diseases whereas Bears feel they are dependent on marketing in order to keep their high-priced (six figure) product sales going with payers still willing to make such purchases. Additionally, given the increased in government liabilities & interest payments, bears feel that they are vulnerable to shocks in drug policy plans.

A bullish case could be made since the increase in cardiac issue statistics as of late. Since wATTR is most prevalent in cardiac tissue of those with heart disorders. However, it’s prognosis is characterized by a slow progression of heart failure and may not be accurately diagnosed given the crossover between other cardiac pathologies (prognosis is evaluated by cardiac biomarkers). It is more prevalent in males with a general onset of 60 years of age, whereas issues in cardiac health have been unexpectedly in the younger than 60 crowd.

Thoughts

Having studied amyloid deposits in neuroscience, I am skeptical that this will become a revolutionary turn around for these specific diseases; ATTR is a rare, progressive disease characterized by the abnormal buildup of amyloid deposits composed of transthyretin protein misfolds.

From Paul et al, 2022 “Though siRNA is a potential therapeutic strategy to treat various disorders, its application is still not widely accepted due to certain drawbacks such as off-target effects, stability etc”. This was reiterated in a 2004 paper. “Development of cell-specific or organ-specific delivery systems for siRNA, as is required for broad in vivo application of this technique, is indeed a demanding task” and once again in a 2013 paper, “…technical difficulties restrict the development of RNAi, including stability, off-target effects, immunostimulation and delivery problems”

It’s also worth noting that while $ALNY is first with a RNA interference launch, there is another existing drug known as Tafamidis available & often prescribed since 2019 in the USA (2013 in European Union).

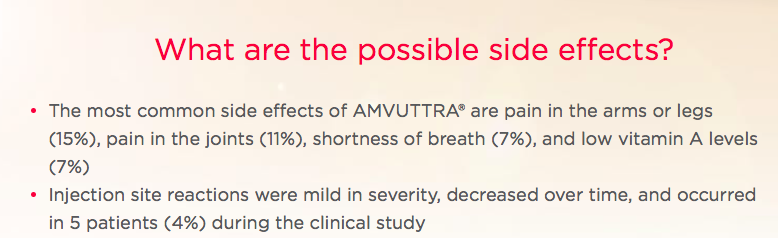

The most obvious limitation I have seen is in Rutz & Scheffold paper in Arthritis Research & Therapy, ‘Towards in vivo application of RNA interference–new toys, old problems’ where they explain that while the pharmacological actions work as intended, it’s delivery directly into the effected or specific mammalian tissue is critical and there’s a need for sustained use. While this is easy in cell lines (in vitro) it’s much more challenging in animal models (although this depends on a myriad of factors that are patient-specific). Given the specificity and complex nature of the drug, it cannot be easily administered without side effects and requires consistent usage, at a high cost.

Amvuttram labels state “Professional Healthcare use only” with regards to administration and as expected:

Even if they rap around this with competent personnel, their supply of patients (customers) is quite small. The prevalence of wATTR (wild-type) is only .0172% of the population, although more general characterizations of the disease have an unknown occurrence (as stated, due to its heterogeneity).

Obi et al, 2022 states “This perception is partly due to the phenotypic heterogeneity of the disease, ranging from exclusively neurologic involvement to cardiac-restricted disease…variability results from differential effects of various TTR mutations, their occurrence in an endemic versus non-endemic location, genetic and demographic factors such as age and sex, and probably other environmental factors that are currently unknown“. In other words, it’s not clear whether this drug will “take off” given it’s grey area in categorizing the underlying disease itself. In other words, how well can you bet on a player to score a goal when the target is changing? This is compounded by the fact there’s existing therapies available as well as many off-label drugs to reduce the symptoms.

In Closing,

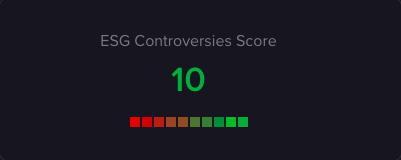

Alnylam Pharmaceuticals, Inc. have cash to burn, no doubt, but it seems like thats just what they’re doing with it. Revenue growth is beating it’s mark and it has raised most of it’s equity from large investment management firms and banks. However, the impressive increase in sales are immediately offset by the increase in COGS, R&D and SG&A expenses. Their need to finance their ever-increasing pile of debt and reliance that their specific product will catch (& hold) on amid biological challenges, continual use and administration from experts puts them in a precarious position. If their product can’t put them in the green, they’ll be forced to refinance, albeit at higher interest rates (adding larger piles of debt load even faster).

If I go back to playing scientist, perhaps if you think growth stocks will continue to outperform & a craze for cardiomyopathy treatments will emergence in the relatively near future, you may be interested. Furthermore, a trader who is playing some positive news headlines surely could do better than I could at trading.

Yet with corporate debt maturing in the upcoming years, no positive operating income, high debt burden, high costs of capital, reliance on shareholder equity, abysmal margins & a terrible Z-score, this company is undoubtedly in trouble. At some point, something has to give.

Of course I hope I’m right and I can retire early but till then I’d really appreciate you taking the time to share this article, consider that cheap subscription & review other posts when you have a moment!

#StayOnTheBall

#StayOnTheBall